FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

| For the month of: February,

2025 |

Commission

File Number: 1-12384 |

SUNCOR ENERGY

INC.

(Name of registrant)

150 – 6th Avenue S.W.

P.O. Box 2844

Calgary, Alberta

Canada, T2P 3E3

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

SUNCOR ENERGY INC. |

| |

|

|

| |

|

|

| Date: |

|

By: |

| |

|

|

| February 26, 2025 |

|

“Shawn Poirier” |

| |

|

Shawn Poirier |

| |

|

Assistant Corporate Secretary |

EXHIBIT INDEX

Exhibit 99.1

|

News

Release |

FOR IMMEDIATE RELEASE

Suncor Energy files annual disclosure documents and renews NCIB

All financial figures are in Canadian dollars.

Calgary, Alberta (February 26, 2025) – Suncor Energy

(TSX: SU) (NYSE: SU) has filed its 2024 Annual Report, 2024 Annual Information Form and 2024 Management Proxy Circular.

To view the company’s annual disclosure documents, visit Suncor’s

profile on sedarplus.com or sec.gov or visit Suncor’s website at suncor.com/financialreports.

Normal Course Issuer Bid (NCIB)

Additionally, the Toronto Stock Exchange (TSX) has accepted a notice

filed by Suncor to renew its NCIB to purchase the company’s common shares through the facilities of the TSX, New York Stock Exchange

and/or alternative trading systems in Canada and the U.S. The notice provides that, beginning March 3, 2025, and ending March 2,

2026, Suncor may purchase for cancellation up to 123,800,000 common shares, which is equal to approximately 10% of Suncor’s public

float of 1,238,099,685 common shares as of February 18, 2025. On February 18, 2025, Suncor had 1,238,456,851 common shares issued

and outstanding.

The actual number of common shares that may be purchased under the

NCIB and the timing of any such purchases will be determined by Suncor. Suncor believes that, depending on the trading price of its common

shares and other relevant factors, purchasing its own shares represents an attractive investment opportunity and is in the best interests

of the company and its shareholders. The company does not expect the decision to allocate cash to repurchase shares will affect its long-term

strategy.

Pursuant to Suncor’s previous NCIB, Suncor agreed that it would

not purchase more than 128,700,000 common shares between February 26, 2024, and February 25, 2025. Between February 26,

2024, and February 25, 2025, and pursuant to Suncor’s previous NCIB, Suncor repurchased 61,065,792 shares on the open market

for approximately $3.258 billion, at a weighted average price of $53.35 per share.

Subject to the block purchase exemption that is available to Suncor

for regular open market purchases under the NCIB, Suncor will limit daily purchases of Suncor common shares on the TSX in connection with

the NCIB to no more than 25% (2,017,894 common shares) of the average daily trading volume of Suncor’s common shares on the TSX

during the previous six-month period (8,071,576 common shares). Purchases under the NCIB will be made through open market purchases at

market price, as well as by other means as may be permitted by securities regulatory authorities. Suncor expects to enter into an automatic

share purchase plan in relation to purchases made in connection with the NCIB on March 3, 2025.

| |

Suncor Energy

150 6 Avenue S.W. Calgary, Alberta T2P 3E3 |

Legal Advisory – Forward-Looking Information

This news release contains certain forward-looking information and

forward-looking statements (collectively referred to herein as “forward-looking statements”) and other information based on

Suncor’s current expectations, estimates, projections and assumptions that were made by the company in light of information available

at the time the statement was made and consider Suncor’s experience and its perception of historical trends.

Forward-looking statements in this news release include statements

about the NCIB, including the amount, timing and manner of purchases under the NCIB, that depending on the trading price of its common

shares and other relevant factors, repurchasing its common shares represents an attractive investment opportunity and is in the best interest

of the company and its shareholders, the expectation that the decision to allocate cash to repurchase shares will not affect its long-term

strategy and the expectation that Suncor will enter into an automatic share purchase plan related to purchases made in connection with

the NCIB.

Forward-looking statements and information are not guarantees of

future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that

are unique to Suncor. Suncor’s actual results may differ materially from those expressed or implied by its forward-looking statements,

so readers are cautioned not to place undue reliance on them.

Suncor’s Annual Information Form, Annual Report to Shareholders

and Form 40-F, each dated February 26, 2025, Suncor’s Report to Shareholders for the Fourth Quarter of 2024 dated February 5,

2024, and other documents it files from time to time with securities regulatory authorities describe the risks, uncertainties, material

assumptions and other factors that could influence actual results and such factors are incorporated herein by reference. Copies of these

documents are available without charge from Suncor at 150 6th Avenue S.W., Calgary, Alberta T2P 3E3; by email request to invest@suncor.com;

or by referring to suncor.com/FinancialReports or to the company’s profile on SEDAR+ at sedarplus.ca or EDGAR at sec.gov. Except

as required by applicable securities laws, Suncor disclaims any intention or obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

Suncor Energy is Canada's leading integrated energy company. Suncor's

operations include oil sands development, production and upgrading; offshore oil production; petroleum refining in Canada and the U.S.;

and the company’s Petro-Canada™ retail and wholesale distribution networks (including Canada’s Electric Highway™,

a coast-to-coast network of fast-charging EV stations). Suncor is developing petroleum resources while advancing the transition to a lower-emissions

future through investments in lower emissions intensity power, renewable feedstock fuels and projects targeting emissions intensity. Suncor

also conducts energy trading activities focused primarily on the marketing and trading of crude oil, natural gas, byproducts, refined

products and power. Suncor's common shares (symbol: SU) are listed on the Toronto and New York stock exchanges.

For more information about Suncor, visit our website at suncor.com.

Media inquiries:

833-296-4570

media@suncor.com

Investor inquiries:

invest@suncor.com

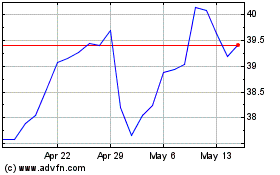

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Feb 2025 to Mar 2025

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Mar 2025