0000891166false00008911662025-02-252025-02-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 25, 2025

Universal Insurance Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-33251 | | 65-0231984 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1110 W. Commercial Blvd., Fort Lauderdale, Florida 33309

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (954) 958-1200

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 Par Value | UVE | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On February 25, 2025, Universal Insurance Holdings, Inc. issued a press release announcing its financial results for the fiscal quarter and year ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Current Report on Form 8-K, including Exhibit 99.1 hereto, is being furnished to the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits:

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Date: February 25, 2025 | | | | UNIVERSAL INSURANCE HOLDINGS, INC. |

| | | |

| | | | By: | | /s/ Frank C. Wilcox |

| | | | Name: | | Frank C. Wilcox |

| | | | Title: | | Chief Financial Officer |

Exhibit 99.1

Universal Reports Fourth Quarter 2024 Results

•Diluted GAAP earnings per common share (EPS) of $0.21; diluted adjusted* EPS of $0.25

•Annualized return on average common equity (“ROCE”) of 6.2%, annualized adjusted* ROCE of 6.5%

•Direct premiums written of $470.9 million, up 8.8% from the prior year quarter

•Book value per share of $13.28, up 12.7% year-over-year; adjusted book value per share of $15.53, up 8.3% year-over-year

•Total capital returned to shareholders of $16.2 million, including $7.7 million of share repurchases, a $0.16 per share regular dividend and a $0.13 per share special dividend

| | |

* Reconciliations of GAAP to non-GAAP financial measures are provided in the attached tables. |

Fort Lauderdale, Fla., February 25, 2025 – Universal Insurance Holdings (NYSE: UVE) (“Universal” or the “Company”) reported fourth quarter and full year 2024 results.

“In 2024, we experienced three hurricanes, including Debbie, Helene and Milton, and we’re working hard, as we always do, to help our customers restore their lives,” said Stephen J. Donaghy, Chief Executive Officer. “We continue to see progress relative to claims trends in our Florida book and recently filed a modest rate decrease in the state that’s directly correlated with the legislative changes made in December 2022. We’re already well underway negotiating and placing our 2025 reinsurance program with 92% of our first event catastrophe tower already placed as we stand here today, along with significant additional multi-year capacity secured for the 2026 hurricane season.”

Summary Financial Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($thousands, except per share data) | Three Months Ended December 31, | | | Twelve Months Ended December 31, |

| 2024 | | 2023 | | Change | | | 2024 | | 2023 | | Change |

| GAAP comparison | | | | | | | | | | | | |

| Total revenues | $ | 384,809 | | | $ | 375,456 | | | 2.5 | % | | | $ | 1,520,536 | | | $ | 1,391,582 | | | 9.3 | % |

Operating income | $ | 8,957 | | | $ | 27,531 | | | (67.5) | % | | | $ | 91,087 | | | $ | 94,880 | | | (4.0) | % |

Operating income margin | 2.3 | % | | 7.3 | % | | (5.0) | pts | | | 6.0 | % | | 6.8 | % | | (0.8) | pts |

| | | | | | | | | | | | |

Net income available to common stockholders | $ | 6,016 | | | $ | 19,997 | | | (69.9) | % | | | $ | 58,918 | | | $ | 66,813 | | | (11.8) | % |

Diluted earnings per common share | $ | 0.21 | | | $ | 0.68 | | | (69.1) | % | | | $ | 2.01 | | | $ | 2.22 | | | (9.5) | % |

| | | | | | | | | | | | |

| Annualized ROCE | 6.2 | % | | 24.9 | % | | (18.7) | pts | | | 16.5 | % | | 21.2 | % | | (4.7) | pts |

| Book value per share, end of period | $ | 13.28 | | | $ | 11.78 | | | 12.7 | % | | | 13.28 | | $ | 11.78 | | | 12.7 | % |

| | | | | | | | | | | | |

Non-GAAP comparison1 | | | | | | | | | | | | |

| Core revenue | $ | 386,414 | | | $ | 365,705 | | | 5.7 | % | | | $ | 1,511,915 | | | $ | 1,380,765 | | | 9.5 | % |

Adjusted operating income | $ | 10,562 | | | $ | 17,780 | | | (40.6) | % | | | $ | 82,466 | | | $ | 84,063 | | | (1.9) | % |

