WEBs Investments Inc. (WEBs), an innovator in volatility-managed

investment solutions, and Westwood Holdings Group, Inc. (NYSE: WHG)

(“Westwood”), a boutique asset management firm, today announced the

launch of the WEBs Defined VolatilitySM ETF series. The

WEBs Defined VolatilitySM

SPY ETF (Nasdaq: DVSP) and the

WEBs Defined VolatilitySM

QQQ ETF (Nasdaq: DVQQ) are

designed to provide a more stable investment experience across

market conditions, using a dynamic, rules-based strategy to adjust

exposure to equity markets based on real-time volatility.

Tracking the Syntax Defined VolatilitySM U.S. Large Cap 500

Index and the Syntax Defined VolatilitySM Triple Qs Index, the

Defined VolatilitySM series seeks to dynamically adjust exposure to

match a target risk level. During low-volatility periods, the ETFs

use total return swaps to amplify exposure, attempting to enhance

potential returns, while in high-volatility periods they shift

toward cash and U.S. Treasuries to potentially help cushion against

losses. This adaptive approach seeks to smooth the investment

journey, and may provide investors with a more stable,

risk-adjusted return potential.

“Defined VolatilitySM is a unique approach to help investors

better navigate the inevitable swings in the market—one that hasn’t

been utilized within the ETF ecosystem before,” said Ben Fulton,

Chief Executive Officer of WEBs Investments Inc. “Think of Defined

VolatilitySM ETFs as a thermostat for your portfolio–by

automatically adjusting exposure based on real-time market

conditions, we offer investors a sophisticated yet simple tool to

navigate unpredictable markets, enhancing stability and creating

new opportunities for growth.”

Brian Casey, Chief Executive Officer of Westwood, added,

“Expanding our ETF platform has been a key strategic priority for

Westwood. Partnering with Ben Fulton and the WEBs team accelerates

this vision by combining our extensive investment expertise and

distribution capabilities with WEBs’ innovative approach to ETF

design. Together, we are creating a powerful suite of products that

addresses investor demand for more sophisticated,

volatility-managed solutions.”

The Defined VolatilitySM ETFs offer uncapped upside potential to

the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust

(QQQ), enabling significant participation in market gains, while

providing portfolio stability by reducing exposure during turbulent

periods. Additionally, unlike many option-based strategies, these

ETFs seek to generate dividend income, adding another layer of

potential value for investors. We believe the swap-based strategy

employed by the ETFs also enhances tax efficiency, avoiding

substantial tax consequences typically associated with

volatility-managed funds.

Defined VolatilitySM is a strategy developed in 2023 by ETF

industry veterans Ben Fulton, Keith Cunningham, Tony Trevisan and

Kevin Rich, who collectively have over a century of Wall Street

experience in ETF innovation, financial analytics and product

structuring. This innovative approach represents the initial

product suite for WEBs Investments Inc., which was founded in

2024.

Fulton has been a pioneer and leader in the ETF industry since

it first began. Fulton previously grew Invesco's PowerShares ETF

platform from $200 million to $80 billion during his tenure at the

firm from 2005 to 2013. Mr. Fulton and his team have launched over

200 ETFs and more than 1,000 other investment products, accounting

for over $150 billion in AUM.

WEBs has partnered with Westwood to bring these new ETF products

to market and expand Westwood’s existing ETF platform. This

partnership combines WEBs' innovative approach to volatility

management with Westwood's established sales, distribution,

operational resources and administrative support cultivated over 40

years in the investment management industry, to offer a unique

investment solution that is specifically tailored to today's market

environment. Westwood’s Head of ETF Distribution & National

Accounts, Chris Doran, will also directly support the advancement

and distribution of the WEBs Defined VolatilitySM ETFs and will

leverage his long-term client relationships for the benefit of the

platform.

For more information about the WEBs Defined VolatilitySM ETFs

and how they could enhance your investment strategy, please visit

websinv.com.

ABOUT WEBs INVESTMENTS INC.

WEBs Investments Inc., which stands for “Westwood Engineered

Beta” (“WEBs”), is an investment adviser registered with the U.S.

Securities and Exchange Commission led by ETF-industry veteran Ben

Fulton. WEBs specializes in developing innovative,

volatility-managed investment solutions.

For more information, please visit:

websinv.com

ABOUT WESTWOOD HOLDINGS GROUP, INC.

Westwood Holdings Group (NYSE: WHG) is a boutique asset

management firm based in Texas that offers a diverse array of

actively-managed and outcome-oriented investment strategies along

with white-glove trust and wealth services to institutional,

intermediary and private wealth clients. For more than 40 years,

Westwood’s client-first approach has facilitated strong, long-term

client relationships and an unwavering commitment to delivering

bespoke investment strategies with a vehicle-agnostic approach,

exceptional counsel and an unparalleled level of attentive client

service. Westwood’s flexible and agile approach to investing allows

the firm to respond and adapt to constantly changing markets, while

continually seeking innovative investment strategies that meet

investors’ short and long-term needs. Westwood’s team comes from

varied backgrounds, reflecting the company’s origins as a

woman-founded firm that is committed to incorporating diverse

insight and knowledge into all aspects of the services and

solutions that they offer clients. Westwood’s core

values—integrity, reliability, responsiveness, adaptability,

flexibility and collaboration—underpin the company’s pursuit of

excellence each and every day.

