0000093556false00000935562025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 5, 2025

Stanley Black & Decker, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| CT | 1-5224 | 06-0548860 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

1000 STANLEY DRIVE

NEW BRITAIN, CT 06053

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (860) 225-5111

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | |

| Title Of Each Class | | Trading Symbols | | Name Of Each Exchange On Which Registered |

| Common Stock | - $2.50 Par Value per Share | | SWK | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02 Results of Operations and Financial Condition

On February 5, 2025, Stanley Black & Decker, Inc. issued a press release announcing fourth quarter and full year 2024 results.

Item 9.01 Financial Statements and Exhibits.

(a) Not applicable

(b) Not applicable

(c) Not applicable

(d) Exhibits

99.1 Press release dated February 5, 2025, issued by Stanley Black & Decker, Inc.

99.2 Financial statements and supporting schedules contained in Stanley Black & Decker, Inc.'s February 5, 2025 press release.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | Stanley Black & Decker, Inc. |

| | | |

| February 5, 2025 | | | | By: | | /s/ Janet M. Link |

| | | | Name: | | Janet M. Link |

| | | | Title: | | Senior Vice President, General Counsel and Secretary |

Exhibit Index

| | | | | |

| |

| Exhibit No. | Description |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Stanley Black & Decker Reports 4Q & Full Year 2024 Results

DEWALT Posts 7th Consecutive Quarter of Organic Growth*

Fourth Quarter Gross Margin Up Versus Prior Year as Global Cost Reduction Program Continues Driving Margin Expansion

Strong Fourth Quarter Cash Generation Supports Ongoing Capital Allocation Priorities Focused on Shareholder Dividends and Further Debt Reduction

New Britain, Connecticut, February 5, 2025 … Stanley Black & Decker (NYSE: SWK), a worldwide leader in tools and outdoor, today announced fourth quarter and full year 2024 financial results.

•2024 Revenues of $15.4 Billion, Down 3% Versus Prior Year; Flat Organic Revenue* Led by Growth in DEWALT as well as Aerospace Fasteners Offset by Infrastructure Divestiture and Currency

•Fourth Quarter Revenues of $3.7 Billion, Flat Versus Prior Year With 3% Organic Growth* Offset by Infrastructure Divestiture and Currency

•Fourth Quarter Gross Margin Was 30.8%, Up 120 Basis Points Versus Prior Year; Fourth Quarter Adjusted Gross Margin* Was 31.2%, Up 140 Basis Points Versus Prior Year. Full Year Gross Margin Was 29.4%; Full Year Adjusted Gross Margin* Was 30.0%

•Fourth Quarter EPS Was $1.28 and Adjusted EPS* Was $1.49; Full Year EPS Was $1.89 and Adjusted EPS* Was $4.36

•Fourth Quarter Cash From Operating Activities Was $679 Million and Free Cash Flow* Was $565 Million. Full Year Cash From Operating Activities Was $1,107 Million and Free Cash Flow* Was $753 Million Which Supported $1.1 Billion in Total 2024 Debt Reduction

•Management Will Provide Its 2025 Planning Assumptions on Today’s Call. The 2025 Planning Assumptions Will Include Management’s Base Case View (Pre-Tariffs) and Tariff Scenario Planning.

Donald Allan, Jr., Stanley Black & Decker's President & CEO, commented, “Stanley Black & Decker delivered across its key focus areas in 2024 with continued gross margin expansion, strong free cash flow* generation, strengthening our balance sheet as well as making new investments aimed at driving market share growth. Against a mixed macroeconomic backdrop, we are encouraged by the growth and share gain momentum in DEWALT and within portions of engineered fastening. As we continue on this journey, we are proud to have delivered on key financial milestones, including adjusted gross margin* exceeding 31% in the fourth quarter along with strong cash generation. I want to

*Non-GAAP Financial Measure As Further Defined On Page 6

1

thank our organization for their relentless focus and dedication to serving our customers and achieving these results.

“Turning to 2025, we are taking actions intended to deliver share gain and to improve the cost structure behind our ongoing strategic initiatives and are preparing countermeasures designed to mitigate the impact from recently announced tariffs as their full effect becomes known. Aggregate market demand is expected to remain muted but relatively stable in the first half with the potential for a positive inflection later in the year supported by strength in professional construction as well as aerospace and industrial fastening. As we seek to capitalize on these opportunities, we remain focused on prudently investing across our portfolio to fuel end-user inspired innovation and differentiated market activation designed to capture the share gain opportunities we anticipate in the near-term and over the long-term horizon.

“Stanley Black & Decker is built on the strength of our people, iconic brands and a powerful innovation engine. By accelerating our growth culture with operational excellence at its core, we are positioning the Company to deliver improved organic growth*, margins and cash flow to support strong long-term shareholder returns."

The Company’s primary areas of multi-year strategic focus remain unchanged:

•Advancing innovation, electrification, and global market penetration to achieve mid-single digit organic revenue growth* (2 to 3 times the market)

•Streamlining and simplifying the organization, and investing in initiatives that more directly impact our customers and end users

•Returning adjusted gross margins* to historical 35%+ levels by accelerating the operations and supply chain transformation to improve fill rates and better match inventory with customer demand

•Prioritizing cash flow generation and inventory optimization

Fourth Quarter 2024 Key Points:

•Net sales for the quarter were $3.7 billion, flat versus prior year as volume (+4%) was offset by price (-1%), currency (-1%), and the Infrastructure business divestiture (-2%).

•Gross margin for the quarter was 30.8%, up 120 basis points versus the prior year rate of 29.6%. Adjusted gross margin* was 31.2%, up 140 basis points versus the prior year, primarily driven by the supply chain transformation efficiencies.

•SG&A expenses were 23.0% of sales for the quarter versus 22.3% in the prior year. Excluding charges, adjusted SG&A expenses* were 22.5% of sales, up versus 21.7% in the prior year, as the Company invested in

*Non-GAAP Financial Measure As Further Defined On Page 6

2

growth initiatives designed to deliver increased market penetration and future market share gains.

•Net earnings from continuing operations was 5.2% of sales versus a net loss from continuing operations (7.4%) of sales in the prior year. Fourth quarter EBITDA* was 9.1% of sales versus 4.2% of sales in the prior year. Fourth quarter adjusted EBITDA* was 10.2% of sales versus 9.4% of sales in the prior year.

•Fourth quarter cash from operating activities was $679 million and free cash flow* was $565 million.

