Computer Modelling Group Ltd. (“CMG Group” or the “Company”)

announces its financial results for the three and nine months ended

December 31, 2023.

CMG Group and its subsidiaries include the

following; Computer Modelling Group Inc., CMG Middle East FZ LLC,

CMGL Services Corporation Inc., CMG Europe Ltd., and CMG

Collaboration Centre India Private Ltd., (together referred to as

“CMG”), and CMG Holdings (USA) Inc., Bluware-Headwave Ventures

Inc., Bluware Inc., Hue AS, and Kalkulo AS (together referred to as

“BHV” or “Bluware”).

As a result of CMG Group’s acquisition of BHV on

September 25, 2023, the Company’s operations are now organized into

two reportable operating segments represented by CMG; the

development and licensing of reservoir simulation software, and

BHV; the development and licensing of seismic interpretation

software.

THIRD QUARTER FISCAL 2024 (“Q3 2024”)

OVERVIEW

CMG GROUP KEY FINANCIAL METRICS

|

For the Three Months Ended |

For the Nine Months Ended |

|

December 31, 2023 and compared to the same period of the previous

fiscal year, when appropriate: |

|

|

- Annuity/maintenance license revenue increased by 21%;

|

- Annuity/maintenance license revenue increased by 18%;

|

- Annuity license fees have increased by 100% or $3.8 million as

a result of a full quarter of BHV operations;

|

- Annuity license fees have increased by 100% or $4.0 million as

a result of a full quarter of BHV operations;

|

- Total revenue increased by 70%;

|

- Total revenue increased by 43%;

|

- Total operating expenses increased by 99%. Adjusted for

acquisition related expenses in the current quarter and

restructuring charges in the prior year’s third quarter, operating

expenses increased by 92%, primarily due to a combination of higher

stock-based compensation expense, direct employee costs,

professional service costs and office-related costs;

|

- Total operating expenses increased by 35%. Adjusted for

acquisition related expenses in the current year and restructuring

charges in the prior year, operating expenses increased by 51% from

the comparative period in the prior year, primarily due to a

combination of higher stock-based compensation expenses, direct

employee costs, professional services, travel-related and

office-related costs;

|

- Quarterly adjusted EBITDA as a % of total revenue was 38%,

decreasing from 49% in the comparative quarter with, CMG achieving

44% and BHV achieving 27% in the current quarter;

|

- Year-to-date adjusted EBITDA as a % of total revenue was 44%,

decreasing from 46% in the comparative period, with CMG achieving

47% and BHV achieving 27% in the current quarter;

|

- Basic EPS of $0.07, down $0.01 per share from the comparative

quarter in the prior fiscal year;

|

- Basic EPS of $0.24, up $0.06 per share from the comparative

period in the prior fiscal year;

|

- Achieved free cash flow per share of $0.09.

|

- Achieved free cash flow per share of $0.32.

|

|

|

|

THIRD QUARTER BUSINESS HIGHLIGHTS

- Our third quarter results represent

the first full quarter of operations following the acquisition of

BHV, which contributed $11.2 million to total revenue and $1.7

million to net income:

- Generated total revenue of $33.0

million in the third quarter of fiscal 2024 compared to $19.4

million in the prior year’s quarter, an increase of 70% with 58%

contributed by BHV and 12% by CMG. Geographically, all regions saw

increases in annuity/maintenance revenue due to new customers and

increased licensing by existing customers. Our existing customers

continue to grow their product offerings on contract renewals.

Annuity license fee revenue increased due to the acquisition of BHV

and was impacted by contract renewals;

- Adjusted EBITDA was 38%, compared

to 49% in the same period of last fiscal year with BHV achieving

27% and CMG achieving 44% adjusted EBITDA;

- Recognition of annuity license fee

from BHV had a positive impact on total revenue and adjusted EBITDA

(see under “Quarterly Performance” heading for further

description);

- Reported free cash flow of $7.7

million, representing $0.09 per share;

- Subsequent to quarter-end, declared

a quarterly cash dividend of $0.05 per share to be paid on March

15, 2024 to all shareholders on record at the close of business on

March 7, 2024.

The following press release should be read in

conjunction with the Company’s unaudited condensed consolidated

interim financial statements for the three and nine months ended

December 31, 2023 and the accompanying notes, our Management’s

Discussion and Analysis (“MD&A”) for the three and nine months

ended December 31, 2023 and with our annual Consolidated Financial

Statements, prepared in accordance with International Financial

Reporting Standards (“IFRS”) and with our MD&A for the year

ended March 31, 2023 which can be found on SEDAR at

www.sedarplus.ca and on the Company’s website www.cmgl.ca.

