UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-39552

YALLA GROUP LIMITED

#234, Building 16, Dubai Internet City

Dubai, United Arab Emirates

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

YALLA GROUP LIMITED |

|

|

|

|

|

|

By: |

/s/ Yang Hu |

|

|

Name: |

Yang Hu |

|

|

Title: |

Chief Financial Officer |

Date: May 21, 2024

Exhibit 99.1

Yalla Group Limited Announces Unaudited First Quarter 2024 Financial Results

DUBAI, UAE, May 20, 2024 /PRNewswire/ -- Yalla Group Limited (“Yalla” or the “Company”) (NYSE: YALA), the largest Middle East and North Africa (MENA)-based online social networking and gaming company, today announced its unaudited financial results for the first quarter ended March 31, 2024.

First Quarter 2024 Financial and Operating Highlights

•Revenues were US$78.7 million in the first quarter of 2024, representing an increase of 7.1% from the first quarter of 2023.

oRevenues generated from chatting services in the first quarter of 2024 were US$52.2 million.

oRevenues generated from games services in the first quarter of 2024 were US$26.5 million.

•Net income was US$31.1 million in the first quarter of 2024, a 56.2% increase from US$19.9 million in the first quarter of 2023. Net margin1 was 39.5% in the first quarter of 2024.

•Non-GAAP net income2 was US$35.3 million in the first quarter of 2024, a 38.4% increase from US$25.5 million in the first quarter of 2023. Non-GAAP net margin3 was 44.8% in the first quarter of 2024.

•Average MAUs4 increased by 14.6% to 37.8 million in the first quarter of 2024 from 33.0 million in the first quarter of 2023.

•The number of paying users5 on our platform decreased by 5.2% to 12.8 million in the first quarter of 2024 from 13.5 million in the first quarter of 2023.

1 Net margin is net income as a percentage of revenues.

2 Non-GAAP net income represents net income excluding share-based compensation. Non-GAAP net income is a non-GAAP financial measure. See the sections entitled “Non-GAAP Financial Measures” and “Reconciliations of GAAP and Non-GAAP Results” for more information about the non-GAAP measures referred to in this press release.

3 Non-GAAP net margin is non-GAAP net income as a percentage of revenues.

4 “Average MAUs” refers to the average monthly active users in a given period calculated by dividing (i) the sum of active users for each month of such period, by (ii) the number of months in such period. “Active users” refers to registered users who accessed any of our main mobile applications at least once during a given period. Yalla, Yalla Ludo, Yalla Parchis, YallaChat and 101 Okey Yalla have been our main mobile applications for the periods presented herein; WeMuslim has been our main mobile application since the second quarter of 2023; and Ludo Royal has been our main mobile application since the third quarter of 2023.

5 “Paying users” refers to registered users who played a game or purchased our virtual items or upgrade services using virtual currencies on our main mobile applications at least once in a given period, except for users who received all of their virtual currencies directly or indirectly from us for free; YallaChat and WeMuslim do not involve the usage of virtual currencies, and the metrics of “paying users” and “ARPPU” do not reflect user activities on YallaChat and WeMuslim. “Registered users” refers to users who have registered accounts on our main mobile applications as of a given time; a registered user is not necessarily a unique user, as an individual may register multiple accounts on our main mobile applications.

|

|

|

|

|

|

|

|

Key Operating Data |

For the three months ended |

|

|

March 31, 2023 |

|

|

March 31, 2024 |

|

|

|

|

|

|

|

Average MAUs (in thousands) |

|

32,973 |

|

|

|

37,791 |

|

|

|

|

|

|

|

Paying users (in thousands) |

|

13,514 |

|

|

|

12,806 |

|

“We kicked off 2024 with a solid set of operational and financial results. In the first quarter, despite the impact posed by Ramadan beginning on March 11, our revenues increased by 7.1% year-over-year to US$78.7 million, landing in the upper end of our guidance and once again demonstrating the remarkable strength of our flagship applications,” said Mr. Yang Tao, Founder, Chairman and CEO of Yalla. “We also reaped rewards as we continued optimizing our user acquisition strategies and strengthening user engagement by leveraging our local know-how. For the first quarter, our group’s average MAUs reached 37.8 million, up 14.6% year-over-year. Our paying users also sequentially increased by 7.3% from last quarter to 12.8 million, reflecting users’ increasing willingness to pay for our products.