4Q’24 Segment Results

| | | | | | | | | | | | | | | | | | | | |

($ in M) | |

| Sales | Segment Profit | Charges1 | Adjusted Segment Profit* | Segment Margin | Adjusted Segment Margin* |

Tools & Outdoor | $3,228 | $298.1 | $32.1 | $330.2 | 9.2% | 10.2% |

| | | | | | |

Industrial | $493 | $52.7 | $0.2 | $52.9 | 10.7% | 10.7% |

1 See Non-GAAP Adjustments On Page 5

•Tools & Outdoor net sales were up (+2%) versus fourth quarter 2023, driven by volume (+4%), which was partially offset by price (-1%) and currency (-1%). Organic revenue* was up 3%, with continued growth in DEWALT and a solid holiday promotional season partially offset by a moderately weaker consumer and DIY backdrop. Regional organic revenues* were: North America (+2%), Europe (+4%) and rest of world (+8%). The Tools & Outdoor segment margin was 9.2%, down 10 basis points versus prior year reflecting higher transformation footprint costs. Adjusted segment margin* was 10.2%, up 20 basis points versus the prior year rate, primarily due to supply chain transformation benefits, which were partially offset by growth investments.

•Industrial net sales were down (-15%) versus fourth quarter 2023, with organic sales flat*. Price (+2%) was offset by volume (-2%), the Infrastructure business divestiture (-14%) and currency (-1%). Engineered Fastening organic revenues* were flat, as aerospace and general industrial growth was offset by automotive market softness. The Industrial segment margin was 10.7% versus the prior year rate of 11.2%. Adjusted segment margin* was 10.7% versus the prior year rate of 11.1% primarily due to lower volume in automotive.

*Non-GAAP Financial Measure As Further Defined On Page 6

3

Global Cost Reduction Program Supporting Gross Margin Expansion

The Company continued executing a series of initiatives that are expected to generate $2 billion of pre-tax run-rate cost savings and be completed by the end of 2025. Of the $2 billion savings, $1.5 billion is expected to be delivered through a supply chain transformation that leverages material productivity, drives operational excellence, consolidates facilities and optimizes the distribution network, and reduces complexity of the product portfolio.

These actions are expected to optimize the Company’s cost base to return adjusted gross margins* to historical 35%+ levels while funding investments that accelerate organic growth*.

The Global Cost Reduction Program generated $110 million of incremental pre-tax run-rate cost savings in fourth quarter 2024. Since inception of the program in mid-2022, the Company has generated approximately $1.5 billion in pre-tax run-rate cost savings and reduced inventory by over $2 billion.

2025 Planning Assumptions

Patrick D. Hallinan, Executive Vice President and CFO, commented, "Our solid operational execution in 2024 delivered full year adjusted gross margin* of 30% and approximately $750 million of free cash flow*, which together allowed us to reduce debt by $1.1 billion while continuing to return cash to shareholders through our dividend. Looking forward, we remain focused on driving toward our target of 35%+ adjusted gross margin* while supporting incremental growth investments to accelerate share gain. We plan to deliver EBITDA* expansion in 2025 through organic growth* from modest share gains combined with supply chain cost structure improvements that are primarily in our control. With the recent tariff announcements, we are preparing for a dynamic backdrop in 2025 and expect to respond with supply chain and price actions designed to mitigate the impact from such tariffs to maintain our margin objectives, which enable us to fuel innovation and brand building. Our top priorities remain delivering margin expansion, cash generation and restoring balance sheet strength over the next 12 to 18 months to position the Company for long-term growth and value creation.”

Management will provide its base planning assumptions and commentary on the current tariff environment. Excluding new tariffs, the Company's planning assumption is for 2025 EPS to be $4.05 (+/- $0.65) on a GAAP basis and $5.25 (+/- $0.50) on an adjusted basis* and free cash flow* of $750 million (+/- $100 million). During the earnings call this morning, Management will review these planning assumptions in more detail.

The difference between the 2025 GAAP and adjusted EPS* planning assumption is approximately $1.05 to $1.35, consisting primarily of charges related to the supply chain transformation under the Global Cost Reduction Program.

*Non-GAAP Financial Measure As Further Defined On Page 6

4

Non-GAAP Adjustments

Total pre-tax non-GAAP adjustments in the fourth quarter of 2024 were $49.3 million, primarily related to footprint actions and other costs related to the supply chain transformation and restructuring costs. Gross profit included $16.1 million of charges, while SG&A included $18.5 million. Other, net included a net benefit of $18.3 million, and Restructuring included $33.0 million of charges.

Earnings Webcast

Stanley Black & Decker will host a webcast with investors today, February 5, 2025, at 8:00 am ET. A slide presentation, which will accompany the call, will be available on the "Investors" section of the Company’s website at www.stanleyblackanddecker.com/investors and will remain available after the call.

The call will be available through a live, listen-only webcast or teleconference. Links to access the webcast, register for the teleconference, and view the accompanying slide presentation will be available on the "Investors" section of the Company’s website, www.stanleyblackanddecker.com/investors under the subheading "News & Events." A replay will also be available two hours after the call and can be accessed on the “Investors” section of Stanley Black & Decker’s website.

About Stanley Black & Decker

Founded in 1843 and headquartered in the USA, Stanley Black & Decker (NYSE: SWK) is a worldwide leader in Tools and Outdoor, operating manufacturing facilities globally. The Company's approximately 48,500 employees produce innovative end-user inspired power tools, hand tools, storage, digital jobsite solutions, outdoor and lifestyle products, and engineered fasteners to support the world’s builders, tradespeople and DIYers. The Company's world class portfolio of trusted brands includes DEWALT®, CRAFTSMAN®, STANLEY®, BLACK+DECKER®, and Cub Cadet®. To learn more visit: www.stanleyblackanddecker.com or follow Stanley Black & Decker on Facebook, Instagram, LinkedIn and X.

