Filed by Smurfit WestRock Limited (Commission File No.

333-278185)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed Pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: WestRock Company (Commission File No. 001-38736)

FAQ REGARDING SETTLEMENT AND DEALINGS IN SMURFIT

WESTROCK SHARES FOLLOWING THE COMBINATION

Frequently Asked Questions regarding

settlement of Smurfit WestRock Shares to be issued to Smurfit Kappa Shareholders and WestRock Shareholders pursuant to the

Smurfit Kappa Share Exchange (FAQs)

The following sets out some frequently asked

questions and provides brief responses regarding the settlement of ordinary shares (“Smurfit WestRock Shares”) in

Smurfit WestRock plc (“Smurfit WestRock”) to be issued to shareholders of Smurfit Kappa Group plc (“Smurfit

Kappa”) following completion of the combination (the “Combination”) of Smurfit Kappa and WestRock Company

(“WestRock”) and the listing of Smurfit WestRock Shares on the London Stock Exchange and the New York Stock Exchange

(“NYSE”). It also includes detail of actions that Smurfit Kappa shareholders (depending on how their interests in

ordinary shares in Smurfit Kappa (“Smurfit Kappa Shares”) are held) should take and by when to ensure the continued

efficient management of their shareholding.

Terms not defined in this document shall have

the meaning given to them in the circular published on 14 May 2024 in respect of the Combination (the “Circular”).

Further information in relation to the settlement of Smurfit WestRock Shares is available in Part V (Settlement and Dealings in Smurfit

WestRock Shares following the Combination) of the Circular. Frequently asked questions in relation to the Combination are available

on pages 9 to 17 of the Circular.

The Combination is currently expected to take

effect in early July 2024 (“Completion”). The expected timetable of principal events relating to (i) Completion, (ii)

the delisting of Smurfit Kappa Shares from the Official List of Euronext Dublin and cancellation of admission to trading on the Euronext

Dublin Market, and (iii) the delisting of Smurfit Kappa Shares from the Official List of the UK Financial Conduct Authority (the “FCA”)

and cancellation from admission to trading on the main market for listed securities of the London Stock Exchange (the “LSE”)

is set out in Section V of these FAQs and on page 7 of the Circular.

SECTION I: GENERAL

| 1. | What will occur on Completion? |

Following Completion:

| § | Country of incorporation: Smurfit WestRock will be an Irish incorporated public limited company; |

| § | Headquarters: Smurfit WestRock will be headquartered in Dublin, Ireland, at Smurfit Kappa’s

current headquarters. Smurfit WestRock’s North and South American operations will be headquartered at facilities in Atlanta, Georgia,

United States; |

| § | Board and Governance: In addition to the US federal securities laws and NYSE standards to which

Smurfit WestRock will become subject, the board of directors of Smurfit WestRock will adhere to the

standards of governance and corporate responsibility as required by the Irish Companies Act 2014, the US federal securities laws and NYSE listing rules. Smurfit

WestRock will not be subject to the UK Corporate Governance Code and does not intend to apply the UK Corporate Governance Code on a voluntary

basis; and |

| § | Tax domicile: Smurfit WestRock will be resident in Ireland for tax purposes, but holders should

refer to the section labelled “US Federal Income Tax Treatment of Smurfit WestRock” in Part VI (Summary of the Tax Consequences

of the Combination) of the Circular for a discussion of the potential application of Section 7874 of the U.S. Internal Revenue Code

of 1986, as amended (the “Code”) and the Treasury Regulations promulgated thereunder to the Combination. |

Following Completion, (i) Smurfit

WestRock Shares will be listed and admitted to trading on NYSE, (ii) Smurfit WestRock Shares will be listed and admitted to trading on

the LSE, and (iii) Smurfit Kappa’s listings on Euronext Dublin and on the LSE will be cancelled.

Subject to Completion, it is proposed

that:

| (i) | the legal title to all Smurfit WestRock Shares issued to the EB Nominee in exchange for Smurfit Kappa

Shares in respect of holders of Scheme Shares held indirectly through CREST depository interests (“Smurfit Kappa CDIs”)

in the CREST System (“CREST”) following the Scheme Effective Time will be transferred to Cede & Co., in its capacity

as nominee for the Depository Trust Company (“DTC”) (without any change to the underlying ultimate beneficial ownership

of the relevant Smurfit WestRock Shares) with the relevant CREST Participants credited with Smurfit WestRock Depositary Interests through

CREST. Please see Section II (Indirect Holders) of this document for further details; |

| (ii) | the legal title to all Smurfit WestRock Shares issued to the EB Nominee in exchange for Smurfit Kappa

Shares in respect of holders of Scheme Shares held indirectly through EB Participants in Euroclear Bank (in respect of entitlements to

Smurfit Kappa Shares not then represented in CDI form, but which are not represented by Smurfit Kappa CDIs) will be transferred to the

Relevant EB Participant interested in those Smurfit WestRock Shares (without any change to the underlying ultimate beneficial ownership

of the relevant Smurfit WestRock Shares), and such EB Participants will be recorded as the registered holders of the relevant Smurfit

WestRock Shares, to be held in “registered form” on the register of members maintained by Smurfit WestRock pursuant to the

Irish Companies Act (the “Smurfit WestRock Register of Members”). Please see Section II (Indirect Holders) of this

document for further details; and |

| (iii) | certificated Smurfit Kappa shareholders will be recorded as the registered holder of their Smurfit WestRock

Shares directly on the Smurfit WestRock Register of Members in “registered form” (a form complying with market practice for

NYSE eligible securities). Please see Section III (Certificated Holders) of this document for further details. |

Euroclear participants holding interests

in Smurfit Kappa Shares for underlying beneficial holders (but not through Smurfit Kappa CDIs) should review Part B (Existing Smurfit

Kappa Euroclear Bank Holders) of Section II of these FAQs for further information on the implications of Completion and the steps which

may be taken by them in advance of the Scheme Record Time.

| 2. | What are the implications of Completion on Smurfit Kappa’s existing listing on the LSE and Euronext

Dublin? |

Smurfit Kappa Shares will no longer

be listed on the LSE or Euronext Dublin. Instead, Smurfit WestRock Shares will be listed on the NYSE and on the LSE.

| 3. | What will happen to your existing inclusion in the FTSE 100 and other European indices? |

Following Completion and the delisting

of Smurfit Kappa from Euronext Dublin and the LSE, Smurfit Kappa Shares will no longer be included in the FTSE 100 index.

Smurfit WestRock, WestRock and Smurfit

Kappa will use their respective reasonable best efforts to seek inclusion of Smurfit WestRock in an S&P index following Completion.

The Combination is expected to result in Smurfit WestRock not being eligible for inclusion in the UK series of FTSE indices, including

the FTSE 100 Index.

| 4. | Can I continue to trade my Smurfit Kappa Shares prior to Completion? |

Yes. Smurfit Kappa Shares will continue

to trade as normal prior to Completion.