“Furthermore, we continued to explore and invest in Yalla Game, with a strategic focus on new game development. We are actively communicating with potential premium partners and recently joined the UK Interactive Entertainment Association (UKIE), deepening our commitment to enhancing connectivity within the global gaming industry and enriching the Middle Eastern gaming community with diverse, high-quality game content. We remain confident in the vast opportunities in MENA’s gaming industry. By capitalizing on our extensive expertise and resources in the MENA region, we are well-positioned to unlock the growth potential in the addressable market. As always, we are dedicated to delivering high-quality, tailored digital products that cater to the evolving needs of local users,” Mr. Yang concluded.

Ms. Karen Hu, CFO of Yalla, commented, “Our financial performance remained robust throughout the first quarter of 2024. Our ongoing efforts to deliver high-quality growth and enhance our operating efficiency resulted in meaningful profitability improvements, with net income increasing 56.2% year-over-year to US$31.1 million and net margin expanding from 27.1% to 39.5%. Looking ahead, we are confident that our strong cash position and excellent execution will empower us to capitalize on future opportunities, driving sustainable growth and creating value for all our stakeholders.”

First Quarter 2024 Financial Results

Revenues

Our revenues were US$78.7 million in the first quarter of 2024, a 7.1% increase from US$73.5 million in the first quarter of 2023. The increase was primarily driven by our broadening user base and enhanced monetization capability. Our average MAUs increased by 14.6% from 33.0 million in the first quarter of 2023 to 37.8 million in the first quarter of 2024. Our solid revenue growth was also partially attributable to the significant increase in ARPPU,6 which grew from US$5.39 in the first quarter of 2023 to US$6.03 in the first quarter of 2024.

In the first quarter of 2024, our revenues generated from chatting services were US$52.2 million, and revenues from games services were US$26.5 million.

Costs and expenses

Our total costs and expenses were US$49.6 million in the first quarter of 2024, a 12.7% decrease from US$56.8 million in the first quarter of 2023.

Our cost of revenues was US$28.6 million in the first quarter of 2024, a 2.6% increase from US$27.9 million in the same period last year, primarily due to higher commission fees paid to third-party payment platforms as a result of increasing revenue generated. Cost of revenues as a percentage of our total revenues decreased to 36.3% in the first quarter of 2024, compared with 37.9% in the first quarter of 2023.

Our selling and marketing expenses were US$8.1 million in the first quarter of 2024, a 28.7% decrease from US$11.4 million in the same period last year, primarily driven by our more disciplined advertising and promotion approach and lower share-based compensation expenses recognized in the first quarter of 2024. Selling and marketing expenses as a percentage of our total revenues decreased from 15.4% in the first quarter of 2023 to 10.3% in the first quarter of 2024.

Our general and administrative expenses were US$6.6 million in the first quarter of 2024, a 34.6% decrease from US$10.2 million in the same period last year, primarily driven by lower share-based compensation expenses recognized in the first quarter of 2024 and a decrease in professional service fees. General and administrative expenses as a percentage of our total revenues decreased from 13.8% in the first quarter of 2023 to 8.4% in the first quarter of 2024.

Our technology and product development expenses were US$6.3 million in the first quarter of 2024, a 15.5% decrease from US$7.4 million in the same period of last year, primarily due to a lower amount in performance-based bonuses recognized during this quarter. Technology and product development expenses as a percentage of our total revenues decreased from 10.1% in the first quarter of 2023 to 8.0% in the first quarter of 2024.

Operating income

Operating income was US$29.1 million in the first quarter of 2024, a 74.2% increase from US$16.7 million in the first quarter of 2023.

Non-GAAP operating income7

Non-GAAP operating income in the first quarter of 2024 was US$33.3 million, a 49.3% increase from US$22.3 million in the same period last year.

Interest income

Our interest income was US$6.6 million in the first quarter of 2024, compared with US$3.1 million in the first quarter of 2023, primarily due to an increase in interest rates applicable to the Company’s bank deposits.

6 “ARPPU” refers to average revenues per paying user in a given period, which is calculated by dividing (i) revenues for such period, by (ii) the number of paying users for such period. When calculating the ARPPU, we include revenues generated from Yalla, Yalla Ludo, Yalla Parchis, 101 Okey Yalla and Ludo Royal (since the third quarter of 2023) in a given period.

