Aecon Group Inc. (TSX: ARE) (“Aecon” or the “Company”) today

reported results for the fourth quarter and year-end 2024 including

full year revenue of $4.2 billion and backlog of $6.7 billion at

December 31, 2024.

“Driven by robust year-end backlog, significant

new contract awards, contributions from strategic acquisitions,

solid recurring revenue, and a strong bid pipeline, revenue in 2025

is expected to be stronger than 2024,” said Jean-Louis Servranckx,

President and Chief Executive Officer, Aecon Group Inc. “Aecon is

actively engaged in delivering several major long-term projects

under more collaborative models and is focused on advancing them to

the construction phase in 2025 and 2026. Aecon will maintain a

disciplined capital allocation approach and remains focused on

strategic investments in its operations to support access to new

markets.”

HIGHLIGHTS

All quarterly financial information contained in

this news release is unaudited.

- Revenue for the

year ended December 31, 2024 of $4,243 million was $401 million, or

9%, lower compared to 2023. The lower revenue was primarily driven

by decreased activity on mainline pipeline work in industrial

operations following the achievement of substantial completion on a

large project in 2023, and in urban transportation solutions from a

decrease in light rail transit (“LRT”) work as three LRT projects

near completion.

- Operating loss

of $60.1 million (operating margin(4) of -1.4%) compared to

operating profit of $240.9 million in 2023 (operating margin of

5.2%). Lower year-over-year operating profit was driven by a

decrease in other income of $186.2 million primarily due to a lower

year-over-year gain related to the sale of a 49.9% interest in the

Bermuda International Airport concessionaire (“Skyport”) of $133.1

million and a lower gain on the sale of Aecon Transportation East

(“ATE”) of $27.5 million. In addition, lower gross profit of $73.1

million contributed to the year-over-year decrease in operating

profit. This decrease was primarily due to lower gross profit

related to the four fixed price legacy projects of $57.6 million

from negative gross profit in 2024 of $272.8 million compared to

negative gross profit in 2023 of $215.2 million. These four fixed

price legacy projects are discussed in Section 5 “Recent

Developments”, Section 10.2 “Contingencies”, and Section 13 “Risk

Factors” in the Company’s December 31, 2024 Management’s

Discussions and Analysis (“MD&A”).

- Adjusted

EBITDA(1)(2) of $82.6 million for the year ended December 31, 2024

(Adjusted EBITDA margin(3) of 1.9%) compared to Adjusted EBITDA of

$143.4 million (Adjusted EBITDA margin of 3.1%) in 2023.

- Loss

attributable to shareholders of $59.5 million (diluted loss per

share of $0.95) for the year ended December 31, 2024 compared to

profit attributable to shareholders of $161.9 million (diluted

earnings per share of $2.10) in 2023.

- Adjusted loss

attributable to shareholders(1)(2) of $61.6 million (diluted

adjusted loss per share(1)(2) of $0.99) for the year ended December

31, 2024 compared to adjusted profit attributable to

shareholders(1)(2) of $160.9 million (diluted adjusted earnings per

share(1)(2) of $2.09) in 2023.

- Reported backlog

at December 31, 2024 of $6,662 million compared to backlog of

$6,157 million at December 31, 2023. New contract awards

of $4,747 million were booked in 2024 compared to $4,505 million in

2023.

- On December 2,

2024, Aecon’s subsidiary, Aecon Utilities Group Inc., acquired

Ainsworth Power Construction, an electrical services and power

systems business unit of Ainsworth Inc.

- On December 17,

2024, Aecon closed the previously disclosed acquisition of United

Engineers & Constructors (“United”).

- On December 23,

2024, Aecon’s common shares were added to the S&P/TSX Composite

Index – the principal benchmark for Canadian equity markets which

includes the largest and most liquid publicly traded companies in

Canada.

- Subsequent to

year-end:

- An Aecon joint

operation was awarded a collaborative contract by Ontario Power

Generation which includes the definition phase work for the retube,

feeder and boiler replacement of Units 5, 6, 7 and 8 at the

Pickering Nuclear Generating Station in Ontario. Aecon holds a 50%

interest in the joint operation and its share of the approximately

$1.1 billion early works portion of the contract was added to its

Construction segment backlog in the fourth quarter of 2024. The

remaining portion of the contract is valued at approximately $1

billion, and Aecon will add its share to backlog in the first

quarter of 2025.

- An Aecon-led

consortium completed the collaborative development phase and

reached commercial close on the Scarborough Subway Extension

Stations, Rail and Systems progressive design-build transit

project. Aecon’s share of the target price contract is valued at

over $2.8 billion and will be added to its backlog in the first

quarter of 2025.

CONSOLIDATED FINANCIAL HIGHLIGHTS(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Year ended |