The last day of trading of Smurfit

Kappa’s shares on Euronext Dublin is currently expected to be Tuesday, 2 July 2024, with trading suspended from close of business

on that day to allow for the settlement of pending trades and repositioning instructions in advance of the Scheme Record Time.

Smurfit Kappa’s shares will

continue to trade on the LSE as normal throughout this period until the Completion.

| 5. | Following Completion, can my Smurfit WestRock Shares be moved between the UK and US if required? |

Yes, Smurfit WestRock Shares will

be listed on both the LSE and the NYSE, and so Smurfit WestRock shareholders can choose to settle trades in their Smurfit WestRock Shares

on the LSE or the NYSE as they see fit, and can hold their interests in the Smurfit WestRock Shares (i) in CREST via Smurfit WestRock

Depositary Interests (“Smurfit Westrock DIs”), held through the Depositary’s participant account in DTC, (ii)

through another bank, securities broker/dealer, firm, financial institution and/or other person that is a participant in DTC (a “DTC

Participant”), or (iii) in “registered” form. Smurfit WestRock shareholders who wish to move their holdings of Smurfit

WestRock Shares following Completion should contact their broker or Computershare Trust Company N.A. (the “Transfer Agent”)

on the phone numbers provided below.

| 6. | How will Completion affect the stock exchange ticker symbol of the Smurfit Kappa Shares? |

Following Completion, you will no

longer hold Smurfit Kappa Shares, but instead hold Smurfit WestRock Shares.

Smurfit Kappa Shares will no longer

be listed on the LSE or Euronext Dublin. Instead, Smurfit WestRock Shares will be listed on the NYSE under the symbol “SW”

and on the LSE under the symbol “SWR”.

| 7. | What will be the Identification Number (ISIN and CUSIP) for the Smurfit WestRock shares? |

The ISIN for the Smurfit WestRock

Shares (i.e., the 12-digit code that uniquely identifies the Smurfit WestRock Shares) will be IE00028FXN24.

The associated CUSIP (as may also

be used as a unique securities identifier) for the Smurfit WestRock Shares will be G8267P 108.

| 8. | Will the number of shares I hold change as a result of Completion? |

The number of shares held (directly

or indirectly) following Completion will remain unchanged, meaning that if you held 100 Smurfit Kappa Shares (directly or indirectly)

at close of business on the day prior to Completion, you will hold 100 Smurfit WestRock Shares (directly or indirectly) immediately after

Completion.

| 9. | Will the voting/proxy process change for future general meetings? |

Your voting rights will remain the

same following Completion, however the process for submitting a proxy will change slightly depending on how you hold your interest in

Smurfit WestRock Shares. Detailed instructions on voting will be included within your general meeting materials. Generally speaking, if

you become a DI holder, you will be able to vote online or via CREST. Please see Part A (What is a Smurfit WestRock DI?) of Section II

of this document for further details. If your shares are held with a DTC Participant, your broker should provide instructions as to how

to vote. If you are a registered holder, you will be able to vote online, by post, or by Interactive Voice Response.

| 10. | When will trading on Euronext Dublin end for Smurfit Kappa Shares? |

Trading on Euronext Dublin will be

possible until close of business on Tuesday, 2 July 2024. After this expected cut-off time, trades in Smurfit Kappa Shares are not expected

to be able to occur on Euronext Dublin. It is expected that transactions in Smurfit Kappa Shares from trades executed on Euronext Dublin

can settle in the Euroclear settlement system until the close of business on Thursday, 4 July 2024, after which, all internal transactions

that have not reached end of life are expected to be cancelled and brokers will need to manually settle/re-negotiate their trades to settle

outside of Euroclear Bank.

| 11. | I hold Smurfit Kappa Shares through an American depositary receipt (“ADR”) programme, what

will happen to my shares after Completion? |

Smurfit Kappa is aware of the existence

of four ADR programmes referencing Smurfit Kappa Shares currently in operation (the “ADR Programmes”) managed by The

Bank of New York Mellon, Citibank N.A., JPMorgan Chase Bank, N.A. and Deutsche Bank Trust Company Americas (collectively, the “ADR

Banks”). It is important to note that each of these ADR Programmes is unsponsored, meaning that Smurfit Kappa did not authorise

and has no control over them and does not have any contractual relationship with any of the ADR Banks in respect of the ADR Programmes.

As such, Smurfit Kappa has no responsibility for these ADR Programmes or the actions of the ADR Banks, and is unable to resolve the queries

or issues raised by ADR holders. The information provided in this FAQ is based solely on information provided to Smurfit WestRock by the

ADR Banks.

When Completion takes effect and

Smurfit WestRock Shares become available directly for listing and trading on NYSE, based on information provided by the ADR banks,

it is Smurfit Kappa’s current understanding that each of the ADR Banks will terminate their ADR Programmes. This is likely to

occur shortly following Completion, but the exact timing of termination is at the discretion of the ADR Banks. Smurfit Kappa

currently understands that each ADR Bank will then cancel the ADRs issued pursuant to their ADR Programme and either (i) facilitate

an exchange process for holders of ADRs to receive the underlying Smurfit WestRock Shares for a short period of time post-Completion

(the “ADR Exchange”) before proceeding with the sale described in the following clause (ii), or (ii) sell the

underlying Smurfit WestRock Shares representing the ADRs in the market (the “Forced Sale”). If the ADR Banks

follow a Forced Sale process, following the Forced Sale, Smurfit Kappa currently understands that each of the ADR Banks will

distribute the sale proceeds to each relevant ADR holder on a pro-rata basis, minus fees, charges, and expenses of such ADR

Bank.

If you wish to avoid a Forced Sale

and maintain your economic interest in Smurfit WestRock Shares, you must reposition your ADR holding, in good time prior to Completion

(or participate promptly in the ADR Exchange, if offered, by the ADR Banks), by:

| (i) | completing and lodging an ADR cancellation instruction with the relevant ADR Bank (where ADRs are held

directly on the ADR register), or |

| (ii) | instructing the ADR Bank, through your broker/custodian, to cancel your existing ADRs (where ADRs are

held through your broker/custodian in the DTC system), and, |

in each case, requesting the delivery

of the underlying Smurfit Kappa Shares to the account of your chosen broker/custodian in advance of the Scheme Record Date.

As explained in Part B of Section

II (Indirect Holders) below, following Completion, it will not be possible to hold interests in Smurfit WestRock Shares through the Euroclear

settlement system. Consequently, when instructing your ADR Bank to deliver the underlying Smurfit Kappa Shares to the account of your

chosen custodian prior to Completion, you should consider requesting, from your chosen custodian, a conversion of your Smurfit Kappa Shares

into CDIs and nominate a custodian which is a participant in the CREST system, who can therefore hold your interests in the Smurfit Kappa

Shares through CDIs in the CREST system until the time of Completion. See Part A of Section II below for more information on the treatment

of persons holding Smurfit Kappa Shares indirectly through CDIs.

