FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

| For the month of: September 2024 |

Commission File Number: 1-12384 |

SUNCOR ENERGY INC.

(Name of registrant)

150 - 6th Avenue S.W.

P.O. Box 2844

Calgary, Alberta

Canada, T2P 3E3

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ¨ Form 40-F x

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

SUNCOR ENERGY INC. |

| |

|

|

| Date: |

|

By: |

| |

|

|

| September 19, 2024 |

|

“Shawn Poirier” |

| |

|

Shawn Poirier |

| |

|

Assistant Corporate Secretary |

EXHIBIT INDEX

Exhibit 99.1

|

News Release |

FOR IMMEDIATE RELEASE

Suncor announces tender offers for certain outstanding series of

notes

Calgary, Alberta (September 19, 2024) – Suncor Energy

Inc. (“Suncor”) (TSX: SU) (NYSE: SU) announced today the commencement of tender offers to purchase for cash certain of its

outstanding series of notes listed in the table below (collectively, the “Notes”) for an aggregate purchase price, excluding

accrued and unpaid interest, of up to C$800 million (collectively, the “Tender Offers”).

| |

Title of Security(1) |

CUSIP/ISIN |

Principal

Amount

Outstanding |

Maximum

Amount(2) |

Acceptance

Priority

Level(3) |

Par Call

Date(4) |

Maturity

Date |

Reference

Security |

Bloomberg

Reference

Page |

Fixed

Spread(5)(6) |

| Pool 1 Tender Offers |

6.50% Notes due 2038 |

867229AE6 / US867229AE68 |

US$954,042,000 |

C$700,000,000 |

1 |

N/A |

June 15, 2038 |

3.875% UST due August 15, 2034 |

FIT1 |

135 |

| 6.80% Notes due 2038(7) |

71644EAJ1 /

US71644EAJ10 |

US$881,081,000 |

2 |

N/A |

May 15, 2038 |

3.875% UST due August 15, 2034 |

FIT1 |

140 |

| Pool 2 Tender Offers |

3.10% Series 6 Medium Term Notes due 2029 |

86721ZAP4 / CA86721ZAP41 |

C$78,743,000 |

C$100,000,000

|

1 |

February 24, 2029 |

May 24, 2029 |

2.25% Government of Canada Bond due June 1, 2029 |

FIT CAN0-50 |

120 |

| 3.00% Series 5 Medium Term Notes due 2026 |

86721ZAM1 / CA86721ZAM10 |

C$115,182,000 |

2 |

June 14, 2026 |

September 14, 2026 |

1.50% Government of Canada Bond due June 1, 2026 |

FIT CAN0-50 |

70 |

| 6.00% Notes due 2042(8) |

13643EAH8, C18885AF7 / US13643EAH80, USC18885AF71 |

US$31,625,000 |

3 |

October 1, 2041 |

April 1, 2042 |

4.125% UST due August 15, 2044 |

FIT1 |

200 |

| 5.35% Notes due 2033(7) |

716442AH1 / US716442AH16 |

US$118,367,000 |

4 |

N/A |

July 15, 2033 |

3.875% UST due August 15, 2034 |

FIT1 |

105 |

| 5.95% Notes due 2035(7) |

71644EAG7 / US71644EAG70 |

US$199,271,000 |

5 |

N/A |

May 15, 2035 |

3.875% UST due August 15, 2034 |

FIT1 |

125 |

| 5.00% Series 7 Medium Term Notes due 2030 |

86721ZAQ2 / CA86721ZAQ24 |

C$154,041,000 |

6 |

January 9, 2030 |

April 9, 2030 |

1.25% Government of Canada Bond due June 1, 2030 |

FIT CAN0-50 |

125 |

| 5.39% Series 4 Medium Term Notes due 2037 |

86721ZAB5 / CA86721ZAB54 |

C$279,124,000 |

7 |

N/A |

March 26, 2037 |

2.75% Government of Canada Bond due December 1, 2055 |

FIT CAN0-50 |

165 |

| |

Suncor Energy

150 6 Avenue S.W. Calgary, Alberta T2P 3E3

suncor.com |

| (1) | The 6.50% Notes due 2038, 6.80% Notes due 2038, 6.00% Notes due 2042, 5.35% Notes due 2033 and 5.95% Notes due 2035 are referred to

herein as the “US$ Notes.” The 3.10% Series 6 Medium Term Notes due 2029, 3.00% Series 5 Medium Term Notes due 2026,

5.00% Series 7 Medium Term Notes due 2030 and 5.39% Series 4 Medium Term Notes due 2037 are referred to herein as the “C$ Notes.” |

| (2) | C$700,000,000 represents the maximum aggregate purchase price payable, excluding the applicable accrued and unpaid interest (the “Pool

