UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February, 2025. |

Commission File Number: 001-14446 |

The Toronto-Dominion Bank

(Translation of registrant's name into English)

c/o General Counsel’s Office

P.O. Box 1, Toronto Dominion Centre,

Toronto, Ontario, M5K 1A2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

| Form

20-F _________ |

Form

40-F √ |

This Form 6-K is incorporated by reference into all outstanding Registration

Statements of The Toronto-Dominion Bank filed with the U.S. Securities and Exchange Commission.

EXHIBIT INDEX

FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

THE TORONTO-DOMINION BANK |

| |

|

|

|

|

| |

|

|

|

|

| DATE: February 11, 2025 |

By: |

/s/ Caroline Cook |

|

| |

|

Name: |

Caroline Cook |

|

| |

|

Title: |

Associate Vice President, Legal Treasury and Corporate Securities |

|

EXHIBIT 99.1

TD Bank Group Announces Pricing of Offering of Schwab Stock

TORONTO, February 11, 2025/CNW/ —

TD Bank Group (“TD” or the “Bank”) (TSX: TD) (NYSE: TD) today announced that, further to its news release

on February 10, it has agreed to sell its entire equity investment in The Charles Schwab Corporation (“Schwab”) (NYSE: SCHW).

TD currently holds 184,678,738 shares of Schwab's common stock representing 10.1% economic ownership. The Bank will sell 165,443,530 shares

through a registered offering at a price of US$79.25 per share. Schwab will purchase 19,235,208 shares from the Bank for a total purchase

price of US$1.5 billion. The sale is expected to close on February 12, 2025, subject to customary closing conditions.

The transaction will generate net proceeds of approximately C$20

billion after taxes and underwriting discount with C$15 billion in CET1 capital created or 247 bps of CET1 capital released. TD intends

to deploy C$8 billion toward a share buyback program, subject to regulatory approval. Additional details on the Bank's normal course issuer

bid (share buyback program) are available in a separate news release issued on February 10. Net of the share buyback program, this transaction

will create approximately 116 bps of CET1 capital. The remainder of the proceeds will be invested in the Bank's businesses to further

support our customers, drive performance and accelerate organic growth. The transaction is expected to be accretive to TD's earnings per

share on a run-rate basis.[1]

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation,

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Schwab has filed a registration statement (including a prospectus)

with the U.S. Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents Schwab has filed with the SEC, including the

preliminary prospectus supplement dated February 10, 2025, for more complete information about Schwab and this offering. You may get

electronic copies of these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies of the preliminary

prospectus supplement and accompanying prospectus may be obtained from: TD Securities (USA) LLC, 1 Vanderbilt Avenue, New York, NY 10017,

telephone: 1 (855) 495-9846 or by email at TD.ECM_Prospectus@tdsecurities.com; or (ii) Goldman

Sachs & Co. LLC, Attn: Prospectus Department, 200 West Street, New York, NY 10282, telephone: 1 (866) 471-2526, facsimile: (212)

902-9316 or by email at Prospectus-ny@ny.email.gs.com.

1Earnings per share accretion

estimates are based on the following key assumptions: (1) average analyst consensus estimates for TD's fiscal 2025 adjusted net income;

(2) estimates regarding Schwab equity pick-up, which are based on an estimate regarding Schwab's adjusted net income from November 2024

to October 2025, which includes an estimate for the actual adjusted net income from November to December 2024 (using 67% of Schwab's

actual adjusted income to common stockholders for Q4 2024) and the median analyst consensus estimate of Schwab's adjusted net income

from January to October 2025 (October estimate using 33% of median analyst consensus estimate for Schwab's Q4 2025), assuming an average

USD/CAD exchange rate of 1.43x; (3) C$8 billion in TD share repurchases pursuant to the Bank's announced normal course issuer bid, which

remains subject to regulatory approval, at a price of C$86.00 as of February 10, 2025; and (4) for earnings on investments, a 5% pre-tax

investment yield and a tax rate of 26.5% on remaining proceeds of approximately C$12 billion.

Conference call

TD Bank Group will host a conference call on Tuesday, February 11,

2025 at 8:00 a.m. ET. The call will be audio webcast live through TD's website. Call details are as follows:

Audio webcast: https://td.streamme.ca/tdconferencecall021125

Participants:

| Toll-free dial-in number |

1-800-806-5484 |

| (Canada/US): |

|

| Local dial-in number: |

416-340-2217 |

| Participant passcode: |

8070122# |

The audio webcast will be archived at www.td.com/investor. A replay

of the teleconference will be available from 5:00 p.m. ET on February 11, 2025, until 11:59 p.m. ET on February 26, 2025 by calling 905-694-9451

or 1-800-408-3053 (toll free) and the passcode is 3193362#.