If you hold an interest in Smurfit

Kappa Shares through an ADR Programme or have any questions related to the ADR Programmes, you are strongly encouraged to contact your

ADR Bank and/or existing broker/custodian (as applicable) as soon as possible for additional information or to confirm what options are

available to you to avoid a Forced Sale,(pre and post-Completion) and what steps you intend to take.

SECTION II: INDIRECT HOLDERS

PART A – Existing Smurfit Kappa CDI Holders

| 1. | I am an indirect holder of Smurfit Kappa Shares through CDIs in the CREST system (an “Existing

Smurfit Kappa CDI Holder”). How will I hold my entitlement to Smurfit WestRock Shares following Completion? |

In order to enable Existing

Smurfit Kappa CDI Holders to transfer and settle their interests in Smurfit WestRock Shares through the CREST system after

Completion in the manner in which they transferred and settled their interests in Smurfit Kappa Shares prior to Completion, holders

will receive new Smurfit WestRock DIs representing Smurfit WestRock Shares issued and operated by Computershare Investor Services

PLC (“Computershare UK”) through the

CREST system on a one for one basis. Accordingly, following Completion, Existing Smurfit Kappa CDI Holders representing Smurfit

Kappa Shares will become holders of Smurfit WestRock DIs and will be able to transfer and settle their interests in Smurfit WestRock

Shares in CREST accounts in the form of Smurfit WestRock DIs, in the same way that Smurfit Kappa shareholders are currently able to

transfer and settle their existing CDIs.

| 2. | What is a Smurfit WestRock DI? |

A Smurfit WestRock DI is a legal instrument

that, in the same manner as existing Smurfit Kappa CDIs, allows interests in Smurfit WestRock Shares to be held, transferred, and settled

within the CREST system.

Existing Smurfit Kappa CDIs are being

replaced with Smurfit WestRock DIs to facilitate the listing of Smurfit WestRock Shares on the NYSE and LSE.

| 3. | How does a Smurfit WestRock DI work and how will I receive my entitlement to Smurfit WestRock Shares? |

A Smurfit WestRock DI represents the

right to a share with, to the extent possible, the same rights and entitlements as a registered shareholder. Smurfit WestRock DI holders

will (like holders of existing Smurfit Kappa CDIs with regard to Smurfit Kappa Shares) be beneficial holders rather than registered holders

of shares in Smurfit WestRock.

Computershare UK has been appointed

to provide the Smurfit WestRock DI service to Smurfit WestRock and will act as the depositary of the Smurfit WestRock DI service.

The Smurfit WestRock DIs will be created

and issued in the CREST system under the terms of the DI deed (the “DI Deed”), which will govern the relationship between

the Depositary (in this case, Computershare UK) and the holders of Smurfit WestRock DIs.

The CREST accounts of holders of Smurfit

Kappa Shares represented by CDIs at Completion will, following Completion, receive a credit to reflect a balance of the same number of

Smurfit WestRock Shares represented by Smurfit WestRock DIs (instead of Smurfit Kappa CDIs) under the new ISIN IE00028FXN24.

Following Completion, holders of Smurfit

WestRock DIs (or brokers on behalf of Smurfit WestRock holders) will be able to cancel their Smurfit WestRock DIs by submitting a cross-border

instruction in respect of the underlying Smurfit WestRock Shares through the CREST system to the Depositary in the form of a CREST stock

withdrawal message (CREST system message type: STW). The cancelation of Smurfit WestRock DIs is subject to a charge. For general enquiries,

details of the current cancelation charges or for assistance in cancelling Smurfit WestRock DIs and lodging cross-border instructions,

holders, or brokers, of Smurfit WestRock DIs should contact the Depositary by phone on +353 1 447 5590 (from inside Ireland) or +44 370

707 1456 (from outside Ireland). Lines are open from 9:00 a.m. to 5:00 p.m., Monday to Friday (excluding public holidays in Ireland and

England).

| 4. | Does being a holder of a Smurfit WestRock DI mean I have the same rights as those of ordinary shareholders? |

Although the identity of the relevant

depositary will change, holders of Smurfit WestRock DIs will continue to enjoy rights equivalent to those currently held through Smurfit

Kappa CDIs.

Smurfit WestRock DI holders will be

entitled to exercise substantially the same rights as holders of Smurfit WestRock Shares so far as possible in accordance with applicable

law, the terms of the DI Deed and the rules and procedures of the CREST system. Smurfit WestRock DI holders who wish to be recorded as

members in Smurfit WestRock’s Register of Members will need to take steps to have their Smurfit WestRock DIs cancelled as outlined

above.

| 5. | Will I be able to convert my Smurfit WestRock DIs into Smurfit WestRock Shares tradable in the US? |

Yes - cross border movements will

be possible following Completion. Details of the process are available by contacting Computershare UK by email at uk.globaltransactions@computershare.co.uk.

Smurfit WestRock shareholders holding their securities through a broker or custodian, and who wish to make an instruction in relation

to their Smurfit WestRock DIs, should contact their broker or custodian for assistance (rather than Computershare).

PART B – Existing Smurfit Kappa Euroclear

Bank Holders

| 1. | I am an indirect holder of Smurfit Kappa Shares through a nominated Euroclear Bank participant (a “Euroclear

participant”) (but not through CDIs) (an “Existing Smurfit Kappa Euroclear Holder”). How will I hold my entitlement

to Smurfit WestRock Shares following Completion? |

In order for Smurfit WestRock Shares

to be listed on the NYSE, Smurfit WestRock Shares must be eligible for deposit and clearing within the DTC’s settlement system,

which requires implementation of the measures set out in paragraph 1 of Section I (General) (the “New Settlement System”).

If no action is taken by relevant

Euroclear participants prior to the Scheme Record Time, the legal title to all Smurfit Kappa Shares held indirectly through Euroclear

participants in the Euroclear system (in respect of entitlements to Smurfit Kappa Shares which are not represented by Smurfit Kappa CDIs)

immediately prior to the Scheme Record Time will be transferred to the relevant Euroclear participants interested in those Smurfit WestRock

Shares following Completion (without any change to the underlying ultimate beneficial ownership of the relevant Smurfit WestRock Shares),

and those Euroclear participants will be recorded as the registered holders of the relevant Smurfit WestRock Shares, to be held in “registered

form” on Smurfit WestRock’s Register of Members, outside of both DTC and CREST.

Existing Smurfit Kappa Euroclear Holders

and relevant Euroclear participants should be aware that following Completion, Smurfit WestRock shareholders holding shares in “registered

form” will be subject to additional procedural requirements before being able to settle transactions in shares placed on the LSE

or NYSE. See paragraph 3 of this section below for further information.