1 Maximum Amount”), in respect of the 6.50% Notes due 2038 and 6.80% Notes due 2038, which may be purchased in the Pool 1 Tender

Offers. C$100,000,000 represents the maximum aggregate purchase price payable, excluding the applicable accrued and unpaid interest (the

“Pool 2 Maximum Amount” and, together with the Pool 1 Maximum Amount, the “Maximum Amounts”), in

respect of the 3.10% Series 6 Medium Term Notes due 2029, 3.00% Series 5 Medium Term Notes due 2026, 6.00% Notes due 2042, 5.35% Notes

due 2033, 5.95% Notes due 2035, 5.00% Series 7 Medium Term Notes due 2030 and 5.39% Series 4 Medium Term Notes due 2037, which may be

purchased in the Pool 2 Tender Offers. For purposes of calculating the portion of the Maximum Amounts attributable to each series of US$

Notes, the aggregate principal amount of US$ Notes tendered in the applicable Tender Offer shall be converted to Canadian dollars based

on the exchange rate of one U.S. dollar for Canadian dollars, as shown on the FXC page displayed on the Bloomberg Pricing Monitor at 11:00

a.m., New York City time, on the Price Determination Date (as defined below). |

| (3) | Subject to the Maximum Amounts and proration, if applicable, the principal amount of each series of Notes that is purchased in each

Tender Offer will be determined in accordance with the applicable Acceptance Priority Level (in numerical priority order) specified in

this column in the manner described in the Offer to Purchase. |

| (4) | The calculation of the applicable U.S. Total Consideration (as defined below) for each series of US$ Notes and the calculation of

the applicable Canadian Total Consideration (as defined below) for each series of C$ Notes will be performed taking into account such

par call date, if any, or maturity date, in accordance with market practice. |

| (5) | The applicable consideration for each series of US$ Notes (the “U.S. Total Consideration”) offered per each US$1,000

principal amount of each series of US$ Notes validly tendered prior to or at the Early Tender Date (as defined below) and accepted

for purchase pursuant to the applicable Tender Offer will be determined in the manner described in the Offer to Purchase by reference

to the applicable fixed spread for such Notes (the “Fixed Spread”) specified in the table above, plus the applicable

yield based on the bid-side price of the applicable U.S. reference security specified in the table above as displayed on the applicable

Bloomberg Reference Page at 11:00 a.m., New York City time, on October 3, 2024 (such date and time, as it may be extended with respect

to a Tender Offer, the applicable “Price Determination Date”). The applicable consideration for each series of C$ Notes

(the “Canadian Total Consideration” and, together with the U.S. Total Consideration, the “Total Consideration”)

offered per C$1,000 principal amount of each series of C$ Notes validly tendered prior to or at the Early Tender Date and accepted for

purchase pursuant to the applicable Tender Offer will be determined in the manner described in the Offer to Purchase by reference to the

applicable Fixed Spread specified in the table above, plus the applicable yield based on the bid-side price of the applicable Canadian

reference security specified in the table above as displayed on the applicable Bloomberg Reference Page at 11:00 a.m., New York City time,

on the Price Determination Date. The Total Consideration for each series of Notes is inclusive of the applicable Early Tender Payment

(as defined below). The Total Consideration for each series of Notes does not include the applicable accrued and unpaid interest, which

will be payable in addition to the applicable Total Consideration. |

| (6) | The U.S. Total Consideration and Canadian Total Consideration include the Early Tender Payment of US$30 and C$30 per US$1,000 and

C$1,000, respectively, principal amount of Notes validly tendered prior to or at the Early Tender Date and accepted for purchase. |

| (7) | Such Notes were issued by Petro-Canada; Suncor assumed the obligations for such Notes in 2009. |

| (8) | Such Notes were issued by Canadian Oil Sands Limited; Suncor assumed the obligations for such Notes in 2016. |

The Tender Offers are being made upon the terms, and subject

to the conditions, described in the offer to purchase dated September 19, 2024 (as it may be amended or supplemented from time to time,

the “Offer to Purchase”), which sets forth a detailed description of the Tender Offers. Suncor reserves the right, but is

under no obligation, to increase or decrease either of the Maximum Amounts in the table above in its sole discretion, at any time, without

extending or reinstating withdrawal rights, subject to compliance with applicable law.