Additional information about the Company is also available on SEDAR

at www.sedarplus.ca.

QUARTERLY PERFORMANCE

|

|

Fiscal 2022(2) |

Fiscal 2023(3) |

Fiscal 2024(4) |

|

($ thousands, unless otherwise stated) |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

|

Annuity/maintenance license |

14,306 |

13,529 |

14,825 |

15,533 |

15,803 |

15,607 |

17,610 |

18,814 |

| Annuity license fee |

- |

- |

- |

- |

- |

- |

- |

3,846 |

| Perpetual license |

2,351 |

386 |

780 |

518 |

1,556 |

1,849 |

1,176 |

584 |

|

Total software license revenue |

16,657 |

13,915 |

15,605 |

16,051 |

17,359 |

17,456 |

18,786 |

23,244 |

|

Professional services revenue |

2,137 |

2,192 |

2,477 |

3,341 |

2,906 |

3,292 |

3,847 |

9,763 |

| Total revenue |

18,794 |

16,107 |

18,082 |

19,392 |

20,265 |

20,748 |

22,633 |

33,007 |

| Operating expenses |

11,482 |

9,382 |

10,870 |

9,262 |

13,356 |

9,079 |

12,414 |

18,434 |

| Adjusted operating

expenses(1) |

12,398 |

7,780 |

8,529 |

9,262 |

13,356 |

9,079 |

11,841 |

17,738 |

| Operating profit |

7,312 |

4,961 |

5,555 |

8,435 |

6,909 |

9,764 |

7,726 |

8,217 |

| Operating profit (%) |

39 |

31 |

31 |

43 |

34 |

47 |

34 |

25 |

| Adjusted operating

profit(1) |

6,396 |

6,563 |

7,896 |

8,435 |

6,909 |

9,764 |

8,299 |

8,913 |

| Adjusted operating profit

(%) |

34 |

41 |

44 |

43 |

34 |

47 |

37 |

27 |

| Profit before income and other

taxes |

6,563 |

5,182 |

5,989 |

8,350 |

7,127 |

9,148 |

8,793 |

8,117 |

| Income and other taxes |

1,611 |

1,369 |

1,579 |

2,002 |

1,901 |

2,244 |

2,277 |

2,507 |

| Net income for the period |

4,952 |

3,813 |

4,410 |

6,348 |

5,226 |

6,904 |

6,516 |

5,610 |

| Adjusted EBITDA(1) |

7,879 |

6,775 |

8,435 |

9,498 |

8,520 |

9,948 |

10,718 |

12,634 |

| Cash dividends declared and

paid |

4,016 |

4,017 |

4,025 |

4,025 |

4,032 |

4,039 |

4,043 |

4,059 |

| Funds flow from

operations |

7,105 |

4,558 |

4,974 |

8,169 |

7,656 |

7,920 |

11,491 |

8,477 |

| Free

cash flow(1) |

6,584 |

4,255 |

4,505 |

7,545 |

5,396 |

7,463 |

11,028 |

7,654 |

| Per share amounts –

($/share) |

|

|

|

|

|

|

|

|

| Earnings per share (EPS) –

basic |

0.06 |

0.05 |

0.05 |

0.08 |

0.07 |

0.09 |

0.08 |

0.07 |

| Earnings per share (EPS) –

diluted |

0.06 |

0.05 |

0.05 |

0.08 |

0.06 |

0.08 |

0.08 |

0.07 |

| Cash dividends declared and

paid |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

0.05 |

| Funds flow from operations per

share – basic |

0.09 |

0.06 |

0.06 |

0.10 |

0.09 |

0.10 |

0.14 |

0.10 |

| Free

cash flow per share – basic(1) |

0.08 |

0.05 |

0.06 |

0.09 |

0.07 |

0.09 |

0.14 |

0.09 |

|

(1) |

This is a non-IFRS financial measure. See the “Non-IFRS Financial

Measures” section. |

| (2) |

Q4 of fiscal 2022 includes $0.8

million of annuity/maintenance revenue that pertains to usage of

CMG’s products in prior quarters. |

| (3) |

Q1, Q2, Q3, and Q4 of fiscal 2023

include $0.2 million, $0.3 million, $0.3 million, and $0.4 million,

respectively, of annuity/maintenance revenue that pertains to usage

of CMG’s products in prior quarters. |

| (4) |

Q1, Q2, and Q3 of fiscal 2024

include $0.1 million, $0.4 million, and $0.2 million, respectively,

of annuity/maintenance revenue that pertains to usage of CMG’s

products in prior quarters. |

Total software license revenue for the three

months ended December 31, 2023 increased by 45%, compared to the

same period of the previous fiscal year, of which 31% is due to BHV

acquisition and 14% due to increases in annuity/maintenance and

perpetual license revenue of CMG. Total software license revenue

for the nine months ended December 31, 2023 increased by 31%,

compared to the same period of the previous fiscal year, of which

11% is due to BHV acquisition and 19% due to increases in

annuity/maintenance and perpetual license revenue of CMG.

