0001165002FALSE00011650022024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2024

______________________________________________________________________________________________________

WESTWOOD HOLDINGS GROUP, INC.

(Exact name of registrant as specified in charter)

______________________________________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-31234 | | 75-2969997 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer Identification No.) |

| of incorporation) | | | | |

200 Crescent Court, Suite 1200

Dallas, Texas 75201

(Address of principal executive offices)

(214) 756-6900

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share | WHG | New York Stock Exchange |

Indicate by checkmark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02: RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On October 30, 2024, Westwood Holdings Group, Inc. (“Westwood”) announced its financial results for the quarter ended September 30, 2024, a copy of which is furnished with this Current Report on Form 8-K as Exhibit 99.1.

The information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

ITEM 7.01: REGULATION FD DISCLOSURE

Westwood announced today that its Board of Directors has approved the payment of a quarterly cash dividend of $0.15 per common share, payable on January 3, 2025 to stockholders of record on December 2, 2024.

ITEM 9.01: FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits: The following exhibit is furnished with this report:

Exhibit Number Description

104 Cover Page Interactive Date File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 30, 2024

| | | | | |

| WESTWOOD HOLDINGS GROUP, INC. |

| |

| |

| By: | /s/ Murray Forbes III |

| Murray Forbes III |

| Chief Financial Officer and Treasurer |

Westwood Holdings Group, Inc. Reports Third Quarter 2024 Results

Firmwide Assets Under Management of $17.7 Billion (Highest Level in 6 years)

Continued Innovation with WEBs Partnership to Expand ETF Platform

Dallas, TX, October 30, 2024 – Westwood Holdings Group, Inc. (NYSE: WHG) today reported third quarter 2024 earnings. Significant items included:

▪Investment strategies beating their primary benchmarks included Platinum, High Alpha, Dividend Select, Income Opportunity, Multi-Asset Income, Alternative Income, Credit Opportunities, Real Estate Income, Tactical Growth SMA, MLP SMA, MLP High Conviction and MLP & Energy Infrastructure.

▪Dividend Select and Income Opportunity posted top third rankings, and Multi-Asset Income, Credit Opportunities and MLP SMA all posted top quartile rankings in their peer universes.

▪Quarterly revenues totaled $23.7 million up from the second quarter's $22.7 million and $21.9 million a year ago. Comprehensive income of $0.1 million compared with the second quarter's loss of $2.2 million and income of $3.4 million in 2023's third quarter.

▪Formed a partnership with Exchange-Traded Fund ("ETF") pioneer Ben Fulton to develop and market new ETF strategies.

▪Our comprehensive income included an after-tax charge of $1.4 million due to an increase in the fair value of contingent consideration from our 2022 Salient acquisition due to an increased earnout valuation based on revised revenue expectations.

▪Non-GAAP Economic Earnings of $1.1 million compared with the second quarter's Economic Loss of $0.5 million and Economic Earnings of $6.5 million in the third quarter of 2023.

▪Westwood held $48.3 million in cash and short-term investments as of September 30, 2024, up $4.2 million from the second quarter. Stockholders' equity totaled $118.4 million and we have no debt.

▪We declared a cash dividend of $0.15 per common share, payable on January 3, 2025 to stockholders of record on December 2, 2024.

Brian Casey, Westwood’s CEO, commented, "We continue to make good progress in our core businesses, delivering higher revenues and earnings as institutional sales grossed over $1.0 billion year to date, assets under management ("AUM") reached $17.7 billion, their highest level in over six years backed by a robust $2 billion pipeline, and most of our strategies performed very well against benchmarks and peers. Continuing our investment in product innovation, we have completed Phase 1 of the Managed Investment Solutions ("MIS") technology build-out and we are in detailed discussions with a prospect for an MIS-managed investment strategy. We recently entered into a partnership with Ben Fulton, a recognized pioneer of the ETF industry who, along with his team, has launched over 200 ETFs and more than 1,000 other investment products accounting for over $150 billion in AUM. Ben advised us earlier this year as we launched our first ETFs, one of which, MDST, has already passed critical AUM and volume thresholds for inclusion on certain intermediary platforms. Ben brought his innovative product ideas to us which led to

the creation of Westwood Engineered Beta ("WEBs"). Chris Doran, who joined us in July to lead our ETF distribution efforts, partnered with Ben for over ten years and we believe the combination of their extensive experience in ETF product development and sales can drive meaningful growth in this new venture. To recap, our current business is performing nicely and our new initiatives offer the promise of profitable growth. Confident in Westwood’s current positioning and future potential, we view our stock as undervalued and our accelerated share repurchase program underscores our belief in Westwood."

