Computer Modelling Group Ltd. (“CMG” or the “Company”) (TSX: CMG)

is pleased to announce the acquisition by a wholly-owned subsidiary

of CMG of all of the shares of Sharp Reflections GmbH (“Sharp”), a

seismic processing and interpretation platform for geophysicists

and quantitative interpreters.

Sharp has been a pioneer in leveraging

high-performance computing in the cloud, setting a new standard on

how to effectively handle massive prestack seismic datasets with

advanced visualization, interactivity, and scientific analysis. The

platform provides capabilities and workflows that help

geophysicists and quantitative seismic interpreters work

efficiently and improve the quality of decision making in

subsurface interpretation, reservoir characterization, and

exploration.

“Sharp is a compelling opportunity to acquire a

growing, founder-led business and expand our seismic solutions

offering with a proven technology innovator,” stated Pramod Jain,

CEO of CMG. “We consider Sharp the intellectual, technological, and

product leader in the niche specialty of multi-dimensional,

prestack seismic interpretation. The company’s expertise and

leadership in real-time seismic processing, prestack analysis, and

4D seismic analysis meets the growing demand for high-fidelity

interpretation and faster, more accurate decision-making in

exploration and production.”

Sharp is headquartered in Germany, with

operations in the US, Norway, and the UK. Sharp's customer base is

global and consists of major oil and gas companies. Bill Shea,

co-founder and CEO of Sharp Reflections, has agreed to remain with

the organization to lead the integration.

Commenting on the transaction, Bill Shea, CEO of

Sharp Reflections stated “I am pleased to have found a great home

for Sharp as it embarks on the next phase of its evolution. CMG’s

vision of acquiring and nurturing leading solutions in upstream oil

and gas resonates deeply with me as a founder. I am confident that

Sharp will achieve great things for our customers in the years to

come and I extend my thanks to all the talented employees of Sharp

without whom we could not have achieved this success.”

In the twelve months ended July 31, 2024, Sharp

had unaudited revenue of approximately €10.0 million1

(approximately $14.7 million1), comprised of approximately €6.9

million1 (approximately $10.1 million1) in software revenue (over

95% considered recurring software revenue) and €3.1 million1

(approximately $4.6 million1) in services revenue. The company

generated low double-digit Adjusted EBITDA Margin1,2.

Total Consideration paid by CMG for Sharp

Reflections was €25.0 million (approximately $37.0 million), cash

consideration, subject to post-closing adjustments, plus an amount

equivalent to Sharp’s cash on hand immediately prior to closing.

CMG funded the consideration from its existing cash-on-hand

resources.

For more information on the transaction, please

refer to the CEO Letter to Shareholders Sharp Reflections

Acquisition which can be found on our website.

For more information on Sharp Reflections, visit

the website.

1 Revenue and Adjusted EBITDA Margin are

unaudited for the period August 1, 2023 – July 31, 2024 and are not

reported in accordance with International Financial Reporting

Standards (IFRS). These figures are subject to adjustment upon

conversion to IFRS. The average CAD/EUR exchange rate used was

1.4695.

2 Adjusted EBITDA Margin is a non-IFRS measure.

See “Non-IFRS Measure”

About CMG

CMG (TSX: CMG) is a global software and

consulting company that combines science and technology with deep

industry expertise to solve complex subsurface and surface

challenges for the new energy industry around the world. CMG is

headquartered in Calgary, AB, with offices in Houston, Oxford,

Dubai, Bogota, Rio de Janeiro, Bengaluru, Kuala Lumpur, Oslo,

Stavanger, and Kaiserslautern. For more information, please visit

www.cmgl.ca.

Non-IFRS Financial Measures

Certain financial measures in this press release, namely

Adjusted EBITDA Margin, do not have a standard meaning prescribed

by IFRS and, accordingly, may not be comparable to measures used by

other companies. Adjusted EBITDA Margin refers to net income before

adjusting for depreciation and amortization expense, interest

income, income and other taxes, stock-based compensation,

restructuring charges, foreign exchange gains and losses, repayment

of lease obligations, asset impairments, acquisition related costs

and other expenses directly related to business combinations,

including compensation expenses and gains or losses on contingent

consideration.

Cautionary Note Regarding Forward Looking

Information

Certain statements contained in this press release constitute

forward-looking information. These statements relate to future

events or future performance. The use of any of the words

“potential”, “target”, “optimize”, “benefit”, and similar

expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on CMG’s assumptions or beliefs as to the

outcome or timing of such future events. In particular, this press

release contains forward-looking information relating to, among

other things, the expected benefits to CMG of the acquired software

business and the performance of such business going forward.

Various assumptions are applied in setting such expectations,

including, but without limitation, the financial and operational

benefits synergies relating to the acquisition and integration of

the acquired business. Although such statements are based on the

reasonable assumptions of CMG’s management, there can be no

assurance that any conclusions will prove to be accurate. The

forward-looking information contained in this press release is made

as of the date hereof. Except as required by applicable securities

laws, CMG is not obligated to update or revise any forward-looking

information, whether as a result of new information, future events,

or otherwise. Because of the risks and assumptions contained

herein, investors should not place undue reliance on

forward-looking information.

For investor inquiries, please contact:

Kim MacEachern

Director, Investor Relations

cmg-investors@cmgl.ca

For media inquiries, please contact:

marketing@cmgl.ca

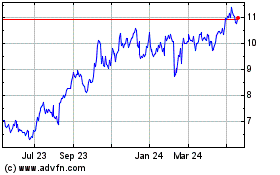

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Computer Modelling (TSX:CMG)

Historical Stock Chart

From Feb 2024 to Feb 2025