In advance of the Scheme Record Time,

relevant Euroclear participants holding interests in Smurfit Kappa Shares for Existing Smurfit Kappa Euroclear Holders may either:

| (i) | reposition their holding of interests in Smurfit Kappa Shares into Smurfit Kappa CDIs through the CREST

system (following which their holding of interests in Smurfit WestRock Shares will, following Completion, be dealt with in the same manner

as holdings of interests in Smurfit Kappa Shares held indirectly through Smurfit Kappa CDIs prior to the Scheme Record Time)

– please see Part A (Existing Smurfit Kappa CDI Holders) of this Section II for further details; or |

| (ii) | withdraw their holding of interests in Smurfit Kappa Shares from the Euroclear system directly into the

names of the underlying beneficial holders (or their nominee) as the registered holder of the relevant Smurfit Kappa Shares (following

which such holdings of Smurfit WestRock Shares will be dealt with in the same manner as Smurfit Kappa Shares currently held directly in

certificated form) - please see Section III (Certificated Holders) of this document for further details. |

A Euroclear participant seeking to

reposition their holding of interests in Smurfit Kappa Shares into CDIs will need to transfer their Smurfit Kappa Shares from Euroclear

Bank to Euroclear UK & International, by instructing an internal delivery free of payment transaction against Euroclear UK & International’s

account in Euroclear Bank 22111. This instruction will need to settle by the CREST deadline which is expected to be 11:00 am on Friday,

5 July 2024. It will not be possible to convert interests in Smurfit Kappa Shares into Smurfit Kappa CDIs after this time. All Smurfit

Kappa CDI positions which are settled in the CREST system immediately prior to the Scheme Record Time will be eligible for conversion

into a Smurfit WestRock DI, effective Monday, 8 July 2024. Further details of these actions that may be taken by Euroclear participants

in advance of the Scheme Record Date will be communicated separately by way of a bulletin newsletter through the Euroclear settlement

system.

| 2. | As an Existing Smurfit Kappa Euroclear Holder, what steps should I take in advance of Completion? |

As an Existing Smurfit Kappa Euroclear

Holder, you are strongly encouraged to contact the Euroclear participant through which you indirectly hold interests in Smurfit Kappa

Shares prior to the Scheme Effective Time to confirm what (if any) steps your Euroclear participant intends to take prior to the Scheme

Record Time and/or the impact on your rights following Completion in respect of your interests in Smurfit WestRock Shares following Completion

and the services currently provided to you by your Euroclear participant.

If you do not wish for the Smurfit

WestRock Shares in which you will be interested to be registered directly in the name of your Euroclear participant on Smurfit WestRock’s

Register of Members, you should take steps to reposition your holding of interests in Smurfit Kappa Shares into Smurfit Kappa CDIs through

the CREST system or withdraw your holding of Smurfit Kappa Shares from the Euroclear system directly into the names of a preferred nominee

in advance of the Scheme Record Time.

| 3. | Will the transfer of indirect holdings of Smurfit WestRock Shares in the Euroclear system into direct

holdings by the relevant Euroclear participants affect the way in which I can trade my Smurfit WestRock Shares? |

The administration of the transfer

of indirect holdings of Smurfit WestRock Shares in the Euroclear system into direct holdings by relevant Euroclear participants as registered

holders of Smurfit WestRock Shares is expected to be completed following Completion. Smurfit WestRock intends to complete this process

as soon as practicable following Completion. During this process, access to, and trading and settlement of, such Smurfit WestRock Shares

may be impacted.

Euroclear participants receiving Smurfit

WestRock Shares in “registered form” may not be able to immediately transact or settle trades in respect of those Smurfit

WestRock Shares on a stock exchange until such time as (i) their holding statement is received by post and (ii) the Smurfit WestRock Shares

are subsequently transferred, by them, to Cede & Co. (as nominee for DTC) through a physical stock transfer form, and such former

Euroclear participants subsequently receive indirect interests in those Smurfit WestRock Shares either through their nominated DTC participant

account or their nominated CREST participant account (in the form of Smurfit WestRock DIs) (as applicable).

In addition, following the listing

of Smurfit WestRock Shares on the NYSE becoming effective, the Transfer Agent will require the execution of a specific stock transfer

form, which form requires certain stamp duty confirmations (please see “Section IV: Tax” below for further information on

stamp duty on Smurfit Kappa or Smurfit WestRock share transfers), together with a medallion signature guarantee for a transfer of Smurfit

WestRock Shares by a person holding in “registered form” to (i) another person holding in “registered form”, (ii)

a broker holding shares on behalf of that person in CREST in the form of Smurfit WestRock DIs, or (iii) a broker holding Smurfit WestRock

Shares on behalf of a person through DTC (save for in circumstances where such Smurfit WestRock Shares are held by a US resident shareholder

and the total account value for such Smurfit WestRock Shares is equal to less than $10,000, and/or in certain circumstances as the Transfer

Agent may determine from time to time). This may result in additional costs and delays in transferring such Smurfit WestRock Shares. A

medallion signature guarantee may be obtained from a US bank or trust company, broker-dealer, clearing agency, savings association or

other financial institution which participates in a medallion program recognised by the Securities Transfer Association. Smurfit WestRock

shareholders may consult https://www.computershare.com/us/what-is-a-medallion-guarantee for information on possible overseas providers

of medallion signature guarantees. Signature guarantees from financial institutions that are not participating in a recognised medallion

program will not be accepted. A notary public cannot provide signature guarantees. Holders of Smurfit WestRock Shares in “registered

form” can contact the Transfer Agent for further information.

SECTION III: CERTIFICATED HOLDERS

Part A - General

| 1. | I am a shareholder holding share certificates for Smurfit Kappa Shares. How will I hold my shares immediately

after Completion? |

You will be recorded as the registered

holder of your Smurfit WestRock Shares on Smurfit WestRock’s Register of Members immediately Completion. However, at Completion,

the paper certificates representing your certificated Smurfit Kappa Shares will be automatically cancelled and replaced by corresponding

paperless book-entry interests on Smurfit WestRock’s Register of Members maintained by Smurfit WestRock’s Transfer Agent.

You will be issued with a statement from the Transfer Agent confirming your holding in Smurfit WestRock Shares. Any such shares are considered

to be held in “registered form”.

| 2. | Will Completion affect the way in which I can trade my new Smurfit WestRock Shares? |

Following the listing of Smurfit

WestRock Shares on the NYSE, shareholders holding Smurfit WestRock Shares in “registered form” may not be able to

immediately transact or settle trades in respect of those Smurfit WestRock Shares on a stock exchange until such time as (i) their

holding statement is received, and (ii) the Smurfit WestRock Shares are subsequently transferred, by them, to Cede & Co. (as

nominee for DTC) through a physical stock transfer form, and such shareholders subsequently receive indirect interests in those

Smurfit WestRock Shares either through their nominated DTC participant account or their nominated CREST participant account (in the

form of Smurfit WestRock DIs) (as applicable).

