- Diluted GAAP earnings per common share (EPS) of $0.21; diluted

adjusted* EPS of $0.25

- Annualized return on average common equity (“ROCE”) of 6.2%,

annualized adjusted* ROCE of 6.5%

- Direct premiums written of $470.9 million, up 8.8% from the

prior year quarter

- Book value per share of $13.28, up 12.7% year-over-year;

adjusted book value per share of $15.53, up 8.3%

year-over-year

- Total capital returned to shareholders of $16.2 million,

including $7.7 million of share repurchases, a $0.16 per share

regular dividend and a $0.13 per share special dividend

Universal Insurance Holdings (NYSE: UVE) (“Universal” or the

“Company”) reported fourth quarter and full year 2024 results.

* Reconciliations of GAAP to non-GAAP financial measures are

provided in the attached tables.

“In 2024, we experienced three hurricanes, including Debbie,

Helene and Milton, and we’re working hard, as we always do, to help

our customers restore their lives,” said Stephen J. Donaghy, Chief

Executive Officer. “We continue to see progress relative to claims

trends in our Florida book and recently filed a modest rate

decrease in the state that’s directly correlated with the

legislative changes made in December 2022. We’re already well

underway negotiating and placing our 2025 reinsurance program with

92% of our first event catastrophe tower already placed as we stand

here today, along with significant additional multi-year capacity

secured for the 2026 hurricane season.”

Summary Financial

Results

($thousands, except per share data)

Three Months Ended December

31,

Twelve Months Ended December

31,

2024

2023

Change

2024

2023

Change

GAAP

comparison

Total revenues

$

384,809

$

375,456

2.5

%

$

1,520,536

$

1,391,582

9.3

%

Operating income

$

8,957

$

27,531

(67.5

)%

$

91,087

$

94,880

(4.0

)%

Operating income margin

2.3

%

7.3

%

(5.0) pts

6.0

%

6.8

%

(0.8) pts

Net income available to common

stockholders

$

6,016

$

19,997

(69.9

)%

$

58,918

$

66,813

(11.8

)%

Diluted earnings per common share

$

0.21

$

0.68

(69.1

)%

$

2.01

$

2.22

(9.5

)%

Annualized ROCE

6.2

%

24.9

%

(18.7) pts

16.5

%

21.2

%

(4.7) pts

Book value per share, end of period

$

13.28

$

11.78

12.7

%

13.28

$

11.78

12.7

%

Non-GAAP

comparison1

Core revenue

$

386,414

$

365,705

5.7

%

$

1,511,915

$

1,380,765

9.5

%

Adjusted operating income

$

10,562

$

17,780

(40.6

)%

$

82,466

$

84,063

(1.9

)%

Adjusted operating income margin

2.7

%

4.9

%

(2.2) pts

5.5

%

6.1

%

(0.6) pts

Adjusted net income available to common

stockholders

$

7,226

$

12,645

(42.9

)%

$

52,418

$

58,657

(10.6

)%

Adjusted diluted earnings per common

share

$

0.25

$

0.43

(41.9

)%

$

1.79

$

1.95

(8.2

)%

Annualized adjusted ROCE

6.5

%

12.4

%

(5.9) pts

12.4

%

14.7

%

(2.3) pts

Adjusted book value per share, end of

period

$

15.53

$

14.34

8.3

%

$

15.53

$

14.34

8.3

%

Underwriting

Summary

Premiums:

Premiums in force

$

2,079,069

$

1,934,369

7.5

%

$

2,079,069

$

1,934,369

7.5

%

Policies in force

855,526

809,932

5.6

%

855,526

809,932

5.6

%

Direct premiums written

$

470,895

$

432,617

8.8

%

$

2,069,692

$

1,921,833

7.7

%

Direct premiums earned

$

519,339

$

482,126

7.7

%

$

1,999,805

$

1,875,129

6.6

%

Ceded premiums earned

$

(170,985

)

$

(146,728

)

