Birchcliff Energy Ltd. (“Birchcliff”) (TSX: BIR)

and

AltaGas Ltd. (“AltaGas”) (TSX: ALA) are

pleased to announce an expanded partnership focused on reducing

long-term operating costs and connecting more liquified petroleum

gas (“LPG”) into premium global markets.

As part of the increased partnership, Birchcliff

and AltaGas have entered into a long-term contract operating

agreement (“COA”) whereby Birchcliff will take over operatorship of

AltaGas’ Gordondale deep-cut gas processing facility (the

“Gordondale Facility”). This will allow Birchcliff to leverage cost

optimization opportunities that exist between its 100 percent owned

and operated gas plant at Pouce Coupe (the “Pouce Coupe Gas Plant”)

and the Gordondale Facility, which are located approximately six

miles apart and are pipeline connected. These optimization

opportunities are expected to drive lower operating costs, reduce

downtime, and optimize natural gas liquids recoveries for

Birchcliff, with no net impact on AltaGas’ profitability.

AltaGas will continue to own 100 percent of the

Gordondale Facility with no plans to reduce its ownership. The

Gordondale Facility will continue to operate under the existing

long-term take-or-pay processing agreement between the parties (the

“Processing Agreement”), with Birchcliff as operator for the

remainder of the Processing Agreement’s term, which will continue

until at least December 31, 2032. Birchcliff has also entered into

additional long-term tolling agreements with AltaGas whereby

Birchcliff will market additional LPG volumes through AltaGas’

global exports platform, which is aligned with AltaGas’ strategy to

grow tolling volumes and cash flow predictability, while providing

Birchcliff with direct market access to premium LPG netbacks in

Asia with Far East Index (“FEI”) pricing.

The uniqueness of these agreements is

underpinned by Birchcliff representing 100 percent of throughput

volumes at the Gordondale Facility, which creates opportunities for

operational efficiencies and cost savings within Birchcliff’s

Gordondale and Pouce Coupe areas. The agreements highlight the

benefits of infrastructure owners and producers partnering to drive

solutions that deliver the best outcomes for all stakeholders.

About Birchcliff

Birchcliff is a dividend-paying, intermediate

oil and natural gas company based in Calgary, Alberta with

operations focused on the Montney/Doig Resource Play in Alberta.

Birchcliff’s common shares are listed for trading on the Toronto

Stock Exchange under the symbol “BIR”.

For more information, please contact:

Chris Carlsen – President and

Chief Executive Officer

Bruno Geremia – Executive Vice

President and Chief Financial Officer

Birchcliff Energy Ltd.Suite

1000, 600 – 3rd Avenue S.W.Calgary, Alberta T2P 0G5Telephone: (403)

261-6401Email: birinfo@birchcliffenergy.com

www.birchcliffenergy.com

About AltaGas

AltaGas is a leading North American

infrastructure company that connects customers and markets to

affordable and reliable sources of energy. The Company operates a

diversified, lower-risk, high-growth Energy Infrastructure business

that is focused on delivering stable and growing value for its

stakeholders.

For more information visit www.altagas.ca or

reach out to one of the following:

Jon MorrisonSenior Vice

President, Corporate Development and Investor

RelationsJon.Morrison@altagas.ca

Aaron SwansonVice President,

Investor RelationsAaron.Swanson@altagas.ca

Media Inquiries

1-403-206-2841media.relations@altagas.ca

Source of Information

The information contained in this press release

as it relates solely to Birchcliff, its business and operations has

been provided by Birchcliff and the information contained in this

press release as it relates solely to AltaGas, its business and

operations has been provided by AltaGas. Neither Birchcliff nor

AltaGas assume any responsibility for the accuracy or completeness

of the information of the other party or the failure by the other

party to disclose events which may have occurred or may affect the

completeness or accuracy of such information but which are unknown

to the other party.

