Brookfield Infrastructure Completes 60-Year Subordinated Note Offering

01 June 2024 - 6:27AM

Brookfield Infrastructure Partners L.P. (NYSE: BIP; TSX: BIP.UN)

(“Brookfield Infrastructure”) today announced the closing of a

public offering of $150 million of fixed rate subordinated notes

due May 31, 2084 (the “notes”). The issuer of the notes has granted

the underwriters an over-allotment option, exercisable in whole or

in part for a period of 30 days from the date of the pricing of the

offering, to purchase up to an additional $22,500,000 principal

amount of notes.

The notes, which have a coupon of 7.25%, will be

listed on the New York Stock Exchange under the symbol “BIPJ”.

Brookfield Infrastructure intends to use the net proceeds of the

offering to refinance existing indebtedness and for general

corporate purposes.

The notes were issued by Brookfield

Infrastructure Finance ULC (the “issuer”), an indirect wholly-owned

subsidiary of Brookfield Infrastructure, and are guaranteed on a

subordinated basis by Brookfield Infrastructure and certain of its

other subsidiaries.

Wells Fargo Securities, LLC, BofA Securities,

Inc., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, RBC

Capital Markets, LLC and UBS Securities LLC acted as joint

book-running managers for the offering.

This news release does not constitute an offer

to sell or the solicitation of an offer to buy the securities

described herein, nor shall there be any sale of these securities

in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the

securities laws of such jurisdiction.

The securities were not offered or sold,

directly or indirectly, in Canada or to any resident of Canada.

About Brookfield

Infrastructure

Brookfield Infrastructure is a leading global

infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, midstream and data

sectors across the Americas, Asia Pacific and Europe. We are

focused on assets that have contracted and regulated revenues that

generate predictable and stable cash flows. Investors can access

its portfolio either through Brookfield Infrastructure Partners

L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership,

or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a

Canadian corporation.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with over $925 billion of assets under

management.

Contact Information

|

Media: |

Investor Relations: |

|

Simon MaineManaging Director,Corporate CommunicationsTel: +44 739

890 9278Email: simon.maine@brookfield.com |

Stephen FukudaSenior Vice President,Corporate Development &

Investor RelationsTel: +1 (416) 956-5129Email:

stephen.fukuda@brookfield.com |

Cautionary Statement Regarding

Forward-looking Statements

This news release may contain forward-looking

statements and information within the meaning of applicable

securities laws. The words “will” and “intends”, derivatives

thereof and other expressions which are predictions of or indicate

future events, trends or prospects and which do not relate to

historical matters, identify forward-looking statements.

Forward-looking statements in this news release include statements

regarding the offering and the use of proceeds therefrom. Although

Brookfield Infrastructure believes that these forward-looking

statements and information are based upon reasonable assumptions

and expectations, the reader should not place undue reliance on

them, or any other forward-looking statements or information in

this news release. The future performance and prospects of

Brookfield Infrastructure are subject to a number of known and

unknown risks and uncertainties. Factors that could cause actual

results of Brookfield Infrastructure to differ materially from

those contemplated or implied by the statements in this news

release are described in the documents filed by Brookfield

Infrastructure with the securities regulators in Canada and the

United States including under “Risk Factors” in Brookfield

Infrastructure’s most recent Annual Report on Form 20-F and other

risks and factors that are described therein. Except as required by

law, Brookfield Infrastructure undertakes no obligation to publicly

update or revise any forward-looking statements or information,

whether as a result of new information, future events or

otherwise.

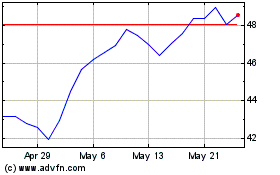

Brookfield Infrastructure (TSX:BIPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Brookfield Infrastructure (TSX:BIPC)

Historical Stock Chart

From Dec 2023 to Dec 2024