After Completion, the Transfer Agent

will require the execution of a specific stock transfer form, which form requires certain stamp tax attestation (please see “Section

IV: Tax” below for further information), together with a medallion signature guarantee for a transfer of Smurfit WestRock Shares

by any person holding in “registered form” to (i) another person holding in “registered form”, (ii) a broker holding

shares on behalf of that person in CREST in the form of Smurfit WestRock DIs, or (iii) a broker holding Smurfit WestRock Shares on behalf

of a person through DTC (save for in circumstances where such Smurfit WestRock Shares held by a US resident shareholder and the total

account value for such Smurfit WestRock Shares is equal to less than $10,000, and/or in certain circumstances as the Transfer Agent may

determine from time to time). This may result in additional costs and delays in transferring such Smurfit WestRock Shares. A medallion

signature guarantee may be obtained from a US bank or trust company, broker-dealer, clearing agency, savings association or other financial

institution which participates in a medallion program recognised by the Securities Transfer Association. Smurfit WestRock shareholders

may consult https://www.computershare.com/us/what-is-a-medallion-guarantee for information on possible overseas providers of medallion

signature guarantees. Signature guarantees from financial institutions that are not participating in a recognised medallion program will

not be accepted. A notary public cannot provide signature guarantees. Holders of Smurfit WestRock Shares in “registered form”

can contact the Transfer Agent for further information.

As an alternative to a medallion signature

guarantee, an Irish resident with a shareholding value in Smurfit WestRock not exceeding €62,000 may use a new security validation

service (“SVS”) provided by Computershare Investor Services (Ireland) Limited (“Computershare Ireland”). The SVS

requires shareholders to submit certain original or certified identification documents and an administration fee to Computershare Ireland,

who will validate the shareholder instructions and verify their identity in lieu of a medallion signature guarantee. Information on the

SVS is available by initially contacting the US shareholder helpline at Computershare Trust Company, N.A. on 1-866-644-4127 (inside the

US, US territories and Canada) or 1-781-575-2906 (outside the US, US territories and Canada). Lines are open 8:30 a.m. to 6:00 p.m. (New

York time), Monday to Friday (excluding public holidays in the US).

| 3. | In what ways can I hold my Smurfit WestRock Shares (or interests to my Smurfit WestRock Shares) after

Completion? |

After Completion, you will be entitled

to hold your Smurfit WestRock Shares directly in “registered form” or (subject to compliance with applicable securities laws)

take steps to deposit and hold your Smurfit WestRock Shares indirectly through (i) DTC; or (ii) the CREST system (in the form of Smurfit

WestRock DIs), by instructing Smurfit WestRock’s Transfer Agent to transfer such shares to a bank, broker or nominee (selected by

the holder) who is a participant in DTC or the CREST system. To do so, you will need to request and lodge a transfer form and, where shares

are to reach a nominated account in the CREST system, a cross-border instruction form. For assistance with this process, please contact

Computershare Trust Company, N.A. (“Computershare US”) on 1-866-644-4127 (inside the US, US territories and Canada)

or 1-781-575-2906 (outside the US, US territories and Canada). Lines are open 8:30 a.m. to 6:00 p.m. (New York time), Monday to Friday

(excluding public holidays in the US).

If you continue to hold your Smurfit

WestRock Shares directly in “registered form” following Completion, you will need to take steps to have your shares transferred

to and deposited with DTC or the CREST system if you want to trade those shares on a particular stock exchange.

Certificated holders should be aware

that following Completion, certificated holders of shares in “registered form” may be subject to additional procedural requirements

before being able to transfer shares on the LSE or the NYSE. See paragraph 3 of Part B of Section II (Indirect Holders) above for further

information.

Part B - Change in Irish Share Registrar

| 1. | Who will be the share registrar for Smurfit WestRock? |

In preparation for the Combination,

Smurfit Kappa appointed Computershare Ireland as its new Irish share registrar in place of Link Registrars Limited (“Link”).

The remaining Q&A in this Section III set out information which will be relevant to you if you are a certificated holder of Smurfit

Kappa Shares.

We recommend that certificated holders

of Smurfit Kappa Shares also consult the separate communication issued by Smurfit Kappa to you on 8 February 2024, which contains important

information in relation to your shareholding in Smurfit Kappa arising from the change in share registrar and highlights actions you will

need to take in order to ensure the continued efficient management of your shareholding in Smurfit Kappa (including confirmation of your

new Shareholder Reference Number (SRN)).

Following Completion, the Smurfit

WestRock share register will be required to be maintained by a US Securities and Exchange Commission (“SEC”) registered

transfer agent (a US registrar is known as a ‘transfer agent’) and Smurfit WestRock will enter into certain agreements with

the Transfer Agent for the provision of such services.

Smurfit WestRock will issue a separate

communication to shareholders around the time of or shortly following Completion advising them of the steps to be taken in connection

with the appointment of Computershare US as Transfer Agent.

| 2. | What does the appointment of a new Irish share registrar mean for my shareholding? |

The appointment of Computershare Ireland

as Irish share registrar will not result in any changes to the manner in which your shares are held but may result in some changes to

the way in which you manage your shares.

Your shareholding information has

been migrated from Link to Computershare Ireland and you have been allocated a new Shareholder Reference Number “SRN” by Computershare

Ireland. A letter was issued by Smurfit Kappa on 8 February 2024, to all certificated holders of Smurfit Kappa Shares (as of 6 February

2024) which confirmed your SRN (the unique 10-digit number preceded by the letter “C”). This SRN replaces the Investor Code

previously provided to you by Link. You should keep your SRN safe, as you will need it when contacting Computershare Ireland and to register

to manage your shareholding online using Computershare Ireland’s Investor Centre (more information below). This SRN will apply until

Completion, at which point Computershare US will provide you with a unique holder account number (“HAN”) which will

replace your SRN in respect of your Smurfit WestRock Shares.

| 3. | How can I continue to manage my shareholding online between now and Completion? |

You can register to manage your shareholding

online using Computershare Ireland’s Investor Centre service by following the below steps. Investor Centre can also be used to check

your current shareholding balance and confirm the details of any transactions. In addition, Investor Centre allows you to securely update

your postal address, contact preferences and change your payment details for any dividend payments.