|

|

|

$ millions (except per share amounts) |

|

December 31 |

|

December 31 |

|

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

1,267.0 |

|

$ |

1,130.2 |

|

$ |

4,242.7 |

|

$ |

4,643.8 |

|

|

|

|

Gross profit |

|

107.2 |

|

|

98.0 |

|

|

182.5 |

|

|

255.6 |

|

|

|

|

Marketing, general and administrative expense |

|

(57.1 |

) |

|

(51.8 |

) |

|

(213.2 |

) |

|

(177.8 |

) |

|

|

|

Income from projects accounted for using the equity method |

|

1.6 |

|

|

5.5 |

|

|

21.2 |

|

|

18.7 |

|

|

|

|

Other income |

|

4.1 |

|

|

2.6 |

|

|

37.3 |

|

|

223.5 |

|

|

|

|

Depreciation and amortization |

|

(26.2 |

) |

|

(14.6 |

) |

|

(87.8 |

) |

|

(79.1 |

) |

|

|

|

Operating profit (loss) |

|

29.6 |

|

|

39.6 |

|

|

(60.1 |

) |

|

240.9 |

|

|

|

|

Finance income |

|

1.9 |

|

|

2.2 |

|

|

8.6 |

|

|

7.7 |

|

|

|

|

Finance cost |

|

(8.3 |

) |

|

(21.4 |

) |

|

(25.1 |

) |

|

(71.0 |

) |

|

|

|

Profit (loss) before income taxes |

|

23.1 |

|

|

20.3 |

|

|

(76.5 |

) |

|

177.5 |

|

|

|

|

Income tax (expense) recovery |

|

(9.0 |

) |

|

(10.7 |

) |

|

17.1 |

|

|

(15.7 |

) |

|

|

|

Profit (loss) |

|

14.1 |

|

|

9.7 |

|

|

(59.4 |

) |

|

161.9 |

|

|

|

|

Non-controlling interests |

|

(0.1 |

) |

|

- |

|

|

(0.1 |

) |

|

- |

|

|

|

|

Profit (loss) attributable to shareholders |

$ |

14.0 |

|

$ |

9.7 |

|

$ |

(59.5 |

) |

$ |

161.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

margin(4) |

|

8.5 |

% |

|

8.7 |

% |

|

4.3 |

% |

|

5.5 |

% |

|

|

|

MG&A as a percent of

revenue(4) |

|

4.5 |

% |

|

4.6 |

% |

|

5.0 |

% |

|

3.8 |

% |

|

|

|

Adjusted

EBITDA(2) |

$ |

76.3 |

|

$ |

70.2 |

|

$ |

82.6 |

|

$ |

143.4 |

|

|

|

|

Adjusted EBITDA

margin(3) |

|

6.0 |

% |

|

6.2 |

% |

|

1.9 |

% |

|

3.1 |

% |

|

|

|

Operating

margin(4) |

|

2.3 |

% |

|

3.5 |

% |

|

(1.4 |

)% |

|

5.2 |

% |

|

|

|

Adjusted profit (loss) attributable to

shareholders(2) |

$ |

16.3 |

|

$ |

7.8 |

|

$ |

(61.6 |

) |

$ |

160.9 |

|

|

|

|

Earnings (loss) per share – basic |

$ |

0.22 |

|

$ |

0.16 |

|

$ |

(0.95 |

) |

$ |

2.62 |

|

|

|

|

Earnings (loss) per share – diluted |

$ |

0.21 |

|

$ |

0.15 |

|

$ |

(0.95 |

) |

$ |

2.10 |

|

|

|

|

Adjusted earnings (loss) per share –

basic(2) |

$ |

0.26 |

|

$ |

0.13 |

|

$ |

(0.99 |

) |

$ |

2.61 |

|

|

|

|

Adjusted earnings (loss) per share –

diluted(2) |

$ |

0.25 |

|

$ |

0.12 |

|

$ |

(0.99 |

) |

$ |

2.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog (at end of period) |

|

|

|

|

$ |

6,662 |

|

$ |

6,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This press release presents certain

non-GAAP and supplementary financial measures, as well as non-GAAP

ratios to assist readers in understanding the Company's performance

(GAAP refers to Canadian Generally Accepted Accounting

Principles). Further details on these measures and ratios are

included in the “Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press

release.(2) This is a non-GAAP financial measure. Refer to the

“Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press release

for more information on each non-GAAP financial

measure.(3) This is a non-GAAP ratio. Refer to the “Non-GAAP

and Supplementary Financial Measures” section of this press release

for more information on each non-GAAP ratio.(4) This is a

supplementary financial measure. Refer to the “Non-GAAP and

Supplementary Financial Measures” section of this press release for

more information on each supplementary financial measure.

Revenue for the year ended December 31,

2024 of $4,243 million was $401 million, or 9%, lower

compared to 2023. Revenue was lower in the Construction segment

($352 million) driven by lower revenue in industrial

($460 million), urban transportation solutions

($198 million), and civil operations ($14 million),

partially offset by higher revenue in nuclear ($282 million)

and utilities operations ($38 million). This lower revenue was

primarily driven by decreased activity on mainline pipeline work in

industrial operations following the achievement of substantial

completion on a large project in 2023, and in urban transportation

solutions from a decrease in LRT work as three LRT projects near

completion. In the Concessions segment, revenue was

$61 million lower in 2024 compared to the prior year primarily

due to the use of the equity method of accounting in 2024 for

Aecon’s 50.1% retained interest in Skyport following the sale of a

49.9% interest in Skyport in the third quarter of 2023. These

amounts were partially offset by higher revenue in Corporate and

Other after inter-segment revenue eliminations

($12 million).

Operating loss of $60.1 million for the

year ended December 31, 2024 compares to operating profit of

$240.9 million for the year ended December 31, 2023, a

decrease of $301.0 million.

Lower year-over-year operating profit was driven

by a decrease in other income of $186.2 million. This decrease

was primarily due to a lower year-over-year gain related to the

sale of a 49.9% interest in Skyport of $133.1 million (a gain

of $5.9 million from incremental proceeds in 2024 compared to

a gain on sale of $139.0 million in 2023) and a lower gain on

the sale of ATE of $27.5 million (a gain of $9.0 million

from incremental proceeds in 2024 compared to a gain on sale of

$36.5 million in 2023). Also contributing to the decrease in

other income were lower gains on the sale of property, buildings,

and equipment of $27.7 million and a lower fair value

remeasurement gain on financial instruments of $0.2 million,

partially offset by higher foreign exchange gains of

$2.3 million.

In addition to the above noted decrease in other

income, lower gross profit of $73.1 million also contributed

to the year-over-year decrease in operating profit. In the

Construction segment, gross profit decreased by $49.8 million.

This decrease was primarily due to lower gross profit related to

the four fixed price legacy projects of $57.6 million from

negative gross profit in 2024 of $272.8 million compared to

negative gross profit in 2023 of $215.2 million. These four

fixed price legacy projects are discussed in Section 5 “Recent

Developments”, Section 10.2 “Contingencies”, and Section 13 “Risk

Factors” in the Company’s December 31, 2024 MD&A. Partially

offsetting the impact of these four fixed price legacy projects in

2024 was higher gross profit in the balance of the Construction

segment of $7.8 million, driven by higher volume and gross

profit margin in nuclear and utilities operations, as well as

higher gross profit in industrial operations, partially offset by

lower gross profit margin in civil operations and a volume driven

decrease in gross profit in urban transportation solutions. In the

Concessions segment, gross profit in 2024 decreased by

$33.9 million compared to 2023 primarily from the use of

the equity method of accounting in 2024 for Aecon’s 50.1% retained

interest in Skyport following the sale of a 49.9% interest in this

project in the third quarter of 2023, while in Corporate and Other,

gross profit increased by $10.7 million as a result of higher

inter-segment cost recoveries from projects.

Marketing, general and administrative expense

(“MG&A”) increased in 2024 by $35.4 million compared to

2023. The increase in MG&A was primarily due to higher

personnel costs reflecting more typical levels in MG&A, ongoing

investments to support growth and acquisitions, particularly in

utilities operations with the expansion of its U.S. operations and

the Xtreme Powerline Construction (“Xtreme”) acquisition in 2024,

and from higher acquisition related transaction costs in 2024

($9.9 million). This higher MG&A in 2024, was partially

offset by lower MG&A related to the ATE operations which was

sold in the second quarter of 2023 ($5.9 million). MG&A as

a percentage of revenue increased from 3.8% in 2023 to 5.0% in

2024.

Reported backlog at December 31, 2024 of

$6,662 million compares to backlog of $6,157 million at

December 31, 2023. New contract awards of $4,747 million

were booked in 2024 compared to $4,505 million in 2023. The

reported 2024 awards include $275 million of backlog acquired at

the time the acquisitions of United, Ainsworth Power Construction,

and Xtreme closed.

REPORTING SEGMENTS

Aecon reports its financial performance on the

basis of two segments: Construction and Concessions, which are

described in the Company’s December 31, 2024 MD&A.