Revenues increased from the second quarter and last year's third quarter principally due to higher average AUM.

Firmwide assets under management and advisement totaled $17.7 billion, consisting of AUM of $16.8 billion and assets under advisement ("AUA") of $1.0 billion.

Third quarter comprehensive income of $0.1 million compared to the second quarter's loss of $2.2 million on higher revenues and changes in the fair value of contingent consideration, offset by higher income taxes. Diluted earnings (loss) per share ("EPS") of $0.01 compared to $(0.27) for the second quarter. Non-GAAP Economic Earnings of $1.1 million, or $0.13 per share, compared with an Economic Loss of $0.5 million, or $0.06 per share, in the second quarter.

Third quarter comprehensive income of $0.1 million compared to last year's third quarter of $3.4 million due to higher revenues and changes in the fair value of contingent consideration, offset by higher employee compensation and benefits expense and the receipt of life insurance proceeds in 2023. Diluted EPS of $0.01 compared with $0.41 per share for 2023's third quarter. Non-GAAP Economic Earnings were $1.1 million, or $0.13 per share, compared with Economic Earnings of $6.5 million, or $0.80 per share, in the third quarter of 2023.

Economic Earnings (Loss) and Economic EPS are non-GAAP performance measures and are explained and reconciled with the most comparable GAAP numbers in the attached tables.

Westwood will host a conference call to discuss third quarter 2024 results and other business matters at 4:30 p.m. Eastern time today. To join the conference call, please register here:

https://registrations.events/direct/NTM7419517.

After registering, you will be provided with a dial-in number containing a personalized PIN.

To view the webcast, please register here:

https://edge.media-server.com/mmc/p/vjn47uq6

Once registered, an email will be sent with important details for this conference call, as well as a unique Registrant ID.

ABOUT WESTWOOD HOLDINGS GROUP

Westwood Holdings Group, Inc. is a focused investment management boutique and wealth management firm.

Founded in 1983, Westwood offers a broad array of investment solutions to institutional investors, private wealth clients and financial intermediaries. The firm specializes in several distinct investment capabilities: U.S. Value Equity, Multi-Asset, Energy & Real Assets, Income Alternatives, Tactical Absolute Return and Managed Investment Solutions, which are available through separate accounts, the Westwood Funds® family of mutual funds, exchange-traded funds ("ETFs") and other pooled vehicles. Westwood benefits from significant, broad-based employee ownership and trades on the New York Stock Exchange under the symbol "WHG." Based in Dallas, Westwood also maintains offices in Chicago, Houston and San Francisco.

For more information on Westwood, please visit westwoodgroup.com.

Forward-looking Statements

Statements in this press release that are not purely historical facts, including, without limitation, statements about our expected future financial position, results of operations or cash flows, as well as other statements including without limitation, words such as “anticipate,” “believe,” “expect,” “could,” and other similar expressions, constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Actual results and the timing of some events could differ materially from those projected in or contemplated by the forward-looking statements due to a number of factors, including, without limitation: the composition and market value of our AUM and AUA; our ability to maintain our fee structure in light of competitive fee pressures; risks associated with actions of activist stockholders; distributions to our common stockholders have included and may in the future include a return of capital; inclusion of foreign company investments in our AUM; regulations adversely affecting the financial services industry; our ability to maintain effective cyber security; litigation risks; our ability to develop and market new investment strategies successfully; our reputation and our relationships with current and potential customers; our ability to attract and retain qualified personnel; our ability to perform operational tasks; our ability to select and oversee third-party vendors; our dependence on the operations and funds of our subsidiaries; our ability to maintain effective information systems; our ability to prevent misuse of assets and information in the possession of our employees and third-party vendors, which could damage our reputation and result in costly litigation and liability for our clients and us; our stock is thinly traded and may be subject to volatility; competition in the investment management industry; our ability to avoid termination of client agreements and the related investment redemptions; the significant concentration of our revenues in a small number of customers; we have made and may continue to make business combinations as a part of our business strategy, which may present certain risks and uncertainties; our relationships with investment consulting firms; our ability to identify and execute on our strategic initiatives; our ability to declare and pay dividends; our ability to fund future capital requirements on favorable terms; our ability to properly address conflicts of interest; our ability to maintain adequate insurance coverage; our ability to maintain an effective system of internal controls; and the other risks detailed from time to time in Westwood’s SEC filings, including, but not limited to, its annual report on Form 10-K for the year ended December 31, 2023 and its quarterly report on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Except as required by law, Westwood is not obligated to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

# # # #

SOURCE: Westwood Holdings Group, Inc.