Caution Regarding Forward-Looking Statements

From time to time, the Bank (as defined

in this document) makes written and/or oral forward-looking statements, including in this document, in other filings with Canadian regulators

or the United States (U.S.) Securities and Exchange Commission (“SEC”), and in other communications. In addition,

representatives of the Bank may make forward-looking statements orally to analysts, investors, the media, and others. All such statements

are made pursuant to the “safe harbour” provisions of, and are intended to be forward-looking statements under, applicable

Canadian and U.S. securities legislation, including the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements

include, but are not limited to, statements made in this document, the Management's Discussion and Analysis ("2024 MD&A")

in the Bank’s 2024 Annual Report under the heading “Economic Summary and Outlook”, under the headings “Key Priorities

for 2025” and “Operating Environment and Outlook” for the Canadian Personal and Commercial Banking, U.S. Retail, Wealth

Management and Insurance, and Wholesale Banking segments, and under the heading “2024 Accomplishments and Focus for 2025”

for the Corporate segment, and in other statements regarding the Bank’s objectives and priorities for 2025 and beyond and strategies

to achieve them, the regulatory environment in which the Bank operates, and the Bank's anticipated financial performance.

Forward-looking statements are typically

identified by words such as “will”, “would”, “should”, “believe”, "expect”,

“anticipate”, “intend”, “estimate”, “plan”, “goal”, “target”,

“may”, and “could”. By their very nature, these forward-looking statements require the Bank to make assumptions

and are subject to inherent risks and uncertainties, general and specific. Especially in light of the uncertainty related to the physical,

financial, economic, political, and regulatory environments, such risks and uncertainties – many of which are beyond the Bank’s

control and the effects of which can be difficult to predict – may cause actual results to differ materially from the expectations

expressed in the forward-looking statements.

Risk factors that could cause, individually

or in the aggregate, such differences include: strategic, credit, market (including equity, commodity, foreign exchange, interest rate,

and credit spreads), operational (including technology, cyber security process, systems, data, third-party, fraud, infrastructure,

insider and conduct), model, insurance, liquidity, capital adequacy, legal and regulatory compliance (including financial crime), reputational,

environmental and social, and other risks. Examples of such risk factors include general business and economic conditions in the regions

in which the Bank operates (including the economic, financial, and other impacts of pandemics); geopolitical risk; inflation, interest

rates and recession uncertainty; regulatory oversight and compliance risk; risks associated with the Bank’s ability to satisfy

the terms of the global resolution of the investigations into the Bank's U.S. Bank Secrecy Act (BSA)/anti-money laundering (AML) program;

the impact of the global resolution of the investigations into the Bank’s U.S. BSA/AML program on the Bank’s businesses, operations,

financial condition, and reputation; the ability of the Bank to execute on long-term strategies, shorter-term key strategic priorities,

including the successful completion of acquisitions and dispositions and integration of acquisitions, the ability of the Bank to achieve

its financial or strategic objectives with respect to its investments, business retention plans, and other strategic plans; technology

and cyber security risk (including cyber-attacks, data security breaches or technology failures) on the Bank’s technologies, systems

and networks, those of the Bank’s customers (including their own devices), and third parties providing services to the Bank; data

risk; model risk; fraud activity; insider risk; conduct risk; the failure of third parties to comply with their obligations

to the Bank or its affiliates, including relating to the care and control of information, and other risks arising from the Bank’s

use of third-parties; the impact of new and changes to, or application of, current laws, rules and regulations, including without limitation

consumer protection laws and regulations, tax laws, capital guidelines and liquidity regulatory guidance; increased competition from incumbents

and new entrants (including Fintechs and big technology competitors); shifts in consumer attitudes and disruptive technology; environmental

and social risk (including climate-related risk); exposure related to litigation and regulatory matters; ability of the Bank to attract,

develop, and retain key talent; changes in foreign exchange rates, interest rates, credit spreads and equity prices; downgrade, suspension

or withdrawal of ratings assigned by any rating agency, the value and market price of the Bank’s common shares and other securities

may be impacted by market conditions and other factors; the interconnectivity of Financial Institutions including existing and potential

international debt crises; increased funding costs and market volatility due to market illiquidity and competition for funding; critical

accounting estimates and changes to accounting standards, policies, and methods used by the Bank; and the occurrence of natural and unnatural

catastrophic events and claims resulting from such events.