16.5

%

$

(626,732

)

$

(623,193

)

0.6

%

Ceded premium ratio

32.9

%

30.4

%

2.5 pts

31.3

%

33.2

%

(1.9) pts

Net premiums earned

$

348,354

$

335,398

3.9

%

$

1,373,073

$

1,251,936

9.7

%

Net ratios:

Loss ratio

82.3

%

81.9

%

0.4 pts

79.2

%

79.3

%

(0.1) pts

Expense ratio

25.6

%

21.8

%

3.8 pts

24.9

%

24.3

%

0.6 pts

Combined ratio

107.9

%

103.7

%

4.2 pts

104.1

%

103.6

%

0.5 pts

1 Reconciliation of GAAP to non-GAAP

financial measures are provided in the attached tables. Adjusted

net income (loss) available to common stockholders, adjusted

diluted earnings (loss) per common share and core revenue exclude

net realized gains (losses) on investments and net change in

unrealized gains (losses) on investments. Adjusted operating income

(loss) excludes the items above and interest and amortization of

debt issuance costs. Adjusted book value per share excludes

accumulated other comprehensive income (loss), net of taxes.

Adjusted ROCE is calculated by dividing annualized adjusted net

income (loss) available to common stockholders by average adjusted

book value per share, with the denominator further excluding

current period after-tax net realized gains (losses) on investments

and net change in unrealized gains (losses) on investments.

Net Income and Adjusted Net

Income

Net income available to common stockholders was $6.0 million,

down from net income of $20.0 million in the prior year quarter,

and adjusted net income available to common stockholders was $7.2

million, down from adjusted net income of $12.6 million in the

prior year quarter. The decrease in adjusted net income mostly

stems from lower underwriting income, partly offset by higher net

investment income and commission revenue.

Revenues

Revenue was $384.8 million, up 2.5% from the prior year quarter

and core revenue was $386.4 million, up 5.7% from the prior year

quarter. The increase in core revenue primarily stems from higher

net premiums earned, net investment income and commission

revenue.

Direct premiums written were $470.9 million, up 8.8% from the

prior year quarter. The increase stems from 0.8% growth in Florida

and 38.4% growth in other states. Overall growth mostly reflects

higher policies in force, higher rates and inflation

adjustments.

Direct premiums earned were $519.3 million, up 7.7% from the

prior year quarter. The increase stems from direct premiums written

growth over the past twelve months.

The ceded premium ratio was 32.9%, up from 30.4%, in the prior

year quarter. The increase primarily reflects replacement of the

Reinsurance to Assist Policyholders (RAP) layer, which was provided

by the state of Florida, with private market coverage.

Net premiums earned were $348.4 million, up 3.9% from the prior

year quarter. The increase is primarily attributable to higher

direct premiums earned, partly offset by a higher ceded premium

ratio, as described above.

Net investment income was $15.6 million, up from $13.7 million

in the prior year quarter. The increase primarily stems higher

fixed income reinvestment yields and higher invested assets.

Commissions, policy fees and other revenue were $22.5 million,

up 35.6% from the prior year quarter. The increase primarily

reflects replacement of the RAP layer with private market coverage

and replacement of the catastrophe bond with traditional

reinsurance coverage in the 2024-2025 program.

Margins

The operating income margin was 2.3%, down from an operating

income margin of 7.3% in the prior year quarter. The adjusted

operating income margin was 2.7%, down from an adjusted operating

income margin of 4.9% in the prior year quarter. The lower adjusted

operating income margin primarily reflects a higher net combined

ratio, partly offset by higher net investment income and commission

revenue.

The net loss ratio was 82.3%, up 0.4 points compared to the

prior year quarter. The increase primarily reflects higher weather

losses, primarily from Hurricane Milton, partly offset by more

favorable prior year reserve development.

The net expense ratio was 25.6%, up 3.8 points from 21.8% in the

prior year quarter. The increase was primarily driven by higher

policy acquisition costs associated with growth outside Florida and

higher other operating costs.