7 Non-GAAP operating income represents operating income excluding share-based compensation. Non-GAAP operating income is a non-GAAP financial measure. See the sections entitled “Non-GAAP Financial Measures” and “Reconciliations of GAAP and Non-GAAP Results” for more information about the non-GAAP measures referred to in this press release.

Income tax expense

Our income tax expense was US$3.48 million in the first quarter of 2024, compared with US$0.62 million in the first quarter of 2023. The increase was primarily due to the introduction and implementation of the UAE Corporate Tax Law, which is effective for the financial years starting on or after June 1, 2023.

Net income

As a result of the foregoing, our net income was US$31.1 million in the first quarter of 2024, a 56.2% increase from US$19.9 million in the first quarter of 2023.

Non-GAAP net income

Non-GAAP net income in the first quarter of 2024 was US$35.3 million, a 38.4% increase from US$25.5 million in the same period last year.

Earnings per ordinary share

Basic and diluted earnings per ordinary share were US$0.20 and US$0.17, respectively, in the first quarter of 2024, while basic and diluted earnings per ordinary share were US$0.13 and US$0.11, respectively, in the same period of 2023.

Non-GAAP earnings per ordinary share8

Non-GAAP basic and diluted earnings per ordinary share were US$0.22 and US$0.20, respectively, in the first quarter of 2024, compared with US$0.16 and US$0.14, respectively, in the same period of 2023.

Cash and cash equivalents, restricted cash, term deposits and short-term investments

As of March 31, 2024, we had cash and cash equivalents, restricted cash, term deposits and short-term investments of US$482.7 million, compared with US$535.7 million as of December 31, 2023. The decrease was primarily due to the reallocation of some of the Company’s cash reserves to long-term investments in the first quarter of 2024.

Extension of the Share Repurchase Program

Pursuant to the Company’s share repurchase program beginning on May 21, 2021 with an extended expiration date of May 21, 2024, the Company had completed cash repurchases in the open market of 3,972,876 American depositary shares (“ADSs”), representing 3,972,876 Class A ordinary shares, for an aggregate amount of approximately US$35.5 million, as of March 31, 2024. The aggregate value of ADSs and/or Class A ordinary shares that remain available for purchase under the current share repurchase program was US$114.5 million as of March 31, 2024. On May 16, 2024, the Company’s board of directors approved an extension of the expiration date of the share repurchase program to May 21, 2025.

Outlook

For the second quarter of 2024, Yalla currently expects revenues to be between US$72.0 million and US$79.0 million.

The above outlook is based on current market conditions and reflects the Company management’s current and preliminary estimates of market and operating conditions and customer demand, which are all subject to change.

8 Non-GAAP earnings per ordinary share is non-GAAP net income attributable to Yalla Group Limited’s shareholders, divided by weighted average number of basic and diluted shares outstanding. Non-GAAP net income attributable to Yalla Group Limited’s shareholders represents net income attributable to Yalla Group Limited’s shareholders, excluding share-based compensation. Non-GAAP earnings per ordinary share and non-GAAP net income attributable to Yalla Group Limited’s shareholders are non-GAAP financial measures. See the sections entitled “Non-GAAP Financial Measures” and “Reconciliations of GAAP and Non-GAAP Results” for more information about the non-GAAP measures referred to in this press release.

Conference Call

The Company’s management will host an earnings conference call on Monday, May 20, 2024, at 8:00 PM U.S. Eastern Time, Tuesday, May 21, 2024, at 4:00 AM Dubai Time, or Tuesday, May 21, 2024, at 8:00 AM Beijing/Hong Kong time.

Dial-in details for the earnings conference call are as follows:

|

|

United States Toll Free: |

+1-888-317-6003 |

International: |

+1-412-317-6061 |

United Arab Emirates Toll Free: |

80-003-570-3589 |

Mainland China Toll Free: |

400-120-6115 |

Hong Kong, China Toll Free: |

800-963-976 |

Access Code: |

3921468 |

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.yalla.com.

