Westwood Holdings Group Partners With ETF Leader Ben Fulton to Expand and Scale ETF Platform

28 October 2024 - 11:30PM

Westwood Holdings Group, Inc. (NYSE: WHG) (“Westwood”), a

diversified asset management firm headquartered in Dallas, TX,

today announced that Westwood has invested in a new venture with

exchange-traded-fund (“ETF”) industry leader Ben Fulton to expand

Westwood’s existing ETF platform to include new, highly innovative

strategies developed under a new stand-alone entity called

WEBs Investments Inc. (“WEBs”), which stands for

“Westwood Engineered Beta.” WEBs is an investment adviser

registered with the U.S. Securities and Exchange Commission.

Westwood will invest in WEBs and provide distribution resources and

administrative support to WEBs, leveraging its more than 40 years

in the investment management industry. Westwood will have the

option to acquire WEBs in the future if the entity achieves certain

growth milestones.

“In the second quarter of this year, we took the first steps

towards achieving our vision of building out our ETF platform with

the rollout of two Energy ETFs, both of which were well received by

the market and our clients,” said Brian O. Casey, Westwood Chief

Executive Officer. “Our partnership with Ben and his team will

greatly accelerate our path to meet the needs of investors who have

expressed growing interest in ETF products. We believe that

combining Ben’s ETF product development track record and vision

with Chris Doran’s sales experience and relationships in the ETF

space, along with the resources of our Westwood distribution team,

will be a powerful combination to drive the growth of our

partnership. Our goal will be to deliver new and innovative

products in the ‘white spaces’ where we can secure first-mover

advantage with less competition—always looking toward the next

phase of growth to deliver value to our clients, our shareholders

and our firm.”

“This partnership with Westwood is tremendously exciting as I

know firsthand the exceptional growth that is possible for us to

achieve together, after seeing Invesco’s PowerShares ETF platform

grow exponentially during my tenure as Head of Global ETFs,” said

Ben Fulton, Chief Executive Officer and Chief Product Officer of

WEBs. “I could not have chosen a better partner, as we see

eye-to-eye on the right investment and market approach needed to

bring new products to market. I am also looking forward to working

again with my long-time colleague, Chris Doran, this time in his

new role at Westwood overseeing ETF Distribution and National

Accounts.”

With nearly 30 years of experience in the ETF industry, Ben

Fulton is recognized as a noted pioneer and product visionary in

ETF investments. He served as the driving force behind Invesco

PowerShares’ assets under management (“AUM”) growth from $200

million to over $80 billion from 2005 to 2013, making it the

world’s fourth largest ETF issuer. He has also received nine

“ETF-of-the-Year” awards throughout his career and is credited with

bringing dozens of “first-of-their-kind” funds to market. Mr.

Fulton and his team have launched over 200 ETFs and more than 1,000

other investment products, accounting for over $150 billion in AUM.

In addition to his tenure at Invesco, Mr. Fulton was Managing

Director of Tactical ETFs at ProShares, where he expanded the

Tactical ETF suite by over $15 billion in AUM. The WEBs team also

includes three former colleagues of Mr. Fulton’s, two from

ProShares and one from another Wall Street firm. The WEBs team

brings together over 75 years of combined ETF product development,

sales and marketing experience.

In addition, Mr. Fulton and Mr. Doran worked together at Invesco

from 2006 to 2013 while Mr. Doran held multiple sales leadership

positions. Mr. Doran joined Westwood in July of this year as Head

of ETF Distribution and National Accounts, further reinforcing

Westwood’s commitment to expanding and innovating its ETF platform

and suite of products.

ABOUT WESTWOOD HOLDINGS GROUP,

INC. Westwood Holdings Group, Inc. is a focused

investment management boutique and wealth management firm. Founded

in 1983, Westwood offers a broad array of investment solutions to

institutional investors, private wealth clients and financial

intermediaries. The firm specializes in several distinct investment

capabilities: U.S. Value Equity, Multi-Asset, Energy & Real

Assets, Income Alternatives, Tactical Absolute Return and Managed

Investment Solutions, which are available through separate

accounts, the Westwood Funds® family of mutual funds,

exchange-traded funds ("ETFs") and other pooled vehicles. Westwood

benefits from significant, broad-based employee ownership and

trades on the New York Stock Exchange under the symbol "WHG." Based

in Dallas, Westwood also maintains offices in Chicago, Houston and

San Francisco. For more information on Westwood, please visit

westwoodgroup.com.

ABOUT WEBs INVESTMENTS INC.WEBs Investments

Inc., which stands for “Westwood Engineered Beta” (“WEBs”), is an

investment adviser registered with the U.S. Securities and Exchange

Commission led by ETF-industry veteran Ben Fulton, which has

entered into a new venture with Westwood Holdings Group, Inc.

Media InquiriesCatherine Polisi JonesPolisi

Jones Communicationscjones@polisijones.com

Forward-looking StatementsStatements in this

press release that are not purely historical facts, including,

without limitation, statements about our expected future product

offerings, growth, investor interest in ETF products, success of

the new venture, financial position, results of operations or cash

flows, as well as other statements including without limitation,

words such as “anticipate,” “believe,” “expect,” “could,” “goal,”

“possible,” and other similar expressions, constitute

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Actual results and the

timing of some events could differ materially from those projected

in or contemplated by the forward-looking statements due to a

number of factors, including, without limitation: risks associated

with actions of activist stockholders; regulations adversely

affecting the financial services industry; our ability to maintain

effective cyber security; litigation risks; our ability to develop

and market new investment strategies successfully; our reputation

and our relationships with current and potential customers; our

ability to attract and retain qualified personnel; our ability to

perform operational tasks; our ability to select and oversee

third-party vendors; our dependence on the operations and funds of

our subsidiaries; our ability to maintain effective information

systems; our ability to prevent misuse of assets and information in

the possession of our employees and third-party vendors, which

could damage our reputation and result in costly litigation and

liability for our clients and us; our stock is thinly traded and

may be subject to volatility; competition in the investment

management industry; our relationships with investment consulting

firms; our ability to identify and execute on our strategic

initiatives; our ability to declare and pay dividends; our ability

to fund future capital requirements on favorable terms; our ability

to properly address conflicts of interest; our ability to maintain

adequate insurance coverage; our ability to maintain an effective

system of internal controls; and the other risks detailed from time

to time in Westwood’s SEC filings, including, but not limited to,

its annual report on Form 10-K for the year ended December 31, 2023

and its quarterly report on Form 10-Q for the quarters ended March

31, 2024 and June 30, 2024. You are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

of the date of this press release. Except as required by law,

Westwood is not obligated to publicly release any revisions to

these forward-looking statements to reflect events or circumstances

after the date of this press release or to reflect the occurrence

of unanticipated events.

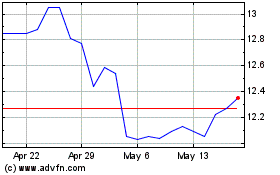

Westwood (NYSE:WHG)

Historical Stock Chart

From Nov 2024 to Dec 2024

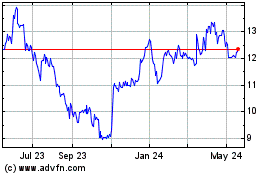

Westwood (NYSE:WHG)

Historical Stock Chart

From Dec 2023 to Dec 2024