CONSTRUCTION SEGMENT

Financial Highlights

|

|

|

|

Three months ended |

|

Year ended |

|

|

|

$ millions |

|

December 31 |

|

December 31 |

|

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

1,252.5 |

|

$ |

1,127.2 |

|

$ |

4,220.5 |

|

$ |

4,572.5 |

|

|

|

|

Gross profit |

$ |

96.1 |

|

$ |

97.6 |

|

$ |

173.6 |

|

$ |

223.4 |

|

|

|

|

Adjusted

EBITDA(1) |

$ |

65.0 |

|

$ |

65.0 |

|

$ |

34.2 |

|

$ |

99.4 |

|

|

|

|

Operating profit (loss) |

$ |

33.0 |

|

$ |

49.1 |

|

$ |

(55.0 |

) |

$ |

59.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

margin(3) |

|

7.7 |

% |

|

8.7 |

% |

|

4.1 |

% |

|

4.9 |

% |

|

|

|

Adjusted EBITDA

margin(2) |

|

5.2 |

% |

|

5.8 |

% |

|

0.8 |

% |

|

2.2 |

% |

|

|

|

Operating

margin(3) |

|

2.6 |

% |

|

4.4 |

% |

|

(1.3 |

)% |

|

1.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog (at end of period) |

|

|

|

|

$ |

6,551 |

|

$ |

6,053 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This is a non-GAAP financial measure.

Refer to the “Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press release

for more information on each non-GAAP financial

measure.(2) This is a non-GAAP ratio. Refer to the “Non-GAAP

and Supplementary Financial Measures” and “Reconciliations and

Calculations” sections of this press release for more information

on each non-GAAP ratio.(3) This is a supplementary financial

measure. Refer to the “Non-GAAP and Supplementary Financial

Measures” section of this press release for more information on

each supplementary financial measure.

For the year ended December 31, 2024, revenue in

the Construction segment of $4,221 million was $352 million, or 8%,

lower than in 2023. The largest decrease in revenue occurred in

industrial ($460 million) driven by decreased activity on mainline

pipeline work following the achievement of substantial completion

on a large project in the third quarter of 2023, partially offset

by a higher volume of field construction work at wastewater

treatment and industrial facilities in western Canada in 2024, in

urban transportation solutions ($198 million) primarily from a

decrease in LRT work in Ontario and Québec as three LRT projects

near completion, and in civil operations ($14 million) largely from

a decrease in road building construction work in eastern Canada

after the sale of ATE in the second quarter of 2023 of $51 million,

partially offset in the balance of civil operations by an increase

in roadbuilding construction work in western Canada. These

decreases were partially offset by higher revenue in nuclear ($282

million) driven by an increased volume of refurbishment work at

nuclear generating stations located in Ontario and the U.S., and in

utilities operations ($38 million) primarily from an increased

volume of electrical transmission work in the U.S. and an increase

in battery energy storage system work, partially offset by a

decreased volume of telecommunications and gas distribution

work.

Operating loss in the Construction segment of

$55.0 million in 2024 compares to an operating profit of $59.0

million in 2023 for a year-over-year decrease of $114.0 million.

The largest driver of the decrease in operating profit was negative

gross profit from the four fixed price legacy projects of $272.8

million in 2024 compared to negative gross profit of $215.2 million

in 2023 for a net negative year-over-year impact on operating

profit of $57.6 million. The four fixed price legacy projects are

discussed in Section 5 “Recent Developments”, Section 10.2

“Contingencies”, and Section 13 “Risk Factors” in the December 31,

2024 MD&A. In the balance of the Construction segment,

operating profit was lower by $56.4 million of which $31.6 million

was largely in civil operations and urban transportation solutions,

and partially offset by higher operating profit in nuclear

operations from higher volume and gross profit margin, and in

industrial due to higher gross profit margin. Other items

contributing to the reduction in operating profit include an

increase in acquisition-related transaction costs that were

expensed in the year ($9.9 million largely in utilities), an

increase in amortization expense related to acquisition-related

intangible assets from the Xtreme, Ainsworth Power Construction,

and United transactions in 2024 of $5.3 million and a decrease in

other income of $9.6 million, driven by lower gains on the sale of

property, buildings, and equipment of $10.9 million, primarily in

utilities operations.

Construction segment backlog at December 31,

2024 was $6,551 million, which was $498 million higher than the

same time last year. Backlog increased year-over-year in nuclear

operations ($493 million), industrial operations ($83 million), and

urban transportation solutions ($139 million), and decreased in

civil ($146 million) and utilities operations ($71 million). New

contract awards in 2024 totaled $4,718 million compared to $4,428

million in 2023. The reported awards in 2024 include backlog of

$275 million acquired at the time the acquisitions of United,

Ainsworth Power Construction, and Xtreme closed. In 2024, joint

operations in which Aecon is a participant were awarded the

contracts to replace steam generators at three units at Bruce

Nuclear Generating Station in Ontario, and a contract for the

definition phase of refurbishment work at four units at the

Pickering Nuclear Generating Station in Ontario. As well, a

consortium, of which Aecon is a participant, was awarded a contract

to design and build the Surrey Langley SkyTrain Stations project in

British Columbia.

CONCESSIONS SEGMENT

Financial Highlights

|

|

|

|

Three months ended |

|

Year ended |

|

|

|

$

millions |

|

December 31 |

|

December 31 |

|

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

4.2 |

$ |

3.0 |

$ |

12.0 |

|

$ |

73.5 |

|

|

|

Gross

profit |

$ |

0.6 |

$ |

1.0 |

$ |

(1.5 |

) |

$ |

32.4 |

|

|

|

Income from projects

accounted for using the equity method |

$ |

0.8 |

$ |

2.6 |

$ |

20.8 |

|

$ |

15.8 |

|

|

|

Adjusted

EBITDA(1) |

$ |

17.4 |

$ |

19.7 |

$ |

86.9 |

|

$ |

89.8 |

|

|

|

Operating

profit |

$ |

1.6 |

$ |

4.6 |

$ |

24.2 |

|

$ |

174.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Backlog (at end of

period) |

|

|

|

|

$ |

111 |

|

$ |

104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) This is a non-GAAP financial measure. Refer to the

“Non-GAAP and Supplementary Financial Measures” and

“Reconciliations and Calculations” sections of this press release

for more information on each non-GAAP financial measure.

Aecon currently holds a 50.1% interest in

Skyport, the concessionaire responsible for the Bermuda airport’s

operations, maintenance, and commercial functions, and the entity

that will manage and coordinate the overall delivery of the Bermuda

International Airport Redevelopment Project over a 30-year

concession term that commenced in 2017. Aecon’s participation in

Skyport is accounted for using the equity method. On September 20,

2023, Aecon sold a 49.9% interest in Skyport to Connor, Clark &

Lunn Infrastructure with Aecon retaining the management contract

for the airport. Prior to this transaction, Aecon’s participation

in Skyport was 100% consolidated and, as such, was accounted for in

the consolidated financial statements by reflecting, line by line,

the assets, liabilities, revenue and expenses of Skyport. Aecon’s

concession participation in the Eglinton Crosstown LRT, Finch West

LRT, Gordie Howe International Bridge, Waterloo LRT, and the GO

Expansion On-Corridor Works projects are joint ventures that are

also accounted for using the equity method.

