Aya Gold & Silver Inc. (TSX: AYA; OTCQX:

AYASF) (“Aya” or the “

Corporation”) is pleased to

report that it has entered into non-binding term sheets for the

spinout of its Amizmiz Gold Project (the “

Amizmiz

Property”) in the Kingdom of Morocco and the granting of

an option on its Tijirit Project in the Islamic Republic of

Mauritania to Mx2 Mining (“

Mx2” or

“

SpinCo”), a new North Africa-dedicated gold

growth company backed by Aya with the participation of Richard

Clark as its Executive Chairman and Adam Spencer as its President

and CEO (the “

Transaction”). The Transaction is

subject to confirmatory due diligence and market standard closing

conditions. All amounts are in Canadian dollars unless otherwise

stated.

In connection with the spinout, Aya will

transfer its rights to the Amizmiz Property, which it owns through

a subsidiary, to Mx2 who will concurrently raise a minimum of $7.5

million, of which Aya will invest an amount of $1 million. As a

result of spinout and the concurrent financing, Aya will become a

majority shareholder of Mx2 and will have two representatives on

the Board of Directors to support the team going forward.

-

Highlights

-

Formation of Mx2, a new North Africa-dedicated gold growth

company backed by Aya:

-

Amizmiz Gold Project (Morocco)

-

Historic resource of 342,000 ounces (‘oz’) at 12.98 grams per tonne

(‘g/t’) gold (‘Au’)

-

2,400 meter drill program underway to validate +1 million oz Au

potential.

-

Mining permit valid until 2029 and renewable.

-

Exclusive option to acquire Tijirit Gold Project (Mauritania)

-

Measured and indicated mineral resources of 292,600 oz at 2.19 g/t

Au and an inferred mineral resource of 533,200 oz at 1.63 g/t

Au.

-

Mx2 can maintain option by covering minimum spend requirements for

3 years.

-

Development opportunity with consolidation potential.

-

Experienced team and board from Aya, and senior mining executives

with top tier pedigree from Red Back Mining, Orca Gold, and Montage

Gold.

-

Mx2 will carry out a non-brokered private placement of a

minimum of $7.5 million:

-

Proceeds of the raise will be used for exploration activities on

the Amizmiz Gold Project and Tijirit Gold Project, and for working

capital and general corporate purposes of Mx2.

-

Aya will contribute $1 million.

-

Aya to crystalize $10 million in share consideration from

Mx2 through the Transaction and initiate a venture to unlock value

of non-core assets:

-

Aya to be the largest shareholder of Mx2, with a dedicated team

focused on untapping the potential of the Amizmiz Property while

benefiting from Aya’s unique positioning in Morocco.

“We are excited to announce the spinout, which

will optimize Aya's portfolio while ensuring our shareholders

continue to benefit from a majority stake in our high-quality gold

assets, particularly the highly promising Amizmiz gold project,”

said Benoit La Salle, President & CEO of Aya. “Additionally,

Mx2 will have the opportunity to exercise its option on Tijirit,

potentially unlocking significant value from this promising project

in the mining-friendly jurisdiction of Mauritania. This transaction

is expected to create substantial shareholder value by leveraging

our strong Mx2 exposure to these outstanding assets and its

seasoned management team, while allowing us to focus on advancing

Boumadine and Zgounder, and other strategic growth

initiatives.”

Richard Clark, Executive Chairman of Mx2,

commented, "We are excited to continue our success in North Africa

with this company-making transaction with Aya. The combination of

the Aya organization and the founders of Red Back, Orca Gold and

Montage Gold presents a unique opportunity for the growth of a new

gold player in North Africa, starting with the foundational assets

of Amizmiz in Morocco and Tijirit in Mauritania."

David Lalonde, B.Sc. P. Geo, Vice-President

Exploration, is Aya Gold & Silver’s Qualified Person and has

reviewed this press release for accuracy and compliance with

National Instrument 43-101.