A replay of the conference call will be accessible until May 27, 2024, by dialing the following telephone numbers:

|

|

United States Toll Free: |

+1-877-344-7529 |

International: |

+1-412-317-0088 |

Access Code: |

7146269 |

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with generally accepted accounting principles in the United States, or GAAP, this press release presents non-GAAP financial measures, namely non-GAAP operating income, non-GAAP net income, non-GAAP net margin and non-GAAP basic and diluted earnings per ordinary share, as supplemental measures to review and assess the Company’s operating performance. The presentation of the non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. We define non-GAAP operating income as operating income excluding share-based compensation. We define non-GAAP net income as net income excluding share-based compensation. We define non-GAAP net margin as non-GAAP net income as a percentage of revenues. We define non-GAAP net income attributable to Yalla Group Limited’s shareholders as net income attributable to Yalla Group Limited’s shareholders, excluding share-based compensation. We define non-GAAP earnings per ordinary share as non-GAAP net income attributable to Yalla Group Limited’s shareholders, divided by the weighted average number of basic and diluted shares outstanding.

By excluding the impact of share-based compensation expenses, which are non-cash charges, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance and future prospects. Investors can better understand the Company’s operating and financial performance, compare business trends among different reporting periods on a consistent basis and assess its core operating results, as they exclude share-based compensation expenses, which are not expected to result in cash payments. The Company also believes that the non-GAAP financial measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measure is not defined under U.S. GAAP and is not presented in accordance with U.S. GAAP. The non-GAAP financial measure has limitations as analytical tools. One of the key limitations of using the non-GAAP financial measures is that they do not reflect all items of income and expense that affect the Company’s operations. Share-based compensation has been and may continue to be incurred in the Company’s business and is not reflected in the presentation of non-GAAP financial measures. Further, the non-GAAP financial measure may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited.

The Company compensates for these limitations by providing the relevant disclosure of its non-GAAP financial measures in the reconciliations to the nearest U.S. GAAP performance measures, all of which should be considered when evaluating its performance. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations of GAAP and non-GAAP results are set forth at the end of this press release.

About Yalla Group Limited

Yalla Group Limited is the largest MENA-based online social networking and gaming company, in terms of revenue in 2022. The Company operates two flagship mobile applications, Yalla, a voice-centric group chat platform, and Yalla Ludo, a casual gaming application featuring online versions of board games, popular in MENA, with in-game voice chat and localized Majlis functionality. Building on the success of Yalla and Yalla Ludo, the Company continues to add engaging new content, creating a regionally-focused, integrated ecosystem dedicated to fulfilling MENA users’ evolving online social networking and gaming needs. Through its holding subsidiary, Yalla Game Limited, the Company has expanded its capabilities in mid-core and hard-core games in the MENA region, leveraging its local expertise to bring innovative gaming content to its users. In addition, the growing Yalla ecosystem includes YallaChat, an IM product tailored for Arabic users, WeMuslim, a product that supports Arabic users in observing their customs, and casual games such as Yalla Baloot and 101 Okey Yalla, developed to sustain vibrant local gaming communities in MENA. Yalla is also actively exploring outside of MENA with Yalla Parchis, a Ludo game designed for the South American markets. Yalla’s mobile applications deliver a seamless experience that fosters a sense of loyalty and belonging, establishing highly devoted and engaged user communities through close attention to detail and localized appeal that profoundly resonates with users.

For more information, please visit: https://ir.yalla.com.

Safe Harbor Statement

This press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to” and similar statements. Statements that are not historical facts, including statements about Yalla Group Limited’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. Further information regarding these and other risks is included in Yalla Group Limited’s filings with the SEC. All information provided in this press release is as of the date of this press release, and Yalla Group Limited does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

