Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

10 March 2025 - 10:39PM

Edgar (US Regulatory)

1934 Act Registration No. 1-14700

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_____________________________

FORM 6-K

_____________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

(Commission File Number: 001-14700)

_____________________________

Taiwan Semiconductor Manufacturing Company Ltd.

(Translation of Registrant’s Name Into English)

_____________________________

No. 8, Li-Hsin Rd. 6,

Hsinchu Science Park,

Taiwan, R.O.C.

(Address of Principal Executive Offices)

_____________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(1):o

Indicate by check mark if the registrant is submitting the Form 6-K in papers as permitted by Regulation S-T Rule 101(b)(7):o

| | | | | | | | | | | | | | | | | | | | | | | |

| SIGNATURES | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. | |

| | | | | | | |

|

| | | | | | |

| | | | | | | | | | | | | | |

| | Taiwan Semiconductor Manufacturing Company Ltd. |

| | | | |

| Date: March 10, 2025 | By | /s/ Wendell Huang | |

| | | | |

| | | Wendell Huang | |

| | | | |

| | | Senior Vice President and Chief Financial Officer | |

TSMC February 2025 Revenue Report

HSINCHU, Taiwan, R.O.C. – Mar. 10, 2025 - TSMC (TWSE: 2330, NYSE: TSM) today announced its net revenue for February 2025: On a consolidated basis, revenue for February 2025 was approximately NT$260.01 billion, a decrease of 11.3 percent from January 2025 and an increase of 43.1 percent from February 2024. Revenue for January through February 2025 totaled NT$553.30 billion, an increase of 39.2 percent compared to the same period in 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| TSMC February Revenue Report (Consolidated): | | | |

| | | | | | | (Unit:NT$ million) |

| | | | | | | | | |

| Period | February 2025 | January 2025 | M-o-M Increase (Decrease) % | February 2024 | Y-o-Y Increase (Decrease) % | January to February 2025 | January to February 2024 | Y-o-Y Increase (Decrease) % |

|

Net Revenue

| 260,009 | 293,288 | (11.3) | 181,648 | 43.1 | 553,297 | 397,433 | 39.2 |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| TSMC Spokesperson: | | Media Contacts | | |

| Wendell Huang

Senior Vice President and CFO

Tel: 886-3-505-5901 | | Nina Kao Head of Public Relations Tel: 886-3-563-6688 ext.7125036 Mobile: 886-988-239-163 E-Mail: nina_kao@tsmc.com | | Ulric Kelly Public Relations Tel: 886-3-563-6688 ext.7126541 Mobile: 886-978-111-503 E-Mail: ukelly@tsmc.com |

Taiwan Semiconductor Manufacturing Company Limited

This is to report the changes or status of 1) revenue, 2) funds lent to other parties, 3) endorsements and guarantees, and 4) financial derivative transactions for February 2025 (“Current Month”).

Note: “Outstanding” herein means the outstanding balance at the end of Current Month; and “Cumulative” herein represents the accumulated amounts from the beginning of this year till the end of Current Month.

1. Revenue (in NT$ thousands)

| | | | | | | | | | | |

| Period | Items | 2025 | 2024 |

February | Net Revenue | 260,008,796 | | 181,648,270 | |

Jan. ~ Feb. | Net Revenue | 553,296,834 | | 397,433,397 | |

2. Funds lent to other parties (in NT$ thousands)

| | | | | | | | | | | |

| Lending Company | Limit of lending | Amount approved by the Board of Directors | Outstanding amount |

TSMC China* | 111,070,036 | | 37,323,000 | | 22,563,000 | |

TSMC Development** | 35,217,426 | | 1,968,000 | | 984,000 | |

* The borrower is TSMC Nanjing, a wholly-owned subsidiary of TSMC.