To register for Investor Centre you

will need to:

| (A) | go to www.investorcentre.com/ie and click the ‘Register’ button on the home page which will

direct you to the online registration form; |

| (B) | enter ‘Smurfit Kappa Group plc’ under the company name and enter your personal Shareholder

Reference Number (SRN) quoted in the letter issued to you; |

| (C) | for security reasons, you may be required to verify your account. This will be via a code sent to your

registered postal address. Access will be limited until this has been completed; and |

| (D) | follow the online instructions to view and manage your shareholding: |

| (i) | you can review your shareholding on the Investor Centre home page once you have registered and logged

in; |

| (ii) | you can change your personal details or your communication preferences, including your email address,

by logging into the Investor Centre and clicking on “Update Your Profile” and selecting the required action under “My

Profile”; |

| (iii) | you can review any historic transactions and payments by logging into the Investor Centre and clicking

“Activity” on the main menu. |

| 4. | How can I update my information and preferences? |

We recommend certificated holders

of Smurfit Kappa Shares take this opportunity to review and, if necessary, update any contact information and preferences. This can be

done via Computershare Ireland’s Investor Centre. Opting to receive information electronically enables you to receive communications

promptly, reduce the amount of paper used, saving costs and minimising the impact on the environment.

Your existing contact information

and preferences on file with Link have been migrated to Computershare Ireland and will be maintained until Completion. There is no need

to take action at this time if you are satisfied with your existing information and preferences.

| 5. | Do I need to resubmit communication preferences / instructions after Completion? |

Your communication

and payment preferences cannot be migrated from Computershare Ireland to Computershare US and so you will need to notify your communication

and payment preferences to Computershare US using its online services following Completion.

Smurfit WestRock will issue a separate

communication to shareholders around the time of or shortly following Completion advising them of the steps to be taken in connection

with the appointment of Computershare US as US transfer agent.

SECTION IV: TAX

Neither Smurfit Kappa nor Smurfit WestRock is

able to give financial or tax advice and all holders should consult their own tax advisers regarding the Combination. For further discussion,

a summary of certain Irish, United Kingdom and United States tax consequences of the Combination is set out in Part VI (Summary of the

Tax Consequences of the Combination) of the Circular. Such summary does not constitute tax advice, is intended as a general guide only,

relates only to certain categories of Smurfit Kappa shareholder in those relevant jurisdictions, and does not consider all aspects of

taxation that may be relevant to particular holders, or any holder’s individual facts and circumstances.

SECTION V: EXPECTED TIMETABLE OF PRINCIPAL

EVENTS

The expected timetable of principal events during

July 2024 for the implementation of Completion and de-listing of Smurfit Kappa from Euronext Dublin and the LSE is as follows, and these

dates and times are indicative only and are subject to change, in accordance with the terms and conditions of the Combination, as described

in the Circular:

| EVENT |

TIME1 AND/OR DATE |

| Last day of trading in Smurfit Kappa Shares on Euronext Dublin |

2 July 2024 |

| Suspension of trading in Smurfit Kappa Shares on Euronext Dublin |

5:00 p.m. on 2 July 2024 |

| Last day for settlement of final trades placed on Euronext Dublin |

4 July 2024 |

| Last day/time for EB Participants to move positions into the Smurfit Kappa CDIs |

11:00 a.m. on 5 July 2024 |

| Scheme Record Time |

5:00 p.m. (New York City Time) on 5 July 2024 |

| Smurfit WestRock Shares issued to Smurfit Kappa shareholders and WestRock shareholders |

After 5:00 p.m. (New York City Time) on 5 July 2024 |

| Delisting of Smurfit Kappa Shares from the Official List of Euronext Dublin and cancellation of admission to trading on the Euronext Dublin Market |

8:00 a.m. on 8 July 2024 |

| Delisting of Smurfit Kappa Shares from the Official List of the FCA and cancellation of admission to trading on the LSE’s main market for listed securities |

8:00 a.m. on 8 July 2024 |

| Expected admission and commencement of dealings in Smurfit WestRock Shares on the LSE |

8:00 a.m. on 8 July 2024 |

| Expected admission and commencement of dealings in Smurfit WestRock Shares on the NYSE |

9:30 a.m. (New York City Time) on 8 July 2024 |

| Expected crediting of Smurfit WestRock DIs to CREST participant accounts |

By or around 2:00 p.m. on 8 July 2024 |

| 1. | All times shown are UK and Irish time unless otherwise stated. |

The above dates are indicative only and assume

that the requisite regulatory clearances and consents have been obtained and the other Conditions have been satisfied before the date

estimated for Completion. The expected dates will depend, among other things, on the timing of the satisfaction or waiver of all the Conditions.

If any of the above times and/or dates change, the revised times and/or dates will be notified by announcement through a Regulatory Information

Service.

Additional Information about the Combination

and Where to Find It

In connection with the Combination, Smurfit WestRock

has filed with the US Securities and Exchange Commission (the “US SEC”) a registration statement on Form S-4 (Reg.

No. 333-278185) (as amended and as may be further amended or supplemented from time to time, the “US Registration Statement”),

which was declared effective by the US SEC on 26 April 2024, that includes a prospectus (the “US Prospectus”) relating

to the offer and sale of the Smurfit WestRock Shares to WestRock Shareholders in connection with the Combination. In addition, on 26 April

2024, WestRock filed a separate definitive proxy statement with the US SEC with respect to the special meeting of WestRock Shareholders

in connection with the Combination (as it may be amended or supplemented from time to time, the “US Proxy Statement”).

WestRock commenced mailing of the US Proxy Statement to WestRock Shareholders on or about 1 May 2024. This announcement is not a substitute

for any registration statement, prospectus, proxy statement or other document that Smurfit Kappa, WestRock and/or Smurfit WestRock have

filed or may file with the US SEC or the FCA in connection with the Combination.

Before making any voting or investment decisions,

investors, stockholders and shareholders of Smurfit Kappa and WestRock are urged to read carefully and in their entirety the Circular,

the prospectus published by Smurfit Kappa on 14 May 2024 relating to the Combination (the “UK Prospectus”), the US

Registration Statement, the US Prospectus and the US Proxy Statement, as applicable, and any other relevant documents that are filed or

will be filed with the FCA or the US SEC, as well as any amendments or supplements to these documents, in connection with the Combination

when they become available, because they contain or will contain important information about the Combination, the parties to the Combination,

the risks associated with the Combination and related matters, including information about certain of the parties’ respective directors,

executive officers and other employees who may be deemed to be participants in the solicitation of proxies in connection with the Combination

and about their interests in the solicitation.

The US Registration Statement, the US

Prospectus, the US Proxy Statement and other documents filed by Smurfit WestRock, Smurfit Kappa and WestRock with the US SEC are

available free of charge at the US SEC’s website at www.sec.gov. In addition, investors and shareholders or stockholders are

able to obtain free copies of the US Registration Statement, the US Proxy Statement and other documents filed with the US SEC by

WestRock online at ir.westrock.com/ir-home/, upon written request delivered to 1000 Abernathy Road, Atlanta, Georgia 30328, United

States, or by calling +1 (770) 448-2193, and are able to obtain free copies of the US Registration Statement, the US Prospectus, the

US Proxy Statement and other documents filed with the US SEC by Smurfit WestRock or Smurfit Kappa online at

www.smurfitkappa.com/investors, upon written request delivered to Beech Hill, Clonskeagh, Dublin 4, D04 N2R2, Ireland or by calling

+353 1 202 7000. The information included on, or accessible through, Smurfit WestRock’s, Smurfit Kappa’s or

WestRock’s websites is not incorporated by reference into this announcement.