Adjusted operating income margin | 2.7 | % | | 4.9 | % | | (2.2) | pts | | | 5.5 | % | | 6.1 | % | | (0.6) | pts |

| | | | | | | | | | | | |

Adjusted net income available to common stockholders | $ | 7,226 | | | $ | 12,645 | | | (42.9) | % | | | $ | 52,418 | | | $ | 58,657 | | | (10.6) | % |

Adjusted diluted earnings per common share | $ | 0.25 | | | $ | 0.43 | | | (41.9) | % | | | $ | 1.79 | | | $ | 1.95 | | | (8.2) | % |

| | | | | | | | | | | | |

| Annualized adjusted ROCE | 6.5 | % | | 12.4 | % | | (5.9) | pts | | | 12.4 | % | | 14.7 | % | | (2.3) | pts |

| Adjusted book value per share, end of period | $ | 15.53 | | | $ | 14.34 | | | 8.3 | % | | | $ | 15.53 | | | $ | 14.34 | | | 8.3 | % |

| | | | | | | | | | | | |

| Underwriting Summary | | | | | | | | | | | | |

| Premiums: | | | | | | | | | | | | |

| Premiums in force | $ | 2,079,069 | | | $ | 1,934,369 | | | 7.5 | % | | | $ | 2,079,069 | | | $ | 1,934,369 | | | 7.5 | % |

| Policies in force | 855,526 | | | 809,932 | | | 5.6 | % | | | 855,526 | | | 809,932 | | | 5.6 | % |

| | | | | | | | | | | | |

| Direct premiums written | $ | 470,895 | | | $ | 432,617 | | | 8.8 | % | | | $ | 2,069,692 | | | $ | 1,921,833 | | | 7.7 | % |

| Direct premiums earned | $ | 519,339 | | | $ | 482,126 | | | 7.7 | % | | | $ | 1,999,805 | | | $ | 1,875,129 | | | 6.6 | % |

| Ceded premiums earned | $ | (170,985) | | | $ | (146,728) | | | 16.5 | % | | | $ | (626,732) | | | $ | (623,193) | | | 0.6 | % |

| Ceded premium ratio | 32.9 | % | | 30.4 | % | | 2.5 | pts | | | 31.3 | % | | 33.2 | % | | (1.9) | pts |

| Net premiums earned | $ | 348,354 | | | $ | 335,398 | | | 3.9 | % | | | $ | 1,373,073 | | | $ | 1,251,936 | | | 9.7 | % |

| | | | | | | | | | | | |

| Net ratios: | | | | | | | | | | | | |

| Loss ratio | 82.3 | % | | 81.9 | % | | 0.4 | pts | | | 79.2 | % | | 79.3 | % | | (0.1) | pts |

| Expense ratio | 25.6 | % | | 21.8 | % | | 3.8 | pts | | | 24.9 | % | | 24.3 | % | | 0.6 | pts |

| Combined ratio | 107.9 | % | | 103.7 | % | | 4.2 | pts | | | 104.1 | % | | 103.6 | % | | 0.5 | pts |

| | | | | | | | | | | | |

1 Reconciliation of GAAP to non-GAAP financial measures are provided in the attached tables. Adjusted net income (loss) available to common stockholders, adjusted diluted earnings (loss) per common share and core revenue exclude net realized gains (losses) on investments and net change in unrealized gains (losses) on investments. Adjusted operating income (loss) excludes the items above and interest and amortization of debt issuance costs. Adjusted book value per share excludes accumulated other comprehensive income (loss), net of taxes. Adjusted ROCE is calculated by dividing annualized adjusted net income (loss) available to common stockholders by average adjusted book value per share, with the denominator further excluding current period after-tax net realized gains (losses) on investments and net change in unrealized gains (losses) on investments. |

Net Income and Adjusted Net Income

Net income available to common stockholders was $6.0 million, down from net income of $20.0 million in the prior year quarter, and adjusted net income available to common stockholders was $7.2 million, down from adjusted net income of $12.6 million in the prior year quarter. The decrease in adjusted net income mostly stems from lower underwriting income, partly offset by higher net investment income and commission revenue.

Revenues

Revenue was $384.8 million, up 2.5% from the prior year quarter and core revenue was $386.4 million, up 5.7% from the prior year quarter. The increase in core revenue primarily stems from higher net premiums earned, net investment income and commission revenue.