(WHG-G)

CONTACT:

Westwood Holdings Group, Inc.

Terry Forbes

Chief Financial Officer and Treasurer

(214) 756-6900

WESTWOOD HOLDINGS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands, except per share and share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2024 | | June 30, 2024 | | September 30, 2023 |

| REVENUES: | | | | | |

| Advisory fees: | | | | | |

| Asset-based | $ | 17,774 | | | $ | 17,139 | | | $ | 16,902 | |

| | | | | |

| Trust fees | 5,447 | | | 5,227 | | | 5,063 | |

| | | | | |

| Other, net | 498 | | | 322 | | | (85) | |

| Total revenues | 23,719 | | | 22,688 | | | 21,880 | |

| EXPENSES: | | | | | |

| Employee compensation and benefits | 13,572 | | | 13,638 | | | 12,661 | |

| Sales and marketing | 644 | | | 755 | | | 676 | |

| Westwood mutual funds | 798 | | | 855 | | | 872 | |

| Information technology | 2,572 | | | 2,350 | | | 2,334 | |

| Professional services | 1,812 | | | 1,450 | | | 1,009 | |

| General and administrative | 2,991 | | | 3,011 | | | 3,298 | |

| | | | | |

| (Gain) loss from change in fair value of contingent consideration | 1,824 | | | 4,807 | | | 2,483 | |

| | | | | |

| Total expenses | 24,213 | | | 26,866 | | | 23,333 | |

| Net operating income (loss) | (494) | | | (4,178) | | | (1,453) | |

| | | | | |

| | | | | |

| Net investment income | 587 | | | 548 | | | 247 | |

| Other income | 374 | | | 224 | | | 5,265 | |

| | | | | |

| Income (loss) before income taxes | 467 | | | (3,406) | | | 4,059 | |

| Income tax provision | 308 | | | (1,193) | | | (316) | |

| Net income (loss) | $ | 159 | | | $ | (2,213) | | | $ | 4,375 | |

| | | | | |

| | | | | |

| | | | | |

| Total comprehensive income (loss) | $ | 159 | | | $ | (2,213) | | | $ | 4,375 | |

| Less: Comprehensive income (loss) attributable to noncontrolling interest | 54 | | | 30 | | | 1,019 | |

| Comprehensive income (loss) attributable to Westwood Holdings Group, Inc. | $ | 105 | | | $ | (2,243) | | | $ | 3,356 | |

| Earnings (loss) per Westwood Holdings Group, Inc. share: | | | | | |

| Basic | $ | 0.01 | | | $ | (0.27) | | | $ | 0.42 | |

| Diluted | $ | 0.01 | | | $ | (0.27) | | | $ | 0.41 | |

| Weighted average shares outstanding: | | | | | |

| Basic | 8,123,714 | | 8,218,596 | | 8,002,537 |

| Diluted | 8,488,372 | | 8,218,596 | | 8,116,747 |

| Economic Earnings (Loss) | $ | 1,084 | | | $ | (508) | | | $ | 6,480 | |

| Economic EPS | $ | 0.13 | | | $ | (0.06) | | | $ | 0.80 | |

| Dividends declared per share | $ | 0.15 | | | $ | 0.15 | | | $ | 0.15 | |

WESTWOOD HOLDINGS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands, except per share and share amounts)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended |

| September 30, 2024 | | September 30, 2023 |

| REVENUES: | | | |

| Advisory fees: | | | |

| Asset-based | $ | 51,730 | | | $ | 50,734 | |

| Performance-based | — | | | 555 | |

| Trust fees | 15,787 | | | 15,118 | |

| | | |

| Other, net | 1,622 | | | 145 | |

| Total revenues | 69,139 | | | 66,552 | |

| EXPENSES: | | | |

| Employee compensation and benefits | 41,921 | | | 40,551 | |

| Sales and marketing | 2,027 | | | 2,180 | |

| Westwood mutual funds | 2,374 | | | 2,350 | |

| Information technology | 7,212 | | | 7,283 | |

| Professional services | 4,751 | | | 3,893 | |

| General and administrative | 8,903 | | | 9,579 | |

| | | |

| (Gain) loss from change in fair value of contingent consideration | 3,682 | | | (2,655) | |

