Amerigo Resources Ltd. (TSX: ARG; OTCQX: ARREF)

(“Amerigo” or the “Company”) is pleased to announce a strong

financial performance for the three months ended September 30, 2024

(“Q3-2024”). Dollar amounts in this news release are in U.S.

dollars unless indicated otherwise.

Amerigo reported net income of $2.8 million in

Q3-2024, a significant turnaround from the $5.8 million net loss in

the three months ended September 30, 2023 (“Q3-2023”), which was

generated by lower copper prices and the impact on production of

last year’s flooding throughout Chile. Amerigo’s copper production

from Minera Valle Central (“MVC”) reached 16.3 million pounds (“M

lbs”) in Q3-2024, a 46% increase compared to Q3-2023 (11.1 M

lbs).

EBITDA1 for the quarter was $13.3 million, with

free cash flow to equity1 of $5.9 million.

In Q3-2024, Amerigo returned $8.5 million to

shareholders through its quarterly dividend of Cdn$0.03 per share

and its initial performance dividend of Cdn$0.04 per share.

“We are pleased to report strong quarterly

financial performance once again. Our three key performance

drivers, production, copper prices, and cost management, were

robust in the third quarter. Of particular significance, in

Q3-2024, Amerigo paid its first performance dividend. This

additional payment illustrated the ability of our Capital Return

Strategy2 to share the benefits of strong copper prices with

shareholders quickly,” said Aurora Davidson, Amerigo’s President

and CEO.

“As we approach the end of 2024, our operations

at MVC continue to outperform internal guidance. The United States

and China have recently initiated economic stimulus measures, and

global electrification continues. These factors will continue to

increase the strain on the copper industry, whose output is vital

to achieving these economic and social goals. We believe the

positive effect on copper prices is just starting to be seen, so we

maintain a positive outlook for copper prices and remain committed

to Amerigo’s successful Capital Return Strategy2,” she added.

On October 28, 2024, Amerigo’s Board of

Directors declared its thirteenth quarterly dividend. The dividend

will be in the amount of Cdn$0.03 per share, payable on December

20, 2024, to shareholders of record as of November 29, 20243.

Amerigo designates the entire amount of this taxable dividend to be

an “eligible dividend” for purposes of the Income Tax Act (Canada),

as amended from time to time.

Based on Amerigo’s September 30, 2024, share

closing price of Cdn$1.74, the Cdn$0.03 quarterly dividends, and

the Performance Dividend of Cdn$0.04 per share declared on July 8,

2024, represent an annual dividend yield of 9.2%4.

This news release should be read with Amerigo’s

interim consolidated financial statements and Management’s

Discussion and Analysis (“MD&A”) for Q3-2024, available on the

Company’s website at www.amerigoresources.com and on the

SEDAR+ website at www.sedarplus.ca.

|

|

|

|

|

|

|

|

|

|

|

|

Q3-2024 |

Q3-2023 |

|

|

MVC's copper price ($/lb)5 |

|

|

|

4.22 |

3.76 |

|

|

Revenue ($ millions) |

|

|

|

45.4 |

30.3 |

|

|

Net income (loss) ($ millions) |

|

|

|

2.8 |

(5.8 |

) |

|

EPS (LPS) ($) |

|

|

|

0.02 |

(0.04 |

) |

|

EPS (LPS) (Cdn) |

|

|

|

0.02 |

(0.05 |

) |

|

EBITDA1 ($ millions) |

|

|

|

13.3 |

3.2 |

|

|

Operating cash flow before changes in non-cash working capital1 ($

millions) |

8.9 |

2.6 |

|

|

FCFE1 ($ millions) |

|

|

|

5.9 |

(2.6 |

) |

|

|

|

September 30, 2024 |

Dec. 31, 2023 |

|

|

|

Cash ($ millions) |

|

25.1 |

16.2 |

|

|

|

Restricted cash ($ millions) |

|

6.7 |

6.3 |

|

|

|

Borrowings ($ millions) |

|

14.9 |

20.7 |

|

|

|

Shares outstanding at end of period (millions) |

|

166.0 |

164.8 |

|

|

|

|

|

|

|

|

|

Highlights and Significant

Items

- Amerigo achieved a solid financial

performance in Q3-2024, posting a net income of $2.8 million

(Q3-2023: net loss of $5.8 million), driven by increased copper

production from MVC of 16.3 M lbs (Q3-2023: 11.1 M lbs) and an

average MVC copper price of $4.22 per pound (/lb”) (Q3-2023:

$3.76/lb).