Direct premiums written were $470.9 million, up 8.8% from the prior year quarter. The increase stems from 0.8% growth in Florida and 38.4% growth in other states. Overall growth mostly reflects higher policies in force, higher rates and inflation adjustments.

Direct premiums earned were $519.3 million, up 7.7% from the prior year quarter. The increase stems from direct premiums written growth over the past twelve months.

The ceded premium ratio was 32.9%, up from 30.4%, in the prior year quarter. The increase primarily reflects replacement of the Reinsurance to Assist Policyholders (RAP) layer, which was provided by the state of Florida, with private market coverage.

Net premiums earned were $348.4 million, up 3.9% from the prior year quarter. The increase is primarily attributable to higher direct premiums earned, partly offset by a higher ceded premium ratio, as described above.

Net investment income was $15.6 million, up from $13.7 million in the prior year quarter. The increase primarily stems higher fixed income reinvestment yields and higher invested assets.

Commissions, policy fees and other revenue were $22.5 million, up 35.6% from the prior year quarter. The increase primarily reflects replacement of the RAP layer with private market coverage and replacement of the catastrophe bond with traditional reinsurance coverage in the 2024-2025 program.

Margins

The operating income margin was 2.3%, down from an operating income margin of 7.3% in the prior year quarter. The adjusted operating income margin was 2.7%, down from an adjusted operating income margin of 4.9% in the prior year quarter. The lower adjusted operating income margin primarily reflects a higher net combined ratio, partly offset by higher net investment income and commission revenue.

The net loss ratio was 82.3%, up 0.4 points compared to the prior year quarter. The increase primarily reflects higher weather losses, primarily from Hurricane Milton, partly offset by more favorable prior year reserve development.

The net expense ratio was 25.6%, up 3.8 points from 21.8% in the prior year quarter. The increase was primarily driven by higher policy acquisition costs associated with growth outside Florida and higher other operating costs.

The net combined ratio was 107.9%, up 4.2 points compared to the prior year quarter. The increase reflects higher net loss ratio and expense ratios, as described above.

Capital Deployment

During the fourth quarter, the Company repurchased approximately 370 thousand shares at an aggregate cost of $7.7 million. The Company’s current share repurchase authorization program has $2.6 million remaining.

On February 6, 2025, the Board of Directors declared a regular quarterly cash dividend of 16 cents per share of common stock, payable March 14, 2025 to shareholders of record as of the close of business on March 7, 2025.

Conference Call and Webcast

•Wednesday, February 26, 2025 at 10:00 a.m. ET

•Investors and other interested parties may listen to the call by accessing the online, real-time webcast at universalinsuranceholdings.com/investors or by registering in advance via teleconference at https://register.vevent.com/register/BIb9ed7bf57ebb4ae697ac54467570a179. Once registration is completed, participants will be provided with a dial-in number containing a personalized conference code to access the call. An online replay of the call will be available at universalinsuranceholdings.com/investors shortly after the investor call concludes.

About Universal

Universal Insurance Holdings, Inc. (NYSE: UVE) is a holding company providing property and casualty insurance and value-added insurance services. We develop, market, and write insurance products for consumers predominantly in the personal residential homeowners lines of business and perform substantially all other insurance-related services for our primary insurance entities, including risk management, claims management and distribution. We provide insurance products in the United States through both our appointed independent agents and our direct online distribution channels, primarily in Florida. Learn more at universalinsuranceholdings.com or get an insurance quote at Clovered.com.

Non-GAAP Financial Measures and Key Performance Indicators

This press release contains non-GAAP financial measures within the meaning of Regulation G promulgated by the U.S. Securities and Exchange Commission (“SEC”), including core revenue, adjusted net income available to common stockholders and diluted adjusted earnings (loss) per common share, which exclude the impact of net realized gains (losses) on investments and net change in unrealized gains (losses) on investments. Adjusted operating income (loss) and adjusted operating income (loss) margin exclude the impact of net realized gains (losses) on investments and net change in unrealized gains (losses) on investments and interest and amortization of debt issuance costs. Adjusted common stockholders’ equity and adjusted book value per share exclude accumulated other comprehensive income (loss) (AOCI), net of taxes. Adjusted return on common equity excludes after-tax net realized gains (losses) on investments and net change in unrealized gains (losses) on investments from the numerator and AOCI, net of taxes, and current period after-tax net realized gains (losses) on investments and net change in unrealized gains (losses) on investments from the denominator. A “non-GAAP financial measure” is generally defined as a numerical measure of a company’s historical or future performance that excludes or includes amounts, or is subject to adjustments, so as to be different from the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles (“GAAP”). UVE management believes that these non-GAAP financial measures are meaningful, as they allow investors to evaluate underlying revenue and profitability trends and enhance comparability across periods. When considered together with the GAAP financial measures, management believes these metrics provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. UVE management also believes that these non-GAAP financial measures enhance the ability of investors to analyze UVE’s business trends and to understand UVE’s