Forward-Looking Information

Certain statements contained in this press

release constitute forward‐looking statements and forward-looking

information (collectively referred to as “forward‐looking

statements”) within the meaning of applicable Canadian securities

laws. The forward-looking statements contained in this press

release relate to future events or Birchcliff’s or AltaGas’ future

plans, strategy, operations, performance or financial position and

are based on Birchcliff’s and AltaGas’ current expectations,

estimates, projections, beliefs and assumptions. All statements and

information other than historical fact may be forward‐looking

statements. Such forward‐looking statements are often, but not

always, identified by the use of words such as “expect”, “believe”,

“anticipate”, “potential”, “continue”, “may”, “will”, “could”,

“might”, “should”, “would”, “maintain”, “deliver” and other similar

words and expressions.

By their nature, forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward‐looking statements. Accordingly,

readers are cautioned not to place undue reliance on such

forward-looking statements. Although Birchcliff and AltaGas believe

that the expectations reflected in the forward-looking statements

are reasonable, there can be no assurance that such expectations

will prove to be correct and neither Birchcliff nor AltaGas makes

any representation that actual results achieved will be the same in

whole or in part as those set out in the forward-looking

statements.

In particular, this press release contains

forward‐looking statements relating to the COA, the Processing

Agreement and the additional long-term tolling agreements and the

anticipated effects and benefits of such arrangements to Birchcliff

and AltaGas (including: that the COA will drive shareholder value

for Birchcliff and AltaGas; the expanded partnership’s focus on

reducing long-term operating costs and connecting more LPG into

premium global markets; that Birchcliff representing 100% of

throughput volumes at the Gordondale Facility creates opportunities

for operational efficiencies and cost savings within Birchcliff’s

Gordondale and Pouce Coupe areas; that the COA will allow

Birchcliff to leverage cost optimization opportunities that exist

between the Pouce Coupe Gas Plant and the Gordondale Facility; that

these optimization opportunities are expected to drive lower

operating costs, reduce downtime and optimize natural gas liquids

recoveries for Birchcliff, with no net impact on AltaGas’

profitability; that AltaGas has no plans to reduce its ownership of

the Gordondale Facility; that Birchcliff will operate the

Gordondale Facility for the remainder of the Processing Agreement’s

term, which is expected to continue until at least December 31,

2032; and statements regarding the additional long-term tolling

agreements including that the agreements are aligned with AltaGas’

strategy to grow tolling volumes and cash flow predictability while

providing Birchcliff with direct market access to premium LPG

netbacks in Asia with FEI pricing.

With respect to the forward‐looking statements

contained in this press release, assumptions have been made

regarding, among other things: Birchcliff’s and AltaGas’ ability to

obtain the anticipated benefits of the COA, the Processing

Agreement and the additional long-term tolling agreements;

prevailing and future commodity prices and differentials, exchange

rates, interest rates, inflation rates, royalty rates and tax

rates; the state of the economy, financial markets and the

exploration, development and production business; the political

environment; the regulatory framework and the ability to comply

with existing and future laws; future cash flow, debt and dividend

levels; future operating, transportation and other expenses; the

ability to access capital and obtain financing; the timing and

amount of capital expenditures; the sufficiency of budgeted capital

expenditures to carry out planned operations; the successful and

timely implementation of capital projects and the timing, location

and extent of future drilling and other operations; results of

operations; Birchcliff’s ability to continue to develop its assets

and obtain the anticipated benefits therefrom; the impact of

competition on Birchcliff and AltaGas; the availability of, demand

for and cost of labour, services and materials; the satisfaction by

third parties of their obligations to Birchcliff and AltaGas; the

ability of Birchcliff to secure adequate transportation for its

products; Birchcliff’s ability to successfully market natural gas

and liquids; and the results of the Birchcliff’s and AltaGas’ risk

management and market diversification activities.