Yalla Group Limited

Investor Relations

Kerry Gao - IR Director

Tel: +86-571-8980-7962

Email: ir@yalla.com

Piacente Financial Communications

Jenny Cai

Tel: +86-10-6508-0677

Email: yalla@tpg-ir.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

Email: yalla@tpg-ir.com

SOURCE Yalla Group Limited

YALLA GROUP LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

December 31,

2023 |

|

|

March 31,

2024 |

|

|

|

US$ |

|

|

US$ |

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

311,883,463 |

|

|

|

296,550,420 |

|

Restricted cash |

|

|

423,567 |

|

|

|

422,833 |

|

Term deposits |

|

|

213,105,501 |

|

|

|

175,330,585 |

|

Short-term investments |

|

|

10,282,329 |

|

|

|

10,394,214 |

|

Amounts due from a related party |

|

|

109,507 |

|

|

|

— |

|

Prepayments and other current assets |

|

|

33,340,602 |

|

|

|

36,199,326 |

|

Total current assets |

|

|

569,144,969 |

|

|

|

518,897,378 |

|

Non-current assets |

|

|

|

|

|

|

Property and equipment, net |

|

|

1,583,604 |

|

|

|

1,346,083 |

|

Intangible asset, net |

|

|

1,133,715 |

|

|

|

1,074,036 |

|

Operating lease right-of-use assets |

|

|

2,382,026 |

|

|

|

2,114,623 |

|

Long-term investments |

|

|

51,692,218 |

|

|

|

131,516,864 |

|

Other assets |

|

|

13,015,729 |

|

|

|

12,993,165 |

|

Total non-current assets |

|

|

69,807,292 |

|

|

|

149,044,771 |

|

Total assets |

|

|

638,952,261 |

|

|

|

667,942,149 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

|

928,055 |

|

|

|

867,064 |

|

Deferred revenue |

|

|

46,558,571 |

|

|

|

49,336,350 |

|

Operating lease liabilities, current |

|

|

1,153,691 |

|

|

|

1,107,495 |

|

Amounts due to a related party |

|

|

— |

|

|

|

47,036 |

|

Accrued expenses and other current liabilities |

|

|

26,694,999 |

|

|

|

18,171,848 |

|

Total current liabilities |

|

|

75,335,316 |

|

|

|

69,529,793 |

|

Non-current liabilities |

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

|

949,970 |

|

|

|

466,142 |

|

Total non-current liabilities |

|

|

949,970 |

|

|

|

466,142 |

|

Total liabilities |

|

|

76,285,286 |

|

|

|

69,995,935 |

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

Shareholders’ equity of Yalla Group Limited |

|

|

|

|

|

|

Class A Ordinary Shares |

|

|

13,778 |

|

|

|

13,811 |

|

Class B Ordinary Shares |

|

|

2,473 |

|

|

|

2,473 |

|

Additional paid-in capital |

|

|

313,306,523 |

|

|

|

317,571,228 |

|

Treasury stock |

|

|

(35,527,305 |

) |

|

|

(35,527,305 |

) |

Accumulated other comprehensive loss |

|

|

(2,341,740 |

) |

|

|

(2,415,420 |

) |

Retained earnings |

|

|

292,223,525 |

|

|

|

323,817,628 |

|

Total shareholders’ equity of Yalla Group Limited |

|

|

567,677,254 |

|

|

|

603,462,415 |

|

Non-controlling interests |

|

|

(5,010,279 |

) |

|

|

(5,516,201 |

) |

Total equity |

|

|

562,666,975 |

|

|

|

597,946,214 |

|

Total liabilities and equity |

|

|

638,952,261 |

|

|

|

667,942,149 |

|

YALLA GROUP LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31,

2023 |

|

|

December 31,

2023 |

|

|

March 31,

2024 |

|

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

Revenues |

|

|

73,518,613 |

|

|

|

80,925,228 |

|

|

|

78,728,578 |

|

Costs and expenses |

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

(27,852,477 |

) |

|

|

(30,571,656 |

) |

|

|

(28,571,261 |

) |

Selling and marketing expenses |

|

|

(11,354,975 |

) |

|

|

(10,356,555 |

) |

|

|

(8,099,936 |

) |

General and administrative expenses |

|

|

(10,164,394 |

) |

|

|

(11,300,036 |

) |

|

|

(6,647,892 |

) |

Technology and product development expenses |

|

|

(7,411,188 |

) |

|

|

(5,411,303 |

) |

|

|

(6,262,254 |

) |

Total costs and expenses |

|

|

(56,783,034 |

) |

|

|

(57,639,550 |

) |

|

|

(49,581,343 |

) |

Operating income |

|

|

16,735,579 |

|

|

|

23,285,678 |

|

|

|

29,147,235 |