The net combined ratio was 107.9%, up 4.2 points compared to the

prior year quarter. The increase reflects higher net loss ratio and

expense ratios, as described above.

Capital Deployment

During the fourth quarter, the Company repurchased approximately

370 thousand shares at an aggregate cost of $7.7 million. The

Company’s current share repurchase authorization program has $2.6

million remaining.

On February 6, 2025, the Board of Directors declared a regular

quarterly cash dividend of 16 cents per share of common stock,

payable March 14, 2025 to shareholders of record as of the close of

business on March 7, 2025.

Conference Call and Webcast

- Wednesday, February 26, 2025 at 10:00 a.m. ET

- Investors and other interested parties may listen to the call

by accessing the online, real-time webcast at

universalinsuranceholdings.com/investors or by registering in

advance via teleconference at

https://register.vevent.com/register/BIb9ed7bf57ebb4ae697ac54467570a179.

Once registration is completed, participants will be provided with

a dial-in number containing a personalized conference code to

access the call. An online replay of the call will be available at

universalinsuranceholdings.com/investors shortly after the investor

call concludes.

About Universal

Universal Insurance Holdings, Inc. (NYSE: UVE) is a holding

company providing property and casualty insurance and value-added

insurance services. We develop, market, and write insurance

products for consumers predominantly in the personal residential

homeowners lines of business and perform substantially all other

insurance-related services for our primary insurance entities,

including risk management, claims management and distribution. We

provide insurance products in the United States through both our

appointed independent agents and our direct online distribution

channels, primarily in Florida. Learn more at

universalinsuranceholdings.com or get an insurance quote at

Clovered.com.

Non-GAAP Financial Measures and Key Performance

Indicators

This press release contains non-GAAP financial measures within

the meaning of Regulation G promulgated by the U.S. Securities and

Exchange Commission (“SEC”), including core revenue, adjusted net

income available to common stockholders and diluted adjusted

earnings (loss) per common share, which exclude the impact of net

realized gains (losses) on investments and net change in unrealized

gains (losses) on investments. Adjusted operating income (loss) and

adjusted operating income (loss) margin exclude the impact of net

realized gains (losses) on investments and net change in unrealized

gains (losses) on investments and interest and amortization of debt

issuance costs. Adjusted common stockholders’ equity and adjusted

book value per share exclude accumulated other comprehensive income

(loss) (AOCI), net of taxes. Adjusted return on common equity

excludes after-tax net realized gains (losses) on investments and

net change in unrealized gains (losses) on investments from the

numerator and AOCI, net of taxes, and current period after-tax net

realized gains (losses) on investments and net change in unrealized

gains (losses) on investments from the denominator. A “non-GAAP

financial measure” is generally defined as a numerical measure of a

company’s historical or future performance that excludes or

includes amounts, or is subject to adjustments, so as to be

different from the most directly comparable measure calculated and

presented in accordance with generally accepted accounting

principles (“GAAP”). UVE management believes that these non-GAAP

financial measures are meaningful, as they allow investors to

evaluate underlying revenue and profitability trends and enhance

comparability across periods. When considered together with the

GAAP financial measures, management believes these metrics provide

information that is useful to investors in understanding

period-over-period operating results separate and apart from items

that may, or could, have a disproportionately positive or negative

impact on results in any particular period. UVE management also

believes that these non-GAAP financial measures enhance the ability

of investors to analyze UVE’s business trends and to understand

UVE’s operational performance. UVE’s management utilizes these

non-GAAP financial measures as guides in long-term planning.

Non-GAAP financial measures should be considered in addition to,

and not as a substitute for or superior to, financial measures

presented in accordance with GAAP. For more information regarding

our key performance indicators, please refer to the section titled

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations – Key Performance Indicators” in our

forthcoming Annual Report on Form 10-K for the year ended December

31, 2024.