- Earnings per share in Q3-2024 was

$0.02 (Cdn$0.02), compared to a loss per share of $0.04 (Cdn$0.05)

in Q3-2023.

- The Company generated operating

cash flow before changes in non-cash working capital1 of $8.9

million in Q3-2024 (Q3-2023: $2.6 million). Quarterly net operating

cash flow was $10.5 million (Q3-2023: cash used of $7.5 million).

Free cash flow to equity1 was $5.9 million in Q3-2024 (Q3-2023:

negative free cash flow to equity1 of $2.6 million).

- Q3-2024 cash cost1 was $1.93/lb

(Q3-2023: $2.44/lb). The $0.51/lb reduction in cash cost was caused

predominantly by a 46% increase in production during Q3-2024,

compared to flooding-impacted production in Q3-2023. This resulted

in decreased unit costs overall, including reductions in power

costs ($0.22/lb), maintenance ($0.08/lb), other direct costs

($0.08/lb), direct labour ($0.06/lb), historic tailings extraction

($0.05/lb), grinding media ($0.05/lb) and administration

($0.04/lb). These lower costs were offset by a $0.09/lb decrease in

by-product credits.

- On September 30, 2024, the Company

held cash and cash equivalents of $25.1 million (December 31, 2023:

$16.2 million), restricted cash of $6.7 million (December 31, 2023:

$6.3 million), and had a working capital deficiency of $4.9 million

(December 31, 2023: $12.3 million)

- In Q3-2024, Amerigo returned $8.5

million to shareholders (Q3-2023: $3.7 million) through the payment

of Amerigo’s quarterly dividend of Cdn$0.03 per share and a

performance dividend of Cdn$0.04 per share.

- The Company’s financial performance

is sensitive to changes in copper prices. MVC’s Q3-2024 provisional

copper price was $4.24/lb. The final prices for July, August and

September 2024 sales will be the average London Metal Exchange

(“LME”) prices for October, November and December 2024,

respectively. A 10% increase or decrease from the $4.24/lb

provisional price used on September 30, 2024, would result in a

$7.0 million change in revenue in Q4-2024 regarding Q3-2024

production.

1 This is a non-IFRS measure. See “Non-IFRS Measures” for

further information.

Investor Conference Call on October 31,

2024

Amerigo’s quarterly investor conference call

will be held on Thursday, October 31, 2024, at 11:00 a.m. Pacific

Daylight Time/2:00 p.m. Eastern Daylight Time.

Participants can join by visiting

https://emportal.ink/4dccA8Y and entering their name and phone

number. The conference system will then call the participants and

place them instantly into the call. Alternatively, participants can

dial directly to be entered into the call by an Operator. Dial

1-888-510-2154 (Toll-Free North America) and state they wish to

participate in the Amerigo Resources Q3-2024 Earnings Call.

Interactive Analyst

CenterAmerigo has made published financial and operational

information available for Excel download through Virtua’s

Interactive Analyst Center (“IAC”). You can access the IAC

by visiting www.amerigoresources.com under Investors >

Interactive Analyst Center.

About Amerigo and Minera Valle Central

(“MVC”)

Amerigo Resources Ltd. is an innovative copper

producer with a long-term relationship with Corporación Nacional

del Cobre de Chile (“Codelco”), the world’s largest copper

producer.

Amerigo produces copper concentrate, and

molybdenum concentrate as a by-product at the MVC operation in

Chile by processing fresh and historic tailings from Codelco’s El

Teniente mine, the world's largest underground copper mine. Tel:

(604) 681-2802; Web: www.amerigoresources.com; ARG:TSX; OTCQX:

ARREF.

