Birchcliff Energy Ltd. Receives TSX Approval for Renewed Normal Course Issuer Bid

21 November 2023 - 8:00AM

Birchcliff Energy Ltd. (“

Birchcliff” or the

“

Corporation”) (TSX: BIR) is pleased to announce

that the Toronto Stock Exchange (the “

TSX”) has

accepted the Corporation’s notice of intention to make a normal

course issuer bid (the “

NCIB”). The NCIB

effectively renews the Corporation’s existing normal course issuer

bid, which is set to expire on November 24, 2023.

The NCIB allows Birchcliff to purchase up to

13,328,267 common shares (representing 5% of its 266,565,357 common

shares outstanding as at November 14, 2023) over a period of twelve

months commencing on November 27, 2023 and terminating no later

than November 26, 2024. Under the NCIB, common shares may be

purchased in open market transactions on the TSX and/or alternative

Canadian trading systems at the prevailing market price at the time

of such transaction. Subject to exceptions for block purchases, the

total number of common shares that Birchcliff is permitted to

purchase on the TSX during a trading day is subject to a daily

purchase limit of 275,590 common shares, which represents 25% of

the average daily trading volume on the TSX of 1,102,362 common

shares for the six-month period ended October 31, 2023. All common

shares purchased under the NCIB will be cancelled.

Birchcliff believes that at times, the

prevailing market price of its common shares may not reflect the

underlying value of the shares and the Corporation’s business.

Accordingly, depending on the market price of the common shares and

other relevant factors, Birchcliff believes that purchasing its

common shares may represent an attractive opportunity to enhance

Birchcliff’s per share metrics and thereby increase the underlying

value of its common shares to its shareholders. In addition,

Birchcliff may use the NCIB to help offset the number of common

shares it issues throughout the year pursuant to the exercise of

options granted under its stock option plan in order to minimize or

eliminate dilution to shareholders.

The actual number of common shares purchased

pursuant to the NCIB and the timing of such purchases will be

determined by Birchcliff. There cannot be any assurance as to how

many common shares, if any, will ultimately be acquired by the

Corporation.

Under Birchcliff’s existing normal course issuer

bid (the “Existing NCIB”), it obtained the

approval of the TSX to purchase up to 13,295,786 common shares over

the period from November 25, 2022 to November 24, 2023. As at

November 17, 2023, the Corporation has purchased 1,727,868 common

shares under the Existing NCIB at a weighted average price per

share of $8.24 through the facilities of the TSX and alternative

Canadian trading systems.

Forward-Looking Statements

Certain statements contained in this press

release constitute forward-looking statements and forward-looking

information (collectively referred to as “forward-looking

statements”) within the meaning of applicable Canadian

securities laws. All statements and information other than

historical fact may be forward-looking statements. By their nature,

forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. Accordingly, readers are cautioned not

to place undue reliance on such forward-looking statements.

Although Birchcliff believes that the expectations reflected in the

forward-looking statements are reasonable, there can be no

assurance that such expectations will prove to be correct and

Birchcliff makes no representation that actual results achieved

will be the same in whole or in part as those set out in the

forward-looking statements.

In particular, this press release contains

forward-looking statements relating to the NCIB, including

potential purchases under the NCIB and the effects and benefits of

the NCIB. With respect to the forward-looking statements contained

in this press release, assumptions have been made regarding, among

other things: the anticipated benefits of the NCIB; prevailing and

future commodity prices and differentials, exchange rates, interest

rates, inflation rates, royalty rates and tax rates; the state of

the economy, financial markets and the exploration, development and

production business; the political environment; the regulatory

framework; future cash flow, debt and dividend levels; future

operating, transportation, marketing, G&A and other expenses;

Birchcliff’s ability to access capital and obtain financing on

acceptable terms; the timing and amount of capital expenditures and

the sources of funding for capital expenditures and other

activities; the sufficiency of budgeted capital expenditures to

carry out planned operations; the successful and timely

implementation of capital projects; results of operations;

Birchcliff’s ability to continue to develop its assets and obtain

the anticipated benefits therefrom; the performance of existing and

future wells; and the ability to obtain any necessary regulatory

approvals in a timely manner. Birchcliff’s actual results,

performance or achievements could differ materially from those

anticipated in the forward-looking statements as a result of both

known and unknown risks and uncertainties including, but not

limited to: the failure to realize the anticipated benefits of the

NCIB; a failure to execute purchases under the NCIB; the risks

posed by pandemics, epidemics and global conflict and their impacts

on supply and demand and commodity prices; actions taken by OPEC

and other major producers of crude oil and the impact such actions

may have on supply and demand and commodity prices; general

economic, market and business conditions which will, among other

things, impact the demand for and market prices of Birchcliff’s

products and Birchcliff’s access to capital; volatility of crude

oil and natural gas prices; risks associated with increasing costs,

whether due to high inflation rates, supply chain disruptions or

other factors; stock market volatility; an inability to access

sufficient capital from internal and external sources on terms

acceptable to the Corporation; risks associated with Birchcliff’s

credit facilities; operational risks and liabilities inherent in

oil and natural gas operations; uncertainty that development

activities in connection with Birchcliff’s assets will be economic;

geological, technical, drilling, construction and processing

problems; the accuracy of cost estimates and variances in

Birchcliff’s actual costs and economic returns from those

anticipated; and changes to the regulatory framework in the

locations where the Corporation operates.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other risk factors that could affect results of operations,

financial performance or financial results are included in

Birchcliff’s most recent annual information form under the heading

“Risk Factors” and in other reports filed with Canadian securities

regulatory authorities. Management has included the above summary

of assumptions and risks related to forward-looking statements

provided in this press release in order to provide readers with a

more complete perspective on Birchcliff’s future operations and

management’s current expectations relating to Birchcliff’s future

performance. Readers are cautioned that this information may not be

appropriate for other purposes. The forward-looking statements

contained in this press release are expressly qualified by the

foregoing cautionary statements. The forward-looking statements

contained herein are made as of the date of this press release.

Unless required by applicable laws, Birchcliff does not undertake

any obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

About Birchcliff:

Birchcliff is a dividend-paying, intermediate

oil and natural gas company based in Calgary, Alberta with

operations focused on the Montney/Doig Resource Play in Alberta.

Birchcliff’s common shares are listed for trading on the TSX under

the symbol “BIR”.

|

For further information, please contact: |

|

Birchcliff Energy Ltd.Suite 1000, 600 – 3rd Avenue

S.W. Calgary, Alberta T2P 0G5Telephone: (403) 261-6401Email:

info@birchcliffenergy.comwww.birchcliffenergy.com |

Jeff Tonken – Chief Executive OfficerChris

Carlsen – President and Chief Operating

OfficerBruno Geremia – Executive Vice President

and Chief Financial Officer |

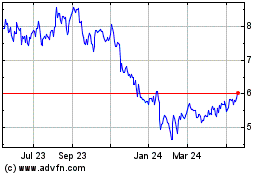

Birchcliff Energy (TSX:BIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

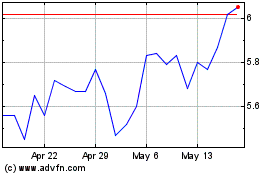

Birchcliff Energy (TSX:BIR)

Historical Stock Chart

From Dec 2023 to Dec 2024