For the year ended December 31, 2024, revenue in

the Concessions segment of $12 million was $61 million lower than

in 2023. The decrease was primarily due to lower reported revenue

from Skyport as a result of the commencement of the equity method

of accounting for the Company’s retained 50.1% interest in Skyport

following the above noted sale of a 49.9% interest in Skyport in

the third quarter of 2023.

Operating profit in the Concessions segment of

$24.2 million for the year ended December 31, 2024 decreased by

$149.9 million compared to an operating profit of $174.1 million in

2023. The lower operating profit was primarily due to gains related

to a sale in the third quarter of 2023 of a 49.9% interest in the

Bermuda International Airport concessionaire which resulted in a

year-over-year decrease in gains on sale of $133.1 million. In the

balance of the Concessions segment, operating profit in 2024

decreased by $16.9 million. Year-over-year reported operating

profit from the ongoing operations at Skyport was negatively

impacted by a 49.9% reduction in Aecon’s ownership interest in

Skyport and from the use of the equity method of accounting in 2024

where operating results for Aecon’s interest in Skyport are

reported net of financing costs and income taxes. These

unfavourable impacts were partially offset by one-time recoveries

in Skyport in 2024 of $5.9 million.

Except for Operations and Maintenance

(“O&M”) activities under contract for the next five years and

that can be readily quantified, Aecon does not include in its

reported backlog expected revenue from concession agreements. As

such, while Aecon expects future revenue from its concession

assets, no concession backlog, other than from such O&M

activities for the next five years, is reported.

DIVIDEND

Aecon's Board of Directors approved the

quarterly dividend of 19 cents per share. The dividend will be paid

on April 2, 2025, to shareholders of record on March 21, 2025.

Unless indicated otherwise, all common share dividends paid by

Aecon to shareholders are designated as “eligible” dividends for

the purpose of the Income Tax Act (Canada) and any similar

provincial legislation.

OUTLOOK

Revenue in 2025 is expected to be stronger than

2024 due to an opening backlog of $6.7 billion combined with recent

new awards in the first quarter, the impact of business

acquisitions completed in the second half of 2024, solid recurring

revenue, and a strong bid pipeline. Revenue growth is expected in

most of the Construction sectors, as progressive design-build or

alliance model projects move into the construction phase in 2025

and 2026.

In the Construction segment, demand for Aecon’s

services across Canada, as well as increasingly in select U.S. and

international markets, continues to be strong. Development phase

work is ongoing in consortiums in which Aecon is a participant to

deliver several significant long-term progressive design-build

projects of various sizes. In the first quarter of 2025, an

Aecon-led consortium completed the collaborative development phase

and reached commercial close on the Scarborough Subway Extension

progressive design-build transit project. The implementation phase

of the project will now commence under a target price contract.

Aecon’s share of the contract is valued at $2.8 billion and will be

added to its Construction segment backlog in the first quarter of

2025 and will no longer be in recurring revenue. As well, other

projects currently being delivered using progressive design-build

or alliance models and projects are also expected to move into

construction in 2025 and 2026. In addition, Aecon and its

consortium partner were recently awarded a collaborative contract

by Ontario Power Generation which includes the definition phase

work for the retube, feeder and boiler replacement of Units 5, 6, 7

and 8 at the Pickering Nuclear Generating Station in Ontario. Aecon

holds a 50% interest in this joint operation and its share of the

approximately $1.1 billion early works portion of the contract was

added to its Construction segment backlog in the fourth quarter of

2024. The remaining portion of the contract is valued at

approximately $1 billion, and Aecon will add its share to backlog

in the first quarter of 2025.

In the Concessions segment, there are several

opportunities to add to the existing portfolio of Canadian and

international concessions in the next 12 to 24 months, including

projects with private sector clients that support a collective

focus on sustainability and the transition to a net-zero economy,

as well as private sector development expertise and investment to

support aging infrastructure, mobility, connectivity, and

population growth. An Aecon-led consortium that was selected by the

U.S. Virgin Islands Port Authority to redevelop the Cyril E. King

Airport in St. Thomas and the Henry E. Rohlsen Airport in St. Croix

under a collaborative Design, Build, Finance, Operate and Maintain

Public-Private Partnership model is expected to reach financial

close in 2025.

Results in recent years were negatively impacted

by the four legacy projects, however, the recent Coastal GasLink

Pipeline settlement along with the additional write-downs on the

fixed price legacy projects in 2024 are anticipated to lead to

improved profitability and margin predictability, especially as the

remaining three projects move closer to substantial completion.

Until the remaining three projects are complete and the related

claims have been resolved, there is a risk that this could also

occur in future periods – see Section 5 “Recent Developments”,

Section 10.2 “Contingencies”, and Section 13 “Risk Factors” in the

December 31, 2024 MD&A regarding the risk on certain large

fixed price legacy projects entered into in 2018 or earlier by

joint operations in which Aecon is a participant. As such, the

completion and satisfactory resolution of claims on the remaining

three legacy projects with the respective clients remains a

critical focus for the Company and its partners. Management will

also be monitoring the impact of announced or threatened tariffs or

non-tariff measures on the Company’s operations. The introduction

of these measures could cause increased purchased material costs

and/or reduced availability.

Aecon plans to maintain a disciplined capital

allocation approach focused on long-term shareholder value through

acquisitions and divestitures, organic growth, dividends, capital

investments, and common share buybacks on an opportunistic basis.

Aecon is also focused on making strategic investments in its

operations to support access and entry into new markets and

increase operational effectiveness.

Capital expenditures in 2025 are expected to be modestly higher

than in 2024. The Company has no debt or working capital credit

facility maturities until 2027, except equipment loans and leases

in the normal course.

CONSOLIDATED RESULTS

The consolidated results for the three months

and years ended December 31, 2024 and 2023 are available at the end

of this news release.

CONSOLIDATED BALANCE SHEET

|

|

|

December 31 |

|

December 31 |

|

$ thousands |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash |

$ |

438,025 |

$ |

645,784 |

|

Other current assets |

|

1,790,589 |

|

1,827,472 |

|

Property, plant and equipment |

|

360,022 |

|

251,899 |

|

Other long-term assets |

|

637,588 |

|

470,473 |

|

Total Assets |

$ |

3,226,224 |

$ |

3,195,628 |

|

|

|

|

|

|

|

Current portion of long-term debt - recourse |

$ |

40,765 |

$ |

42,608 |

|

Preferred Shares of Aecon Utilities |

|

160,300 |

|

157,110 |

|

Other current liabilities |

|

1,742,363 |

|

1,583,549 |

|

Long-term debt - recourse |

110,804 |

106,770 |

|

Other long-term liabilities |

|

209,556 |

|

241,265 |

|

|

|

|

|

|

|

Equity |

|

962,436 |

|

1,064,326 |

|

Total Liabilities and Equity |

$ |

3,226,224 |

$ |

3,195,628 |

CONFERENCE CALL

A conference call and live webcast has been

scheduled for 9 a.m. (Eastern Time) on Thursday, March 6, 2025. A

live webcast of the conference call can be accessed using this link

and will be available at www.aecon.com/InvestorCalendar.