*Non-GAAP Financial Measure As Further Defined On Page 6

5

Investor Contacts:

| | | | | |

| Dennis Lange | Christina Francis |

| Vice President, Investor Relations | Director, Investor Relations |

| dennis.lange@sbdinc.com | christina.francis@sbdinc.com |

| (860) 827-3833 | (860) 438-3470 |

Media Contacts:

Debora Raymond

Vice President, Public Relations

debora.raymond@sbdinc.com

(203) 640-8054

Non-GAAP Financial Measures

Organic revenue or organic sales is defined as the difference between total current and prior year sales less the impact of companies acquired and divested in the past twelve months and any foreign currency impacts. Organic revenue growth, organic sales growth or organic growth is organic revenue or organic sales divided by prior year sales. Gross profit is defined as sales less cost of sales. Gross margin is gross profit as a percentage of sales. Segment profit is defined as sales less cost of sales and selling, general and administrative (“SG&A”) expenses (aside from corporate overhead expense). Segment margin is segment profit as a percentage of sales. EBITDA is earnings before interest, taxes, depreciation and amortization. EBITDA margin is EBITDA as a percentage of sales. Gross profit, gross margin, SG&A, segment profit, segment margin, earnings, EBITDA and EBITDA margin are adjusted for certain gains and charges, such as environmental charges, supply chain transformation costs, acquisition and divestiture-related items, asset impairments, restructuring, and other adjusting items. Management uses these metrics as key measures to assess the performance of the Company as a whole, as well as the related measures at the segment level. Adjusted earnings per share or adjusted EPS, is diluted GAAP EPS excluding certain gains and charges. Free cash flow is defined as cash flow from operations less capital and software expenditures. Management considers free cash flow an important indicator of its liquidity, as well as its ability to fund future growth and to provide a return to the shareowners and is useful information for investors. Free cash flow does not include deductions for mandatory debt service, other borrowing activity, discretionary dividends on the Company’s common stock and business acquisitions, among other items. Free cash flow conversion is defined as free cash flow divided by net income. The Non-GAAP statement of operations and business segment information is reconciled to GAAP on pages 13 through 17 and in the appendix to the earnings conference call slides available at http://www.stanleyblackanddecker.com/investors. The Company considers the use of the Non-GAAP financial measures above relevant to aid analysis and understanding of the Company’s results, business trends and outlook measures aside from the material impact of certain gains and charges and ensures appropriate comparability to operating results of prior periods.

The Company provides expectations for the non-GAAP financial measures of full-year 2025 adjusted EPS, presented on a basis excluding certain gains and charges, as well as 2025 free cash flow. Forecasted full-year 2025 adjusted EPS is reconciled to forecasted full-year 2025 GAAP EPS under “2025 Planning Assumptions”. Consistent with past methodology, the forecasted full-year 2025 GAAP EPS excludes the impacts of potential acquisitions and divestitures, future regulatory changes or strategic shifts that could impact the Company's contingent liabilities or intangible assets, respectively, potential future cost actions in response to external factors that have not yet occurred, and any other items not specifically referenced under “2025 Planning Assumptions”. A reconciliation of forecasted free cash flow to its most directly

*Non-GAAP Financial Measure As Further Defined On Page 6

6

comparable GAAP estimate is not available without unreasonable effort due to high variability and difficulty in predicting items that impact cash flow from operations, which could be material to the Company’s results in accordance with U.S. GAAP. The Company believes such a reconciliation would also imply a degree of precision that is inappropriate for this forward-looking measure.

The Company also provides multi-year strategic goals for the non-GAAP financial measures of adjusted gross margin, presented on a basis excluding certain gains and charges, as well as organic revenue growth. A reconciliation for these non-GAAP measures is not available without unreasonable effort due to the inherent difficulty of forecasting the timing and/or amount of various items that have not yet occurred, including the high variability and low visibility with respect to certain gains or charges that would generally be excluded from non-GAAP financial measures and which could be material to the Company’s results in accordance with U.S. GAAP. Additionally, estimating such GAAP measures and providing a meaningful reconciliation consistent with the Company’s accounting policies for future periods requires a level of precision that is unavailable for these future multi-year periods and cannot be accomplished without unreasonable effort. The Company believes such a reconciliation would also imply a degree of precision that is inappropriate for these forward-looking measures.

*Non-GAAP Financial Measure As Further Defined On Page 6

7

CAUTIONARY STATEMENT

CONCERNING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any goals, projections or guidance of earnings, income, revenue, margins, costs or sales, sales growth, profitability or other financial items; any statements of the plans, strategies and objectives of management for future operations, including expectations around our ongoing transformation; future market share gain, any statements concerning proposed new products, services or developments; any statements regarding future economic conditions or performance; any statements of beliefs, plans, intentions or expectations; any statements and assumptions regarding possible tariff and tariff impact projections and related mitigation plans; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include, among others, the words “may,” “will,” “estimate,” “intend,” “could,” “project,” “plan,” “continue,” “believe,” “expect,” “anticipate”, “run-rate”, “annualized”, “forecast”, “commit”, “goal”, “target”, “design”, “on track”, “position or positioning”, “guidance,” “aim,” “looking forward,” “multi-year” or any other similar words.

Although the Company believes that the expectations reflected in any of its forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of its forward-looking statements. The Company's future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties, such as those disclosed or incorporated by reference in the Company's filings with the Securities and Exchange Commission.