| Acquisition expenses | — | | | 209 | |

| Total expenses | 70,870 | | | 63,390 | |

| Net operating income (loss) | (1,731) | | | 3,162 | |

| | | |

| Net change in unrealized appreciation (depreciation) on private investments | — | | | 24 | |

| Net investment income | 1,590 | | | 630 | |

| Other income | 783 | | | 5,876 | |

| | | |

| Income before income taxes | 642 | | | 9,692 | |

| Income tax provision | 530 | | | 1,704 | |

| Net income | $ | 112 | | | $ | 7,988 | |

| | | |

| | | |

| | | |

| Total comprehensive income | $ | 112 | | | $ | 7,988 | |

| Less: Comprehensive income (loss) attributable to noncontrolling interest | (46) | | | 1,044 | |

| Comprehensive income attributable to Westwood Holdings Group, Inc. | $ | 158 | | | $ | 6,944 | |

| Earnings per share: | | | |

| Basic | $ | 0.02 | | | $ | 0.87 | |

| Diluted | $ | 0.02 | | | $ | 0.86 | |

| Weighted average shares outstanding: | | | |

| Basic | 8,140,664 | | 7,949,773 |

| Diluted | 8,448,629 | | 8,072,739 |

| Economic Earnings | $ | 3,588 | | | $ | 12,178 | |

| Economic EPS | $ | 0.42 | | | $ | 1.51 | |

| Dividends declared per share | $ | 0.45 | | | $ | 0.45 | |

WESTWOOD HOLDINGS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value and share amounts)

(unaudited) | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 | |

| ASSETS | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | $ | 22,790 | | | $ | 20,422 | | |

| Accounts receivable | 14,596 | | | 14,394 | | |

| Investments, at fair value | 25,522 | | | 32,674 | | |

| Prepaid income taxes | 639 | | | 205 | | |

| Other current assets | 5,075 | | | 4,543 | | |

| Total current assets | 68,622 | | | 72,238 | | |

| Investments | 8,944 | | | 7,247 | | |

| Equity method investments | 4,211 | | | 4,284 | | |

| Noncurrent investments at fair value | 1,919 | | | 241 | | |

| Goodwill | 39,501 | | | 39,501 | | |

| Deferred income taxes | 1,590 | | | 726 | | |

| Operating lease right-of-use assets | 2,842 | | | 3,673 | | |

| Intangible assets, net | 21,718 | | | 24,803 | | |

| Property and equipment, net of accumulated depreciation of $8,326 and $10,078 | 1,014 | | | 1,444 | | |

| Other long-term assets | 1,140 | | | 1,010 | | |

| Total long-term assets | 82,879 | | | 82,929 | | |

| Total assets | $ | 151,501 | | | $ | 155,167 | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current Liabilities: | | | | |

| Accounts payable and accrued liabilities | $ | 4,934 | | | $ | 6,130 | | |

| Dividends payable | 1,431 | | | 1,692 | | |

| Compensation and benefits payable | 8,283 | | | 9,539 | | |

| Operating lease liabilities | 1,523 | | | 1,286 | | |

| | | | |

| | | | |

| Total current liabilities | 16,171 | | | 18,647 | | |

| Accrued dividends | 905 | | | 675 | | |

| Contingent consideration | 12,000 | | | 10,133 | | |

| Noncurrent operating lease liabilities | 2,041 | | | 3,266 | | |

| Total long-term liabilities | 14,946 | | | 14,074 | | |

| Total liabilities | 31,117 | | | 32,721 | | |

| | | | |

| Stockholders’ Equity: | | | | |

Common stock, $0.01 par value, authorized 25,000,000 shares, issued 12,174,073 and 11,856,737, respectively and outstanding 9,271,568 and 9,140,760, respectively | 123 | | | 119 | | |

| Additional paid-in capital | 202,247 | | | 201,622 | | |

Treasury stock, at cost – 2,902,505 and 2,715,977, respectively | (88,278) | | | (85,990) | | |

| | | | |

| Retained earnings | 4,293 | | | 4,650 | | |

| Total Westwood Holdings Group, Inc. stockholders’ equity | 118,385 | | | 120,401 | | |

| Noncontrolling interest in consolidated subsidiary | 1,999 | | | 2,045 | | |

| Total liabilities and stockholders’ equity | $ | 151,501 | | | $ | 155,167 | | |