Participants can also dial-in to the conference

call and pre-register using this link. After registering, an email

will be sent, including dial-in details and a unique access code

required to join the live call. Please ensure you have registered

at least 15 minutes prior to the conference call time.

An accompanying presentation of the fourth

quarter and year-end 2024 financial results will also be available

after market close on March 5, 2025 at www.aecon.com/investing. For

those unable to attend, a replay will be available within one hour

following the live webcast and conference call at the same webcast

link above.

AECON 2025 ANNUAL MEETING OF

SHAREHOLDERS

Aecon’s Annual Meeting of Shareholders will be

held on Tuesday, June 3, 2025. Additional details will be set out

in the Notice of Annual Meeting of Shareholders and Management

Information Circular which will be filed on SEDAR+ prior to the

meeting.

ABOUT AECON

Aecon Group Inc. (TSX: ARE) is a North American

construction and infrastructure development company with global

experience. Aecon delivers integrated solutions to private and

public-sector clients through its Construction segment in the

Civil, Urban Transportation, Nuclear, Utility and Industrial

sectors, and provides project development, financing, investment,

management, and operations and maintenance services through its

Concessions segment. Join our online community on X, LinkedIn,

Facebook, and Instagram @AeconGroupInc.

For further

information:

Adam BorgattiSVP, Corporate Development and Investor

Relations416-297-2600ir@aecon.com

Nicole CourtVice President, Corporate

Affairs416-297-2600corpaffairs@aecon.com

NON-GAAP AND SUPPLEMENTARY FINANCIAL

MEASURES

The press release presents certain non-GAAP and

supplementary financial measures, as well as non-GAAP ratios to

assist readers in understanding the Company’s performance (“GAAP”

refers to IFRS Accounting Standards). These measures do not have

any standardized meaning and therefore are unlikely to be

comparable to similar measures presented by other issuers and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with GAAP.

Throughout this press release, the following

terms are used, which do not have a standardized meaning under

GAAP.

Non-GAAP Financial Measures

A non-GAAP financial measure: (a) depicts the

historical or expected future financial performance, financial

position or cash flow of the Company; (b) with respect to its

composition, excludes an amount that is included in, or includes an

amount that is excluded from, the composition of the most

comparable financial measure presented in the primary consolidated

financial statements; (c) is not presented in the financial

statements of the Company; and (d) is not a ratio.

Non-GAAP financial measures and ratios presented and discussed

in this press release are as follows:

- “Adjusted EBITDA”

represents operating profit (loss) adjusted to exclude depreciation

and amortization, the gain (loss) on sale of assets and

investments, costs related to business acquisitions including:

costs related to advisory, legal and other transaction fees;

changes in the fair value of contingent consideration; and

contingent consideration classified as compensation per IFRS; costs

associated with the remediation of properties sold; and net income

(loss) from projects accounted for using the equity method, but

including “Equity Project EBITDA” from projects accounted for using

the equity method (refer to the “Reconciliations and Calculations”

section of this press release for a quantitative reconciliation to

the most comparable financial measure). The most directly

comparable measure calculated in accordance with IFRS is operating

profit.

- “Equity Project

EBITDA” represents Aecon’s proportionate share of the

earnings or losses from projects accounted for using the equity

method before depreciation and amortization, finance income,

finance cost and income tax expense (recovery) (refer to the

“Reconciliations and Calculations” section of this press release

for a quantitative reconciliation to the most comparable financial

measure).

- “Adjusted Profit (Loss)

Attributable To Shareholders” represents profit (loss)

attributable to shareholders adjusted where applicable to exclude

unrealized gains or losses on derivative financial instruments,

costs related to business acquisitions including: amortization of

acquisition-related intangible assets; costs related to advisory,

legal and other transaction fees; changes in the fair value of

contingent consideration; and contingent consideration classified

as compensation per IFRS; costs associated with the remediation of

properties sold; and where applicable the income tax effect of

these adjustments (refer to the “Reconciliations and Calculations”

section of this press release for a quantitative reconciliation to

the most comparable financial measure). The most comparable IFRS

measures for Adjusted Profit (Loss) Attributable to Shareholders is

Profit (Loss) Attributable To Shareholders.

- “Adjusted Earnings Per

Share – Basic” and “Adjusted Earnings Per Share – Diluted”

are calculated by dividing Adjusted Profit (Loss) Attributable To

Shareholders (defined above) by the basic and diluted weighted

average number of shares outstanding, respectively. The most

comparable IFRS measure for Adjusted Earnings Per Share is earnings

per share (refer to the “Reconciliations and Calculations” section

of this press release for a quantitative reconciliation to the most

comparable financial measure).

Management uses the above non-GAAP financial

measures to analyze and evaluate operating performance. Aecon also

believes the above financial measures are commonly used by the

investment community for valuation purposes, and are useful

complementary measures of profitability, and provide metrics useful

in the construction industry. These non-GAAP financial measures

exclude items which management believes will allow investors a

consistent way to analyze Aecon’s financial performance, allow for

better analysis of core operating income and business trends, and

improve comparability of companies within the industry.

Primary Financial

Statements

Primary financial statement means any of the

following: the consolidated balance sheets, the consolidated

statements of income, the consolidated statements of comprehensive

income, the consolidated statements of changes in equity, and the

consolidated statements of cash flows.

Key financial measures presented in the primary

financial statements of the Company and discussed in this press

release are as follows:

- “Gross profit”

represents revenue less direct costs and expenses. Not included in

the calculation of gross profit are marketing, general and

administrative expense (“MG&A”), depreciation and amortization,

income (loss) from projects accounted for using the equity method,

other income (loss), finance income, finance cost, income tax

expense (recovery), and non-controlling interests.

- “Operating profit

(loss)” represents the profit (loss) from operations,

before finance income, finance cost, income tax expense (recovery),

and non-controlling interests.

The above measures are presented in the

Company’s consolidated statements of income and are not meant to be

a substitute for other subtotals or totals presented in accordance

with GAAP, but rather should be evaluated in conjunction with such

GAAP measures.

- “Backlog” (Remaining

Performance Obligations) means the total value of work

that has not yet been completed that: (a) has a high certainty of

being performed as a result of the existence of an executed

contract or work order specifying job scope, value and timing; or

(b) has been awarded to Aecon, as evidenced by an executed binding

letter of intent or agreement, describing the general job scope,

value and timing of such work, and where the finalization of a

formal contract in respect of such work is reasonably assured.