Important factors that could cause the Company's actual results, performance and achievements, or industry results to differ materially from estimates or projections contained in its forward-looking statements include, among others, the following: (i) successfully developing, marketing and achieving sales from new products and services and the continued acceptance of current products and services; (ii) macroeconomic factors, including global and regional business conditions, commodity prices, inflation and deflation, interest rate volatility, currency exchange rates, and uncertainties in the global financial markets related to the recent failures of several financial institutions; (iii) laws, regulations and governmental policies affecting the Company's activities in the countries where it does business, including those related to tariffs, taxation, data privacy, anti-bribery, anti-corruption, government contracts, trade controls such as section 301 tariffs and section 232 steel and aluminum tariffs, and import and export controls; (iv) the Company’s ability to predict the timing and extent of any trade related regulations, restrictions and tariffs as well as its ability to successfully assess the impact to its business of, and mitigate or respond to macroeconomic or trade and tariff changes or policies, (v) the economic, political, cultural and legal environment in Europe and the emerging markets in which the Company generates sales, particularly Latin America and China; (vi) realizing the anticipated benefits of mergers, acquisitions, joint ventures, strategic alliances or divestitures; (vii) pricing pressure and other changes within competitive markets; (viii) availability and price of raw materials, component parts, freight, energy, labor and sourced finished goods; (ix) the impact that the tightened credit markets may have on the Company or its customers or suppliers; (x) the extent to which the Company has to write off accounts receivable, inventory or other assets or experiences supply chain disruptions in connection with bankruptcy filings by customers or suppliers; (xi) the Company's ability to identify and effectively execute productivity improvements and cost reductions; (xii) potential business, supply chain and distribution disruptions, including those related to physical security threats, information technology or cyber-attacks, epidemics, natural disasters or pandemics, sanctions, political unrest, war or terrorism, including the conflicts between Russia and Ukraine, and Israel and Hamas, and tensions or conflicts in South Korea, China, Taiwan and the Middle East; (xiii) the continued consolidation of customers, particularly in consumer channels, and the Company’s continued reliance on significant customers; (xiv) managing franchisee relationships; (xv) the impact of poor weather conditions and climate change and risks related to the transition to a lower-carbon economy, such as the Company's ability to successfully adopt new technology, meet market-driven demands for carbon neutral and renewable energy technology, or to comply with changes in environmental regulations or requirements, which may be more stringent and complex, impacting its manufacturing facilities and business operations as well as remediation plans and costs relating to any of its current or former locations or other sites; (xvi) maintaining or improving production rates in the Company's manufacturing facilities, responding to significant changes in customer preferences or expectations, product demand and fulfilling demand for new and existing products, and learning, adapting and integrating new technologies into products, services and processes; (xvii) changes in the competitive landscape in the Company's markets; (xviii) the Company's non-U.S. operations, including sales to non-U.S. customers; (xix) the impact from demand changes within world-wide markets associated with construction, homebuilding and remodeling, aerospace, and other markets which the Company serves; (xx) potential adverse developments in new or pending litigation and/or government investigations; (xxi) the incurrence of debt and changes in the Company's ability to obtain debt on commercially reasonable terms and at competitive rates; (xxii) substantial pension and other postretirement benefit obligations; (xxiii) potential regulatory liabilities, including environmental, privacy, data breach, workers compensation and product liabilities; (xxiv) attracting, developing and retaining senior management and other key employees, managing a workforce in many jurisdictions, labor shortages, work stoppages or other labor disruptions; (xxv) the Company's ability to keep abreast with the pace of technological change; (xxvi) changes in accounting estimates; (xxvii) the Company’s ability to protect its intellectual property rights and to maintain its public reputation and the strength of its brands; (xxviii) critical or negative publicity, including on social media, whether or not accurate, concerning the Company’s brands, products or initiatives, and (xxix) the Company’s ability to implement, and achieve the expected benefits (including cost savings and reduction in working capital) from its Global Cost Reduction Program including: continuing to advance innovation, electrification and global market penetration to achieve mid-single digit organic revenue growth; streamlining and simplifying the organization, and investing in initiatives that more directly impact the Company's customers and end users; returning adjusted gross margins* to historical 35%+ levels by accelerating the supply chain transformation to leverage material productivity, drive operational excellence, rationalize manufacturing and distribution networks, including consolidating facilities and optimizing the distribution network, and reduce complexity of the product portfolio; improving fill rates and matching inventory with customer demand; prioritizing cash flow generation and inventory optimization; delivering operational excellence through efficiency, simplified organizational design; and reducing complexity through platforming products and implementing initiatives to drive a SKU reduction.

Additional factors that could cause actual results to differ materially from forward-looking statements are set forth in the Annual Report on Form 10-K and in the Quarterly Reports on Form 10-Q, including under the headings “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in the Consolidated Financial Statements and the related Notes, and other filings with the Securities and Exchange Commission.

Forward-looking statements in this press release speak only as of the date hereof, and forward-looking statements in documents that are incorporated by reference herein speak only as of the date of those documents. The Company does not undertake any obligation or intention to update or revise any forward-looking statements, whether as a result of future events or circumstances, new information or otherwise, except as required by law.

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, Millions of Dollars Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | FOURTH QUARTER | | YEAR-TO-DATE |

| | 2024 | | 2023 | | 2024 | | 2023 |

| NET SALES | $ | 3,720.5 | | | $ | 3,736.5 | | | $ | 15,365.7 | | | $ | 15,781.1 | |

| COSTS AND EXPENSES | | | | | | | |

| Cost of sales | 2,576.4 | | | 2,632.1 | | | 10,851.3 | | | 11,848.5 | |

| Gross profit | 1,144.1 | | | 1,104.4 | | | 4,514.4 | | | 3,932.6 | |

| % of Net Sales | 30.8 | % | | 29.6 | % | | 29.4 | % | | 24.9 | % |

| Selling, general and administrative | 855.2 | | | 834.0 | | | 3,332.7 | | | 3,290.7 | |

| % of Net Sales | 23.0 | % | | 22.3 | % | | 21.7 | % | | 20.9 | % |

| Other - net | 55.9 | | | 95.8 | | | 448.8 | | | 320.1 | |

| Loss on sales of businesses | — | | | 3.2 | | | — | | | 10.8 | |

| Asset impairment charges | — | | | 150.8 | | | 72.4 | | | 274.8 | |

| Restructuring charges | 33.0 | | | 11.8 | | | 99.9 | | | 39.4 | |

| Income (loss) from operations | 200.0 | | | 8.8 | | | 560.6 | | | (3.2) | |

| Interest - net | 74.6 | | | 87.6 | | | 319.5 | | | 372.5 | |

| EARNINGS (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | 125.4 | | | (78.8) | | | 241.1 | | | (375.7) | |

| Income taxes on continuing operations | (69.5) | | | 197.3 | | | (45.2) | | | (94.0) | |

| NET EARNINGS (LOSS) FROM CONTINUING OPERATIONS | $ | 194.9 | | | $ | (276.1) | | | $ | 286.3 | | | $ | (281.7) | |

| (Loss) gain on Security sale before income taxes | — | | | (13.5) | | | 10.4 | | | (14.3) | |

| Income taxes on discontinued operations | — | | | 14.8 | | | 2.4 | | | 14.5 | |

| NET (LOSS) EARNINGS FROM DISCONTINUED OPERATIONS | $ | — | | | $ | (28.3) | | | $ | 8.0 | | | $ | (28.8) | |

| NET EARNINGS (LOSS) | $ | 194.9 | | | $ | (304.4) | | | $ | 294.3 | | | $ | (310.5) | |

| BASIC EARNINGS (LOSS) PER SHARE OF COMMON STOCK | | | | | | | |

| Continuing operations | $ | 1.29 | | | $ | (1.84) | | | $ | 1.90 | | | $ | (1.88) | |

| Discontinued operations | $ | — | | | $ | (0.19) | | | $ | 0.05 | | | $ | (0.19) | |

