Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

22 January 2025 - 4:37AM

Edgar (US Regulatory)

THE

TAIWAN FUND, INC.

Schedule

of Investments / November 30, 2024 (Showing

Percentage of Net Assets) (unaudited)

| | |

SHARES | | |

US $

VALUE | |

| COMMON STOCKS – 91.1% | |

| | | |

| | |

| COMMUNICATION SERVICES — 1.4% | |

| | | |

| | |

| Diversified Telecommunication Services — 1.4% | |

| | | |

| | |

| Chunghwa Telecom Co. Ltd. | |

| 1,285,000 | | |

$ | 4,865,776 | |

| TOTAL COMMUNICATION SERVICES | |

| | | |

| 4,865,776 | |

| CONSUMER DISCRETIONARY — 8.2% | |

| | | |

| | |

| Hotels, Restaurants & Leisure — 0.5% | |

| | | |

| | |

| Gourmet Master Co. Ltd. | |

| 526,000 | | |

| 1,549,678 | |

| Household Durables — 2.8% | |

| | | |

| | |

| Nien Made Enterprise Co. Ltd. | |

| 799,000 | | |

| 9,838,993 | |

| Leisure Products — 2.5% | |

| | | |

| | |

| Giant Manufacturing Co. Ltd. | |

| 520,000 | | |

| 2,433,273 | |

| Merida Industry Co. Ltd. | |

| 1,290,000 | | |

| 6,354,093 | |

| | |

| | | |

| 8,787,366 | |

| Textiles, Apparel & Luxury Goods — 2.4% | |

| | | |

| | |

| Eclat Textile Co. Ltd. | |

| 80,000 | | |

| 1,305,298 | |

| Feng TAY Enterprise Co. Ltd. | |

| 564,800 | | |

| 2,277,770 | |

| Fulgent Sun International Holding Co. Ltd. | |

| 505,000 | | |

| 1,741,218 | |

| Makalot Industrial Co. Ltd. | |

| 320,000 | | |

| 3,157,344 | |

| | |

| | | |

| 8,481,630 | |

| TOTAL CONSUMER DISCRETIONARY | |

| | | |

| 28,657,667 | |

| CONSUMER STAPLES — 2.1% | |

| | | |

| | |

| Consumer Staples Distribution & Retail — 2.1% | |

| | | |

| | |

| President Chain Store Corp. | |

| 869,000 | | |

| 7,236,539 | |

| TOTAL CONSUMER STAPLES | |

| | | |

| 7,236,539 | |

| INDUSTRIALS — 6.3% | |

| | | |

| | |

| Electrical Equipment — 6.3% | |

| | | |

| | |

| Bizlink Holding, Inc. | |

| 815,000 | | |

| 16,233,260 | |

| Fortune Electric Co. Ltd. (a) | |

| 330,400 | | |

| 5,594,311 | |

| TOTAL INDUSTRIALS | |

| | | |

| 21,827,571 | |

| INFORMATION TECHNOLOGY — 70.8% | |

| | | |

| | |

| Communications Equipment — 0.8% | |

| | | |

| | |

| Arizon RFID Technology Cayman Co. Ltd. | |

| 20,000 | | |

| 134,840 | |

| EZconn Corp. (a) | |

| 166,000 | | |

| 2,580,735 | |

| | |

| | | |

| 2,715,575 | |

| Electronic Equipment, Instruments & Components — 11.1% | |

| | | |

| | |

| All Ring Tech Co. Ltd. | |

| 84,000 | | |

| 1,121,017 | |

| Delta Electronics, Inc. | |

| 1,189,000 | | |

| 13,946,033 | |

| E Ink Holdings, Inc. | |

| 187,000 | | |

| 1,617,677 | |

| Fositek Corp. (a) | |

| 276,000 | | |

| 7,664,071 | |