Annuity/maintenance license revenue increased by

21% during the three months ended December 31, 2023, compared to

the same period of the previous fiscal year, of which 8% is due to

BHV acquisition and 13% due to annuity/ maintenance license revenue

increase of CMG. Annuity/maintenance license revenue increased by

18% during the nine months ended December 31, 2023, compared to the

same period in the previous fiscal year, of which 3% is due to BHV

acquisition and 15% due to increases in annuity/ maintenance

license revenue of CMG. CMG’s annuity/maintenance license revenue

increases during both three and nine months ended December 31, 2023

were a result of increases in all regions, supported by license fee

increases, increased the license usage by existing customers and

addition of new customers. We continue to see a strong contribution

to revenue from CMG energy transition customers and estimate during

the three and nine months ended December 31, 2023, 22% of total

software license revenue is related to energy transition.

Annuity license fee revenue relates to BHV and

this revenue stream is expected to fluctuate quarterly depending on

the timing of contract renewals as the annuity license fees are

recognized in revenue when the software license is delivered.

Historically, a majority of contracts renew during the third and

fourth quarters.

Perpetual license revenue increased by 13%

during the three months ended December 31, 2023, compared to the

same period of the previous fiscal year, due to perpetual license

sales generated in Canada during the quarter. During the nine

months ended December 31, 2023, compared to the same period of the

previous fiscal year, perpetual license revenue increased by 114%

due to increases in all regions.

Professional services revenue for the three and

nine months ended December 31, 2023 was $9.8 million and $16.9

million which represents increases of 192% and 111%, respectively,

compared to the same periods of the previous fiscal year. The

acquisition of BHV contributed 185% and 82% of the increase,

respectively, for the three and nine months ended December 31,

2023.The remaining increases are due to increased CMG professional

services revenue from consulting projects as a result of expanded

services to address customer demand.

Total operating expenses for the three and nine

months ended December 31, 2023, increased by 99% and 35%,

respectively, compared to the same periods of the previous fiscal

year. Adjusted total operating expenses increased by 92% and 51%

for the three and nine months ended December 31, 2023,

respectively, compared to the same periods of the previous fiscal

year. The acquisition of BHV contributed to 46% and 17% of the

increase in total adjusted operating costs for the three and nine

months ended December 31, 2023, respectively, compared to the same

periods of the previous fiscal year. CMG’s total adjusted operating

expenses increased by 46% and 34% for the three and nine months

ended December 31, 2023, respectively, compared to the same periods

of the previous fiscal year, due to an increase in both direct

employee costs and other corporate costs.

Operating profit as a percentage of total

revenue for the three months ended December 31, 2023 was 25%, down

from 43% in the comparative quarter. Adjusted operating profit was

27%, down from 43% in the comparative quarter. Current quarter

includes BHV’s adjusted operating profit as a percentage of revenue

at 26% and CMG’s adjusted operating profit as a percentage of

revenue at 28%. CMG’s adjusted operating profit as a percentage of

revenue decreased from 43% recorded in the same quarter of the

previous fiscal year, due to an increase in direct employee costs

driven by the increase in stock-based compensation, other corporate

costs inclusive of the increase in amortization expense as a result

of BHV acquisition, partially offset by an increase in revenue.

Operating profit as a percentage of total revenue for the nine

months ended December 31, 2023 was 34%, slightly down from 35% in

the comparative quarter. Adjusted operating profit was 35%, down

from 43% in the comparative quarter. Current year-to-date quarter

includes BHV’s adjusted operating profit as a percentage of revenue

at 26% and CMG’s adjusted operating profit as a percentage of

revenue at 37%. CMG’s adjusted operating profit as a percentage of

revenue decreased from 43% recorded in the same period of the

previous fiscal year, due to the same reasons that affected the

quarterly comparison as explained above.

NON-IFRS FINANCIAL MEASURES AND

RECONCILIATION OF NON-IFRS MEASURES

Funds flow from operations is an additional IFRS

measure that the Company presents in its consolidated statements of

cash flows. Funds flow from operations is calculated as cash flows

provided by operating activities adjusted for changes in non-cash

working capital. Management believes that this measure provides

useful supplemental information about operating performance and

liquidity, as it represents cash generated during the period,

regardless of the timing of collection of receivables and payment

of payables, which may reduce comparability between periods.