| Total basic earnings (loss) per share of common stock | $ | 1.29 | | | $ | (2.03) | | | $ | 1.96 | | | $ | (2.07) | |

| DILUTED EARNINGS (LOSS) PER SHARE OF COMMON STOCK | | | | | | | |

| Continuing operations | $ | 1.28 | | | $ | (1.84) | | | $ | 1.89 | | | $ | (1.88) | |

| Discontinued operations | $ | — | | | $ | (0.19) | | | $ | 0.05 | | | $ | (0.19) | |

| Total diluted earnings (loss) per share of common stock | $ | 1.28 | | | $ | (2.03) | | | $ | 1.95 | | | $ | (2.07) | |

| DIVIDENDS PER SHARE OF COMMON STOCK | $ | 0.82 | | | $ | 0.81 | | | $ | 3.26 | | | $ | 3.22 | |

| WEIGHTED-AVERAGE SHARES OUTSTANDING (in thousands) | | | | | | | |

| Basic | 150,725 | | 149,933 | | 150,485 | | 149,751 |

| Diluted | 151,710 | | 149,933 | | 151,297 | | 149,751 |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | |

| | December 28, 2024 | | December 30, 2023 |

| ASSETS | | | | |

| Cash and cash equivalents | | $ | 290.5 | | | $ | 449.4 | |

| Accounts and notes receivable, net | | 1,153.7 | | | 1,302.0 | |

| Inventories, net | | 4,536.4 | | | 4,738.6 | |

| Current assets held for sale | | — | | | 140.8 | |

| Other current assets | | 397.1 | | | 386.5 | |

| Total current assets | | 6,377.7 | | | 7,017.3 | |

| Property, plant and equipment, net | | 2,034.3 | | | 2,169.9 | |

| Goodwill and other intangibles, net | | 11,636.4 | | | 11,945.5 | |

| Long-term assets held for sale | | — | | | 716.8 | |

| Other assets | | 1,800.5 | | | 1,814.3 | |

| Total assets | | $ | 21,848.9 | | | $ | 23,663.8 | |

| LIABILITIES AND SHAREOWNERS’ EQUITY | | | | |

| Short-term borrowings | | $ | — | | | $ | 1,074.8 | |

| Current maturities of long-term debt | | 500.4 | | | 1.1 | |

| Accounts payable | | 2,437.2 | | | 2,298.9 | |

| Accrued expenses | | 1,979.3 | | | 2,464.3 | |

| Current liabilities held for sale | | — | | | 44.1 | |

| Total current liabilities | | 4,916.9 | | | 5,883.2 | |

| Long-term debt | | 5,602.6 | | | 6,101.0 | |

| Long-term liabilities held for sale | | — | | | 84.8 | |

| Other long-term liabilities | | 2,609.5 | | | 2,538.7 | |

| Shareowners’ equity | | 8,719.9 | | | 9,056.1 | |

| Total liabilities and shareowners' equity | | $ | 21,848.9 | | | $ | 23,663.8 | |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

SUMMARY OF CASH FLOW ACTIVITY

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOURTH QUARTER | | YEAR-TO-DATE |

| | 2024 | | 2023 | | 2024 | | 2023 |

| OPERATING ACTIVITIES | | | | | | | |

| Net earnings (loss) | $ | 194.9 | | | $ | (304.4) | | | $ | 294.3 | | | $ | (310.5) | |

| Depreciation and amortization | 139.6 | | | 148.4 | | | 589.5 | | | 625.1 | |

| Loss on sales of businesses | — | | | 3.2 | | | — | | | 10.8 | |

| (Loss) gain on sale of discontinued operations | — | | | 13.5 | | | (10.4) | | | 14.3 | |

| Asset impairment charges | — | | | 150.8 | | | 72.4 | | | 274.8 | |

| Changes in working capital1 | 344.3 | | | 515.7 | | | 321.5 | | | 769.0 | |

| Other | 0.3 | | | 242.1 | | | (160.4) | | | (192.2) | |

| Net cash provided by operating activities | 679.1 | | | 769.3 | | | 1,106.9 | | | 1,191.3 | |

| INVESTING AND FINANCING ACTIVITIES | | | | | | | |

| Capital and software expenditures | (114.5) | | | (122.3) | | | (353.9) | | | (338.7) | |

| Proceeds from sales of businesses, net of cash sold | — | | | — | | | 735.6 | | | (5.7) | |

| Proceeds from debt issuances, net of fees | — | | | — | | | — | | | 745.3 | |

| Net short-term commercial paper repayments | (364.6) | | | (450.4) | | | (1,056.9) | | | (1,044.7) | |

| Cash dividends on common stock | (124.0) | | | (121.8) | | | (491.2) | | | (482.6) | |

| Effect of exchange rate changes on cash | (77.7) | | | 30.8 | | | (106.2) | | | 2.1 | |

| Other | (6.4) | | | (3.1) | | | 3.9 | | | (17.3) | |

| Net cash used in investing and financing activities | (687.2) | | | (666.8) | | | (1,268.7) | | | (1,141.6) | |

| (Decrease) increase in cash, cash equivalents and restricted cash | (8.1) | | | 102.5 | | | (161.8) | | | 49.7 | |

| Cash, cash equivalents and restricted cash, beginning of period | 300.9 | | | 352.1 | | | 454.6 | | | 404.9 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 292.8 | | | $ | 454.6 | | | $ | 292.8 | | | $ | 454.6 | |

| | | | | | | | |

| Free Cash Flow Computation2 | | | | | | | |

| Net cash provided by operating activities | $ | 679.1 | | | $ | 769.3 | | | $ | 1,106.9 | | | $ | 1,191.3 | |

| Less: capital and software expenditures | (114.5) | | | (122.3) | | | (353.9) | | | (338.7) | |

| Free cash flow (before dividends) | $ | 564.6 | | | $ | 647.0 | | | $ | 753.0 | | | $ | 852.6 | |

| | | | | | | | |

| Reconciliation of Cash, Cash Equivalents and Restricted Cash | | | | | | | |

| | December 28, 2024 | | December 30, 2023 | | | | |

| Cash and cash equivalents | $ | 290.5 | | | $ | 449.4 | | | | | |

| Restricted cash included in Other current assets | 2.3 | | | 4.6 | | | | | |

| Cash and cash equivalents included in Current assets held for sale | — | | | 0.6 | | | | | |

| Cash, cash equivalents and restricted cash | $ | 292.8 | | | $ | 454.6 | | | | | |

| | | | | | | | |

1 | Working capital is comprised of accounts receivable, inventory, accounts payable and deferred revenue. |