operational performance. UVE’s management utilizes these non-GAAP financial measures as guides in long-term planning. Non-GAAP financial measures should be considered in addition to, and not as a substitute for or superior to, financial measures presented in accordance with GAAP. For more information regarding our key performance indicators, please refer to the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Key Performance Indicators” in our forthcoming Annual Report on Form 10-K for the year ended December 31, 2024.

Forward-Looking Statements

This press release may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “will,” “plan,” and similar expressions identify forward-looking statements, which speak only as of the date the statement was made. Such statements may include commentary on plans, products and lines of business, marketing arrangements, reinsurance programs and other business developments and assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, including those risks and uncertainties described under the heading “Risk Factors” and “Liquidity and Capital Resources” in our 2024 Annual Report on Form 10-K, and supplemented in our subsequent Quarterly Reports on Form 10-Q. Future results could differ materially from those described, and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. For further information regarding risk factors that could affect the Company’s operations and future results, refer to the Company’s reports filed with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and the most recent quarterly reports on Form 10-Q.

Investors/Media:

Arash Soleimani, CFA, CPA, CPCU, ARe

Chief Strategy Officer

954-804-8874

asoleimani@universalproperty.com

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands, except per share data)

| | | | | | | | | | | | | | |

| | December 31, | | December 31, |

| | 2024 | | 2023 |

| ASSETS | | | | |

| Invested Assets | | | | |

| Fixed maturities, at fair value | | $ | 1,269,079 | | | $ | 1,064,330 | |

| Equity securities, at fair value | | 77,752 | | | 80,495 | |

| Other investments, at fair value | | $ | 16,123 | | | $ | 10,434 | |

| Investment real estate, net | | 8,322 | | | 5,525 | |

| Total invested assets | | 1,371,276 | | | 1,160,784 | |

| Cash and cash equivalents | | 259,441 | | | 397,306 | |

| Restricted cash and cash equivalents | | 2,635 | | | 2,635 | |

| Prepaid reinsurance premiums | | 262,716 | | | 236,254 | |

| Reinsurance recoverable | | 627,617 | | | 219,102 | |

| Premiums receivable, net | | 77,936 | | | 77,064 | |

| Property and equipment, net | | 48,653 | | | 47,628 | |

| Deferred policy acquisition costs | | 121,178 | | | 109,985 | |

Deferred income tax asset, net | | 42,163 | | | 43,175 | |

| Goodwill | | 2,319 | | | 2,319 | |

| Other assets | | 25,927 | | | 20,309 | |

| TOTAL ASSETS | | $ | 2,841,861 | | | $ | 2,316,561 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| LIABILITIES: | | | | |

| Unpaid losses and loss adjustment expenses | | $ | 959,291 | | | $ | 510,117 | |

| Unearned premiums | | 1,060,446 | | | 990,559 | |

| Advance premium | | 46,237 | | | 48,660 | |

Income taxes payable | | 6,561 | | | 5,886 | |

| Reinsurance payable, net | | 220,328 | | | 191,850 | |

Commission payable | | 25,931 | | | 20,989 | |

| Long-term debt, net | | 101,243 | | | 102,006 | |

Other liabilities and accrued expenses | | 48,574 | | | 105,197 | |

| Total liabilities | | 2,468,611 | | | 1,975,264 | |

| STOCKHOLDERS' EQUITY: | | | | |

Cumulative convertible preferred stock ($0.01 par value)2 | | — | | | — | |

Common stock ($0.01 par value)3 | | 475 | | | 472 | |

| Treasury shares, at cost - 19,382 and 18,303 | | (282,693) | | | (260,779) | |

| Additional paid-in capital | | 121,781 | | | 115,086 | |

| Accumulated other comprehensive income (loss), net of taxes | | (63,166) | | | (74,172) | |

| Retained earnings | | 596,853 | | | 560,690 | |

| Total stockholders' equity | | 373,250 | | | 341,297 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 2,841,861 | | | $ | 2,316,561 | |

| | | | |

| Notes: | | | | |

2 Cumulative convertible preferred stock ($0.01 par value): Authorized - 1,000 shares; Issued - 10 and 10 shares; Outstanding - 10 and 10 shares; Minimum liquidation preference - $9.99 and $9.99 per share. |