Contact Information

|

Aurora DavidsonPresident and CEO(604)

697-6207ad@amerigoresources.com |

Graham FarrellInvestor Relations(416)

842-9003Graham@49northir.ca |

|

Summary Consolidated Statements of Financial

Position |

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

2023 |

|

|

|

$ thousands |

|

$ thousands |

|

|

Cash and cash equivalents |

25,127 |

|

16,248 |

|

|

Restricted cash |

6,727 |

|

6,282 |

|

|

Property plant and equipment |

146,273 |

|

156,002 |

|

|

Other assets |

23,525 |

|

21,027 |

|

|

Total assets |

201,652 |

|

199,559 |

|

|

Total liabilities |

95,244 |

|

94,706 |

|

|

Shareholders' equity |

106,408 |

|

104,853 |

|

|

Total liabilities and shareholders' equity |

201,652 |

|

199,559 |

|

|

|

|

|

|

Summary Consolidated Statements of Income (Loss) and

Comprehensive Income (Loss) |

|

|

Three months ended September 30, |

|

|

2024 |

|

2023 |

|

|

|

$ thousands |

|

$ thousands |

|

|

Revenue |

45,438 |

|

30,329 |

|

|

Tolling and production costs |

(38,063 |

) |

(32,353 |

) |

|

Other expenses |

(400 |

) |

(4,250 |

) |

|

Finance expense |

(870 |

) |

(1,043 |

) |

|

Income tax (expense) recovery |

(3,323 |

) |

1,524 |

|

|

Net income (loss) |

2,782 |

|

(5,793 |

) |

|

Other comprehensive (loss) income |

(176 |

) |

1,169 |

|

|

Comprehensive income (loss) |

2,606 |

|

(4,624 |

) |

|

|

|

|

|

Earnings (loss) per share - basic & diluted |

0.02 |

|

(0.04 |

) |

|

|

|

|

|

Summary Consolidated Statements of Cash Flows |

|

|

Three months ended September 30, |

|

|

2024 |

|

2023 |

|

|

|

$ thousands |

|

$ thousands |

|

|

Cash flow from operating activities |

8,895 |

|

2,617 |

|

|

Changes in non-cash working capital |

1,570 |

|

(10,072 |

) |

|

Net cash from (used in) operating activities |

10,465 |

|

(7,455 |

) |

|

Net cash used in investing activities |

(3,032 |

) |

(5,203 |

) |

|

Net cash used in financing activities |

(11,027 |

) |

(5,771 |

) |

|

Net (decrease) in cash and cash equivalents |

(3,594 |

) |

(18,429 |

) |

|

Effect of foreign exchange rates on cash |

(15 |

) |

(115 |

) |

|

Cash and cash equivalents, beginning of period |

28,736 |

|

31,675 |

|

|

Cash and cash equivalents, end of period |

25,127 |

|

13,131 |

|

| |

|

|

1 Non-IFRS

Measures

This news release includes five non-IFRS

measures: (i) EBITDA, (ii) operating cash flow before changes in

non-cash working capital, (iii) free cash flow to equity (“FCFE”),

(iv) free cash flow (“FCF”) and (v) cash cost.

These non-IFRS performance measures are included

in this news release because they provide key performance measures

used by management to monitor operating performance, assess

corporate performance, and plan and assess the overall

effectiveness and efficiency of Amerigo’s operations. These

performance measures are not standardized financial measures under

International Financial Reporting Standards as issued by the

International Accounting Standards Board (“IFRS Accounting

Standards”), and, therefore, amounts presented may not be

comparable to similar financial measures disclosed by other

companies. These performance measures should not be considered in

isolation as a substitute for performance measures in accordance

with IFRS Accounting Standards.

(i) EBITDA refers to earnings

before interest, taxes, depreciation, and administration and is

calculated by adding depreciation expense to the Company’s gross

profit.

|

|

|

|

|

(Expressed in thousands) |

Q3-2024 |

|

Q3-2023 |

|

|

|

$ |

|

$ |

|

|

Gross profit (loss) |

7,375 |

|

(2,024 |

) |

|

Add: |

|

|

|

Depreciation and amortization |

5,900 |

|

5,192 |

|

|

EBITDA |

13,275 |

|

3,168 |

|

| |

|

|

(ii) Operating cash flow

before changes in non-cash working capital is calculated by adding

back the decrease or subtracting the increase in changes in

non-cash working capital to or from cash provided by operating

activities.