2 | Free cash flow is defined as cash flow from operations less capital and software expenditures. Management considers free cash flow an important measure of its liquidity, as well as its ability to fund future growth and to provide a return to the shareowners, and is useful information for investors. Free cash flow does not include deductions for mandatory debt service, other borrowing activity, discretionary dividends on the Company’s common stock and business acquisitions, among other items. |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

BUSINESS SEGMENT INFORMATION

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOURTH QUARTER | | YEAR-TO-DATE |

| | 2024 | | 2023 | | 2024 | | 2023 |

| NET SALES | | | | | | | |

| Tools & Outdoor | $ | 3,227.6 | | | $ | 3,154.2 | | | $ | 13,304.2 | | | $ | 13,367.1 | |

| Industrial | 492.9 | | | 582.3 | | | 2,061.5 | | | 2,414.0 | |

| Total | $ | 3,720.5 | | | $ | 3,736.5 | | | $ | 15,365.7 | | | $ | 15,781.1 | |

| SEGMENT PROFIT | | | | | | | |

| Tools & Outdoor | $ | 298.1 | | | $ | 293.5 | | | $ | 1,197.4 | | | $ | 687.6 | |

| Industrial | 52.7 | | | 65.0 | | | 254.9 | | | 266.5 | |

| Segment Profit | 350.8 | | | 358.5 | | | 1,452.3 | | | 954.1 | |

| Corporate Overhead | (61.9) | | | (88.1) | | | (270.6) | | | (312.2) | |

| Total | $ | 288.9 | | | $ | 270.4 | | | $ | 1,181.7 | | | $ | 641.9 | |

| Segment Profit as a Percentage of Net Sales | | | | | | | |

| Tools & Outdoor | 9.2 | % | | 9.3 | % | | 9.0 | % | | 5.1 | % |

| Industrial | 10.7 | % | | 11.2 | % | | 12.4 | % | | 11.0 | % |

| Segment Profit | 9.4 | % | | 9.6 | % | | 9.5 | % | | 6.0 | % |

| | | | | | | | |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP EARNINGS FINANCIAL MEASURES TO CORRESPONDING

NON-GAAP FINANCIAL MEASURES

(Unaudited, Millions of Dollars Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | FOURTH QUARTER 2024 |

| | | GAAP | | Non-GAAP

Adjustments | | Non-GAAP1 |

| Gross profit | | $ | 1,144.1 | | | $ | 16.1 | | | $ | 1,160.2 | |

| % of Net Sales | | 30.8 | % | | | | 31.2 | % |

| Selling, general and administrative | | 855.2 | | | (18.5) | | | 836.7 | |

| % of Net Sales | | 23.0 | % | | | | 22.5 | % |

| Earnings from continuing operations before income taxes | | 125.4 | | | 49.3 | | | 174.7 | |

| Income taxes on continuing operations | | (69.5) | | | 18.2 | | | (51.3) | |

| Net earnings from continuing operations | | 194.9 | | | 31.1 | | | 226.0 | |

| Diluted earnings per share of common stock - Continuing operations | | $ | 1.28 | | | $ | 0.21 | | | $ | 1.49 | |

| | | | | | | |

| |

| | | | | | | |

| | | FOURTH QUARTER 2023 |

| | | GAAP | | Non-GAAP

Adjustments | | Non-GAAP1 |

| Gross profit | | $ | 1,104.4 | | | $ | 9.9 | | | $ | 1,114.3 | |

| % of Net Sales | | 29.6 | % | | | | 29.8 | % |

| Selling, general and administrative | | 834.0 | | | (23.9) | | | 810.1 | |

| % of Net Sales | | 22.3 | % | | | | 21.7 | % |

| (Loss) earnings from continuing operations before income taxes | | (78.8) | | | 197.3 | | | 118.5 | |

| Income taxes on continuing operations | | 197.3 | | | (216.8) | | | (19.5) | |

| Net (loss) earnings from continuing operations | | (276.1) | | | 414.1 | | | 138.0 | |

| Diluted (loss) earnings per share of common stock - Continuing operations2 | | $ | (1.84) | | | $ | 2.76 | | | $ | 0.92 | |

| | | | | | | |

| 1 | The Non-GAAP 2024 and 2023 information, as reconciled to GAAP above, is considered relevant to aid analysis and understanding of the Company’s results, business trends and outlook measures aside from the material impact of certain gains and charges and ensures appropriate comparability to operating results of prior periods. See further detail on Non-GAAP adjustments on page 17. |

| 2 | The Non-GAAP diluted earnings per share for the fourth quarter of 2023 is calculated using diluted weighted-average shares outstanding of 150.671 million. |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP EARNINGS FINANCIAL MEASURES TO CORRESPONDING

NON-GAAP FINANCIAL MEASURES

(Unaudited, Millions of Dollars Except Per Share Amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | YEAR-TO-DATE 2024 |

| | | GAAP | | Non-GAAP

Adjustments | | Non-GAAP1 |

| Gross profit | | $ | 4,514.4 | | | $ | 88.8 | | | $ | 4,603.2 | |

| % of Net Sales | | 29.4 | % | | | | 30.0 | % |

| Selling, general and administrative | | 3,332.7 | | | (81.3) | | | 3,251.4 | |

| % of Net Sales | | 21.7 | % | | | | 21.2 | % |

| Earnings from continuing operations before income taxes | | 241.1 | | | 466.0 | | | 707.1 | |

| Income taxes on continuing operations | | (45.2) | | | 92.6 | | | 47.4 | |

| Net earnings from continuing operations | | 286.3 | | | 373.4 | | | 659.7 | |

| Diluted earnings per share of common stock - Continuing operations | | $ | 1.89 | | | $ | 2.47 | | | $ | 4.36 | |

| | | | | | | |

| | | | | | | |

| | | YEAR-TO-DATE 2023 |

| | | GAAP | | Non-GAAP

Adjustments | | Non-GAAP1 |

| Gross profit | | $ | 3,932.6 | | | $ | 166.9 | | | $ | 4,099.5 | |

| % of Net Sales | | 24.9 | % | | | | 26.0 | % |

| Selling, general and administrative | | 3,290.7 | | | (99.4) | | | 3,191.3 | |

| % of Net Sales | | 20.9 | % | | | | 20.2 | % |

| (Loss) earnings from continuing operations before income taxes | | (375.7) | | | 566.2 | | | 190.5 | |

