UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: February 13, 2025

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

TIM S.A.

Publicly-Held Company

CNPJ/MF 02.421.421/0001-11

NIRE 333.0032463-1

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON FEBRUARY 12, 2025

DATE, TIME AND PLACE: February 12, 2025, at

14.00 p.m. Due to the importance and urgency of the matter on the Agenda, the meeting was held in the form of a virtual deliberative circuit,

as provided in the 3rd paragraph of Section 25 of TIM S.A.’s By-laws (“Company”).

PRESENCE: The Board of Directors’ Meeting

of the Company was held with the presence of Messrs. Nicandro Durante, Adrian Calaza, Alberto Mario Griselli, Alessandra Michelini, Claudio

Giovanni Ezio Ongaro, Flavia Maria Bittencourt, Gesner José de Oliveira Filho, Gigliola Bonino, Herculano Aníbal Alves and

Michele Valensise.

BOARD: Mr. Nicandro Durante – Chairman;

and Mrs. Fabiane Reschke – Secretary.

AGENDA: (1) To resolve on the proposal

of the Share Buyback Plan.

RESOLUTIONS: Upon the review of the material

presented and filed at the Company’s head office, and based on the information provided and discussions of the subject included

on the Agenda, the Board Members, unanimously by those present and with the abstention of the legally restricted, decided to register

the discussions as follows:

(1) The Board members acknowledged

on the results of the latest Share Buyback Program, approved by the Company's Board of Directors’ at its meeting held on July 30,

2024 (“Program 7”) and approved the opening of a new Share Buyback Program ("Program 8"), pursuant

to Section 22, v, of the Company's By-laws and CVM Resolution No. 77 of March 29, 2022 ("CVM Resolution 77/2022"), with the

following conditions:

(1.1) Purpose of the Program: acquisition of common

shares issued by the Company to be held in treasury and subsequently canceled, without reduction of capital stock, aiming to increase

value for shareholders through the efficient use of available cash Resources, as well as to support the stock-based compensation under

the Long Term Incentive Plan - LTI;

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM S.A. February 12, 2025 |

(1.2) Number of shares that may be acquired: up to

67,210,173 (sixty-seven million, two hundred and ten thousand, one hundred and seventy-three) common shares of the Company ("Shares")

may be acquired, without reduction of the capital stock, corresponding to 2.78% (two point seventy-eight percent) of the total common

shares of the Company. The portion referring to the LTI represents less than 8% of the total to be repurchased (about 5 million shares).

The Board of Officers may decide the best moment, within the term of the Program, to carry out the Shares acquisitions, and perform one

or several acquisitions;

(1.3) Term, Price and Form of Acquisition: the Program

8 shall begin on the date of the Board of Directors' resolution, remaining in force until August 13, 2026, with the acquisitions carried

out on the Stock Exchange (B3 S.A. - Brasil, Bolsa e Balcão) at market prices, observing applicable legal and regulatory limits;

(1.4) Intermediary financial institutions: buy-ins

carried out under Programme 8 will be intermediated by the following financial institutions: (i) MORGAN STANLEY CORRETORA DE TÍTULOS

E VALORES MOBILIÁRIOS S.A., (ii) J.P. MORGAN CORRETORA DE CÂMBIO E VALORES MOBILIÁRIOS S.A., (iii) BTG PACTUAL CORRETORA

DE TÍTULOS E VALORES MOBILIÁRIOS S.A.; and (iv) UBS BB CORRETORA DE CÂMBIO, TÍTULOS E VALORES MOBILIÁRIOS

S.A.;

(1.5) Resources to be used: the resources of the

profit reserves, which total R$ 6,285,419,877.54 (six billion, two hundred eighty-five million, four hundred nineteen thousand, eight

hundred seventy-seven reais and fifty-four cents) will be used according to the Financial Statements for the year ended December 31, 2024,

except for the reserves referred in the Section 8, paragraph 1, of CVM Resolution 77/2022. The approximate maximum amount to be used in

Program 8 is R$1 billion; and

(1.6) Pursuant to Section 6 of CVM Resolution 77/2022,

the members of the Company's Board of Directors provided the information contained in Annex I to these minutes and authorized the

Board of Officers of the Company to perform all necessary acts to complete the transaction.

CLOSING: With no further issues to discuss,

the meeting was adjourned, read, approved and signed by all attendees Board Members.

I herein certify that these minutes are the faithful copy

of the original version duly recorded in the respective corporate book.

Rio de Janeiro (RJ), February 12, 2025.

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM S.A. February 12, 2025 |

FABIANE RESCHKE

Secretary

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM S.A. February 12, 2025 |

ANNEX I

ANNEX G TO CVM RESOLUTION NO. 80, OF MARCH 29, 2022

Trading of Own Shares

1. Justify in detail the objective and expected economic effects of the operation:

The Share Buyback Program of TIM S.A. ("Company"),

approved at the meeting of the Company's Board of Directors, held on February 12, 2025, aims to support the acquisition of common shares

issued by the Company to be held in treasury and subsequent cancellation, without reduction of the capital stock, aiming to increase value

to shareholders through the efficient use of available cash resources, as well as support for the stock-based compensation of the Long

Term Incentive Plan (LTI) ("Program").

2. Inform the number of shares (i) outstanding and (ii)

already held in treasury:

The number of shares of the Company: (i) outstanding is

807,135,446 (eight hundred and seven million, one hundred and thirty-five thousand, four hundred and forty-six) common shares (free float);

and (ii) in treasury is 201,320 (two hundred and one thousand, three hundred and twenty) common shares.