Certain financial measures – namely, Adjusted

EBITDA, free cash flow, adjusted total operating expenses, direct

employee costs, adjusted direct employee costs, other corporate

costs, adjusted other corporate costs, adjusted operating profit,

and adjusted net income – do not have a standard meaning prescribed

by IFRS and, accordingly, may not be comparable to measures used by

other companies. Management believes that these indicators

nevertheless provide useful measures in evaluating the Company’s

performance. Reconciliations of the non-IFRS financial measures to

the most directly comparable IFRS financial measure are presented

below:

Free Cash Flow Reconciliation to Funds Flow from

Operations

|

|

Fiscal 2022 |

|

Fiscal 2023 |

|

Fiscal 2024 |

|

|

($ thousands, unless otherwise stated) |

Q4 |

|

Q1 |

|

Q2 |

|

Q3 |

|

Q4 |

|

Q1 |

|

Q2 |

|

Q3 |

|

|

Funds flow from operations |

7,105 |

|

4,558 |

|

4,974 |

|

8,169 |

|

7,656 |

|

7,920 |

|

11,491 |

|

8,477 |

|

|

Capital expenditures |

(62 |

) |

- |

|

(130 |

) |

(211 |

) |

(1,707 |

) |

(45 |

) |

(51 |

) |

(459 |

) |

|

Repayment of lease liabilities |

(459 |

) |

(303 |

) |

(339 |

) |

(413 |

) |

(553 |

) |

(412 |

) |

(412 |

) |

(364 |

) |

|

Free cash flow |

6,584 |

|

4,255 |

|

4,505 |

|

7,545 |

|

5,396 |

|

7,463 |

|

11,028 |

|

7,654 |

|

|

Weighted average shares – basic (thousands) |

80,335 |

|

80,335 |

|

80,412 |

|

80,511 |

|

80,603 |

|

80,685 |

|

80,834 |

|

81,067 |

|

|

Free cash flow per share – basic |

0.08 |

|

0.05 |

|

0.06 |

|

0.09 |

|

0.07 |

|

0.09 |

|

0.14 |

|

0.09 |

|

Adjusted EBITDA and Adjusted EBITDA as a % of Total

Revenue

| |

Three months ended December 31 |

|

Nine months ended December 31 |

|

|

2023 |

|

2022 |

|

$ change |

|

% change |

|

2023 |

|

2022 |

|

$ change |

|

% change |

|

| ($

thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

5,610 |

|

6,348 |

|

(738 |

) |

(12 |

%) |

19,030 |

|

14,571 |

|

4,459 |

|

31 |

% |

| Add

(deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

1,555 |

|

864 |

|

691 |

|

80 |

% |

3,537 |

|

2,732 |

|

805 |

|

29 |

% |

|

Stock-based compensation |

2,974 |

|

1,094 |

|

1,880 |

|

172 |

% |

5,370 |

|

1,596 |

|

3,774 |

|

236 |

% |

|

Acquisition related expenses |

696 |

|

- |

|

696 |

|

100 |

% |

1,269 |

|

- |

|

1,269 |

|

100 |

% |

|

Restructuring charges |

- |

|

- |

|

- |

|

0 |

% |

- |

|

3,943 |

|

(3,943 |

) |

(100 |

%) |

|

Income and other tax expense |

2,507 |

|

2,002 |

|

505 |

|

25 |

% |

7,028 |

|

4,950 |

|

2,078 |

|

42 |

% |

|

Interest income |

(986 |

) |

(548 |

) |

(438 |

) |

80 |

% |

(2,438 |

) |

(1,105 |

) |

(1,333 |

) |

121 |

% |

|

Foreign exchange loss (gain) |

642 |

|

151 |

|

491 |

|

325 |

% |

693 |

|

(923 |

) |

1,616 |

|

(175 |

%) |

|

Repayment of lease liabilities |

(364 |

) |

(413 |

) |

49 |

|

(12 |

%) |

(1,188 |

) |

(1,055 |

) |

(133 |

) |

13 |

% |

|

Adjusted EBITDA |

12,634 |

|

9,498 |

|

3,136 |

|

33 |

% |

33,301 |

|

24,709 |

|

8,592 |

|

35 |

% |

|

Adjusted EBITDA as a % of total revenue |

38 |

% |

49 |

% |

|

|

|

|

44 |

% |

46 |

% |

|

|

|

OPERATIONS BY REPORTABLE SEGMENT AND

ANALYSIS

|

CMG |

Three months ended December 31 |

Nine months ended December 31 |

|

|

2023 |