| Income taxes on continuing operations | | (94.0) | | | 65.8 | | | (28.2) | |

| Net (loss) earnings from continuing operations | | (281.7) | | | 500.4 | | | 218.7 | |

| Diluted (loss) earnings per share of common stock - Continuing operations2 | | $ | (1.88) | | | $ | 3.33 | | | $ | 1.45 | |

| | | | | | | |

1 | The Non-GAAP 2024 and 2023 information, as reconciled to GAAP above, is considered relevant to aid analysis and understanding of the Company’s results, business trends and outlook measures aside from the material impact of certain gains and charges and ensures appropriate comparability to operating results of prior periods. See further detail on Non-GAAP adjustments on page 17. |

| 2 | The Non-GAAP diluted earnings per share for year-to-date 2023 is calculated using diluted weighted-average shares outstanding of 150.371 million. |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP SEGMENT PROFIT FINANCIAL MEASURES TO CORRESPONDING

NON-GAAP FINANCIAL MEASURES

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | FOURTH QUARTER 2024 |

| | | GAAP | | Non-GAAP Adjustments1 | | Non-GAAP3 |

| SEGMENT PROFIT | | | | | | |

| Tools & Outdoor | | $ | 298.1 | | | $ | 32.1 | | | $ | 330.2 | |

| Industrial | | 52.7 | | | 0.2 | | | 52.9 | |

| Segment Profit | | 350.8 | | | 32.3 | | | 383.1 | |

| Corporate Overhead | | (61.9) | | | 2.3 | | | (59.6) | |

| Total | | $ | 288.9 | | | $ | 34.6 | | | $ | 323.5 | |

| Segment Profit as a Percentage of Net Sales | | | | | | |

| Tools & Outdoor | | 9.2 | % | | | | 10.2 | % |

| Industrial | | 10.7 | % | | | | 10.7 | % |

| Segment Profit | | 9.4 | % | | | | 10.3 | % |

| | | | | | | |

1 | Non-GAAP adjustments relate primarily to footprint actions associated with the supply chain transformation and transition services costs related to previously divested businesses. |

| | | | | | | |

| | | FOURTH QUARTER 2023 |

| | | GAAP | | Non-GAAP Adjustments2 | | Non-GAAP3 |

| SEGMENT PROFIT | | | | | | |

| Tools & Outdoor | | $ | 293.5 | | | $ | 22.3 | | | $ | 315.8 | |

| Industrial | | 65.0 | | | (0.6) | | | 64.4 | |

| Segment Profit | | 358.5 | | | 21.7 | | | 380.2 | |

| Corporate Overhead | | (88.1) | | | 12.1 | | | (76.0) | |

| Total | | $ | 270.4 | | | $ | 33.8 | | | $ | 304.2 | |

| Segment Profit as a Percentage of Net Sales | | | | | | |

| Tools & Outdoor | | 9.3 | % | | | | 10.0 | % |

| Industrial | | 11.2 | % | | | | 11.1 | % |

| Segment Profit | | 9.6 | % | | | | 10.2 | % |

| | | | | | | |

2 | Non-GAAP adjustments relate primarily to footprint actions and other costs associated with the supply chain transformation and integration-related costs. |

3 | The Non-GAAP 2024 and 2023 business segment information, as reconciled to GAAP above, is considered relevant to aid analysis and understanding of the Company’s results, business trends and outlook measures aside from the material impact of certain gains and charges and ensures appropriate comparability to operating results of prior periods. |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP SEGMENT PROFIT FINANCIAL MEASURES TO CORRESPONDING

NON-GAAP FINANCIAL MEASURES

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | YEAR-TO-DATE 2024 |

| | | GAAP | | Non-GAAP Adjustments1 | | Non-GAAP3 |

| SEGMENT PROFIT | | | | | | |

| Tools & Outdoor | | $ | 1,197.4 | | | $ | 143.1 | | | $ | 1,340.5 | |

| Industrial | | 254.9 | | | 3.6 | | | 258.5 | |

| Segment Profit | | 1,452.3 | | | 146.7 | | | 1,599.0 | |

| Corporate Overhead | | (270.6) | | | 23.4 | | | (247.2) | |

| Total | | $ | 1,181.7 | | | $ | 170.1 | | | $ | 1,351.8 | |

| Segment Profit as a Percentage of Net Sales | | | | | | |

| Tools & Outdoor | | 9.0 | % | | | | 10.1 | % |

| Industrial | | 12.4 | % | | | | 12.5 | % |

| Segment Profit | | 9.5 | % | | | | 10.4 | % |

| | | | | | | |

1 | Non-GAAP adjustments relate primarily to footprint actions associated with the supply chain transformation and transition services costs related to previously divested businesses. |

| | | | | | | |

| | | YEAR-TO-DATE 2023 |

| | | GAAP | | Non-GAAP Adjustments2 | | Non-GAAP3 |

| SEGMENT PROFIT | | | | | | |

| Tools & Outdoor | | $ | 687.6 | | | $ | 196.7 | | | $ | 884.3 | |

| Industrial | | 266.5 | | | 18.7 | | | 285.2 | |

| Segment Profit | | 954.1 | | | 215.4 | | | 1,169.5 | |

| Corporate Overhead | | (312.2) | | | 50.9 | | | (261.3) | |

| Total | | $ | 641.9 | | | $ | 266.3 | | | $ | 908.2 | |

| Segment Profit as a Percentage of Net Sales | | | | | | |

| Tools & Outdoor | | 5.1 | % | | | | 6.6 | % |

| Industrial | | 11.0 | % | | | | 11.8 | % |

| Segment Profit | | 6.0 | % | | | | 7.4 | % |

| | | | | | | |

2 | Non-GAAP adjustments relate primarily to footprint actions and other costs associated with the supply chain transformation and integration-related costs. |

3 | The Non-GAAP 2024 and 2023 business segment information, as reconciled to GAAP above, is considered relevant to aid analysis and understanding of the Company’s results, business trends and outlook measures aside from the material impact of certain gains and charges and ensures appropriate comparability to operating results of prior periods. |

