Commercial Property Values Drive Optimism Around 2025 Investments, TD Bank Survey Finds

20 February 2025 - 1:00AM

Business Wire

The survey found industry challenges won't stop investment into

commercial real estate in 2025, but innovation and changing

employee expectations will impact how investments are assessed.

Despite rising energy costs, office vacancies, interest rates

and economic uncertainties as the industry adjusts to a new

administration, recent insights garnered from TD Bank’s survey at

the CRE Finance Council Miami found that commercial real estate

leaders are still excited for the opportunities this year could

bring. More than 200 commercial real estate professionals shared

their 2025 outlooks, with 76% believing dropping commercial real

estate property values will drive increased investment this

year.

So, is Commercial Real Estate “Back"?

TD Bank's survey focused on sentiment surrounding the commercial

real estate sector, along with what's driving investment. A few

other survey highlights include:

- More than half of commercial real estate

investors (52%) believe future interest rate movement –

specifically lowering rates – will have the biggest impact on the

sector, but just 14% expect the biggest business impact to come

from changing policies and regulations of the new presidential

administration.

- The majority (70%) of respondents expect

housing material prices to rise in 2025, but only 32% expect it to

have an impact on investing in new developments.

Return-to-Office Policies and Their Impact

As CRE professionals plan their 2025 investments, there’s a

rising confidence among investors. That confidence could be driven

by return-to-office requirements from companies across the U.S. In

fact, the majority (68%) of industry professionals predict that

return-to-office requirements are the business-level decision that

will have the biggest impact on the commercial real estate market

in 2025. However, many investors and property owners aren't

expecting office work to match pre-Covid levels – instead,

mixed-use spaces are expected to be the future. The survey revealed

that more than two-thirds (68%) of CRE professionals expect

mixed-use properties will garner the most traction in 2025.

“We’re experiencing a very modest recovery in parts of the

office market, but that doesn't mean the industry should be quick

to revert to its old ways. The office segment will continue to face

challenges as a whole. As employees return to in-person work, they

crave unique, meaningful workplace experiences that make coming

into the office a positive experience,” said Hugh Allen, Head of

U.S. Commercial Real Estate at TD Bank. “Investors and commercial

real estate owners are taking these changing expectations into

account when they invest in their next project. This includes

amenities like in-office gyms, extended break rooms, and cafeterias

– organizations want to create a sense of place for their

employees, enhancing their return-to-work experience.”

Investment Interest at a Crossroads Amid Various

Uncertainties

While the majority (70%) of commercial real estate professionals

believe that the price of housing materials will rise again in

2025, they are divided when it comes to predicting how this will

impact the market, with 38% anticipating continued investment and

32% forecasting an impact on the market’s ability to invest in new

developments. Many investors have concluded this interest rate

environment is the "new normal."

“The commercial real estate sector will face new challenges in

2025, and a new administration will bring wild cards to the market,

but this analysis shows that the right investors are prepared to

face those challenges head on,” said Hugh Allen. “Navigating the

uncertainties regarding inflation and interest rates will be key to

getting the timing right for investors to pull the trigger on

acquisitions and developments.”

CRE’s Top-of-Mind Tech & Sustainability

Initiatives

Along with properties, CRE professionals have their eyes on tech

investment this year, especially predictive analytics. Three-fifths

(60%) of industry professionals expect predictive analytics to have

the biggest technological impact on CRE in 2025. This is followed

by smart buildings (32%) and efficiency and sustainability

advancements (28%), in-line with green initiatives in recent

years.

"Technology will drive commercial real estate into its next

era," said Allen. "The advancements in artificial intelligence and

overall upgrades to how we use innovation in CRE will continue to

bear positive outcomes for the investors who use them

properly."

As energy costs continue to rise, more than half (55%) of

industry professionals believe smart buildings and other

technological advancements are the sustainability trend that will

make the largest splash. That said, changes in the White House

raise questions on the state of sustainability moving forward, with

30% of CRE professionals citing government environmental

protections as the most significant sustainability trend in

2025.

Survey Methodology

This study was conducted at the Commercial Real Estate Finance

Council Miami 2025 from January 12-15, 2025. A total of 211

commercial real estate professionals were polled.

About TD Bank, America's Most Convenient Bank®

TD Bank, America's Most Convenient Bank, is one of the 10

largest banks in the U.S. by assets, providing over 10 million

customers with a full range of retail, small business and

commercial banking products and services at more than 1,100

convenient locations throughout the Northeast, Mid-Atlantic, Metro

D.C., the Carolinas and Florida. In addition, TD Auto Finance, a

division of TD Bank, N.A., offers vehicle financing and dealer

commercial services. TD Bank and its subsidiaries also offer

customized private banking and wealth management services through

TD Wealth®. TD Bank is headquartered in Cherry Hill, N.J. To learn

more, visit www.td.com/us. Find TD Bank on Facebook at

www.facebook.com/TDBank and on Instagram at

www.instagram.com/TDBank_US/.

TD Bank is a subsidiary of The Toronto-Dominion Bank, a top 10

North American bank. The Toronto-Dominion Bank trades on the New

York and Toronto stock exchanges under the ticker symbol "TD". To

learn more, visit www.td.com/us.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219872687/en/

Media: Nick Villano TD Bank Communications Manager

Nick.Villano@td.com

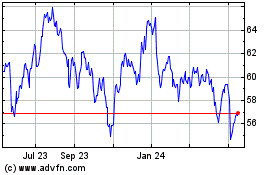

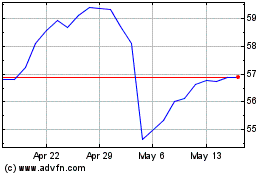

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Toronto Dominion Bank (NYSE:TD)

Historical Stock Chart

From Feb 2024 to Feb 2025