WESTWOOD HOLDINGS GROUP, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 112 | | | $ | 7,988 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Depreciation | 464 | | | 511 | |

| Amortization of intangible assets | 3,085 | | | 3,106 | |

| Net change in unrealized (appreciation) depreciation on investments | (917) | | | (499) | |

| | | |

| Stock-based compensation expense | 4,321 | | | 5,111 | |

| Deferred income taxes | (864) | | | 652 | |

| Non-cash lease expense | 831 | | | 844 | |

| Loss on asset disposition | — | | | 69 | |

| Gain on remeasurement of lease liabilities | — | | | (119) | |

| | | |

| Fair value change of contingent consideration | 3,682 | | | (2,655) | |

| Gain on insurance settlement | — | | | (5,000) | |

| Changes in operating assets and liabilities: | | | |

| Net (purchases) sales of trading securities | 6,267 | | | (15,626) | |

| Accounts receivable | (202) | | | 1,355 | |

| Other current assets | (644) | | | 1,101 | |

| Accounts payable and accrued liabilities | (1,192) | | | (55) | |

| Compensation and benefits payable | (1,254) | | | (1,428) | |

| Income taxes payable | (434) | | | 25 | |

| Other liabilities | (1,041) | | | (1,064) | |

| Net cash provided by (used in) operating activities | 12,214 | | | (5,684) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Acquisition, net of cash acquired | — | | | (741) | |

| | | |

| | | |

| Purchases of property and equipment | (34) | | | (119) | |

| Purchases of investments | (1,500) | | | — | |

| | | |

| | | |

| Insurance settlement proceeds | — | | | 5,000 | |

| Net cash provided by (used in) investing activities | (1,534) | | | 4,140 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Purchases of treasury stock | (1,348) | | | — | |

| | | |

| Restricted stock returned for payment of taxes | (940) | | | (863) | |

| | | |

| Payment of contingent consideration in acquisition | (1,815) | | | — | |

| Cash dividends | (4,209) | | | (4,274) | |

| Net cash used in financing activities | (8,312) | | | (5,137) | |

| | | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | 2,368 | | | (6,681) | |

| Cash and cash equivalents, beginning of period | 20,422 | | | 23,859 | |

| Cash and cash equivalents, end of period | $ | 22,790 | | | $ | 17,178 | |

| SUPPLEMENTAL CASH FLOW INFORMATION: | | | |

| Cash paid during the period for income taxes | $ | 1,817 | | | $ | 1,024 | |

| Accrued dividends | $ | 2,336 | | | $ | 2,220 | |

| | | |

| | | |

| | | |

WESTWOOD HOLDINGS GROUP, INC. AND SUBSIDIARIES

Reconciliation of Comprehensive Income (Loss) Attributable to Westwood Holdings Group, Inc. to Economic Earnings (Loss)

(in thousands, except per share and share amounts)

(unaudited)

As supplemental information, we are providing non-GAAP performance measures that we refer to as Economic Earnings (Loss) and Economic EPS. We provide these measures in addition to, not as a substitute for, Comprehensive income (loss) attributable to Westwood Holdings Group, Inc. and earnings (loss) per share, which are reported on a GAAP basis. Our management and Board of Directors review Economic Earnings (Loss) and Economic EPS to evaluate our ongoing performance, allocate resources, and review our dividend policy. We believe that these non-GAAP performance measures, while not substitutes for GAAP Comprehensive income (loss) attributable to Westwood Holdings Group, Inc. or earnings (loss) per share, are useful for management and investors when evaluating our underlying operating and financial performance and our available resources. We do not advocate that investors consider these non-GAAP measures without also considering financial information prepared in accordance with GAAP.