3 Common stock ($0.01 par value): Authorized - 55,000 shares; Issued - 47,478 and 47,269 shares; Outstanding - 28,096 and 28,966 shares. |

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (LOSS) (UNAUDITED)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Twelve Months Ended |

| | December 31, | | | December 31, |

| | 2024 | | 2023 | | | 2024 | | 2023 |

| REVENUES | | | | | | | | | |

| Net premiums earned | | $ | 348,354 | | | $ | 335,398 | | | | $ | 1,373,073 | | | $ | 1,251,936 | |

| Net investment income | | 15,559 | | | 13,714 | | | | 59,148 | | | 48,449 | |

Net realized gains (losses) on investments | | 219 | | | (892) | | | | (1,315) | | | (1,229) | |

Net change in unrealized gains (losses) on investments | | (1,824) | | | 10,643 | | | | 9,936 | | | 12,046 | |

| Commission revenue | | 16,121 | | | 10,960 | | | | 51,792 | | | 54,058 | |

| Policy fees | | 4,315 | | | 4,219 | | | | 19,490 | | | 18,881 | |

| Other revenue | | 2,065 | | | 1,414 | | | | 8,412 | | | 7,441 | |

| Total revenues | | 384,809 | | | 375,456 | | | | 1,520,536 | | | 1,391,582 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | | |

| Losses and loss adjustment expenses | | 286,652 | | | 274,783 | | | | 1,087,366 | | | 992,636 | |

| Policy acquisition costs | | 63,344 | | | 51,134 | | | | 233,444 | | | 208,011 | |

| Other operating expenses | | 25,856 | | | 22,008 | | | | 108,639 | | | 96,055 | |

| Total operating costs and expenses | | 375,852 | | | 347,925 | | | | 1,429,449 | | | 1,296,702 | |

| Interest and amortization of debt issuance costs | | 1,612 | | | 1,635 | | | | 6,476 | | | 6,531 | |

Income before income tax expense | | 7,345 | | | 25,896 | | | | 84,611 | | | 88,349 | |

Income tax expense | | 1,327 | | | 5,897 | | | | 25,683 | | | 21,526 | |

NET INCOME | | $ | 6,018 | | | $ | 19,999 | | | | $ | 58,928 | | | $ | 66,823 | |

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

SHARE AND PER SHARE INFORMATION

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | Twelve Months Ended |

| | December 31, | | | | December 31, |

| | 2024 | | 2023 | | | 2024 | | 2023 |

| Weighted average common shares outstanding - basic | | 28,173 | | | 29,064 | | | | | 28,498 | | | 29,829 | |

| Weighted average common shares outstanding - diluted | | 29,118 | | | 29,487 | | | | | 29,274 | | | 30,147 | |

| Shares outstanding, end of period | | 28,096 | | | 28,966 | | | | | 28,096 | | | 28,966 | |

Basic earnings per common share | | $ | 0.21 | | | $ | 0.69 | | | | | $ | 2.07 | | | $ | 2.24 | |

Diluted earnings per common share | | $ | 0.21 | | | $ | 0.68 | | | | | $ | 2.01 | | | $ | 2.22 | |

| Cash dividend declared per common share | | $ | 0.29 | | | $ | 0.29 | | | | | $ | 0.77 | | | $ | 0.77 | |

| Book value per share, end of period | | $ | 13.28 | | | $ | 11.78 | | | | | $ | 13.28 | | | $ | 11.78 | |

| Annualized return on average common equity (ROCE) | | 6.2 | % | | 24.9 | % | | | | 16.5 | % | | 21.2 | % |