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly growing,

Canada-based silver producer with operations in the Kingdom of

Morocco.

The only TSX-listed pure silver mining company,

Aya operates the high-grade Zgounder Silver Mine and is exploring

its properties along the prospective South-Atlas Fault, several of

which have hosted past-producing mines and historical resources.

Aya’s Moroccan mining assets are complemented by its Tijirit Gold

Project in Mauritania, which is being advanced to feasibility.

Aya’s management team has been focused on

maximising shareholder value by anchoring sustainability at the

heart of its operations, governance, and financial growth

plans.

For additional information, please visit Aya’s website at

www.ayagoldsilver.com.

Or contact

|

Benoit La Salle, FCPA, MBAPresident &

CEOBenoit.lasalle@ayagoldsilver.com |

Alex BallVP, Corporate Development &

IRalex.ball@ayagoldsilver.com |

|

|

|

Forward-Looking Statements

This press release contains certain statements

that constitute forward-looking information within the meaning of

applicable securities laws (“forward-looking statements”), which

reflects management’s expectations regarding Aya’s future growth

and business prospects (including the timing and development of new

deposits and the success of exploration activities) and other

opportunities. Wherever possible, words such as “expect”, “unlock”,

“promising”, “deliver”, “untap” and similar expressions or

statements that certain actions, events or results “may”, “could”,

“would”, “might”, “will”, or are “likely” to be taken, occur or be

achieved, have been used to identify such forward-looking

information. Specific forward-looking statements in this press

release include, but are not limited to, statements and information

with respect to advancement of the potential Transaction described

herein and the Company’s ability to close the Transaction. Although

the forward-looking information contained in this press release

reflect management’s current beliefs based upon information

currently available to management and based upon what management

believes to be reasonable assumptions, Aya cannot be certain that

actual results will be consistent with such forward-looking

information. Such forward-looking statements are based upon

assumptions, opinions and analysis made by management in light of

its experience, current conditions, and its expectations of future

developments that management believe to be reasonable and relevant

but that may prove to be incorrect. These assumptions include,

among other things, the ability to obtain any requisite

governmental approvals, obtaining regulatory permits for on-site

work, importing goods and machinery and employment permits, the

accuracy of Mineral Reserve and Mineral Resource Estimates

(including, but not limited to, ore tonnage and ore grade

estimates), the price of silver, the price of gold, exchange rates,

fuel and energy costs, future economic conditions, anticipated

future estimates of free cash flow, and courses of action. Aya

cautions you not to place undue reliance upon any such

forward-looking statements.

The risks and uncertainties that may affect

forward-looking statements include, among others: the inherent

risks involved in exploration and development of mineral

properties, including government approvals and permitting, changes

in economic conditions, changes in the worldwide price of silver

gold and other key inputs, changes in mine plans (including, but

not limited to, throughput and recoveries being affected by

metallurgical characteristics) and other factors, such as project

execution delays, many of which are beyond the control of Aya, as

well as other risks and uncertainties which are more fully

described in Aya’s 2023 Annual Information Form dated March 28,

2024, and in other filings of Aya with securities and regulatory

authorities which are available on SEDAR+ at www.sedarplus.ca. Aya

does not undertake any obligation to update forward-looking

statements should assumptions related to these plans, estimates,

projections, beliefs, and opinions change. Nothing in this document

should be construed as either an offer to sell or a solicitation to

buy or sell Aya securities. All references to Aya include its

subsidiaries unless the context requires otherwise.

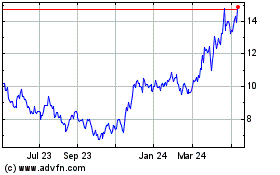

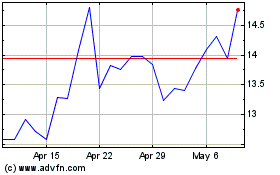

Aya Gold & Silver (TSX:AYA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aya Gold & Silver (TSX:AYA)

Historical Stock Chart

From Nov 2023 to Nov 2024