Forward-Looking Statements

This press release may contain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. The words “believe,” “expect,” “anticipate,” “will,”

“plan,” and similar expressions identify forward-looking

statements, which speak only as of the date the statement was made.

Such statements may include commentary on plans, products and lines

of business, marketing arrangements, reinsurance programs and other

business developments and assumptions relating to the foregoing.

Forward-looking statements are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified,

including those risks and uncertainties described under the heading

“Risk Factors” and “Liquidity and Capital Resources” in our 2024

Annual Report on Form 10-K, and supplemented in our subsequent

Quarterly Reports on Form 10-Q. Future results could differ

materially from those described, and the Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise. For further information regarding risk factors that

could affect the Company’s operations and future results, refer to

the Company’s reports filed with the Securities and Exchange

Commission, including the Company’s Annual Report on Form 10-K and

the most recent quarterly reports on Form 10-Q.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in thousands, except per

share data)

December 31,

December 31,

2024

2023

ASSETS

Invested Assets

Fixed maturities, at fair value

$

1,269,079

$

1,064,330

Equity securities, at fair value

77,752

80,495

Other investments, at fair value

$

16,123

$

10,434

Investment real estate, net

8,322

5,525

Total invested assets

1,371,276

1,160,784

Cash and cash equivalents

259,441

397,306

Restricted cash and cash equivalents

2,635

2,635

Prepaid reinsurance premiums

262,716

236,254

Reinsurance recoverable

627,617

219,102

Premiums receivable, net

77,936

77,064

Property and equipment, net

48,653

47,628

Deferred policy acquisition costs

121,178

109,985

Deferred income tax asset, net

42,163

43,175

Goodwill

2,319

2,319

Other assets

25,927

20,309

TOTAL ASSETS

$

2,841,861

$

2,316,561

LIABILITIES AND STOCKHOLDERS'

EQUITY

LIABILITIES:

Unpaid losses and loss adjustment

expenses

$

959,291

$

510,117

Unearned premiums

1,060,446

990,559

Advance premium

46,237

48,660

Income taxes payable

6,561

5,886

Reinsurance payable, net

220,328

191,850

Commission payable

25,931

20,989

Long-term debt, net

101,243

102,006

Other liabilities and accrued expenses

48,574

105,197

Total liabilities

2,468,611

1,975,264

STOCKHOLDERS' EQUITY:

Cumulative convertible preferred stock

($0.01 par value)2

—

—

Common stock ($0.01 par value)3

475

472

Treasury shares, at cost - 19,382 and

18,303

(282,693

)

(260,779

)

Additional paid-in capital

121,781

115,086

Accumulated other comprehensive income

(loss), net of taxes

(63,166

)

(74,172

)

Retained earnings

596,853

560,690

Total stockholders' equity

373,250

341,297

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

2,841,861

$

2,316,561

Notes:

2 Cumulative convertible preferred stock

($0.01 par value): Authorized - 1,000 shares; Issued - 10 and 10

shares; Outstanding - 10 and 10 shares; Minimum liquidation

preference - $9.99 and $9.99 per share.

3 Common stock ($0.01 par value):

Authorized - 55,000 shares; Issued - 47,478 and 47,269 shares;

Outstanding - 28,096 and 28,966 shares.

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

INCOME (LOSS) (UNAUDITED)

(in thousands)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

REVENUES

Net premiums earned

$

348,354

$

335,398

$

1,373,073

$

1,251,936

Net investment income

15,559

13,714

59,148

48,449

Net realized gains (losses) on

investments

219

(892

)

(1,315

)

(1,229

)

Net change in unrealized gains (losses) on

investments

(1,824

)