Forward-Looking Statements

This announcement and the Circular, as well

as oral statements made or to be made by Smurfit WestRock, Smurfit Kappa and WestRock, include certain “forward-looking

statements” (including within the meaning of US federal securities laws) regarding the Combination and the listing of Smurfit

WestRock, the rationale and expected benefits of the Combination (including, but not limited to, synergies), and any other

statements regarding Smurfit WestRock’s, Smurfit Kappa’s and WestRock’s future expectations, beliefs, plans,

objectives, results of operations, financial condition and cash flows, or future events or performance. Statements included in this

announcement and the Circular that are not historical facts, including statements about the beliefs and expectations of the

management of each of Smurfit WestRock, Smurfit Kappa and WestRock, are forward-looking statements. Words such as “may”,

“will”, “could”, “should”, “would”, “anticipate”, “intend”,

“estimate”, “project”, “plan”, “believe”, “expect”,

“target”, “prospects”, “potential”, “commit”, “forecasts”,

“aims”, “considered”, “likely”, “estimate” and variations of these words and similar

future or conditional expressions are intended to identify forward-looking statements but are not the exclusive means of identifying

such statements. While Smurfit WestRock, Smurfit Kappa and WestRock believe these expectations, assumptions, estimates and

projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and

uncertainties, many of which are beyond the control of Smurfit WestRock, Smurfit Kappa and WestRock. By their nature,

forward-looking statements involve risk and uncertainty because they relate to events and depend upon future circumstances that may

or may not occur. Actual results may differ materially from the current expectations of Smurfit WestRock, Smurfit Kappa and WestRock

depending upon a number of factors affecting their businesses and risks associated with the successful execution of the Combination

and the integration and performance of their businesses following the Combination. Important factors that could cause actual results

to differ materially from such plans, estimates or expectations include: developments related to pricing cycles and volumes;

economic, competitive and market conditions generally, including macroeconomic uncertainty, customer inventory rebalancing, the

impact of inflation and increases in energy, raw materials, shipping, labour and capital equipment costs; reduced supply of raw

materials, energy and transportation, including from supply chain disruptions and labour shortages; intense competition; risks

related to international sales and operations; failure to respond to changing customer preferences and to protect intellectual

property; results and impacts of acquisitions by Smurfit Kappa, WestRock or, following Completion, Smurfit WestRock; the amount and

timing of Smurfit Kappa’s, WestRock’s and, following Completion, Smurfit WestRock’s capital expenditures; evolving

legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions in Ireland, the United

Kingdom, the United States and elsewhere, and other factors that contribute to uncertainty and volatility, natural and man-made

disasters, civil unrest, pandemics (such as the COVID-19 pandemic), geopolitical uncertainty, and conditions that may result from

legislative, regulatory, trade and policy changes associated with the current or subsequent Irish, US or UK administrations; the

ability of Smurfit Kappa, WestRock or, following Completion, Smurfit WestRock, to successfully recover from a disaster or other

business continuity problem due to a hurricane, flood, earthquake, terrorist attack, war, pandemic, security breach, cyber-attack,

power loss, telecommunications failure or other natural or man-made event, including the ability to function remotely during

long-term disruptions such as the COVID-19 pandemic; the impact of public health crises, such as pandemics (including the COVID-19

pandemic) and epidemics and any related company or governmental policies and actions to protect the health and safety of individuals

or governmental policies or actions to maintain the functioning of national or global economies and markets; the potential

impairment of assets and goodwill; the scope, costs, timing and impact of any restructuring of operations and corporate and tax

structure; actions by third parties, including government agencies; a condition to the closing of the Combination may not be

satisfied; the occurrence of any event that can give rise to termination of the Combination; a regulatory approval that may be

required for the Combination is delayed, is not obtained in a timely manner or at all or is obtained subject to conditions that are

not anticipated; Smurfit WestRock may be unable to achieve the synergies and value creation contemplated by the Combination; Smurfit

WestRock’s availability of sufficient cash to distribute to Smurfit WestRock shareholders in line with current expectations;

Smurfit WestRock may be unable to promptly and effectively integrate Smurfit Kappa’s and WestRock’s businesses; failure

to successfully implement strategic transformation initiatives; each of Smurfit Kappa’s, WestRock’s and, following

Completion, Smurfit WestRock’s management’s time and attention is diverted on issues related to the Combination;

disruption from the Combination makes it more difficult to maintain business, contractual and operational relationships; significant

levels of indebtedness; credit ratings may decline following the Combination; legal proceedings may be instituted against Smurfit

WestRock, Smurfit Kappa or WestRock; Smurfit Kappa, WestRock and, following Completion, Smurfit WestRock, may be unable to retain or

hire key personnel; the consummation of the Combination may have a negative effect on Smurfit Kappa’s or WestRock’s

share prices, or on their operating results; the risk that disruptions from the Combination will harm Smurfit Kappa’s or

WestRock’s business, including current plans and operations; certain restrictions during the pendency of the Combination that

may impact Smurfit Kappa’s or WestRock’s ability to pursue certain business opportunities or strategic transactions;

Smurfit WestRock’s ability to meet expectations regarding the accounting and tax treatments of the Combination, including the

risk that the Internal Revenue Service may assert that Smurfit WestRock should be treated as a US corporation or be subject to

certain unfavourable US federal income tax rules under Section 7874 of the Internal Revenue Code of 1986, as amended, as a result of

the Combination; and other factors such as future market conditions, currency fluctuations, the behaviour of other market

participants, the actions of regulators and other factors such as changes in the political, social and regulatory framework in which

the Combined Group will operate or in economic or technological trends or conditions.

None of Smurfit WestRock, Smurfit Kappa, WestRock

or any of their respective associates or directors, officers or advisers provides any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any forward-looking statements in this announcement or the Circular will actually occur.