|

|

|

|

|

(Expressed in thousands) |

Q3-2024 |

|

Q3-2023 |

|

|

|

$ |

|

$ |

|

|

Net cash provided by (used in) operating activities |

10,465 |

|

(7,455 |

) |

|

Deduct: |

|

|

|

Changes in non-cash working capital |

(1,570 |

) |

10,072 |

|

|

Operating cash flow before non-cash working capital |

8,895 |

|

2,617 |

|

| |

|

|

Free cash flow to equity (“FCFE”) refers to

operating cash flow before changes in non-cash working capital,

less capital expenditures plus new debt issued less debt and lease

repayments. FCFE represents the amount of cash generated by the

Company in a reporting period that can be used to pay for the

following:

a) potential distributions to the Company’s

shareholders and b) any additional taxes triggered by the

repatriation of funds from Chile to Canada to fund these

distributions.

Free cash flow (“FCF”) refers to FCFE plus

repayments of borrowings and lease repayments.

|

|

|

|

|

(Expressed in thousands) |

Q3-2024 |

|

Q3-2023 |

|

|

|

$ |

|

$ |

|

|

Operating cash flow before changes in non-cash working capital |

8,895 |

|

2,617 |

|

|

Deduct: |

|

|

|

Cash used to purchase plant and equipment |

(3,032 |

) |

(5,203 |

) |

|

Repayment of borrowings, net of new debt issue |

- |

|

- |

|

|

Lease repayments |

- |

|

- |

|

|

Free cash flow to equity |

5,863 |

|

(2,586 |

) |

|

Add: |

|

|

|

Repayment of borrowings, net of new debt issued |

- |

|

- |

|

|

Lease repayments |

- |

|

- |

|

|

Free cash flow |

5,863 |

|

(2,586 |

) |

| |

|

|

(iii) Cash cost is a

performance measure commonly used in the mining industry that is

not defined under IFRS. Cash cost is the aggregate of smelting and

refining charges, tolling/production costs net of inventory

adjustments and administration costs, net of by-product credits.

Cash cost per pound produced is based on pounds of copper produced

and is calculated by dividing cash cost by the number of pounds of

copper produced.

|

(Expressed in thousands) |

|

Q3-2024 |

|

Q3-2023 |

|

|

|

|

$ |

|

$ |

|

|

Tolling and production costs |

|

38,063 |

|

32,353 |

|

| Add

(deduct): |

|

|

|

|

Smelting and refining charges |

|

6,358 |

|

4,473 |

|

|

Transportation costs |

|

425 |

|

295 |

|

|

Inventory adjustments |

|

(1,126 |

) |

684 |

|

|

By-product credits |

|

(5,241 |

) |

(4,580 |

) |

|

Depreciation and amortization |

|

(5,900 |

) |

(5,192 |

) |

|

DET royalties - molybdenum |

|

(1,190 |

) |

(863 |

) |

| Cash

cost |

|

31,389 |

|

27,170 |

|

| Copper

tolled (M lbs) |

|

16.27 |

|

11.12 |

|

|

Cash cost ($/lb) |

|

1.93 |

|

2.44 |

|

| |

|

|

|

|

|

2 Capital returned to

shareholders

The table below summarizes the capital returned

to shareholders since Amerigo’s Capital Return Strategy was

implemented in October 2021.

|

(Expressed in millions) |

|

|

|

|

|

|

|

|

|

Shares repurchased |

Dividends Paid |

Total |

|

|

$ |

$ |

$ |

|

2021 |

8.8 |

2.8 |

11.6 |

|

2022 |

12.3 |

15.8 |

28.1 |

|

2023 |

2.6 |

14.6 |

17.2 |

|

2024 |

- |

15.8 |

15.8 |

|

|

23.7 |

49.0 |

72.7 |

|

|

|

|

|

3 Dividend dates

A dividend of Cdn$0.03 per share will be paid on

December 20, 2024, to shareholders of record as of November 29,

2024. Under the “T+1 settlement cycle”, the Company’s shares will

commence trading on an ex-dividend basis at the opening of trading

on November 29, 2024. Shareholders purchasing Amerigo shares on the

ex-dividend date or after will not receive this dividend, as it

will be paid to selling shareholders. Shareholders purchasing

Amerigo shares before the ex-dividend date will receive the

dividend.

4 Dividend yield

The disclosed annual yield of 9.2% is based on

four quarterly dividends of Cdn$0.03 per share each and the July 8,

2024, Performance Dividend of Cdn$0.04, divided over Amerigo’s

September 30, 2024 closing share price of Cdn$1.74.