Operations and maintenance (“O&M”) activities are provided

under contracts that can cover a period of up to 30 years. In order

to provide information that is comparable to the backlog of other

categories of activity, Aecon limits backlog for O&M activities

to the earlier of the contract term and the next five years.

Remaining Performance Obligations, i.e. Backlog,

is presented in the notes to the Company’s annual consolidated

financial statements and is not meant to be a substitute for other

amounts presented in accordance with GAAP, but rather should be

evaluated in conjunction with such GAAP measures.

Non-GAAP Ratios

A non-GAAP ratio is a financial measure

presented in the form of a ratio, fraction, percentage or similar

representation, and that has a non-GAAP financial measure as one of

its components and is not disclosed in the financial statements of

the Company.

A non-GAAP ratio presented and discussed in this

press release is as follows:

- “Adjusted EBITDA

margin” represents Adjusted EBITDA as a percentage of

revenue.

Management uses the above non-GAAP ratio to

analyze and evaluate operating performance. The most directly

comparable measures calculated in accordance with GAAP are gross

profit and operating profit that can be used to calculate gross

profit margin and operating margin.

Supplementary Financial

Measures

A supplementary financial measure: (a) is, or is

intended to be, disclosed on a periodic basis to depict the

historical or expected future financial performance, financial

position or cash flow of the Company; (b) is not presented in the

financial statements of the Company; (c) is not a non-GAAP

financial measure; and (d) is not a non-GAAP ratio.

Key supplementary financial measures presented

in this press release are as follows:

- “Gross profit

margin” represents gross profit as a percentage of

revenue.

- “Operating margin”

represents operating profit (loss) as a percentage of revenue.

- “MG&A as a percent of

revenue” represents marketing, general and administrative

expense as a percentage of revenue.

RECONCILIATIONS AND

CALCULATIONS

Set out below is the calculation of Adjusted

EBITDA by segment for the three months and years ended December 31,

2024 and 2023:

|

$ millions |

|

|

|

Three months ended December 31, 2024 |

Year ended December 31, 2024 |

|

|

|

|

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit (loss) |

$ |

33.0 |

|

$ |

1.6 |

|

$ |

(5.1 |

) |

$ |

29.6 |

|

$ |

(55.0 |

) |

$ |

24.2 |

|

$ |

(29.2 |

) |

$ |

(60.1 |

) |

|

|

|

Depreciation and amortization |

|

26.1 |

|

|

0.1 |

|

|

0.1 |

|

|

26.2 |

|

|

86.9 |

|

|

0.3 |

|

|

0.7 |

|

|

87.8 |

|

|

|

|

(Gain) on sale of assets |

|

(0.6 |

) |

|

- |

|

|

(1.1 |

) |

|

(1.7 |

) |

|

(17.9 |

) |

|

(5.9 |

) |

|

(10.1 |

) |

|

(33.9 |

) |

|

|

|

Costs related to business acquisitions(2) |

|

4.3 |

|

|

- |

|

|

- |

|

|

4.3 |

|

|

9.7 |

|

|

0.1 |

|

|

0.1 |

|

|

9.9 |

|

|

|

|

(Income) from projects accounted for using the equity method |

|

(0.8 |

) |

|

(0.8 |

) |

|

- |

|

|

(1.6 |

) |

|

(0.4 |

) |

|

(20.8 |

) |

|

- |

|

|

(21.2 |

) |

|

|

|

Equity Project EBITDA(1) |

|

3.1 |

|

|

16.5 |

|

|

- |

|

|

19.6 |

|

|

11.1 |

|

|

88.9 |

|

|

- |

|

|

100.0 |

|

|

|

|

Adjusted

EBITDA(1) |

$ |

65.1 |

|

$ |

17.4 |

|

$ |

(6.1 |

) |

$ |

76.3 |

|

$ |

34.2 |

|

$ |

86.9 |

|

$ |

(38.5 |

) |

$ |

82.6 |

|

|

|

$ millions |

|

|

|

Three months ended December 31, 2023 |

Year ended December 31, 2023 |

|

|

|

|

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit (loss) |

$ |

49.1 |

|

$ |

4.6 |

|

$ |

(14.1 |

) |

$ |

39.6 |

|

$ |

59.0 |

|

$ |

174.1 |

|

$ |

7.8 |

|

$ |

240.9 |

|

|

|

|

Depreciation and amortization |

|

14.9 |

|

|

0.1 |

|

|

(0.4 |

) |

|

14.6 |

|

|

61.1 |

|

|

17.0 |

|

|

1.0 |

|

|

79.1 |

|

|

|

|

(Gain) on sale of assets |

|

(1.8 |

) |

|

- |

|

|

(0.1 |

) |

|

(1.9 |

) |

|

(28.8 |

) |

|

(139.0 |

) |

|

(54.5 |

) |

|

(222.3 |

) |

|

|

|

Costs related to business acquisitions(2) |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

(Income) from projects accounted for using the equity method |

|

(2.9 |

) |

|

(2.6 |

) |

|

- |

|

|

(5.5 |

) |

|

(2.9 |

) |

|

(15.8 |

) |

|

- |

|

|

(18.7 |

) |

|

|

|

Equity Project EBITDA(1) |

|

5.7 |

|

|

17.7 |

|

|

- |

|

|

23.4 |

|

|

10.9 |

|

|

53.6 |

|

|

- |

|

|

64.5 |

|

|

|

|

Adjusted

EBITDA(1) |

$ |

65.0 |

|

$ |

19.7 |

|

$ |

(14.5 |

) |

$ |

70.2 |

|

$ |

99.4 |

|

$ |

89.8 |

|

$ |

(45.8 |

) |

$ |

143.4 |

|

|

(1) This is a non-GAAP financial measure. Refer

to the “Non-GAAP and Supplementary Financial Measures” section in

this press release for more information on each non-GAAP financial

measure.(2) Costs related to business acquisitions includes costs

related to advisory, legal and other transaction fees; changes in

the fair value of contingent consideration; and contingent

consideration classified as compensation per IFRS.

