Condor Gold (AIM: CNR; TSX: COG) announces that it has today

published its unaudited financial results for the three months

ending 31 March 2022 and the Management’s Discussion and Analysis

for the same period.

Both of the above have been posted on the

Company’s website www.condorgold.com and are also available on

SEDAR at www.sedar.com.

Highlights for the First Quarter of

2022:

- On March 10,

2022, the Company announced that all assay results have been

received for an 8,004 m infill drilling programme on the fully

permitted high-grade La Mestiza Open Pit Mineral Resource at La

India Project.

- Advanced the

technical studies needed for the completion of a Definitive

Feasibility Study covering the La India open pit, the processing

plant facility and location, tailings storage facility, waste dump

locations, explosive magazine, power supply, surface hydrology,

hydrogeology (dewatering the pit), geochemistry, metallurgy,

environmental and social.

- Continued with

acquisitions of land at the La India open pit and associated mine

site infrastructure. To date, 99.6% of the core areas have been

purchased.

- Site clearance

of 14 hectares has been completed for the processing plant

location, including areas for offices, warehouses, a stockpile and

a buffer zone.

- Project finance

discussions are underway with potential providers of project

finance who have access to Condor’s data room under confidentiality

agreements.

- Further

advanced compliance with the terms of the La India Environmental

Permit to construct and operate the mine, including completion of

additional technical and engineering studies.

Mark Child, Chairman and CEO

Commented:

“During the first quarter, we continued to make

significant progress on advancing the Feasibility Study for the La

India open pit and associated mine site infrastructure. All

technical studies undertaken at the Project level are complete. We

are currently reviewing the metallurgical test work, geotechnical

analysis and capital cost estimates. Additionally, we received the

results from the 8,004 m infill drill program at the fully

permitted high-grade Mestiza open pit. Although not included in the

scope of our forthcoming Feasibility Study, we expect Mestiza to

provide an additional high-grade ore source for the La India

mill.

Concurrently, we are finalizing our analysis of

an updated Mineral Resource Estimate for La India Project, which is

inclusive of a Mineral Reserve Estimate for the La India open pit.

The geological model is consistent with our current best

understanding. Lithologies, weathering and structures have been

re-modelled from scratch with existing drilling, trenching and

outcrops considered.

In summary, the La India open pit including the

associated mine site infrastructure is essentially construction

ready and materially de-risked. The plan is to add the two fully

permitted high grade feeder pits of Mestiza and America to the mine

plan during the construction phase. The Feasibility Study on La

India open pit is almost complete, the formal announcement will

probably take us into Q3. It will put the Company in a position to

pursue various project financing alternatives, some of which have

already been initiated.”

CONDOR GOLD PLC

CONDENSED CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOMEFOR THE THREE MONTHS TO 31

MARCH 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months to 31

March2022unaudited£ |

|

Three months to 31

March2021unaudited£ |

|

Revenue |

|

|

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

| Administrative expenses |

|

|

|

|

(668,134 |

) |

|

(512,518 |

) |

| |

|

|

|

|

|

|

|

| Operating gain/(loss) |

Note 3 |

|

|

|

(668,134 |

) |

|

(512,518 |

) |

| |

|

|

|

|

|

|

|

| Finance income |

|

|

|

|

255 |

|

|

- |

|

| |

|

|

|

|

|

|

|

| Loss before income tax |

|

|

|

|

(667,879 |

) |

|

(512,518 |

) |

| |

|

|

|

|

|

|

|

| Income tax expense |

Note 4 |

|

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

| Gain/(loss) for the

period |

|

|

|

|

(667,789 |

) |

|

(512,518 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Other comprehensive

income/(loss): |

|

|

|

|

|

|

|

| Write off of Minority

Interest |

|

|

|

|

|

|

- |

|

| Currency translation

differences |

|

|

|

|

664,824 |

|

|

(422,392 |

) |

| Other comprehensive

income/(loss) for the period |

|

|

|

|

664,824 |

|

|

(422,392 |

) |

| |

|

|

|

|

|

|

|

| Total comprehensive

income/(loss) for the period |

|

|

|

|

(3,055 |

) |

|

(934,910 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Gain/(loss) per share