You are cautioned not to place undue reliance on these forward-looking statements. Other than in accordance with its legal or regulatory

obligations (including under the UK Prospectus Regulation, the UK Listing Rules, the Disclosure Guidance and Transparency Rules, the Prospectus

Regulation Rules, the UK Market Abuse Regulation and other applicable regulations), Smurfit Kappa is under no obligation, and Smurfit

Kappa expressly disclaims any intention or obligation, to update or revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

No Offer of Securities

This announcement does not constitute or

form part of any offer or invitation to purchase, acquire, subscribe for, sell, dispose of or issue, or any solicitation of any

offer to sell, dispose of, purchase, acquire or subscribe for, any security, including any Smurfit WestRock Shares, expected to be

issued to shareholders of Smurfit Kappa Shareholders and WestRock Shareholders in connection with the Combination. In particular,

the issuance of the Smurfit WestRock Shares in connection with the Combination to Smurfit Kappa Shareholders has not been, and is

not expected to be, registered under the US Securities Act of 1933, as amended (the “US Securities Act”) or the

securities laws of any other jurisdiction. The Smurfit WestRock Shares to be issued in connection with the Combination to Smurfit

Kappa Shareholders will be issued pursuant to an exemption from the registration requirements provided by Section 3(a)(10) of the US

Securities Act based on the approval of the Scheme under Section 450 of the Companies Act 2014 of Ireland to effect the acquisition

by Smurfit WestRock of the Smurfit Kappa Share Exchange under the terms of the transaction agreement by the Irish High Court.

Section 3(a)(10) of the US Securities Act exempts securities issued in exchange for one or more bona fide outstanding securities

from the general requirement of registration where the fairness of the terms and conditions of the issuance and exchange of the

securities have been approved by any court or authorised governmental entity, after a hearing upon the fairness of the terms and

conditions of the exchange at which all persons to whom securities will be issued have the right to appear and to whom adequate

notice of the hearing has been given. In determining whether it is appropriate to authorise the Scheme, the Irish High Court will

consider at the hearing of the motion to sanction the Scheme under Section 453 of the Irish Companies Act (the “Irish Court

Hearing”) whether the terms and conditions of the Scheme are fair to Scheme shareholders. The Irish High Court will fix

the date and time for the Irish Court Hearing. If the Irish High Court approves the Scheme, its approval will constitute the basis

for the Smurfit WestRock Shares to be issued without registration under the US Securities Act in reliance on the exemption from the

registration requirements of the US Securities Act provided by Section 3(a)(10) of the US Securities Act.

Participants in the Solicitation of Proxies

This announcement is not a solicitation of proxies

in connection with the Combination. However, under US SEC rules, Smurfit WestRock, WestRock, Smurfit Kappa, and certain of their respective

directors, executive officers and other members of the management and employees may be deemed to be participants in the solicitation of

proxies in connection with the Combination.

Information about (i) WestRock’s directors

is set forth in the section entitled “Board Composition” on page 8 of WestRock’s proxy statement on Schedule 14A filed

with the US SEC on 13 December 2023 and (ii) WestRock’s executive officers is set forth in the section entitled “Executive

Officers” on page 141 of WestRock’s Annual Report on Form 10-K (the “WestRock 2023 Annual Report”) filed

with the US SEC on 17 November 2023. Information about the compensation of WestRock’s directors for the financial year ended 30

September 2023 is set forth in the section entitled “Director Compensation” starting on page 19 of WestRock’s proxy

statement on Schedule 14A filed with the US SEC on 13 December 2023. Information about the compensation of WestRock’s executive

officers for the financial year ended 30 September 2023 is set forth in the section entitled “Executive Compensation Tables”

starting on page 38 of WestRock’s proxy statement on Schedule 14A filed with the US SEC on 13 December 2023. Transactions with related

persons (as defined in Item 404 of Regulation S-K promulgated under the US Securities Act) are disclosed in the section entitled “Certain

Relationships and Related Person Transactions” on page 20 of WestRock’s proxy statement on Schedule 14A filed with the US

SEC on 13 December 2023. Information about the beneficial ownership of WestRock’s securities by WestRock’s directors and named

executive officers as of 22 April 2024 is set forth in the section entitled “Security Ownership of Certain Beneficial Holders, Directors

and Management of WestRock” starting on page 277 of each of the US Proxy Statement and the US Prospectus. As of 22 April 2024, none

of the participants (within the meaning of Rule 13d¬3 under the Securities Exchange Act of 1934, as amended) owned more than 1% of

shares of WestRock. Other information regarding certain participants in the proxy solicitation and a description of their direct and indirect

interests, by security holdings or otherwise are contained in the section entitled “Interests of WestRock’s Directors and

Executive Officers in the Combination” beginning on page 139 of each of the US Prospectus and the US Proxy Statement.

Information about Smurfit Kappa’s

directors and executive officers is set forth in the section entitled “Board of Directors,” starting on page 112 of

Smurfit Kappa’s 2023 Annual Report (the “Smurfit Kappa 2023 Annual Report”) published on Smurfit

Kappa’s website on 15 March 2024, which was filed with the FCA on 15 March 2024 and Euronext Dublin in Ireland on 15 March

2024. Information about the compensation of Smurfit Kappa executive officers and directors is set forth in the remuneration report

starting on page 129 of the Smurfit Kappa 2023 Annual Report. Transactions with related persons (as defined under Paragraph 24 of

the International Accounting Standards) are disclosed in the subsection entitled “Related Party Transactions” to the

section entitled “Notes to the Consolidated Financial Statements,” on page 223 of the Smurfit Kappa 2023 Annual Report.

Information about the beneficial ownership of Smurfit Kappa’s securities by Smurfit Kappa’s directors and executive

officers is set forth in the sections entitled “Executive Directors’ Interests in Share Capital at 31 December

2023” on page 147 and “Non-executive Directors’ Interests in Share Capital at 31 December 2023” on page 150

of the Smurfit Kappa 2023 Annual Report.

Information about the expected beneficial ownership

of Smurfit WestRock securities by the individuals who are expected to be executive officers and directors of Smurfit WestRock at Completion

is set forth in the section entitled “Security Ownership of Certain Beneficial Holders, Directors and Management of Smurfit WestRock”

beginning on page 279 of each of the US Prospectus and the US Proxy Statement. Information required by Item 402 of the SEC’s Regulation

S-K with respect to the executive officers of Smurfit WestRock who served as executives of Smurfit Kappa during Smurfit Kappa’s

fiscal year 2023, as well as a description of certain post-Completion compensation arrangements that are expected to apply to the executive

officers of Smurfit WestRock, is set forth in the section entitled “Executive Compensation” beginning on page 327 of each

of the US Prospectus and the US Proxy Statement.

Other

The contents of this announcement are not to be

construed as legal, business or tax advice. Each investor, stockholder or shareholder should consult its own legal adviser, financial

adviser or tax adviser for legal, financial or tax advice, respectively.

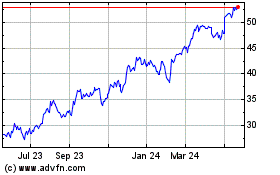

WestRock (NYSE:WRK)

Historical Stock Chart

From Nov 2024 to Dec 2024

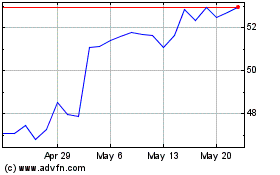

WestRock (NYSE:WRK)

Historical Stock Chart

From Dec 2023 to Dec 2024