The Tender Offers for the Notes will expire at 5:00 p.m.,

New York City time, on October 18, 2024, or any other date and time to which Suncor extends the applicable Tender Offer (such date and

time, as it may be extended with respect to a Tender Offer, the “Expiration Date”), unless earlier terminated. Holders of

Notes must validly tender and not validly withdraw their Notes prior to or at 5:00 p.m., New York City time, on October 2, 2024 (such

date and time, as it may be extended with respect to a Tender Offer, the applicable “Early Tender Date”), to be eligible to

receive the applicable Total Consideration, which is inclusive of an amount in cash equal to US$30 and C$30 per US$1,000 and C$1,000,

respectively, principal amount of Notes validly tendered prior to or at the Early Tender Date and accepted for purchase (the “Early

Tender Payment”), plus accrued and unpaid interest (as described below). If a holder validly tenders Notes after the applicable

Early Tender Date but prior to or at the applicable Expiration Date, the holder will only be eligible to receive the applicable Late Tender

Offer Consideration (as defined below), plus accrued and unpaid interest (as described below).

The U.S. Total Consideration offered per US$1,000 principal

amount of each series of US$ Notes validly tendered prior to or at the Early Tender Date and accepted for purchase pursuant to the applicable

Tender Offer will be determined in the manner described in the Offer to Purchase by reference to the applicable Fixed Spread plus the

applicable yield based on the bid-side price of the applicable U.S. reference security as displayed on the applicable Bloomberg Reference

Page at 11:00 a.m., New York City time, on the Price Determination Date. The applicable Canadian Total Consideration for each series of

C$ Notes offered per C$1,000 principal amount of each series of C$ Notes validly tendered prior to or at the Early Tender Date and accepted

for purchase pursuant to the applicable Tender Offer will be determined in the manner described in the Offer to Purchase by reference

to the applicable Fixed Spread plus the applicable yield based on the bid-side price of the applicable Canadian reference security as

displayed on the applicable Bloomberg Reference Page at 11:00 a.m., New York City time, on the Price Determination Date.

The “Late Tender Offer Consideration” for each

series of Notes is equal to the Total Consideration minus the Early Tender Payment for each series of Notes. Holders will also

receive accrued and unpaid interest on Notes validly tendered and accepted for purchase from the applicable last interest payment date

up to, but not including, the applicable settlement date.

Suncor intends to fund the purchase of validly tendered

and accepted Notes with cash on hand.

The Tender Offers will expire on the applicable Expiration

Date. Provided that the conditions of the applicable Tender Offer are satisfied, and except as set forth below, payment for the Notes

validly tendered prior to or at the Expiration Date, and accepted for purchase, will be made on a date promptly following the Expiration

Date, which is anticipated to be October 22, 2024, the second business day following the Expiration Date. Suncor reserves the right, in

its sole discretion, to make payment for Notes validly tendered prior to or at the Early Tender Date and accepted for purchase on an earlier

settlement date, which, if applicable, is currently anticipated to be October 7, 2024, the third business day following the Early Tender

Date.

Tendered Notes may be withdrawn prior to or at, but not

after, 5:00 p.m., New York City time, on October 2, 2024, unless extended or earlier terminated by Suncor.

All Notes accepted for purchase will be retired and cancelled

and will no longer remain outstanding obligations of Suncor.

The Tender Offers are subject to the satisfaction or waiver

of certain conditions, which are specified in the Offer to Purchase. The Tender Offers are not conditioned on any minimum principal amount

of Notes being tendered.

Information relating to the Tender Offers

CIBC World Markets Corp., CIBC World Markets Inc. (solely

with respect to the Tender Offers for the C$ Notes) (together, “CIBC”), J.P. Morgan Securities LLC, J.P. Morgan Securities

Canada Inc. (solely with respect to the Tender Offers for the C$ Notes) (together, “J.P. Morgan”), Mizuho Securities USA

LLC, Mizuho Securities Canada Inc. (solely with respect to the C$ Tender Offers) (together, “Mizuho”), RBC Capital Markets,

LLC, RBC Dominion Securities Inc. (solely with respect to the Tender Offers for the C$ Notes) (together, “RBC”), Scotia Capital

(USA) Inc. (“Scotiabank”), TD Securities (USA) LLC and TD Securities Inc. (solely with respect to the Tender Offers for the

C$ Notes) (together, “TD Securities”) are acting as the Dealer Managers for the Tender Offers. For additional information

regarding the terms of the Tender Offers, please contact CIBC at (800) 282-0822 (toll free) or (212) 455-6427 (collect), J.P. Morgan

at (866) 834-4666 (toll free) or (212) 834-4818 (collect), Mizuho at (866) 271-7403 (toll free) or (212) 205-7736 (collect), RBC at (877)

381-2099 (toll free), (212) 618-7843 (collect U.S.) or (416) 842-6311 (collect Canada), Scotiabank at (800) 372-3930 (toll free) or (212)

225-5000 (collect), or TD Securities at (866) 584-2096 (toll free), (212) 827-2842 (collect U.S.) or (416) 982-2243 (collect Canada).