| Hon Hai Precision Industry Co. Ltd. | |

| 426,000 | | |

| 2,563,895 | |

| Lotes Co. Ltd. | |

| 146,000 | | |

| 8,045,439 | |

| Unimicron Technology Corp. | |

| 766,000 | | |

| 3,513,653 | |

| | |

| | | |

| 38,471,785 | |

| Semiconductors & Semiconductor Equipment — 45.8% | |

| | | |

| | |

| Alchip Technologies Ltd. (a) | |

| 85,000 | | |

| 5,796,109 | |

| ASPEED Technology, Inc. | |

| 21,000 | | |

| 2,640,920 | |

| eMemory Technology, Inc. | |

| 151,000 | | |

| 13,550,627 | |

| Global Unichip Corp. (a) | |

| 100,000 | | |

| 3,663,455 | |

| Grand Process Technology Corp. | |

| 252,000 | | |

| 12,761,752 | |

| Jentech Precision Industrial Co. Ltd. (a) | |

| 324,000 | | |

| 13,814,611 | |

| LandMark Optoelectronics Corp. (a) | |

| 362,000 | | |

| 3,822,492 | |

| MediaTek, Inc. | |

| 84,000 | | |

| 3,245,390 | |

| SDI Corp. | |

| 616,000 | | |

| 1,934,304 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. | |

| 2,781,000 | | |

| 85,271,557 | |

| Visual Photonics Epitaxy Co. Ltd. (a) | |

| 1,954,000 | | |

| 10,226,272 | |

| WinWay Technology Co. Ltd. | |

| 77,000 | | |

| 2,797,155 | |

| | |

| | | |

| 159,524,644 | |

| Technology Hardware, Storage & Peripherals — 13.1% | |

| | | |

| | |

| Asia Vital Components Co. Ltd. (a) | |

| 607,000 | | |

| 12,015,547 | |

| AURAS Technology Co. Ltd. | |

| 25,000 | | |

| 524,890 | |

| King Slide Works Co. Ltd. (a) | |

| 300,000 | | |

| 13,483,976 | |

| Quanta Computer, Inc. | |

| 1,624,000 | | |

| 14,548,656 | |

| Wiwynn Corp. | |

| 84,000 | | |

| 5,003,848 | |

| | |

| | | |

| 45,576,917 | |

| TOTAL INFORMATION TECHNOLOGY | |

| | | |

| 246,288,921 | |

| MATERIALS — 2.3% | |

| | | |

| | |

| Metals & Mining — 2.3% | |

| | | |

| | |

| Century Iron & Steel Industrial Co. Ltd. (a) | |

| 1,488,000 | | |

| 8,016,501 | |

| TOTAL MATERIALS | |

| | | |

| 8,016,501 | |

TOTAL COMMON STOCKS

(Cost — $202,585,946) | |

| | | |

| 316,892,975 | |

TOTAL INVESTMENTS — 91.1%

(Cost — $202,585,946) | |

| | | |

| 316,892,975 | |

| OTHER ASSETS AND LIABILITIES, NET—8.9% | |

| | | |

| 30,997,900 | |

| NET ASSETS—100.0% | |

| | | |

| 347,890,875 | |

Legend:

US $ – United States dollar

| (a) | All or a portion of the security is on loan. The market value

of the securities on loan is $35,641,334, collateralized by non-cash collateral such as U.S. Government securities in the amount of $38,240,279. |

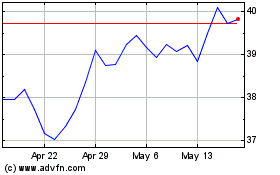

Taiwan (NYSE:TWN)

Historical Stock Chart

From Feb 2025 to Mar 2025

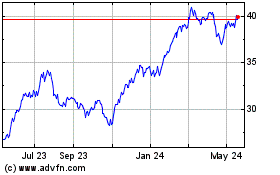

Taiwan (NYSE:TWN)

Historical Stock Chart

From Mar 2024 to Mar 2025