We define Economic Earnings (Loss) as Comprehensive income (loss) attributable to Westwood Holdings Group, Inc. plus non-cash equity-based compensation expense, amortization of intangible assets and deferred taxes related to goodwill. Although depreciation on fixed assets is a non-cash expense, we do not add it back when calculating Economic Earnings (Loss) because depreciation charges represent an allocation of the decline in the value of the related assets that will ultimately require replacement. Although gains and losses from changes in the fair value of contingent consideration are non-cash, we do not add or subtract those back when calculating Economic Earnings (Loss) because gains and losses on changes in the fair value of contingent consideration are considered regular following an acquisition. In addition, we do not adjust Economic Earnings (Loss) for tax deductions related to restricted stock expense or amortization of intangible assets. Economic EPS represents Economic Earnings (Loss) divided by diluted weighted average shares outstanding.

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2024 | | June 30, 2024 | | September 30, 2023 |

| Comprehensive income (loss) attributable to Westwood Holdings Group, Inc. | $ | 105 | | | $ | (2,243) | | | $ | 3,356 | |

| Stock-based compensation expense | 1,409 | | | 1,397 | | | 1,739 | |

| | | | | |

| Intangible amortization | 1,011 | | | 1,032 | | | 1,043 | |

| | | | | |

| Tax benefit from goodwill amortization | 156 | | | 156 | | | 125 | |

| Tax impact of adjustments to GAAP comprehensive income (loss) | (1,597) | | | (850) | | | 217 | |

| Economic Earnings (Loss) | $ | 1,084 | | | $ | (508) | | | $ | 6,480 | |

| Earnings (loss) per share | $ | 0.01 | | | $ | (0.27) | | | $ | 0.41 | |

| Stock-based compensation expense | 0.17 | | | 0.17 | | | 0.21 | |

| | | | | |

| Intangible amortization | 0.12 | | | 0.12 | | | 0.13 | |

| | | | | |

| Tax benefit from goodwill amortization | 0.02 | | | 0.02 | | | 0.02 | |

| Tax impact of adjustments to GAAP comprehensive income (loss) | (0.19) | | | (0.10) | | | 0.03 | |

| Economic EPS | $ | 0.13 | | | $ | (0.06) | | | $ | 0.80 | |

| Diluted weighted average shares | 8,488,372 | | 8,218,596 | | 8,116,747 |

| | | | | |

| | | Nine Months Ended |

| | | September 30, 2024 | | September 30, 2023 |

| Comprehensive income attributable to Westwood Holdings Group, Inc. | | | $ | 158 | | | $ | 6,944 | |

| Stock-based compensation expense | | | 4,321 | | | 5,111 | |

| | | | | |

| Intangible amortization | | | 3,085 | | | 3,106 | |

| | | | | |

| Tax benefit from goodwill amortization | | | 437 | | | 375 | |

| Tax impact of adjustments to GAAP comprehensive income | | | (4,413) | | | (3,358) | |

| Economic Earnings | | | $ | 3,588 | | | $ | 12,178 | |

| Earnings per share | | | $ | 0.02 | | | $ | 0.86 | |

| Stock-based compensation expense | | | 0.50 | | 0.63 |

| | | | | |

| Intangible amortization | | | 0.37 | | 0.38 |

| | | | | |

| Tax benefit from goodwill amortization | | | 0.05 | | 0.05 |

| Tax impact of adjustments to GAAP comprehensive income | | | (0.52) | | | (0.41) | |

| Economic EPS | | | $ | 0.42 | | | $ | 1.51 | |

| Diluted weighted average shares | | | 8,448,629 | | 8,072,739 |

Cover

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

WESTWOOD HOLDINGS GROUP, INC.

|

| Entity Tax Identification Number |

75-2969997

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-31234

|

| Entity Address, Address Line One |

200 Crescent Court, Suite 1200

|

| Entity Address, City or Town |

Dallas

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75201

|

| City Area Code |

(214)

|

| Local Phone Number |

756-6900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Pre-commencement Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

WHG

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0001165002

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

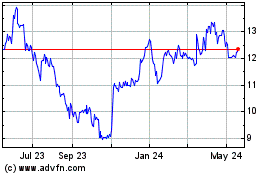

Westwood (NYSE:WHG)

Historical Stock Chart

From Nov 2024 to Dec 2024

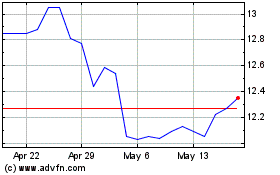

Westwood (NYSE:WHG)

Historical Stock Chart

From Dec 2023 to Dec 2024