Global Bondholder Services Corporation will act as the information agent and the tender agent for the Tender Offers for the US$ Notes.

Computershare Investor Services Inc. will act as the tender agent for the Tender Offers for the C$ Notes. Questions or requests for assistance

related to the Tender Offers or for additional copies of the Offer to Purchase may be directed to Global Bondholder Services Corporation

at (855) 654-2014 (toll free) or (212) 430-3774 (collect). You may also contact your broker, dealer, commercial bank, trust company or

other nominee for assistance concerning the Tender Offers. The Offer to Purchase can be accessed at the following website: https://www.gbsc-usa.com/suncor.

The full details of the Tender Offers, including complete

instructions on how to tender Notes, are included in the Offer to Purchase. Holders are strongly encouraged to carefully read the Offer

to Purchase, including the documents incorporated by reference therein, because they contain important information. The Offer to Purchase

may be obtained from Global Bondholder Services Corporation, free of charge, by calling (212) 430-3774 (for banks and brokers) or (855)

654-2014 (for all others, toll-free).

This news release does not constitute an offer to purchase,

or a solicitation of an offer to sell, or the solicitation of tenders with respect to the Notes. No offer, solicitation, purchase or sale

will be made in any jurisdiction in which such an offer, solicitation or sale would be unlawful. The Tender Offers are being made solely

pursuant to the Offer to Purchase made available to holders of the Notes. None of Suncor or its affiliates, their respective boards of

directors, the dealer managers, the tender agents, the information agent or the trustee with respect to any series of Notes is making

any recommendation as to whether or not holders should tender or refrain from tendering all or any portion of their Notes in response

to the Tender Offers. Holders are urged to evaluate carefully all information in the Offer to Purchase, consult their own investment and

tax advisors and make their own decisions whether to tender Notes in the Tender Offers, and, if so, the principal amount of Notes to tender.

Legal Advisory – Forward-Looking Information

This news release contains certain forward-looking information

and forward-looking statements (collectively referred to herein as “forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities laws. Forward-looking statements are based on Suncor’s current expectations, estimates, projections

and assumptions that were made by the company in light of information available at the time the statement was made and consider Suncor’s

experience and its perception of historical trends. Forward-looking statements in this news release include statements about the purchase

of the Notes and amount of the consideration paid therefor; the expected source of funds for the Tender Offers; the deadlines, determination

dates and settlement dates specified herein in regards to the Tender Offers; increasing or decreasing the Maximum Amounts; and the payment

of accrued and unpaid interest.

Forward-looking statements and information are not guarantees

of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that

are unique to Suncor. Suncor’s actual results may differ materially from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s Management Discussion and Analysis for

the Second Quarter of 2024 dated August 6, 2024, its Annual Information Form, Annual Report to Shareholders and Form 40-F,

each dated March 21, 2024, and other documents it files from time to time with securities regulatory authorities describe the risks,

uncertainties, material assumptions and other factors that could influence actual results and such factors are incorporated herein by

reference. Copies of these documents are available without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta T2P 3E3; by referring

to suncor.com/FinancialReports or to the company’s profile on SEDAR+ at sedarplus.ca or EDGAR

at sec.gov. Except as required by applicable securities laws, Suncor disclaims any intention or obligation to publicly update

or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Suncor Energy is Canada's leading integrated energy company. Suncor's

operations include oil sands development, production and upgrading; offshore oil production; petroleum refining in Canada and the U.S.;

and the company’s Petro-CanadaTM retail and wholesale distribution networks (including Canada’s Electric HighwayTM,

a coast-to-coast network of fast-charging EV stations). Suncor is developing petroleum resources while advancing the transition to a lower-emissions

future through investments in lower emissions intensity power, renewable feedstock fuels and projects targeting emissions intensity. Suncor

also conducts energy trading activities focused primarily on the marketing and trading of crude oil, natural gas, byproducts, refined

products and power. Suncor's common shares (symbol: SU) are listed on the Toronto and New York stock exchanges.

– 30 –

For more information about Suncor, visit our website at suncor.com.

Media inquiries:

(833) 296-4570

media@suncor.com

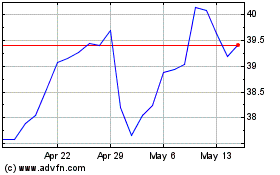

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Jan 2024 to Jan 2025