3. Inform the number of shares that may be acquired or

sold:

Up to 67,210,173 (sixty-seven million, two hundred and ten

thousand, one hundred and seventy-three) common shares of the Company ("Shares") may be acquired, without reduction of the capital

stock, which correspond to 2.78% (two point seventy-eight percent) of the total common shares of the Company. The portion referring to

the LTI represents less than 8% (eight percent) of the total to be repurchased (about 5 million shares).

4. Describe the main characteristics of the derivative

instruments that the company will use, if any:

Not applicable. The Company will not use derivative instruments.

5. Describe, if any, any agreements or voting guidelines

between the company and the counterparty of the transactions:

Not applicable. The acquisition of shares will occur through

stock exchange operations and, therefore, there are no existing voting guidelines between the Company and counterparties in the transaction.

6. In the event of operations carried out outside organized

securities markets, inform: a. the maximum (minimum) price at which the shares will be acquired (sold); Eb. if applicable, the reasons

that justify carrying out the operation at prices more than 10% (ten percent) higher, in the case of acquisition, or more than 10% (ten

percent) lower, in the case of sale, than the average price, weighted by volume, in the 10 (ten) previous trading sessions:

Not applicable. The operations will be carried out on the

stock exchange, at market values.

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM S.A. February 12, 2025 |

7. Inform, if any, the impacts that the negotiation will

have on the composition of the shareholding control or the administrative structure of the company:

Not applicable. There will be no impact on the Company's

control composition or administrative structure due to the implementation of the Program.

8. Identify the counterparties, if known, and, in the

case of a party related to the company, as defined by the accounting rules that deal with this matter, also provide the information required

by article 9 of CVM Resolution No. 81, of March 29, 2022:

Not applicable. The acquisition of shares will take place

through stock exchange operations and, therefore, the counterparties are not known.

9. Indicate the destination of the funds earned, if applicable:

The Program aims to support the acquisition of common shares

issued by the Company to be held in treasury and subsequently canceled, without reduction of the capital stock, aiming at increasing value

to shareholders through the efficient use of available cash resources, as well as supporting share-based compensation of the Long-Term

Incentive Plan (LTI). The allocation of resources will be decided in due course, when there will be adequate communication to the market.

10. Indicate the maximum period for the settlement of

authorised transactions:

The Company's Share Buyback Program will begin as of the

date of the Board of Directors' resolution and will remain in force until August 13, 2026, and the acquisitions will be made on the Stock

Exchange (B3 S.A. – Brasil, Bolsa e Balcão), at market prices, observing the applicable legal and regulatory limits.

11. Identify institutions that will act as intermediaries,

if any:

Buy-ins carried out under Programme 8 will be intermediated

by the following financial institutions:

| (i) | MORGAN STANLEY CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS

S.A., headquartered at Avenida Brigadeiro Faria Lima, 3.600, 6th floor, São Paulo, SP; |

| (ii) | J.P. MORGAN CORRETORA DE CÂMBIO E VALORES MOBILIÁRIOS S.A.,

headquartered at Avenida Brigadeiro Faria Lima, 3729, 13th floor, Itaim Bibi, São Paulo, SP; |

| (iii) | BTG PACTUAL CORRETORA DE TÍTULOS E VALORES MOBILIÁRIOS S.A.,

headquartered at Rua Praia de Botafogo, 501 – Botafogo; Rio de Janeiro/RJ, CEP 22250-911; and |

| (iv) | UBS BB CORRETORA DE CÂMBIO, TÍTULOS E VALORES MOBILIÁRIOS

S.A., headquartered at Avenida Brigadeiro Faria Lima, nº 4.440, 7º Andar (part), Itaim Bibi, São Paulo, SP. |

|

CONT. OF MINUTES OF THE BOARD OF DIRECTORS’ MEETING OF TIM S.A. February 12, 2025 |

12. Specify the available resources to be used, pursuant

to article 8, paragraph 1, of CVM Resolution No. 77, of March 29, 2022:

The resources from the balances of the profit reserves,

which total R$6,285,419,877.54 (six billion, two hundred and eighty-five million, four hundred and nineteen thousand, eight hundred and

seventy-seven reais and fifty-four cents), will be used, according to the Financial Statements for the year ended December 31, 2024, except

for the reserves referred to in article 8, Paragraph 1 of CVM Resolution 77/2022. The approximate maximum amount to be used in the Company's

Share Buyback Program is R$1 billion.

13. Specify the reasons why the members of the Board

of Directors feel comfortable that the share buyback will not affect the fulfillment of obligations assumed with creditors or the payment

of mandatory, fixed or minimum dividends:

In view of the recently disclosed strategic plan, the company

expects to have a relevant evolution in its operating cash flow, further reinforcing the already robust cash position (R$5.67 bilion)

and low debt (0.83x Net Debt/EBITDA). In addition, the Buyback Program was analyzed within the context of shareholder remuneration estimates

(Dividends and Interest on Equity), already updated in the same strategic plan. Thus, the members of the Company's Board of Directors

understand that the Share Buyback Program will not affect the fulfillment of obligations assumed with creditors or the payment of mandatory,

fixed or minimum dividends.

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

February 13, 2025 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

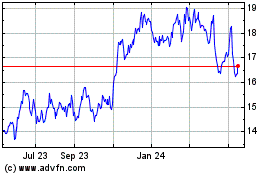

TIM (NYSE:TIMB)

Historical Stock Chart

From Jan 2025 to Feb 2025

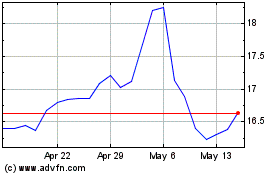

TIM (NYSE:TIMB)

Historical Stock Chart

From Feb 2024 to Feb 2025