|

2022 |

|

$ change |

|

% change |

|

2023 |

|

2022 |

|

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Software license

revenue |

18,209 |

|

16,051 |

|

2,158 |

|

13 |

% |

54,282 |

|

45,571 |

|

8,711 |

|

19 |

% |

|

Professional service revenue |

3,594 |

|

3,341 |

|

253 |

|

7 |

% |

10,338 |

|

8,010 |

|

2,238 |

|

29 |

% |

|

Total revenue |

21,803 |

|

19,392 |

|

2,411 |

|

12 |

% |

64,620 |

|

53,581 |

|

11,039 |

|

21 |

% |

| Cost of

revenues |

2,288 |

|

1,695 |

|

593 |

|

35 |

% |

6,464 |

|

5,116 |

|

1,348 |

|

26 |

% |

| Operating

expenses |

13,606 |

|

9,262 |

|

4,344 |

|

47 |

% |

34,912 |

|

29,514 |

|

5,398 |

|

18 |

% |

|

Operating profit |

5,909 |

|

8,435 |

|

(2,526 |

) |

(30 |

%) |

23,244 |

|

18,951 |

|

4,293 |

|

23 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

3,918 |

|

6,348 |

|

(2,430 |

) |

(38 |

%) |

17,245 |

|

14,571 |

|

2,674 |

|

18 |

% |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

1,449 |

|

865 |

|

584 |

|

68 |

% |

3,424 |

|

2,732 |

|

692 |

|

25 |

% |

| Stock-based

compensation |

2,974 |

|

1,093 |

|

1,881 |

|

172 |

% |

5,370 |

|

1,596 |

|

3,774 |

|

236 |

% |

| Acquisition

related expenses |

146 |

|

- |

|

146 |

|

100 |

% |

719 |

|

- |

|

719 |

|

100 |

% |

| Restructuring

charges |

- |

|

- |

|

- |

|

- |

- |

|

3,943 |

|

(3,943 |

) |

(100 |

%) |

| Income and other

tax expense |

1,805 |

|

2,002 |

|

(197 |

) |

(10 |

%) |

6,288 |

|

4,950 |

|

1,338 |

|

27 |

% |

| Interest

income |

(982 |

) |

(548 |

) |

(434 |

) |

79 |

% |

(2,434 |

) |

(1,105 |

) |

(1,329 |

) |

120 |

% |

| Foreign exchange

loss (gain) |

701 |

|

151 |

|

550 |

|

364 |

% |

752 |

|

(923 |

) |

1,675 |

|

(181 |

%) |

|

Repayment of lease liabilities |

(428 |

) |

(413 |

) |

(15 |

) |

4 |

% |

(1,248 |

) |

(1,055 |

) |

(193 |

) |

18 |

% |

|

Adjusted EBITDA |

9,583 |

|

9,498 |

|

85 |

|

1 |

% |

30,116 |

|

24,709 |

|

5,407 |

|

22 |

% |

|

Adjusted EBITDA as a % CMG total revenue |

44 |

% |

49 |

% |

|

|

|

47 |

% |

46 |

% |

|

|

|

CMG experienced increases in revenue for the

three and nine months ended December 31, 2023, with increases of

$2.4 million or 12% and $11.0 million or 21%, respectively. This

consistent growth demonstrates CMG’s ability to capture new

customers and grow existing customers’ revenue through increased

license contracts and pricing.

Cost of revenues has increased for the three and

nine months ended December 31, 2023, by 35% and 26%, respectively,

primarily as a result of increased headcount and headcount related

costs to support increased professional services revenue

growth.

Operating expenses have increased for the three

and nine months ended December 31, 2023, by 47% and 18%,

respectively, primarily as a result of acquisition-related

expenses, and increases in stock-based compensation, headcount and

headcount related costs, agent commissions, depreciation and

amortization expenses, and other corporate costs.

CMG adjusted EBITDA as a percentage of CMG total

revenue is 44% for the three months ended December 31, 2023,

compared to 49% in the prior year comparative quarter, primarily

due to an increase in operating expenses as a result of an increase

in headcount and headcount related costs and other corporate costs.