STANLEY BLACK & DECKER, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP EARNINGS (LOSS) TO EBITDA

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOURTH QUARTER | | YEAR-TO-DATE |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net earnings (loss) from continuing operations | | $ | 194.9 | | | $ | (276.1) | | | $ | 286.3 | | | $ | (281.7) | |

| % of Net Sales | | 5.2 | % | | (7.4) | % | | 1.9 | % | | (1.8) | % |

| | | | | | | | |

| Interest - net | | 74.6 | | | 87.6 | | | 319.5 | | | 372.5 | |

| Income taxes on continuing operations | | (69.5) | | | 197.3 | | | (45.2) | | | (94.0) | |

| Depreciation and amortization | | 139.6 | | | 148.4 | | | 589.5 | | | 625.1 | |

EBITDA1 | | $ | 339.6 | | | $ | 157.2 | | | $ | 1,150.1 | | | $ | 621.9 | |

| % of Net Sales | | 9.1 | % | | 4.2 | % | | 7.5 | % | | 3.9 | % |

| | | | | | | | |

| Non-GAAP Adjustments before income taxes | | 49.3 | | | 197.3 | | | 466.0 | | | 566.2 | |

| | | | | | | | |

| Less: Accelerated depreciation included in Non-GAAP Adjustments before income taxes | | 10.6 | | | 4.2 | | | 59.5 | | | 50.0 | |

Adjusted EBITDA1 | | $ | 378.3 | | | $ | 350.3 | | | $ | 1,556.6 | | | $ | 1,138.1 | |

| % of Net Sales | | 10.2 | % | | 9.4 | % | | 10.1 | % | | 7.2 | % |

| | | | | |

| 1 | EBITDA is earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA represents EBITDA excluding certain gains and charges, as summarized below. EBITDA and Adjusted EBITDA, both Non-GAAP measures, are considered relevant to aid analysis and understanding of the Company’s operating results and ensures appropriate comparability to prior periods. |

SUMMARY OF NON-GAAP ADJUSTMENTS BEFORE INCOME TAXES

(Unaudited, Millions of Dollars)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | FOURTH QUARTER | | YEAR-TO-DATE |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Supply Chain Transformation Costs: | | | | | | | | |

Footprint Rationalization2 | | $ | 8.5 | | | $ | 8.6 | | | $ | 66.3 | | | $ | 96.9 | |

Material Productivity & Operational Excellence3 | | 6.2 | | | 0.4 | | | 18.6 | | | 69.1 | |

| Facility-related costs | | — | | | 0.4 | | | 2.6 | | | 1.5 | |

| Other charges (gains) | | 1.4 | | | 0.5 | | | 1.3 | | | (0.6) | |

| Gross Profit | | $ | 16.1 | | | $ | 9.9 | | | $ | 88.8 | | | $ | 166.9 | |

| | | | | | | | |

| Supply Chain Transformation Costs: | | | | | | | | |

Footprint Rationalization2 | | $ | 8.5 | | | $ | 2.4 | | | $ | 42.5 | | | $ | 10.8 | |

| Complexity Reduction & Operational Excellence | | 2.5 | | | 1.0 | | | 8.7 | | | 9.0 | |

Acquisition & integration-related costs4 | | 0.3 | | | 9.6 | | | 9.4 | | | 33.6 | |

| Transition services costs related to previously divested businesses | | 4.8 | | | 9.6 | | | 19.6 | | | 46.6 | |

| Other charges (gains) | | 2.4 | | | 1.3 | | | 1.1 | | | (0.6) | |

| Selling, general and administrative | | $ | 18.5 | | | $ | 23.9 | | | $ | 81.3 | | | $ | 99.4 | |

| | | | | | | | |

Other, net5 | | $ | (9.4) | | | $ | (2.3) | | | $ | (19.6) | | | $ | (25.1) | |

| Loss on sales of businesses | | — | | | 3.2 | | | — | | | 10.8 | |

Asset impairment charges6 | | — | | | 150.8 | | | 72.4 | | | 274.8 | |

Environmental charges7 | | (8.9) | | | — | | | 143.2 | | | — | |

| Restructuring charges | | 33.0 | | | 11.8 | | | 99.9 | | | 39.4 | |

| Earnings from continuing operations before income taxes | | $ | 49.3 | | | $ | 197.3 | | | $ | 466.0 | | | $ | 566.2 | |

| | | | | |

| 2 | Footprint Rationalization costs in 2024 primarily relate to accelerated depreciation of manufacturing and distribution center equipment of $48.9 million and other facility exit and re-configuration costs of $45.2 million. In 2023, transfers and closures of targeted manufacturing sites, including Fort Worth, Texas and Cheraw, South Carolina as previously announced in March 2023, resulted in accelerated depreciation of production equipment of $49.1 million, non-cash asset write-downs of $44.0 million (predominantly tooling, raw materials and WIP), and other facility exit and re-configuration costs of $14.6 million. |

| | | | | |

| 3 | Material Productivity & Operational Excellence costs in 2023 primarily related to third-party consultant fees to provide expertise in identifying and quantifying opportunities to source in a more integrated manner and re-design in-plant operations following footprint rationalization, developing a detailed program and related governance, and assisting the Company with the implementation of actions necessary to achieve the related objectives. |

| |

| 4 | Acquisition & integration-related costs primarily relate to the MTD and Excel acquisitions, including costs to integrate the organizations and shared processes, as well as harmonize key IT applications and infrastructure. |

| |

| 5 | Includes deal-related costs, net of income related to providing transition services to previously divested businesses. |

| |

| 6 | Asset impairment charges in 2024 include a $41.0 million pre-tax impairment charge related to the Lenox trade name, a $25.5 million pre-tax impairment charge related to the Infrastructure business, and a $5.9 million pre-tax impairment charge related to a small Industrial business. Asset impairment charges in 2023 include a $124.0 million pre-tax impairment charge related to the Irwin and Troy-Bilt trade names and a $150.8 million pre-tax impairment charge related to the Infrastructure business. |

| |

| 7 | The $143.2 million pre-tax environmental charges in 2024 related primarily to a reserve adjustment for the non-active Centredale Superfund site as a result of regulatory changes and revisions to remediation alternatives. |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

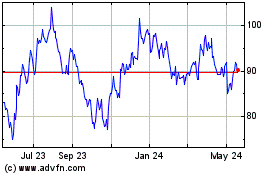

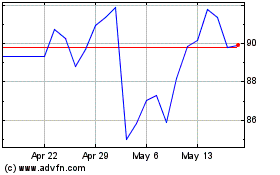

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Feb 2024 to Feb 2025