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

SUPPLEMENTARY INFORMATION

(in thousands, except for Policies In Force data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Twelve Months Ended |

| | December 31, | | | December 31, |

| | 2024 | | 2023 | | | 2024 | | 2023 |

| Premiums | | | | | | | | | |

| Direct premiums written - Florida | | $ | 342,565 | | | $ | 339,902 | | | | $ | 1,598,426 | | | $ | 1,565,197 | |

| Direct premiums written - Other States | | 128,330 | | | 92,715 | | | | 471,266 | | | 356,636 | |

| Direct premiums written - Total | | $ | 470,895 | | | $ | 432,617 | | | | $ | 2,069,692 | | | $ | 1,921,833 | |

| Direct premiums earned | | $ | 519,339 | | | $ | 482,126 | | | | $ | 1,999,805 | | | $ | 1,875,129 | |

| Net premiums earned | | $ | 348,354 | | | $ | 335,398 | | | | $ | 1,373,073 | | | $ | 1,251,936 | |

| | | | | | | | | |

| Underwriting Ratios - Net | | | | | | | | | |

| Loss and loss adjustment expense ratio | | 82.3 | % | | 81.9 | % | | | 79.2 | % | | 79.3 | % |

| General and administrative expense ratio | | 25.6 | % | | 21.8 | % | | | 24.9 | % | | 24.3 | % |

| Policy acquisition cost ratio | | 18.2 | % | | 15.2 | % | | | 17.0 | % | | 16.6 | % |

| Other operating expense ratio | | 7.4 | % | | 6.6 | % | | | 7.9 | % | | 7.7 | % |

| Combined ratio | | 107.9 | % | | 103.7 | % | | | 104.1 | % | | 103.6 | % |

| | | | | | | | | | | | | | |

| | As of |

| | December 31, |

| | 2024 | | 2023 |

| Policies in force | | | | |

| Florida | | 567,307 | | | 567,893 | |

| Other States | | 288,219 | | | 242,039 | |

| Total | | 855,526 | | | 809,932 | |

| | | | |

| Premiums in force | | | | |

| Florida | | $ | 1,608,142 | | | $ | 1,577,210 | |

| Other States | | 470,927 | | | 357,159 | |

| Total | | $ | 2,079,069 | | | $ | 1,934,369 | |

| | | | |

| Total Insured Value | | | | |

| Florida | | $ | 186,751,842 | | | $ | 188,516,949 | |

| Other States | | 171,759,368 | | | 134,939,758 | |

| Total | | $ | 358,511,210 | | | $ | 323,456,707 | |

UNIVERSAL INSURANCE HOLDINGS, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in thousands, except for per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP revenue to core revenue |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| GAAP revenue | $ | 384,809 | | | $ | 375,456 | | | | $ | 1,520,536 | | | $ | 1,391,582 | |

| less: Net realized gains (losses) on investments | 219 | | | (892) | | | | (1,315) | | | (1,229) | |

less: Net change in unrealized gains (losses) on investments | (1,824) | | | 10,643 | | | | 9,936 | | | 12,046 | |

| Core revenue | $ | 386,414 | | | $ | 365,705 | | | | $ | 1,511,915 | | | $ | 1,380,765 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

GAAP operating income to adjusted operating income |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

GAAP income before income tax expense | $ | 7,345 | | | $ | 25,896 | | | | $ | 84,611 | | | $ | 88,349 | |

| add: Interest and amortization of debt issuance costs | 1,612 | | | 1,635 | | | | 6,476 | | | 6,531 | |

GAAP operating income | 8,957 | | | 27,531 | | | | 91,087 | | | 94,880 | |

| less: Net realized gains (losses) on investments | 219 | | | (892) | | | | (1,315) | | | (1,229) | |

less: Net change in unrealized gains (losses) on investments | (1,824) | | | 10,643 | | | | 9,936 | | | 12,046 | |

Adjusted operating income | $ | 10,562 | | | $ | 17,780 | | | | $ | 82,466 | | | $ | 84,063 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

GAAP operating income margin to adjusted operating income margin |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

GAAP operating income (a) | $ | 8,957 | | | $ | 27,531 | | | | $ | 91,087 | | | $ | 94,880 | |

| GAAP revenue (b) | 384,809 | | | 375,456 | | | | 1,520,536 | | | 1,391,582 | |

GAAP operating income margin (a÷b) | 2.3 | % | | 7.3 | % | | | 6.0 | % | | 6.8 | % |

Adjusted operating income (c) | 10,562 | | | 17,780 | | | | 82,466 | | | 84,063 | |

| Core revenue (d) | 386,414 | | | 365,705 | | | | 1,511,915 | | | 1,380,765 | |

Adjusted operating income margin (c÷d) | 2.7 | % | | 4.9 | % | | | 5.5 | % | | 6.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