5 MVC’s copper

price

MVC’s copper price is the average notional

copper price for the period before smelting and refining, DET

notional copper royalties, transportation costs and excluding

settlement adjustments to prior period sales.

MVC’s pricing terms are based on the average LME

copper price of the third month following the delivery of copper

concentrates produced under the DET tolling agreement (“M+3”). This

means that when final copper prices are not yet known, they are

provisionally marked to market at the end of each month based on

the progression of the LME-published average monthly M and M+3

prices. Provisional prices are adjusted monthly using this

consistent methodology until they are settled.

Q2-2024 copper deliveries were marked to market

on June 30, 2024, at $4.41/lb and were settled in Q3-2024 as

follows:

- April 2024 sales settled at the July 2024 LME average price of

$4.26/lb

- May 2024 sales settled at the August 2024 LME average price of

$4.07/lb

- June 2024 sales settled at the September 2024 LME average price

of $4.20//lb

Q3-2024 copper deliveries were marked to market

on September 30, 2024, at $4.24/lb and will be settled at the LME

average prices for October, November and December 2024.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains certain

“forward-looking information” as such term is defined under

applicable securities laws (collectively called "forward-looking

statements"). This information relates to future events or the

Company’s future performance. All statements other than statements

of historical fact are forward-looking statements. The use of any

of the words "anticipate", "plan", "continue", "estimate",

"expect", "may", "will", "project", "predict", "potential",

"should", "believe" and similar expressions are intended to

identify forward-looking statements. These forward-looking

statements include, but are not limited to, statements

concerning:

- forecasted production and operating costs;

- our strategies and objectives;

- our estimates of the availability and quantity of tailings and

the quality of our mine plan estimates;

- the sufficiency of MVC’s water reserves to maintain projected

historic tailings tonnage processing for at least 18 months;

- prices and price volatility for copper, molybdenum and other

commodities and materials we use in our operations;

- the demand for and supply of copper, molybdenum and other

commodities and materials that we produce, sell and use;

- sensitivity of our financial results and share price to changes

in commodity prices;

- our financial resources and financial condition;

- interest and other expenses;

- domestic and foreign laws affecting our operations;

- our tax position and the tax rates applicable to us;

- our ability to comply with our loan covenants;

- the production capacity of our operations, our planned

production levels and future production;

- potential impact of production and transportation

disruptions;

- hazards inherent in the mining industry causing personal injury

or loss of life, severe damage to or destruction of property and

equipment, pollution or environmental damage, claims by third

parties and suspension of operations

- estimates of asset retirement obligations and other costs

related to environmental protection;

- our future capital and production costs, including the costs

and potential impact of complying with existing and proposed

environmental laws and regulations in the operation and closure of

our operations;

- repudiation, nullification, modification or renegotiation of

contracts;

- our financial and operating objectives;

- our environmental, health and safety initiatives;

- the outcome of legal proceedings and other disputes in which we

may be involved;

- the outcome of negotiations concerning metal sales, treatment

charges and royalties;

- disruptions to the Company's information technology systems,

including those related to cybersecurity;

- our dividend policy, including the security of the quarterly

dividends and our Capital Return Strategy; and

- general business and economic conditions, including, but not

limited to, our assessment of strong market fundamentals supporting

copper prices.

These forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such statements. Inherent in forward-looking