Adjusted EBITDA as a percentage of total revenue for the nine

months ended December 31, 2023, for CMG was 47% which is relatively

consistent with the prior year.

|

BHV |

Three months ended December 31 |

Nine months ended December 31 |

|

|

2023 |

|

2022 |

$ change |

|

% change |

|

2023 |

|

2022 |

$ change |

|

% change |

|

| ($

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Software

license revenues |

5,035 |

|

- |

5,035 |

|

100 |

% |

5,200 |

|

- |

5,200 |

|

100 |

% |

|

Professional service revenue |

6,169 |

|

- |

6,169 |

|

100 |

% |

6,568 |

|

- |

6.568 |

|

100 |

% |

|

Total revenue |

11,204 |

|

- |

11,204 |

|

100 |

% |

11,768 |

|

- |

11,768 |

|

100 |

% |

| Cost of

revenues |

4,068 |

|

- |

4,068 |

|

100 |

% |

4,290 |

|

- |

4,290 |

|

100 |

% |

| Operating

expenses |

4,828 |

|

- |

4,828 |

|

100 |

% |

5,015 |

|

- |

5,015 |

|

100 |

% |

|

Operating profit |

2,308 |

|

- |

2,308 |

|

100 |

% |

2,463 |

|

- |

2,463 |

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

1,692 |

|

- |

1,692 |

|

100 |

% |

1,785 |

|

- |

1,785 |

|

100 |

% |

| Depreciation and

amortization |

106 |

|

- |

106 |

|

100 |

% |

113 |

|

- |

113 |

|

100 |

% |

| Acquisition

related expenses |

550 |

|

- |

550 |

|

100 |

% |

550 |

|

- |

550 |

|

100 |

% |

| Income and other

tax expense |

702 |

|

- |

702 |

|

100 |

% |

740 |

|

- |

740 |

|

100 |

% |

| Interest

income |

(4 |

) |

- |

(4 |

) |

100 |

% |

(4 |

) |

- |

(4 |

) |

100 |

% |

| Foreign exchange

loss (gain) |

(59 |

) |

- |

(59 |

) |

100 |

% |

(59 |

) |

- |

(59 |

) |

100 |

% |

|

Repayment of lease liabilities |

64 |

|

- |

64 |

|

100 |

% |

60 |

|

- |

60 |

|

100 |

% |

|

Adjusted EBITDA |

3,051 |

|

- |

3,404 |

|

100 |

% |

3,184 |

|

|

|

|

|

Adjusted EBITDA as a % of BHV total revenue |

27 |

% |

- |

|

|

|

27 |

% |

- |

|

|

BHVs revenue for the three and nine months ended

December 31, 2023, is comprised of 55% professional services

revenue, which is primarily driven by a contract with one customer.

BHVs software license revenue for the three and nine months ended

December 31, 2023, was supported by contract renewals.

BHVs cost of revenues consist mainly of

headcount and headcount related costs incurred to support

professional services revenue.

Operating expenses for BHV are primarily

comprised of headcount and headcount related costs, office related

costs and professional services costs.

BHV adjusted EBITDA as a percentage of BHV

revenue is 27% for both the three and nine months ended December

31, 2023, respectively. The recognition of the annual license fee

revenue in connection to third quarter contract renewals had a

positive effect on adjusted EBITDA. We expect that adjusted EBITDA

will fluctuate on a quarterly basis as a result of annual license

fee revenue recognition which is skewed towards the last two

quarters of the fiscal year.

CORPORATE PROFILE

CMG Group (TSX:CMG) is a global software and

consulting company that combines science and technology with deep

industry expertise to solve complex subsurface and surface

challenges for the new energy industry around the world. The

Company is headquartered in Calgary, AB, with offices in Houston,

Oxford, Dubai, Bogota, Rio de Janeiro, Bengaluru, Oslo, and Kuala

Lumpur. For more information, please visit www.cmgl.ca.

QUARTERLY FILINGS AND RELATED QUARTERLY FINANCIAL

INFORMATION

Management’s Discussion and Analysis

(“MD&A”) and condensed consolidated interim financial

statements and the notes thereto for the three and nine-months

ended December 31, 2023 can be obtained from our website

www.cmgl.ca. The documents will also be available under CMG Group’s

SEDAR profile www.sedarplus.ca.

Condensed Consolidated Statements of Financial

Position

|

UNAUDITED (thousands of Canadian $) |

December 31, 2023 |

|

March 31, 2023 |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash |

45,183 |

|

66,850 |

|

|

Restricted cash |

158 |

|

- |

|

|

Trade and other receivables |

32,090 |

|

23,910 |

|

|

Prepaid expenses |

1,652 |

|

1,060 |

|

|

Prepaid income taxes |

2,858 |

|

444 |

|

|

|

81,941 |

|

92,264 |

|

| Intangible assets |

24,347 |

|

1,321 |

|

| Right-of-use assets |

30,008 |

|

30,733 |

|

| Property and equipment |

10,072 |

|

10,366 |

|

| Goodwill |

3,787 |

|

- |

|

|

Deferred tax asset |

- |

|

2,444 |

|

|

Total assets |

150,155 |

|

137,128 |

|

|

|

|

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Trade payables and accrued liabilities |

