United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

October 2024

Vale S.A.

Praia de Botafogo nº 186, 18º andar,

Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One)

Form 20-F x Form 40-F ¨

|

Press Release |

|

Vale updates on settlement negotiation for the full reparation of

Samarco’s Fundão dam collapse

Rio de Janeiro, October 18, 2024 –

In attention to recent press articles on the status of negotiations for a Definitive Settlement of claims relating to the Fundão

dam collapse in Mariana, Minas Gerais, Brazil, Vale S.A. (“Vale” or “Company”) informs that Samarco Mineração

S.A. (“Samarco”), BHP Billiton Brasil Ltda. (“BHP Brasil”) and the Company (jointly, “the Companies”),

together with the Brazilian Federal Government, the State Governments of Minas Gerais and Espírito Santo, the Federal and State

Public Prosecutors’ and Public Defenders’ Offices and other Brazilian public entities (jointly, “the Parties”)

are considering the general terms for the Definitive Settlement.

The general terms under discussion aims

at fair and effective terms for a mutually beneficial resolution for all parties, especially for the impacted people, communities, and

the environment, while creating definitiveness and legal certainty for the Companies. They reinforce Vale’s commitment to the full

reparation of Samarco’s Fundão dam collapse.

Financial value and main obligations

The general terms under discussion provide

for a total financial value of approximately R$ 170 billion[1], comprising past and future obligations, to serve the people,

communities and environment impacted by the dam failure. It includes three main lines of obligations:

| § | R$ 38 billion[2] in amounts

already invested on remediation and compensation measures, |

| § | R$ 100 billion[3]

paid in installments[4] over 20 years to the Federal Government, the States of Minas Gerais and Espírito Santo and the

municipalities to fund compensatory programs and actions tied to public policies, |

| § | R$ 32 billion[5] in performance

obligations by Samarco, including initiatives for individual indemnification, resettlement, and environmental recovery. |

Parties’ legitimacy and contemplated

claims

A high-level mediation process by the

Brazilian Federal Court of Appeals of the 6th Region and the engagement of Brazilian public institutions, playing their Constitutional

role as authentic representatives of the affected people, have ensured transparency and legitimacy to the settlement process. The general

terms under discussion can pave the way for a Definitive Settlement of all controversies set forth in public civil actions and other proceedings

brought by the signatory Brazilian public authorities relating to the Samarco’s Fundão dam collapse, while defining measures

to fully repair all socio-environmental damages and all collective and diffuse socio-economic damages arising from the rupture. The Definitive

Settlement is also expected to bring voluntary-based alternatives for individual indemnification.

Vale’s incremental provision and

cash outflow expectation

Vale reaffirms its commitments to supporting

Samarco on repairing the damage caused by the Fundão dam collapse and to the shareholders' previously agreed obligation to finance,

up to a 50% share, the amounts that Samarco may eventually fail to fund as the primary obligor. Considering the financial value under

consideration, and based on preliminary cash outflow expectations, Vale estimates that R$ 5.3 billion (US$ 956 million[6])

will be added to liabilities associated with Mariana’s reparation in the 3Q24 results. The estimated timeline for disbursement will

be updated in due course.

[1] On a 100% basis.

[2] Approximately US$ 7.9 billion, considering exchange

rates and disbursements up to September 30, 2024.

[3] Approximately US$ 18.0 billion, considering an average

exchange rate of 5.5415 in September 2024.

[4] Adjusted by the Brazilian inflation index IPCA.

[5] Approximately US$ 5.8 billion, considering an average

exchange rate of 5.5415 in September 2024.

[6] Considering an average exchange rate of 5.5415 in

September 2024.

Definitive Settlement

The negotiations between the Parties are

ongoing and, therefore, no final agreement has been signed. The Definitive Settlement is subject to conclusion of the terms and conditions

of a final settlement agreement and the definitive settlement documentation, with approvals and signing by the Parties, including Vale’s

Board of Directors.

Murilo Muller

Executive Vice President, Finance and Investor

Relations

For further information, please contact:

Vale.RI@vale.com

Thiago Lofiego: thiago.lofiego@vale.com

Mariana Rocha: mariana.rocha@vale.com

Luciana Oliveti: luciana.oliveti@vale.com

Patricia Tinoco: patricia.tinoco@vale.com

Pedro Terra: pedro.terra@vale.com

This press release may include statements that

present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve

various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include

factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital

markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global

competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those

forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão

de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk

Factors” in Vale’s annual report on Form 20-F.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Vale S.A.

(Registrant) |

| |

|

| |

By: |

/s/ Thiago Lofiego |

| Date: October 18, 2024 |

|

Director of Investor Relations |

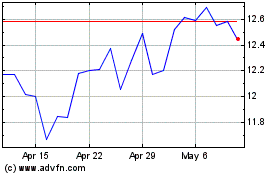

Vale (NYSE:VALE)

Historical Stock Chart

From Oct 2024 to Nov 2024

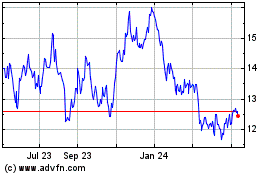

Vale (NYSE:VALE)

Historical Stock Chart

From Nov 2023 to Nov 2024