Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

13 February 2025 - 5:06AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 12, 2025

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

Publicly-held company

CNPJ/ME 02.421.421/0001-11

NIRE 33.300.324.631

MATERIAL FACT

Approval of a New Share Buyback Program and

Termination of the Previous Program

TIM S.A. ("Company") (B3: TIMS3 and

NYSE: TIMB), in compliance with section 157 of Law No. 6,404/76 and the provisions of CVM Resolution No. 44/21, hereby informs its shareholders,

the market in general and other interested parties that its Board of Directors on this date:

| 1. | Approved a new Share Buyback Program issued by

it (Program 8), pursuant to section 22, V, of the Company's Bylaws and CVM Resolution No. 77/22, with the following conditions: |

| (i) | Objective: Acquisition of common shares issued

by the Company to be held in treasury and subsequently canceled, without reduction of capital stock, and with the main objective of increasing

value to shareholders through the efficient use of available cash resources, optimizing TIM's capital allocation. In addition, a small

portion of these shares will be allocated to support the stock-based compensation of the Long-Term Incentive Plan ("LTI"). |

| (ii) | Number of shares that may be acquired under Program

8: up to 67,210,173 (sixty-seven million, two hundred and ten thousand, one hundred and seventy-three) common shares of the Company, which

correspond to approximately 2.78% (two point seventy-eight percent) of the total common shares of the Company. The portion referring to

the LTI represents less than 8% of the total to be repurchased (about 5 million shares). The Company's Management may decide the best

time, within the Program Term, to carry out the acquisitions of shares, and may make one or several purchases. |

| (iii) | Deadline Price, and Acquisition Method: Program

8 will start from the date of the Board of Directors' resolution, remaining in force until August 13, 2026, and the acquisitions will

be made on the Stock Exchange (B3 S.A. – Brasil, Bolsa, Balcão), at market prices, observing the applicable legal and regulatory

limits. |

| (iv) | Intermediary financial institutions: the share

acquisition operations will be intermediated by MORGAN STANLEY CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS S.A., J.P. MORGAN

CORRETORA DE CÂMBIO E VALORES MOBILIÁRIOS S.A., BTG PACTUAL CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS S.A.

and UBS BB CORRETORA DE CÂMBIO, TÍTULOS E VALORES MOBILIÁRIOS S.A. |

| (v) | Resources that will be used: the resources from

the balances of the profit reserves, which totals R$ 6,285,419,877.54 (six billion, two hundred eighty-five million, four hundred nineteen

thousand, eight hundred seventy-seven reais and fifty-four cents) will be used, according to the Financial Statements for the year ended

December 31, 2024, except for the reserves referred to in Section 8, Paragraph 1 of CVM Resolution 77/22. The approximate maximum amount

to be used in the Program 8 is R$1 billion. |

| (vi) | The Minutes of the Board of Directors' Meeting

that approved the Program are available on the Investor Relations website of the www.tim.com.br/ri Company, as well as on the websites

of the Brazilian Securities and Exchange Commission (CVM) and B3, www.cvm.gov.br and www.b3.com.br, where the information required by

ANNEX G of CVM Resolution No. 80/22 is available. |

| 2. | As a condition for the approval of Program 8,

the previous program approved at the meeting of the Company's Board of Directors on July 30, 2024 ("Program 7") was terminated.

For the latter, no share buybacks were executed. |

The Company will keep its shareholders and the

market informed about the progress of the Program, in accordance with the applicable regulations.

Rio de Janeiro, February 12, 2025.

TIM S.A.

Alberto Griselli

Chief Executive Officer and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

February 12, 2025 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

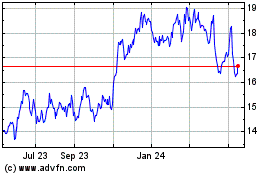

TIM (NYSE:TIMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

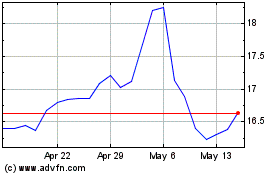

TIM (NYSE:TIMB)

Historical Stock Chart

From Feb 2024 to Feb 2025