13,329 |

|

9,883 |

|

|

Income taxes payable |

1,027 |

|

33 |

|

|

Acquisition holdback payable |

2,283 |

|

- |

|

|

Deferred revenue |

27,089 |

|

34,797 |

|

|

Lease liabilities |

2,738 |

|

1,829 |

|

|

|

46,466 |

|

46,542 |

|

| Lease liabilities |

35,017 |

|

36,151 |

|

| Stock-based compensation

liabilities |

2,706 |

|

1,985 |

|

| Acquisition earnout |

1,470 |

|

- |

|

| Other long-term

liabilities |

261 |

|

- |

|

| Deferred tax liabilities |

1,113 |

|

- |

|

|

Total liabilities |

87,033 |

|

84,678 |

|

| |

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

Share capital |

85,925 |

|

81,820 |

|

|

Contributed surplus |

15,596 |

|

15,471 |

|

|

Cumulative translation adjustment |

(448 |

) |

- |

|

|

Deficit |

(37,951 |

) |

(44,841 |

) |

|

Total shareholders’ equity |

63,122 |

|

52,450 |

|

|

Total liabilities and shareholders' equity |

150,155 |

|

137,128 |

|

Condensed Consolidated Statements of Operations and

Comprehensive Income

| |

Three months endedDecember 31 |

|

Nine months endedDecember 31 |

|

|

UNAUDITED (thousands of Canadian $ except per share amounts) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

RevenueCost of revenue |

33,0076,356 |

|

19,3921,695 |

|

76,38810,754 |

|

53,5815,116 |

|

| Gross

profit |

26,651 |

|

17,697 |

|

65,634 |

|

48,465 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

Sales and marketing |

4,857 |

|

2,480 |

|

10,596 |

|

6,674 |

|

|

Research and development |

7,253 |

|

4,096 |

|

16,072 |

|

13,268 |

|

|

General and administrative |

6,324 |

|

2,686 |

|

13,259 |

|

9,572 |

|

|

|

18,434 |

|

9,262 |

|

39,927 |

|

29,514 |

|

| Operating

profit |

8,217 |

|

8,435 |

|

25,707 |

|

18,951 |

|

| |

|

|

|

|

|

|

|

|

| Finance income |

986 |

|

548 |

|

2,644 |

|

2,028 |

|

| Finance costs |

(1,086 |

) |

(633 |

) |

(2,293 |

) |

(1,458 |

) |

|

Profit before income and other taxes |

8,117 |

|

8,350 |

|

26,058 |

|

19,521 |

|

| Income

and other taxes |

2,507 |

|

2,002 |

|

7,028 |

|

4,950 |

|

| |

|

|

|

|

|

|

|

|

|

Net income for the period |

5,610 |

|

6,348 |

|

19,030 |

|

14,571 |

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income: |

|

|

|

|

|

|

|

|

| Foreign

currency translation adjustment |

(453 |

) |

- |

|

(449 |

) |

- |

|

|

Other comprehensive income |

(453 |

) |

- |

|

(449 |

) |

- |

|

|

Total comprehensive income |

4,157 |

|

6,348 |

|

18,581 |

|

14,571 |

|

|

|

|

|

|

|

|

|

|

|

| Net income per share –

basic |

0.07 |

|

0.08 |

|

0.24 |

|

0.18 |

|

| Net income per share –

diluted |

0.07 |

|

0.08 |

|

0.23 |

|

0.18 |

|

|

Dividend per share |

0.05 |

|

0.05 |

|

0.15 |

|

0.15 |

|

Condensed Consolidated Statements of Cash

Flows

| |

Three months endedDecember 31 |

|

Nine months endedDecember 31 |

|

|

UNAUDITED (thousands of Canadian $) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

|

| Net income |

5,610 |

|

6,348 |

|

19,030 |

|

14,571 |

|

| Adjustments for: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization of property, equipment, right-of use