For more information, please visit:

westwoodgroup.com

Investors should consider the investment objectives,

risks, charges and expenses carefully before investing. For a

prospectus or summary prospectus with this and other information

about the Fund, please call 844-455-9327 or visit our website at

websinv.com . Read the prospectus or summary prospectus carefully

before investing.

The funds are new with a limited operating history. Investing in

the fund involves a high degree of risk. Principal loss is

possible.

Fund Objective:

The DVSP Fund seeks to provide investment results that, before

fees and expenses, correspond to the performance of the Syntax

Defined VolatilitySM US Large Cap 500 Index. The Syntax Defined

VolatilitySM US Large Cap 500 Index tracks the net asset value

(NAV) of a portfolio that seeks exposure to the large-cap US equity

market while targeting annual volatility of 20%. The Index seeks to

accomplish these objectives by primarily allocating to shares of

the SPDR S&P 500 ETF Trust (Ticker: SPY) and alternately

allocating to either a cash position as a way of reducing

volatility, or a total return swap on SPY as a way of applying

leverage to the equity position and thereby increasing

volatility.

The DVQQ Fund seeks to provide investment results that, before

fees and expenses, correspond to the performance of the Syntax

Defined VolatilitySM Triple Qs Index. The Syntax Defined

VolatilitySM Triple Qs Index tracks the net asset value (NAV) of a

portfolio that seeks exposure to non-financial large-cap US

equities while targeting annual volatility of 22%. The Index seeks

to accomplish these objectives by primarily allocating to shares of

the Invesco QQQ ETF (Ticker: QQQ) and alternately allocating to

either a cash position as a way of reducing volatility, or a total

return swap on QQQ as a way of applying leverage to the equity

position and thereby increasing volatility.

Important Information

The Funds are passively managed ETFs listed for trading on the

Exchange. The Fund implements its investment objective by

investing, under normal market conditions, at least 80% of its net

assets (including borrowings for investment purposes) in financial

instruments that achieve the investment results of the Index. The

Fund will, from time to time as determined by the Index, hold cash,

cash-like instruments or high-quality fixed income securities to

the extent the Underlying ETF concentrates (i.e., holds 25% or more

of its total assets) in the securities of a particular industry or

group of industries, the Fund will concentrate its investments to

approximately the same extent as the Underlying ETF. Because the

Fund seeks exposure to the Underlying ETF, the Fund’s investment

performance largely depends on the investment performance and

associated risks of the Underlying ETF. A significant portion of

the Underlying ETF is represented by securities of companies in the

information technology sector. The Fund is classified as

“non-diversified” which means that the Fund may invest a higher

percentage of its assets in a fewer number of issuers than is

permissible for a “diversified” fund. If for any reason the Fund is

unable to rebalance all or a portion of its portfolio, or if all or

a portion of the portfolio is rebalanced incorrectly, the Fund’s

investment exposure may not be consistent with the Fund’s

investment objective. In these instances, the Fund may have

investment exposure to the Index that is significantly greater or

less than what is intended in its strategy. As a result, the Fund

may be more exposed to leverage risk than if it had been properly

rebalanced and may not achieve its investment objective.

There can be no assurance that the Fund will achieve its

investment objective and could incur substantial losses. The Fund’s

returns will likely differ in amount, and possibly even direction,

from the returns of the Underlying ETF. These differences can be

significant, the Fund could lose money regardless of the

performance of its Underlying ETF and as a result of portfolio

rebalancing, fees, the Underlying ETF’s volatility, compounding and

other factors, the Fund is unlikely to match the performance of the

Underlying ETF.

The Funds are distributed by Foreside Fund Services, LLC which

is not affiliated with WEBs Investments Inc., Westwood Holdings

Group, Inc., U.S. Bank, or any of their affiliates.

Investor Inquiries:Chris DoranHead of ETF

Distribution and National AccountsWestwood Holdings Group,

Inc.cdoran@westwoodgroup.comWEBs Media

Inquiries:For WEBs Investments Inc.Gregory

FCAwebs@gregoryfca.com484-798-7730

Westwood Media Inquiries:Catherine Polisi

JonesPolisi Jones Communicationscjones@polisijones.com

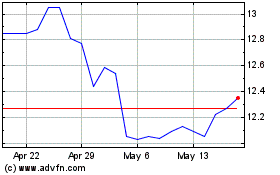

Westwood (NYSE:WHG)

Historical Stock Chart

From Nov 2024 to Dec 2024

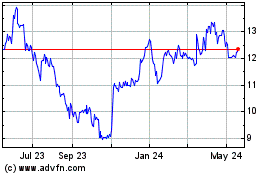

Westwood (NYSE:WHG)

Historical Stock Chart

From Dec 2023 to Dec 2024