10,643

9,936

12,046

Commission revenue

16,121

10,960

51,792

54,058

Policy fees

4,315

4,219

19,490

18,881

Other revenue

2,065

1,414

8,412

7,441

Total revenues

384,809

375,456

1,520,536

1,391,582

EXPENSES

Losses and loss adjustment expenses

286,652

274,783

1,087,366

992,636

Policy acquisition costs

63,344

51,134

233,444

208,011

Other operating expenses

25,856

22,008

108,639

96,055

Total operating costs and

expenses

375,852

347,925

1,429,449

1,296,702

Interest and amortization of debt issuance

costs

1,612

1,635

6,476

6,531

Income before income tax

expense

7,345

25,896

84,611

88,349

Income tax expense

1,327

5,897

25,683

21,526

NET INCOME

$

6,018

$

19,999

$

58,928

$

66,823

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

SHARE AND PER SHARE

INFORMATION

(in thousands, except per

share data)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

Weighted average common shares outstanding

- basic

28,173

29,064

28,498

29,829

Weighted average common shares outstanding

- diluted

29,118

29,487

29,274

30,147

Shares outstanding, end of period

28,096

28,966

28,096

28,966

Basic earnings per common share

$

0.21

$

0.69

$

2.07

$

2.24

Diluted earnings per common share

$

0.21

$

0.68

$

2.01

$

2.22

Cash dividend declared per common

share

$

0.29

$

0.29

$

0.77

$

0.77

Book value per share, end of period

$

13.28

$

11.78

$

13.28

$

11.78

Annualized return on average common equity

(ROCE)

6.2

%

24.9

%

16.5

%

21.2

%

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

SUPPLEMENTARY

INFORMATION

(in thousands, except for

Policies In Force data)

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

Premiums

Direct premiums written - Florida

$

342,565

$

339,902

$

1,598,426

$

1,565,197

Direct premiums written - Other States

128,330

92,715

471,266

356,636

Direct premiums written - Total

$

470,895

$

432,617

$

2,069,692

$

1,921,833

Direct premiums earned

$

519,339

$

482,126

$

1,999,805

$

1,875,129

Net premiums earned

$

348,354

$

335,398

$

1,373,073

$

1,251,936

Underwriting Ratios - Net

Loss and loss adjustment expense ratio

82.3

%

81.9

%

79.2

%

79.3

%

General and administrative expense

ratio

25.6

%

21.8

%

24.9

%

24.3

%

Policy acquisition cost ratio

18.2

%

15.2

%

17.0

%

16.6

%

Other operating expense ratio

7.4

%

6.6

%

7.9

%

7.7

%

Combined ratio

107.9

%

103.7

%

104.1

%

103.6

%

As of

December 31,

2024

2023

Policies in force

Florida

567,307

567,893

Other States

288,219

242,039

Total

855,526

809,932

Premiums in force

Florida

$

1,608,142

$

1,577,210

Other States

470,927

357,159

Total

$

2,079,069

$

1,934,369

Total Insured Value

Florida

$

186,751,842

$

188,516,949

Other States

171,759,368

134,939,758

Total

$

358,511,210

$

323,456,707

UNIVERSAL INSURANCE HOLDINGS,

INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(in thousands, except for per

share data)

GAAP revenue to

core revenue

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

GAAP revenue

$

384,809

$

375,456

$

1,520,536

$

1,391,582

less: Net realized gains (losses) on

investments

219

(892

)

(1,315

)

(1,229

)

less: Net change in unrealized gains

(losses) on investments

(1,824

)

10,643

9,936

12,046

Core revenue

$

386,414

$

365,705

$

1,511,915

$

1,380,765

GAAP operating

income to adjusted operating income

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

GAAP income before income tax

expense

$

7,345

$

25,896

$

84,611

$

88,349

add: Interest and amortization of debt

issuance costs

1,612

1,635

6,476

6,531

GAAP operating income

8,957

27,531

91,087

94,880

less: Net realized gains (losses) on

investments

219

(892

)

(1,315

)

(1,229

)

less: Net change in unrealized gains

(losses) on investments

(1,824

)

10,643

9,936

12,046

Adjusted operating income

$

10,562

$

17,780

$

82,466

$

84,063

GAAP operating

income margin to adjusted operating income margin

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

GAAP operating income (a)