statements are risks and uncertainties beyond our ability to

predict or control, including risks that may affect our operating

or capital plans; risks generally encountered in the operation,

permitting and development of mineral projects such as unusual or

unexpected geological formations, negotiations with government and

other third parties, unanticipated metallurgical difficulties,

delays associated with permits, approvals and permit appeals,

ground control problems, adverse weather conditions (including, but

not limited, to heavy rains), process upsets and equipment

malfunctions; risks associated with labour disturbances and

availability of skilled labour and management; risks related to the

potential impact of global or national health concerns; government

or regulatory actions or inactions; fluctuations in the market

prices of our principal commodities, which are cyclical and subject

to substantial price fluctuations; risks created through

competition for mining projects and properties; risks associated

with lack of access to markets; risks associated with availability

of and our ability to obtain both tailings from Codelco’s Division

El Teniente (“DET”) current production and historic tailings from

tailings deposit; the availability of and ability of the Company to

obtain adequate funding on reasonable terms for expansions and

acquisitions; mine plan estimates; risks posed by fluctuations in

exchange rates and interest rates, as well as general economic

conditions; risks associated with environmental compliance and

changes in environmental legislation and regulation; risks

associated with our dependence on third parties for the provision

of critical services; risks associated with non-performance by

contractual counterparties; risks associated with supply chain

disruptions; title risks; social and political risks associated

with operations in foreign countries; risks of changes in laws

affecting our operations or their interpretation, including foreign

exchange controls; and risks associated with tax reassessments and

legal proceedings. Many of these risks and uncertainties apply to

the Company and its operations, as well as DET and its operations.

DET’s ongoing mining operations provide a significant portion of

the materials the Company processes and its resulting metals

production. Therefore, these risks and uncertainties may also

affect the Company's operations and have a material effect.

Actual results and developments will likely

differ materially from those expressed or implied by the

forward-looking statements in this news release. Such statements

are based on several assumptions which may prove to be incorrect,

including, but not limited to, assumptions about:

- general business and economic conditions;

- interest and currency exchange rates;

- changes in commodity and power prices;

- acts of foreign governments and the outcome of legal

proceedings;

- the supply and demand for, deliveries of, and the level and

volatility of prices of copper, molybdenum and other commodities

and products used in our operations;

- the ongoing supply of material for processing from DET’s

current mining operations;

- the grade and projected recoveries of tailings processed by

MVC;

- the ability of the Company to profitably extract and process

material from the historic tailings deposit;

- the timing of the receipt of and retention of permits and other

regulatory and governmental approvals;

- our costs of production and our production and productivity

levels, as well as those of our competitors;

- changes in credit market conditions and conditions in financial

markets generally;

- our ability to procure equipment and operating supplies in

sufficient quantities and on a timely basis;

- the availability of qualified employees and contractors for our

operations;

- our ability to attract and retain skilled staff;

- the satisfactory negotiation of collective agreements with

unionized employees;

- the impact of changes in foreign exchange rates and capital

repatriation on our costs and results;

- engineering and construction timetables and capital costs for

our expansion projects;

- costs of closure of various operations;

- market competition;

- tax benefits and tax rates;

- the outcome of our copper concentrate sales and treatment and

refining charge negotiations;

- the resolution of environmental and other proceedings or

disputes;

- the future supply of reasonably priced power;

- rainfall in the vicinity of MVC continuing to trend towards

normal levels;

- average recoveries for fresh and historic tailings

tailings;

- our ability to obtain, comply with and renew permits and

licenses in a timely manner; and

- Our ongoing relations with our employees and entities we do

business with.

Future production levels and cost estimates

assume no adverse mining or other events significantly affecting

budgeted production levels.

Climate change is a global issue that could pose

challenges that could affect the Company's future operations. This

could include more frequent and intense droughts followed by

intense rainfall. In the last several years, Central Chile has had

drought conditions and also rain episodes of significant magnitude.

The Company’s operations are sensitive to water availability and

the reserves required to process projected historic tailings

tonnage.

Although the Company believes that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond the Company’s control, the Company cannot assure that it

will achieve or accomplish the expectations, beliefs or projections

described in the forward-looking statements.

The preceding list of important factors and

assumptions is not exhaustive. Other events or circumstances could

cause our results to differ materially from those estimated,

projected, and expressed in or implied by our forward-looking

statements. You should also consider the matters discussed under

Risk Factors in the Company`s Annual Information Form. The

forward-looking statements contained herein speak only as of the

date of this news release. Except as required by law, we undertake

no obligation to revise any forward-looking statements or the

preceding list of factors, whether due publicly or otherwise, to

new information or future events.

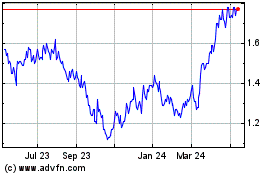

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Jan 2025 to Feb 2025

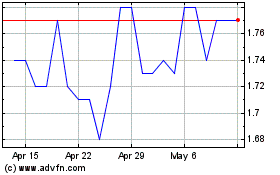

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Feb 2024 to Feb 2025