assets |

890 |

|

864 |

|

2,686 |

|

2,732 |

|

|

Amortization of intangible assets |

665 |

|

- |

|

851 |

|

- |

|

|

Deferred income tax expense (recovery) |

1,104 |

|

(145 |

) |

3,082 |

|

(64 |

) |

|

Stock-based compensation |

513 |

|

1,102 |

|

2,222 |

|

462 |

|

|

Foreign exchange and other non-cash items |

(305 |

) |

- |

|

17 |

|

- |

|

|

Funds flow from operations |

8,477 |

|

8,169 |

|

27,888 |

|

17,701 |

|

| Movement in non-cash working

capital: |

|

|

|

|

|

|

|

|

|

Trade and other receivables |

(5,413 |

) |

(4,872 |

) |

(2,112 |

) |

(1,048 |

) |

|

Trade payables and accrued liabilities |

2,413 |

|

649 |

|

24 |

|

27 |

|

|

Prepaid expenses and other assets |

(639 |

) |

1 |

|

(349 |

) |

(421 |

) |

|

Income taxes receivable (payable) |

(181 |

) |

1,157 |

|

(1,432 |

) |

733 |

|

|

Deferred revenue |

(4,214 |

) |

2,553 |

|

(9,351 |

) |

(3,737 |

) |

|

Change in non-cash working capital |

(8,034 |

) |

(512 |

) |

(13,220 |

) |

(4,446 |

) |

|

Net cash provided by operating activities |

443 |

|

7,657 |

|

14,668 |

|

13,255 |

|

| |

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

| Repayment of acquired line of

credit |

- |

|

- |

|

(2,012 |

) |

- |

|

| Proceeds from issuance of

common shares |

1,783 |

|

19 |

|

2,996 |

|

434 |

|

| Repayment of lease

liabilities |

(364 |

) |

(413 |

) |

(1,188 |

) |

(1,055 |

) |

|

Dividends paid |

(4,059 |

) |

(4,025 |

) |

(12,140 |

) |

(12,067 |

) |

|

Net cash used in financing activities |

(2,640 |

) |

(4,419 |

) |

(12,344 |

) |

(12,688 |

) |

|

|

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

| Corporate acquisition, net of

cash acquired |

157 |

|

- |

|

(22,893 |

) |

- |

|

| Change in non-cash working

capital |

(517 |

) |

- |

|

(517 |

) |

- |

|

|

Property and equipment additions |

(459 |

) |

(211 |

) |

(555 |

) |

(341 |

) |

|

Net cash used in investing activities |

(819 |

) |

(211 |

) |

(23,695 |

) |

(341 |

) |

|

|

|

|

|

|

|

|

|

|

| Increase (decrease) in

cash |

(3,016 |

) |

3,027 |

|

(21,641 |

) |

226 |

|

| Effect of foreign exchange on

cash |

(26 |

) |

- |

|

(26 |

) |

- |

|

| Cash,

beginning of period |

48,225 |

|

56,859 |

|

66,850 |

|

59,660 |

|

|

Cash, end of period |

45,183 |

|

59,886 |

|

45,183 |

|

59,886 |

|

|

|

|

|

|

|

|

|

|

|

| Supplementary cash

flow information |

|

|

|

|

|

|

|

|

| Interest received |

986 |

|

548 |

|

2,438 |

|

1,105 |

|

| Interest paid |

444 |

|

482 |

|

1,394 |

|

1,458 |

|

| Income

taxes paid |

1,071 |

|

1,732 |

|

5,429 |

|

4,615 |

|

For further information, please contact:

| Pramod

Jain |

or |

Sandra

Balic |

| Chief Executive Officer |

|

Vice President, Finance & CFO |

| (403) 531-1300 |

|

(403) 531-1300 |

| pramod.jain@cmgl.ca |

|

sandra.balic@cmgl.ca |

| |

|

|

| For investor inquiries, please contact: |

|

|

| Kim MacEachern |

|

|

| Manager, Investor Relations |

|

|

| cmg-investors@cmgl.ca |

|

|

| |

|

|

| For media inquiries, please contact: |

|

|

| marketing@cmgl.ca |

|

|

| |

|

|

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking

statements". Forward-looking statements can be identified by words

such as: "anticipate", "intend", "plan", "goal", "seek", "believe",

"project", "estimate", "expect", "strategy", "future", "likely",

"may", "should", "will", and similar references to future periods.

Examples of forward-looking statements include, among others,

statements we make regarding the benefits of the acquired

technology, the ongoing development thereof; and the ability of

data analytics to improve efficiency, cut costs and reduce

risks.

Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on our current beliefs, expectations, and

assumptions regarding the future of our business, future plans and

strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict

and many of which are outside of our control. Our actual results

and financial condition may differ materially from those indicated

in the forward-looking statements. Therefore, you should not rely

on any of these forward-looking statements. Important factors that

could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

are detailed in the companies’ public filings.

Any forward-looking statement made by us in this

press release is based only on information currently available to

us and speaks only as of the date on which it is made. Except as

required by applicable securities laws, we undertake no obligation

to publicly update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

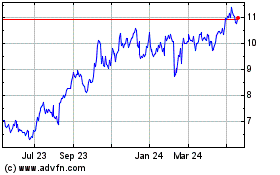

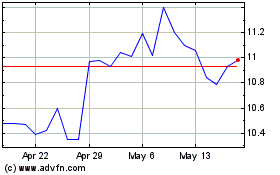

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Nov 2023 to Nov 2024