** The borrower is TSMC Washington, a wholly-owned subsidiary of TSMC.

3. Endorsements and guarantees (in NT$ thousands)

| | | | | | | | | | | |

| Guarantor | Limit of guarantee | Amount approved by the Board of Directors | Outstanding amount |

| TSMC* | 1,715,418,067 | | 2,729,396 | | 2,729,396 | |

| TSMC** | 246,000,000 | | 246,000,000 | |

| TSMC*** | 470,489,024 | | 312,557,024 | |

* The guarantee was provided to TSMC North America, a wholly-owned subsidiary of TSMC.

** The guarantee was provided to TSMC Global, a wholly-owned subsidiary of TSMC.

*** The guarantee was provided to TSMC Arizona, a wholly-owned subsidiary of TSMC.

4. Financial derivative transactions (in NT$ thousands)

(1)Derivatives not applying hedge accounting.

‧TSMC

| | | | | | | | |

| Forward |

Margin Payment | - | |

Premium Income (Expense) | - | |

Existing Contracts | Outstanding Notional Amount | 215,875,109 | |

Mark to Market of Outstanding Contracts | 171,754 | |

Cumulative Unrealized Profit/Loss | 597,690 | |

Expired Contracts | Cumulative Notional Amount | 134,817,475 | |

Cumulative Realized Profit/Loss | (524,469) | |

Equity price linked product (Y/N) | N |

‧TSMC China

| | | | | | | | |

| Forward |

Margin Payment | - | |

Premium Income (Expense) | - | |

Existing Contracts | Outstanding Notional Amount | 163,730 | |

Mark to Market of Outstanding Contracts | (1,422) | |

Cumulative Unrealized Profit/Loss | (1,400) | |

Expired Contracts | Cumulative Notional Amount | 355,388 | |

Cumulative Realized Profit/Loss | 774 | |

Equity price linked product (Y/N) | N |

‧TSMC Nanjing

| | | | | | | | |

| Forward |

Margin Payment | - | |

Premium Income (Expense) | - | |

Existing Contracts | Outstanding Notional Amount | 687,666 | |

Mark to Market of Outstanding Contracts | (5,999) | |

Cumulative Unrealized Profit/Loss | (5,812) | |

Expired Contracts | Cumulative Notional Amount | 1,411,197 | |

Cumulative Realized Profit/Loss | 2,899 | |

Equity price linked product (Y/N) | N |

‧Japan Advanced Semiconductor Mfg., Inc.

| | | | | | | | |

| Forward |

Margin Payment | - | |

Premium Income (Expense) | - | |

Existing Contracts | Outstanding Notional Amount | 13,795,383 | |

Mark to Market of Outstanding Contracts | (83,849) | |

Cumulative Unrealized Profit/Loss | (270,760) | |

Expired Contracts | Cumulative Notional Amount | 20,716,965 | |

Cumulative Realized Profit/Loss | (245,873) | |

Equity price linked product (Y/N) | N |

(2)Derivatives applying hedge accounting.

‧TSMC Global

| | | | | | | | |

| Future |

Margin Payment | (41,459) | |

Premium Income (Expense) | - | |

Existing Contracts | Outstanding Notional Amount | 1,804,000 | |

Mark to Market of Outstanding Contracts | (18,919) | |

Cumulative Unrealized Profit/Loss | (29,925) | |

Expired Contracts | Cumulative Notional Amount | 4,536,240 | |

Cumulative Realized Profit/Loss | (13,219) | |

Equity price linked product (Y/N) | N |

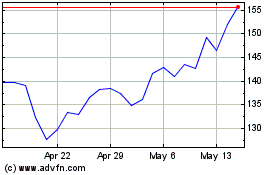

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Feb 2025 to Mar 2025

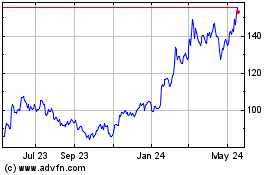

Taiwan Semiconductor Man... (NYSE:TSM)

Historical Stock Chart

From Mar 2024 to Mar 2025