|

Interest income |

|

|

3,118,289 |

|

|

|

6,479,095 |

|

|

|

6,644,884 |

|

Government grants |

|

|

177,659 |

|

|

|

154,908 |

|

|

|

67,332 |

|

Investment income (loss) |

|

|

491,889 |

|

|

|

271,566 |

|

|

|

(1,288,127 |

) |

Income before income taxes |

|

|

20,523,416 |

|

|

|

30,191,247 |

|

|

|

34,571,324 |

|

Income tax expense |

|

|

(616,358 |

) |

|

|

(539,276 |

) |

|

|

(3,483,208 |

) |

Net income |

|

|

19,907,058 |

|

|

|

29,651,971 |

|

|

|

31,088,116 |

|

Net loss attributable to non-controlling interests |

|

|

554,591 |

|

|

|

1,533,491 |

|

|

|

505,987 |

|

Net income attributable to Yalla Group

Limited’s shareholders |

|

|

20,461,649 |

|

|

|

31,185,462 |

|

|

|

31,594,103 |

|

Earnings per ordinary share |

|

|

|

|

|

|

|

|

|

——Basic |

|

|

0.13 |

|

|

|

0.20 |

|

|

|

0.20 |

|

——Diluted |

|

|

0.11 |

|

|

|

0.17 |

|

|

|

0.17 |

|

Weighted average number of shares

outstanding used in computing earnings

per ordinary share |

|

|

|

|

|

|

|

|

|

——Basic |

|

|

157,976,350 |

|

|

|

159,656,332 |

|

|

|

160,379,455 |

|

——Diluted |

|

|

180,517,715 |

|

|

|

182,819,044 |

|

|

|

183,260,168 |

|

Share-based compensation was allocated in cost of revenues, selling and marketing expenses, general and administrative expenses and technology and product development expenses as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31,

2023 |

|

|

December 31,

2023 |

|

|

March 31,

2024 |

|

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

Cost of revenues |

|

|

1,030,249 |

|

|

|

1,479,600 |

|

|

|

1,902,717 |

|

Selling and marketing expenses |

|

|

971,335 |

|

|

|

692,727 |

|

|

|

700,115 |

|

General and administrative expenses |

|

|

3,245,278 |

|

|

|

1,417,835 |

|

|

|

1,333,314 |

|

Technology and product development expenses |

|

|

349,277 |

|

|

|

198,803 |

|

|

|

262,731 |

|

Total share-based compensation expenses |

|

|

5,596,139 |

|

|

|

3,788,965 |

|

|

|

4,198,877 |

|

YALLA GROUP LIMITED

RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31,

2023 |

|

|

December 31,

2023 |

|

|

March 31,

2024 |

|

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

Operating income |

|

|

16,735,579 |

|

|

|

23,285,678 |

|

|

|

29,147,235 |

|

Share-based compensation expenses |

|

|

5,596,139 |

|

|

|

3,788,965 |

|

|

|

4,198,877 |

|

Non-GAAP operating income |

|

|

22,331,718 |

|

|

|

27,074,643 |

|

|

|

33,346,112 |

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

19,907,058 |

|

|

|

29,651,971 |

|

|

|

31,088,116 |

|

Share-based compensation expenses,

net of tax effect of nil |

|

|

5,596,139 |

|

|

|

3,788,965 |

|

|

|

4,198,877 |

|

Non-GAAP net income |

|

|

25,503,197 |

|

|

|

33,440,936 |

|

|

|

35,286,993 |

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Yalla

Group Limited’s shareholders |

|

|

20,461,649 |

|

|

|

31,185,462 |

|

|

|

31,594,103 |

|

Share-based compensation expenses,

net of tax effect of nil |

|

|

5,596,139 |

|

|

|

3,788,965 |

|

|

|

4,198,877 |

|

Non-GAAP net income attributable to

Yalla Group Limited’s shareholders |

|

|

26,057,788 |

|

|

|

34,974,427 |

|

|

|

35,792,980 |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP earnings per ordinary share |

|

|

|

|

|

|

|

|

|

——Basic |

|

|

0.16 |

|

|

|

0.22 |

|

|

|

0.22 |

|

——Diluted |

|

|

0.14 |

|

|

|

0.19 |

|

|

|

0.20 |

|

Weighted average number of shares

outstanding used in computing earnings

per ordinary share |

|

|

|

|

|

|

|

|

|

——Basic |

|

|

157,976,350 |

|

|

|

159,656,332 |

|

|

|

160,379,455 |

|

——Diluted |

|

|

180,517,715 |

|

|

|

182,819,044 |

|

|

|

183,260,168 |

|

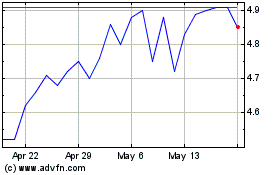

Yalla (NYSE:YALA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Yalla (NYSE:YALA)

Historical Stock Chart

From Feb 2024 to Feb 2025