$

8,957

$

27,531

$

91,087

$

94,880

GAAP revenue (b)

384,809

375,456

1,520,536

1,391,582

GAAP operating income margin

(a÷b)

2.3

%

7.3

%

6.0

%

6.8

%

Adjusted operating income (c)

10,562

17,780

82,466

84,063

Core revenue (d)

386,414

365,705

1,511,915

1,380,765

Adjusted operating income margin

(c÷d)

2.7

%

4.9

%

5.5

%

6.1

%

GAAP net income

(NI) to adjusted NI available to common stockholders

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

GAAP NI

$

6,018

$

19,999

$

58,928

$

66,823

less: Preferred dividends

2

2

10

10

GAAP NI available to common

stockholders (e)

6,016

19,997

58,918

66,813

less: Net realized gains (losses) on

investments

219

(892

)

(1,315

)

(1,229

)

less: Net change in unrealized gains

(losses) on investments

(1,824

)

10,643

9,936

12,046

add: Income tax effect on above

adjustments

(395

)

2,399

2,121

2,661

Adjusted NI available to common

stockholders (f)

$

7,226

$

12,645

$

52,418

$

58,657

Weighted average diluted common shares

outstanding (g)

29,118

29,487

29,274

30,147

Diluted earnings per common share

(e÷g)

$

0.21

$

0.68

$

2.01

$

2.22

Diluted adjusted earnings per common share

(f÷g)

$

0.25

$

0.43

$

1.79

$

1.95

GAAP

stockholders’ equity to adjusted common stockholders’

equity

As of

December 31,

December 31,

December 31,

2024

2023

2022

GAAP stockholders’ equity

$

373,250

$

341,297

$

287,896

less: Preferred equity

100

100

100

Common stockholders’ equity (h)

373,150

341,197

287,796

less: Accumulated other comprehensive

(loss), net of taxes

(63,166

)

(74,172

)

(103,782

)

Adjusted common stockholders’ equity

(i)

$

436,316

$

415,369

$

391,578

Common shares outstanding (j)

28,096

28,966

30,389

Book value per common share (h÷j)

$

13.28

$

11.78

$

9.47

Adjusted book value per common share

(i÷j)

$

15.53

$

14.34

$

12.89

GAAP return on

common equity (ROCE) to adjusted ROCE

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

2022

Actual or Annualized NI (loss) available

to common stockholders (k)

$

24,064

$

79,988

$

58,918

$

66,813

$

(22,267

)

Average common stockholders’ equity

(l)

386,648

321,300

357,174

314,497

358,699

ROCE (k÷l)

6.2

%

24.9

%

16.5

%

21.2

%

(6.2

)%

Annualized adjusted NI (loss) available to

common stockholders (m)

$

28,904

$

50,580

$

52,418

$

58,657

$

(12,618

)

Adjusted average common stockholders’

equity4 (n)

441,632

408,267

422,593

399,396

423,199

Adjusted ROCE (m÷n)

6.5

%

12.4

%

12.4

%

14.7

%

(3.0

)%

4 Adjusted average common stockholders’

equity excludes current period after-tax net realized gains

(losses) on investments and net change in unrealized gains (losses)

on investments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225227965/en/

Investors/Media: Arash Soleimani, CFA, CPA, CPCU, ARe

Chief Strategy Officer 954-804-8874

asoleimani@universalproperty.com

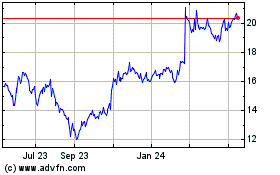

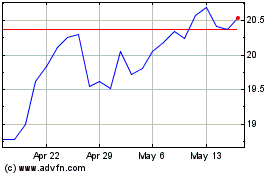

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Universal Insurance (NYSE:UVE)

Historical Stock Chart

From Mar 2024 to Mar 2025