XAI Octagon Floating Rate & Alternative Income Trust (the

“Trust”) has declared its regular monthly distribution of $0.077

per share on the Trust’s common shares (NYSE: XFLT), payable on

March 3, 2025, to common shareholders of record as of February 18,

2025, as noted below. The amount of the distribution represents no

change from the previous month's distribution amount of $0.077 per

share.

The following dates apply to the declaration:

|

Ex-Dividend Date |

February 18, 2025 |

| |

|

| Record Date |

February 18,

2025 |

| |

|

| Payable Date |

March 3, 2025 |

| |

|

| Amount |

$0.077 per common

share |

| |

|

|

Change from Previous Month |

No change |

| |

Common share distributions may be paid from net

investment income (regular interest and dividends), capital gains

and/or a return of capital. The specific tax characteristics of the

distributions will be reported to the Trust’s common shareholders

on Form 1099 after the end of the 2025 calendar year. Shareholders

should not assume that the source of a distribution from the Trust

is net income or profit. For further information regarding the

Trust’s distributions, please visit

www.xainvestments.com.

The Trust’s net investment income and capital gain

can vary significantly over time; however, the Trust seeks to

maintain more stable common share monthly distributions over time.

The Trust’s investments in CLOs are subject to complex tax rules

and the calculation of taxable income attributed to an investment

in CLO subordinated notes can be dramatically different from the

calculation of income for financial reporting purposes under

accounting principles generally accepted in the United States

(“U.S. GAAP”), and, as a result, there may be significant

differences between the Trust’s GAAP income and its taxable income.

The Trust’s final taxable income for the current fiscal year will

not be known until the Trust’s tax returns are filed.

As a registered investment company, the Trust is

subject to a 4% excise tax that is imposed if the Trust does not

distribute to common shareholders by the end of any calendar year

at least the sum of (i) 98% of its ordinary income (not taking into

account any capital gain or loss) for the calendar year and (ii)

98.2% of its capital gain in excess of its capital loss (adjusted

for certain ordinary losses) for a one-year period generally ending

on October 31 of the calendar year (unless an election is made to

use the Trust’s fiscal year). In certain circumstances, the Trust

may elect to retain income or capital gain to the extent that the

Board of Trustees, in consultation with Trust management,

determines it to be in the interest of shareholders to do so.

The common share distributions paid by the Trust

for any particular period may be more than the amount of net

investment income from that period. As a result, all or a portion

of a distribution may be a return of capital, which is in effect a

partial return of the amount a common shareholder invested in the

Trust, up to the amount of the common shareholder’s tax basis in

their common shares, which would reduce such tax basis. Although a

return of capital may not be taxable, it will generally increase

the common shareholder’s potential gain, or reduce the common

shareholder’s potential loss, on any subsequent sale or other

disposition of common shares.

The distribution shall be paid on the Payment Date

unless the payment of such distribution is deferred by the Board of

Trustees upon a determination that such deferral is required in

order to comply with applicable law to ensure that the Trust

remains solvent and able to pay its debts as they become due and

continue as a going concern, or to comply with the applicable terms

or financial covenants of the Trust’s senior securities.

Future common share distributions will be made if

and when declared by the Trust’s Board of Trustees, based on a

consideration of number of factors, including the Trust’s continued

compliance with terms and financial covenants of its senior

securities, the Trust’s net investment income, financial

performance and available cash. There can be no assurance that the

amount or timing of common share distributions in the future will

be equal or similar to that described herein or that the Board of

Trustees will not decide to suspend or discontinue the payment of

common share distributions in the future.

The investment objective of the Trust is to seek

attractive total return with an emphasis on income generation

across multiple stages of the credit cycle. The Trust seeks to

achieve its investment objective by investing in a dynamically

managed portfolio of opportunities primarily within the private

credit markets. Under normal market conditions, the Trust will

invest at least 80% of its Managed Assets in floating rate credit

instruments and other structured credit investments. There can be

no assurance that the Trust will achieve its investment

objective.

The Trust’s common shares are traded on the New

York Stock Exchange under the symbol “XFLT,” and the Trust’s 6.50%

Series 2026 Term Preferred Shares are traded on the New York Stock

Exchange under the symbol “XFLTPRA”.

About XA Investments

XA Investments LLC (“XAI”) serves as the Trust’s

investment adviser. XAI is a Chicago-based firm founded by XMS

Capital Partners in 2016. XAI serves as the investment adviser for

two listed closed-end funds and an interval closed-end fund. The

listed closed-end funds, the XAI Octagon Floating Rate &

Alternative Income Trust (NYSE: XFLT) and XAI Madison Equity

Premium Income Fund (NYSE: MCN) both trade on the New York Stock

Exchange. The interval closed-end fund, Octagon XAI CLO Income Fund

(OCTIX), is newly launched and has been made widely available to

investors.

In addition to investment advisory services, the

firm also provides investment fund structuring and consulting

services focused on registered closed-end funds to meet

institutional client needs. XAI offers custom product build and

consulting services, including development and market research,

sales, marketing, and fund management.

XAI believes that the investing public can benefit

from new vehicles to access a broad range of alternative investment

strategies and managers. XAI provides individual investors with

access to institutional-caliber alternative managers. For more

information, please visit

www.xainvestments.com.

About XMS Capital Partners XMS

Capital Partners, LLC, established in 2006, is a global,

independent, financial services firm providing M&A,

corporate advisory and asset management services to

clients. It has offices in Chicago, Boston and London. For more

information, please visit www.xmscapital.com.

About Octagon Credit Investors

Octagon Credit Investors, LLC (“Octagon”) serves as the Trust’s

investment sub-adviser. Octagon is a 25+ year old, $33.2B

below-investment grade corporate credit investment adviser focused

on leveraged loan, high yield bond and structured credit (CLO debt

and equity) investments. Through fundamental credit analysis and

active portfolio management, Octagon’s investment team identifies

attractive relative value opportunities across below-investment

grade asset classes, sectors and issuers. Octagon’s investment

philosophy and methodology encourage and rely upon dynamic internal

communication to manage portfolio risk. Over its history, the firm

has applied a disciplined, repeatable and scalable approach in its

effort to generate attractive risk-adjusted returns for its

investors. For more information, please visit

www.octagoncredit.com.

XAI does not provide tax advice; please consult a

professional tax advisor regarding your specific tax situation.

Income may be subject to state and local taxes, as well as the

federal alternative minimum tax.

Investors should consider the investment objectives

and policies, risk considerations, charges and expenses of the

Trust carefully before investing. For more information on the

Trust, please visit the Trust’s webpage at

www.xainvestments.com.

This press release shall not constitute an offer to

sell or a solicitation to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer or

solicitation or sale would be unlawful prior to registration or

qualification under the laws of such state or jurisdiction.

|

|

|

|

|

|

|

NOT FDIC INSURED |

|

NO BANK GUARANTEE |

|

MAY LOSE VALUE |

|

|

|

|

|

|

Paralel Distributors, LLC - Distributor

Media Contact:Kimberly Flynn,

PresidentXA Investments LLCPhone: 888-903-3358Email:

KFlynn@XAInvestments.comwww.xainvestments.com

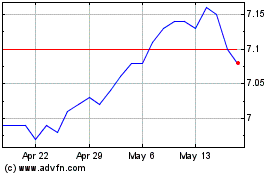

XAI Octagon Floating Rat... (NYSE:XFLT)

Historical Stock Chart

From Jan 2025 to Feb 2025

XAI Octagon Floating Rat... (NYSE:XFLT)

Historical Stock Chart

From Feb 2024 to Feb 2025