Birchcliff’s and AltaGas’ actual results,

performance or achievements could differ materially from those

anticipated in the forward-looking statements as a result of both

known and unknown risks and uncertainties including, but not

limited to: the failure to realize the anticipated benefits of the

COA, the Processing Agreement and the additional long-term tolling

agreements; global conflict and their impacts on supply and demand

and commodity prices; actions taken by OPEC and other major

producers of crude oil and the impact such actions may have on

supply and demand and commodity prices; the uncertainty of

estimates and projections relating to production, revenue, costs,

expenses and reserves; general economic, market and business

conditions which will, among other things, impact the demand for

and market prices of parties respective products and their access

to capital; volatility of crude oil and natural gas prices; risks

associated with increasing costs; fluctuations in exchange and

interest rates; an inability to access sufficient capital from

internal and external sources; operational risks and liabilities

inherent in oil and natural gas operations and the occurrence of

unexpected events such as fires, severe weather, explosions and

transportation incidents; an inability to access sufficient water

or other fluids needed for operations; uncertainty that development

activities in connection with the parties’ respective assets will

be economic; the accuracy of estimates of production levels;

geological, technical, drilling, construction and processing

problems; uncertainty of geological and technical data; horizontal

drilling and completions techniques and the failure of drilling

results to meet expectations for reserves or production; delays or

changes in plans with respect to exploration or development

projects or capital expenditures; the accuracy of cost estimates

and variances in actual costs and economic returns from those

anticipated; incorrect assessments of the value of acquisitions and

exploration and development programs; changes to the regulatory

framework; political uncertainty and uncertainty associated with

government policy changes; actions by government authorities; an

inability of the parties to comply with existing and future laws

and the cost of compliance with such laws; dependence on

facilities, gathering lines and pipelines; uncertainties and risks

associated with pipeline restrictions and outages to third-party

infrastructure that could cause disruptions to production; the lack

of available pipeline capacity and an inability to secure adequate

and cost-effective transportation for the parties’ products; an

inability to satisfy obligations under Birchcliff’s firm marketing

and transportation arrangements; shortages in equipment and skilled

personnel; competition; environmental and climate change risks,

claims and liabilities; potential litigation; default under or

breach of agreements by counterparties and potential enforceability

issues in contracts; claims by Indigenous peoples; unforeseen title

defects; uncertainties associated with the outcome of litigation or

other proceedings involving Birchcliff or AltaGas; risks associated

with the parties’ risk management and market diversification

activities; the failure to obtain any required approvals in a

timely manner or at all; the failure to complete or realize the

anticipated benefits of acquisitions and dispositions and the risk

of unforeseen difficulties in integrating acquired assets into

operations; the availability of insurance and the risk that certain

losses may not be insured; and breaches or failure of information

systems and security (including risks associated with

cyber-attacks). Readers are cautioned that the foregoing lists of

factors are not exhaustive. Additional information on these and

other risk factors that could affect results of operations,

financial performance or financial results are included in

Birchcliff’s and AltaGas’ annual information forms for the

financial year ended December 31, 2023 and in other reports filed

by each of Birchcliff and AltaGas with Canadian securities

regulatory authorities.

Birchcliff and AltaGas have included the above

summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

readers with a more complete perspective on Birchcliff’s and

AltaGas’ respective future operations. Readers are cautioned that

this information may not be appropriate for other purposes. The

forward-looking statements contained in this press release are

expressly qualified by the foregoing cautionary statements. The

forward-looking statements contained herein are made as of the date

of this press release. Unless required by applicable laws, neither

Birchcliff nor AltaGas undertakes any obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

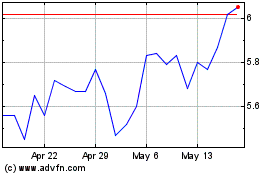

Birchcliff Energy (TSX:BIR)

Historical Stock Chart

From Mar 2025 to Apr 2025

Birchcliff Energy (TSX:BIR)

Historical Stock Chart

From Apr 2024 to Apr 2025