GAAP net income (NI) to adjusted NI available to common stockholders |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

GAAP NI | $ | 6,018 | | | $ | 19,999 | | | | $ | 58,928 | | | $ | 66,823 | |

| less: Preferred dividends | 2 | | | 2 | | | | 10 | | | 10 | |

GAAP NI available to common stockholders (e) | 6,016 | | | 19,997 | | | | 58,918 | | | 66,813 | |

| less: Net realized gains (losses) on investments | 219 | | | (892) | | | | (1,315) | | | (1,229) | |

less: Net change in unrealized gains (losses) on investments | (1,824) | | | 10,643 | | | | 9,936 | | | 12,046 | |

| | | | | | | | |

| add: Income tax effect on above adjustments | (395) | | | 2,399 | | | | 2,121 | | | 2,661 | |

| | | | | | | | |

Adjusted NI available to common stockholders (f) | $ | 7,226 | | | $ | 12,645 | | | | $ | 52,418 | | | $ | 58,657 | |

| | | | | | | | |

| Weighted average diluted common shares outstanding (g) | 29,118 | | | 29,487 | | | | 29,274 | | | 30,147 | |

Diluted earnings per common share (e÷g) | $ | 0.21 | | | $ | 0.68 | | | | $ | 2.01 | | | $ | 2.22 | |

Diluted adjusted earnings per common share (f÷g) | $ | 0.25 | | | $ | 0.43 | | | | $ | 1.79 | | | $ | 1.95 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| GAAP stockholders’ equity to adjusted common stockholders’ equity |

| As of |

| December 31, | | | December 31, | | | December 31, |

| 2024 | | | 2023 | | | 2022 |

| GAAP stockholders’ equity | $ | 373,250 | | | | $ | 341,297 | | | | $ | 287,896 | |

| less: Preferred equity | 100 | | | 100 | | | 100 |

| Common stockholders’ equity (h) | 373,150 | | | | 341,197 | | | | 287,796 | |

| less: Accumulated other comprehensive (loss), net of taxes | (63,166) | | | | (74,172) | | | | (103,782) | |

| Adjusted common stockholders’ equity (i) | $ | 436,316 | | | | $ | 415,369 | | | | $ | 391,578 | |

| | | | | | | |

| Common shares outstanding (j) | 28,096 | | | | 28,966 | | | | 30,389 | |

| Book value per common share (h÷j) | $ | 13.28 | | | | $ | 11.78 | | | | $ | 9.47 | |

| Adjusted book value per common share (i÷j) | $ | 15.53 | | | | $ | 14.34 | | | | $ | 12.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP return on common equity (ROCE) to adjusted ROCE | | |

| Three Months Ended | | | Twelve Months Ended |

| December 31, | | | December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 | | 2022 |

Actual or Annualized NI (loss) available to common stockholders (k) | $ | 24,064 | | | $ | 79,988 | | | | $ | 58,918 | | | $ | 66,813 | | | $ | (22,267) | |

| Average common stockholders’ equity (l) | 386,648 | | | 321,300 | | | | 357,174 | | | 314,497 | | | 358,699 | |

| ROCE (k÷l) | 6.2 | % | | 24.9 | % | | | 16.5 | % | | 21.2 | % | | (6.2) | % |

Annualized adjusted NI (loss) available to common stockholders (m) | $ | 28,904 | | | $ | 50,580 | | | | $ | 52,418 | | | $ | 58,657 | | | $ | (12,618) | |

| | | | | | | | | | |

Adjusted average common stockholders’ equity4 (n) | 441,632 | | | 408,267 | | | | 422,593 | | | 399,396 | | | 423,199 | |

| Adjusted ROCE (m÷n) | 6.5 | % | | 12.4 | % | | | 12.4 | % | | 14.7 | % | | (3.0) | % |

| | | | | | | | | | |

4 Adjusted average common stockholders’ equity excludes current period after-tax net realized gains (losses) on investments and net change in unrealized gains (losses) on investments. |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

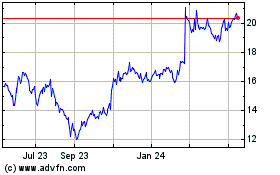

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

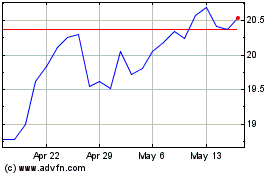

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Mar 2025