The Bank cautions that the preceding

list is not exhaustive of all possible risk factors and other factors could also adversely affect the Bank’s results. For more detailed

information, please refer to the “Risk Factors and Management” section of the 2024 MD&A, as may be updated in subsequently

filed quarterly reports to shareholders and news releases (as applicable) related to any events or transactions discussed under the headings

“Significant Events” or “Significant and Subsequent Events” in the relevant MD&A, which applicable releases

may be found on www.td.com.

All such factors, as well as other uncertainties and potential events,

and the inherent uncertainty of forward-looking statements, should be considered carefully when making decisions with respect to the Bank.

The Bank cautions readers not to place undue reliance on the Bank's forward-looking statements. Material economic assumptions underlying

the forward-looking statements contained in this document are set out in this document, as well as the 2024 MD&A under the headings

“Economic Summary and Outlook” and “Significant Events”, under the headings “Key Priorities for 2025”

and “Operating Environment and Outlook” for the Canadian Personal and Commercial Banking, U.S. Retail, Wealth Management and

Insurance, and Wholesale Banking segments, and under the heading “2024 Accomplishments and Focus for 2025” for the Corporate

segment, each as may be updated in subsequently filed quarterly reports to shareholders. In addition, with respect to the Bank's estimates

regarding EPS accretion, assumptions have been made with respect to the following key factors: foreign exchange fluctuations, tax

rates, average analyst consensus estimates for the Bank's fiscal 2025 adjusted net income, value of the Q1 Schwab equity pick-up, number

of shares purchased for cancellation under the Bank's proposed normal course issuer bid (which remains subject to regulatory approvals),

and earnings on investments. With respect to the Bank's estimates regarding net proceeds, assumptions have been made with respect

to the following key factors: foreign exchange fluctuations and tax rates. With respect to the Bank's estimates regarding

investment rate of return, assumptions have been made with respect to foreign exchange fluctuations. With respect to the Bank's estimates

regarding CET1 impact, assumptions have been made with respect to the following key factors: foreign exchange fluctuations, tax

rates, number of shares purchased for cancellation under the Bank's proposed normal course issuer bid (which remains subject to regulatory

approvals), and risk-weighted asset levels. The illustrative impact on TD's earnings per share on a run-rate basis is based on analyst

consensus estimates of TD's and Schwab's future adjusted results, and we caution that the methodology applied by analysts to estimate

those results may not be consistent with TD's methodology. For reference, an example of TD's reconciliation of reported results to adjusted

results is available in TD's 2024 MD&A.

Any forward-looking statements contained in this document represent the

views of management only as of the date hereof and are presented for the purpose of assisting the Bank’s shareholders and analysts

in understanding the Bank’s financial position, objectives and priorities and anticipated financial performance as at and for the

periods ended on the dates presented, and may not be appropriate for other purposes. The Bank does not undertake to update any forward-looking

statements, whether written or oral, that may be made from time to time by or on its behalf, except as required under applicable securities

legislation.

About TD Bank Group

The Toronto-Dominion Bank and its subsidiaries

are collectively known as TD Bank Group (“TD” or the “Bank”). TD is the sixth largest bank in North America by

assets and serves over 27.9 million customers in four key businesses operating in a number of locations in financial centres around the

globe: Canadian Personal and Commercial Banking, including TD Canada Trust and TD Auto Finance Canada; U.S. Retail, including TD Bank,

America's Most Convenient Bank®, TD Auto Finance U.S., and TD Wealth (U.S.); Wealth Management and Insurance, including TD Wealth

(Canada), TD Direct Investing, and TD Insurance; and Wholesale Banking, including TD Securities and TD Cowen. TD also ranks among the

world's leading online financial services firms, with more than 17 million active online and mobile customers. TD had $2.06 trillion in

assets on October 31, 2024. The Toronto-Dominion Bank trades under the symbol “TD” on the Toronto and New York

Stock Exchanges.

For further information contact:

TD Investors:

Brooke Hales

Vice President, Investor Relations, TD Bank Group

416-307-8647

Brooke.hales@td.com

Media:

Elizabeth Goldenshtein

Senior Manager, Corporate Communications, TD Bank

Group

416-994-4124

Elizabeth.goldenshtein@td.com

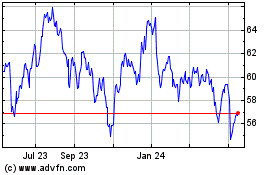

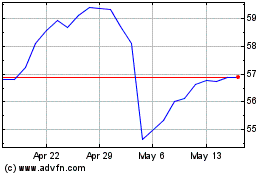

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Feb 2024 to Feb 2025