Set out below is the calculation of Equity

Project EBITDA by segment for the three months and years ended

December 31, 2024 and 2023:

|

$ millions |

|

|

|

|

Three months ended December 31, 2024 |

|

Year ended December 31, 2024 |

|

|

|

Aecon's proportionate share of projects accounted for using

the equity method (1) |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit |

$ |

3.1 |

$ |

12.5 |

$ |

- |

$ |

15.6 |

$ |

11.1 |

$ |

73.5 |

$ |

- |

$ |

84.6 |

|

|

|

Depreciation and amortization |

|

- |

|

4.0 |

|

- |

|

4.0 |

|

- |

|

15.4 |

|

- |

|

15.4 |

|

|

|

Equity Project

EBITDA(2) |

$ |

3.1 |

$ |

16.5 |

$ |

- |

$ |

19.6 |

$ |

11.1 |

$ |

88.9 |

$ |

- |

$ |

100.0 |

|

|

$ millions |

|

|

|

|

Three months ended December 31, 2023 |

|

Year ended December 31, 2023 |

|

|

|

Aecon's proportionate share of projects accounted for using

the equity method (1) |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

Construction |

Concessions |

Other costs and eliminations |

Consolidated |

|

|

|

Operating profit |

$ |

5.7 |

$ |

13.9 |

$ |

- |

$ |

19.6 |

$ |

10.7 |

$ |

49.8 |

$ |

- |

$ |

60.5 |

|

|

|

Depreciation and amortization |

|

- |

|

3.8 |

|

- |

|

3.8 |

|

0.2 |

|

3.8 |

|

- |

|

4.0 |

|

|

|

Equity Project

EBITDA(2) |

$ |

5.7 |

$ |

17.7 |

$ |

- |

$ |

23.4 |

$ |

10.9 |

$ |

53.6 |

$ |

- |

$ |

64.5 |

|

(1) Refer to Note 12 “Projects Accounted for

Using the Equity Method” in the Company’s audited consolidated

financial statements for the year ended December 31, 2024.(2)

This is a non-GAAP financial measure. Refer to the “Non-GAAP and

Supplementary Financial Measures” section in this press release for

more information on each non-GAAP financial measure.

Set out below is the calculation of Adjusted

Profit (Loss) Attributable to Shareholders and Adjusted Earnings

(Loss) per Share for the three months and years ended December 31,

2024 and 2023:

|

$ millions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Year ended |

|

|

|

|

|

|

December 31 |

|

December 31 |

|

|

|

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

Profit (loss) attributable to shareholders |

$ |

14.0 |

|

$ |

9.7 |

|

$ |

(59.5 |

) |

$ |

161.9 |

|

|

|

|

|

Unrealized (gain) on derivative financial instruments |

|

(4.3 |

) |

|

(2.9 |

) |

|

(19.6 |

) |

|

(2.9 |

) |

|

|

|

|

Amortization of acquisition related intangible assets |

|

3.1 |

|

|

0.4 |

|

|

6.8 |

|

|

1.5 |

|

|

|

|

|

Costs related to business acquisitions(2) |

|

4.3 |

|

|

- |

|

|

9.9 |

|

|

- |

|

|

|

|

|

Income tax effect of the above items |

|

(0.8 |

) |

|

0.7 |

|

|

0.8 |

|

|

0.4 |

|

|

|

|

|

Adjusted profit (loss) attributable to

shareholders (1) |

$ |

16.3 |

|

$ |

7.8 |

|

$ |

(61.6 |

) |

$ |

160.9 |

|

|

|

|

|

Adjusted earnings (loss) per share -

basic(1) |

$ |

0.26 |

|

$ |

0.13 |

|

$ |

(0.99 |

) |

$ |

2.61 |

|

|

|

|

|

Adjusted earnings (loss) per share -

diluted(1) |

|

0.25 |

|

|

0.12 |

|

|

(0.99 |

) |

|

2.09 |

|

|

|

(1) This is a non-GAAP financial measure. Refer

to the “Non-GAAP and Supplementary Financial Measures” section in

this press release for more information on each non-GAAP financial

measure.(2) Costs related to business acquisitions includes costs

related to advisory, legal and other transaction fees; changes in

the fair value of contingent consideration; and contingent

consideration classified as compensation per IFRS.

STATEMENT ON FORWARD-LOOKING INFORMATION

The information in this press release includes

certain forward-looking statements which may constitute

forward-looking information under applicable securities laws. These

forward-looking statements are based on currently available

competitive, financial, and economic data and operating plans but

are subject to known and unknown risks, assumptions and

uncertainties. Forward-looking statements may include, without

limitation, statements regarding the operations, business,

financial condition, expected financial results, performance,

prospects, ongoing objectives, strategies and outlook for Aecon,

including statements regarding: expectations regarding the

financial risks and impact of the fixed price legacy projects and

the expected timelines of such projects; backlog and estimated

duration; the impact of certain contingencies on Aecon (see:

Section 10.2 “Contingencies” in the Company’s December 31, 2024

MD&A); the uncertainties related to the unpredictability of

global economic conditions; its belief regarding the sufficiency of

its current liquidity position including sufficiency of its cash

position, unused credit capacity, and cash generated from its

operations; its strategy of seeking to differentiate its service

offering and execution capability and the expected results

therefrom; its efforts to maintain a conservative capital position;

expectations regarding revenue and future revenue growth and the

impact therefrom; expectations regarding profitability and margin

predictability; expectations regarding capital expenditures;

expectations regarding the pipeline of opportunities available to

Aecon; statements regarding the various phases of projects for

Aecon and expectations regarding project timelines; its strategic

focus on projects linked to decarbonization, energy transition and

sustainability, and the opportunities arising therefrom;

communities sharing in the benefits and opportunities associated

with Aecon’s work, including commitments to publish information

with respect to reconciliation and targets including Indigenous

suppliers; expectations regarding access to new markets through

strategic investments; expectations regarding opportunities to add

to the existing portfolio of Canadian and international concessions

in the next 12 to 24 months; expectations regarding growth, and the

acceleration thereof, of Aecon in Canada and the U.S.; ; and the

effective transition and collaboration with United and United

management. Forward-looking statements may in some cases be

identified by words such as “will,” “plans,” “schedule,”

“forecast,” “outlook,” “completing,” “mitigating,” “potential,”

“possible,” “maintain,” “seek,” “cost savings,” “synergies,”

“strategy,” “goal,” “indicative,” “may,” “could,” “might,” “can,”

"believes," "expects," "anticipates," “aims,” “assumes,” “upon,”

“commences,” "estimates," "projects," "intends," “prospects,”

“targets,” “occur,” “continue,” "should" or the negative of these

terms, or similar expressions. In addition to events beyond Aecon's

control, there are factors which could cause actual or future

results, performance, or achievements to differ materially from

those expressed or inferred herein including, but not limited to:

the risk of not being able to drive a higher margin mix of business

by participating in more complex projects, achieving operational

efficiencies and synergies, and improving margins; the risk of not

being able to meet contractual schedules and other performance

requirements on large, fixed priced contracts; the risks associated

with a third party’s failure to perform; the risk of not being able

to meet its labour needs at reasonable costs; possibility of gaps

in insurance coverage; the risk of not being able to address any

supply chain issues which may arise and pass on costs of supply

increases to customers; the risks associated with international

operations and foreign jurisdiction factors; the risk of not being

able, through its joint ventures or joint operations, to enter into

implementation phases of certain projects following the successful

completion of the relevant development phase; the risk of not being

able to execute its strategy of building strong partnerships and

alliances; the risk of not being able to execute its risk

management strategy; the risk of not being able to grow backlog

across the organization by winning major projects; the risk of not

being able to maintain a number of open, recurring, and repeat

contracts; the risk of not being able to identify and capitalize on

strategic operational investments; the risk of not being able to

accurately assess the risks and opportunities related to its

industry’s transition to a lower-carbon economy; the risk of not

being able to oversee, and where appropriate, respond to known and

unknown environmental and climate change-related risks, including

the ability to recognize and adequately respond to climate change

concerns or public, governmental, and other stakeholders’

expectations on climate matters; the risk of not being able to meet

its commitment to meeting its greenhouse gas emissions reduction,

Board diversity or Indigenous supplier targets; the risks of

nuclear liability; the risks of cyber interruption or failure of

information systems; the risks associated with the strategy of

differentiating its service offerings in key end markets; the risks

associated with undertaking initiatives to train employees; the

risks associated with the seasonal nature of its business; the

risks associated with being able to participate in large projects;

the risks associated with legal proceedings to which it is a party;

the ability to successfully respond to shareholder activism; the

risk that Aecon will not realize the opportunities presented by a

transition to a net-zero economy; the risk the increase in energy

demand does not continue; risks associated with future pandemics,

epidemics and other health crises and Aecon’s ability to respond to

and implement measures to mitigate the impact of such pandemics or

epidemics; the risk that the strategic partnership with Oaktree

will not realize the expected results and may negatively impact the

existing business of Aecon Utilities; the risk that Aecon Utilities

will not realize opportunities to expand its geographic reach and

range of services in the U.S; the risk of costs or difficulties

related to the integration of Aecon and United, and of Aecon

Utilities and Xtreme, being greater than expected; the risk of the

anticipated benefits and synergies from the United and Xtreme

transactions not being fully realized or taking longer than

expected to realize; the risk of being unable to retain key

personnel, including management of United and Xtreme; the risk of

being unable to maintain relationships with customers, suppliers or

other business partners of United and Xtreme; and various other

risk factors described in Aecon’s filings with the securities

regulatory authorities, which are available under Aecon’s profile

on SEDAR+ (www.sedarplus.ca), including the risk factors described

in Section 13 - “Risk Factors” in Aecon's 2024 Management’s

Discussion and Analysis for the fiscal year ended December 31, 2024

and in other filings made by Aecon with the securities regulatory

authorities in Canada.

These forward-looking statements are based on a

variety of factors and assumptions including, but not limited to

that: none of the risks identified above materialize, there are no

unforeseen changes to economic and market conditions and no

significant events occur outside the ordinary course of business

and assumptions regarding the outcome of the outstanding claims in

respect of the fixed price legacy projects being performed by joint

ventures in which Aecon is a participant. These assumptions are

based on information currently available to Aecon, including

information obtained from third-party sources. While the Company

believes that such third-party sources are reliable sources of

information, the Company has not independently verified the

information. The Company has not ascertained the validity or

accuracy of the underlying economic assumptions contained in such

information from third-party sources and hereby disclaims any

responsibility or liability whatsoever in respect of any

information obtained from third-party sources.

Except as required by applicable securities

laws, forward-looking statements speak only as of the date on which

they are made and Aecon undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

|

CONSOLIDATED STATEMENTS OF INCOME FOR THE

THREE MONTHS AND YEARS ENDED DECEMBER 31, 2024 AND

2023 |

|

(in thousands of Canadian dollars, except per share

amounts) |

|

|

|

|

|

|

For the three months ended |

For the year ended |

|

|

|

|

December 31 |

|

December 31 |

December 31 |

|

December 31 |

|

|

|

|

2024 |

|

2023 |

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

1,267,013 |

|

|

$ |

1,130,185 |

|

$ |

4,242,731 |

|

|

$ |

4,643,842 |

|

|

Direct costs and expenses |

|

|

(1,159,770 |

) |

|

|

(1,032,235 |

) |

|

(4,060,184 |

) |

|

|

(4,388,216 |

) |

|

Gross profit |

|

|

107,243 |

|

|

|

97,950 |

|

|

182,547 |

|

|

|

255,626 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing, general and administrative expense |

|

|

(57,132 |

) |

|

|

(51,811 |

) |

|

(213,248 |

) |

|

|

(177,839 |

) |

|

Depreciation and amortization |

|

|

(26,237 |

) |

|

|

(14,648 |

) |

|

(87,849 |

) |

|

|

(79,087 |

) |

|

Income from projects accounted for using the equity method |

|

|

1,566 |

|

|

|

5,496 |

|

|

21,210 |

|

|

|

18,747 |

|

|

Other income |

|

|

4,111 |

|

|

|

2,584 |

|

|

37,288 |

|

|

|

223,467 |

|

|

Operating profit (loss) |

|

|

29,551 |

|

|

|

39,571 |

|

|

(60,052 |

) |

|

|

240,914 |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

Finance income |

|

|

1,920 |

|

|

|

2,202 |

|

|

8,637 |

|

|

|

7,665 |

|

|

Finance cost |

|

|

(8,326 |

) |

|

|

(21,427 |

) |

|

(25,114 |

) |

|

|

(71,034 |

) |

|

Profit (loss) before income taxes |

|

|

23,145 |

|

|

|

20,346 |

|

|

(76,529 |

) |

|

|

177,545 |

|

|

Income tax recovery (expense) |

|

|

(9,042 |

) |

|

|

(10,651 |

) |

|

17,089 |

|

|

|

(15,655 |

) |

|

Profit (loss) for the period |

|

$ |

14,103 |

|

|

$ |

9,695 |

|

$ |

(59,440 |

) |

|

$ |

161,890 |

|

|

Profit (loss) attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Aecon shareholders |

|

|

14,025 |

|

|

|

9,695 |

|

|

(59,524 |

) |

|

|

161,890 |

|

|

|

Non-controlling interests |

|

|

78 |

|

|

|

- |

|

|

84 |

|

|

|

- |

|

|

|

|

|

$ |

14,103 |

|

|

$ |

9,695 |

|

$ |

(59,440 |

) |

|

$ |

161,890 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

0.22 |

|

|

$ |

0.16 |

|

$ |

(0.95 |

) |

|

$ |

2.62 |

|

|

Diluted earnings (loss) per share |

|

$ |

0.21 |

|

|

$ |

0.15 |

|

$ |

(0.95 |

) |

|

$ |

2.10 |

|

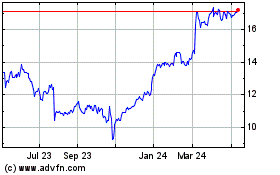

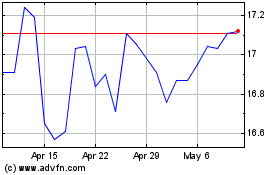

Aecon (TSX:ARE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Aecon (TSX:ARE)

Historical Stock Chart

From Mar 2024 to Mar 2025