expressed in pence per share: |

|

|

|

|

|

|

|

| Basic and diluted (in pence) |

Note 7 |

|

|

|

(0.46 |

) |

|

(0.41 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CONDOR GOLD PLC

CONDENSED CONSOLIDATED STATEMENT OF

FINANCIAL POSITIONAS AT 31 MARCH 2022

| |

|

|

|

|

|

|

| |

|

As at 31March

2022unaudited£ |

|

As at 31December

2021audited£ |

|

As at 31March

2021unaudited£ |

| ASSETS: |

|

|

|

|

|

|

| NON-CURRENT

ASSETS |

|

|

|

|

|

|

|

Property, plant and equipment |

|

7,579,866 |

|

|

7,473,433 |

|

|

4,081,961 |

|

| Intangible assets |

|

29,634,986 |

|

|

28,100,980 |

|

|

22,623,998 |

|

| |

|

37,214,852 |

|

|

35,574,413 |

|

|

26,705,959 |

|

| |

|

|

|

|

|

|

| CURRENT

ASSETS |

|

|

|

|

|

|

| Trade and other receivables |

|

875,390 |

|

|

775,693 |

|

|

282,202 |

|

| Cash and cash equivalents |

|

408,028 |

|

|

2,072,046 |

|

|

6,278,947 |

|

| |

|

1,283,418 |

|

|

2,847,739 |

|

|

4,723,800 |

|

| |

|

|

|

|

|

|

| TOTAL

ASSETS |

|

38,498,270 |

|

|

38,422,152 |

|

|

33,267,108 |

|

| |

|

|

|

|

|

|

|

LIABILITIES: |

|

|

|

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

|

|

| Trade and other payables |

|

99,190 |

|

|

248,176 |

|

|

192,525 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| TOTAL

LIABILITIES |

|

99,190 |

|

|

248,176 |

|

|

192,525 |

|

| |

|

|

|

|

|

|

| NET CURRENT

ASSETS |

|

1,184,228 |

|

|

2,599,563 |

|

|

6,368,624 |

|

| |

|

|

|

|

|

|

| NET ASSETS |

|

38,399,080 |

|

|

38,173,976 |

|

|

33,074,583 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY

ATTRIBUTABLE TO OWNERS OF THE PARENT |

|

|

|

|

|

|

| Called up share

capital |

Note 8 |

29,386,143 |

|

|

29,326,143 |

|

|

26,964,836 |

|

| Share premium |

|

42,534,627 |

|

|

42,528,627 |

|

|

38,700,439 |

|

| Legal reserves |

|

- |

|

|

- |

|

|

- |

|

| Exchange difference reserve |

|

(1,817,214 |

) |

|

(2,482,038 |

) |

|

(2,784,493 |

) |

| Retained earnings |

|

(31,704,476 |

) |

|

(31,198,756 |

) |

|

(29,806,199 |

) |

| TOTAL

EQUITY |

|

38,399,080 |

|

|

38,173,976 |

|

|

33,074,583 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

CONDOR GOLD PLC

CONDENSED CONSOLIDATED STATEMENT OF

CHANGES IN EQUITYAS AT 31 MARCH 2022

| |

Sharecapital |

Sharepremium |

Exchangedifferencereserve |

Retainedearnings |

Total |

Total equity |

| |

£ |

£ |

£ |

£ |

£ |

£ |

| At

1 January 2021 |

23,732,526 |

37,175,626 |

(2,362,101 |

) |

(29,381,952 |

) |

29,164,099 |

|

29,164,099 |

|

| Comprehensive income: |

|

|

|

|

|

|

| Gain for the period |

- |

- |

- |

|

(512,518 |

) |

(512,518 |

) |

(512,518 |

) |

| Other comprehensive income: |

|

|

|

|

|

|

| Currency translation

differences |

- |

- |

(422,392 |

) |

- |

|

(422,392 |

) |

(422,392 |

) |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Total comprehensive income |

- |

- |

(422,392 |

) |

(512,518 |

) |

(934,910 |

) |

(934,910 |

) |

| |

|

|

|

|

|

|

| New shares issued |

3,232,310 |

1,524,813 |

- |

|

- |

|

4,757,123 |

|

4,757,123 |

|

| Issue costs |

- |

- |

- |

|

- |

|

- |

|

- |

|

| Share based payment |

- |

- |

- |

|

88,271 |

|

88,271 |

|

88,271 |

|

| |

|

|

|

|

|

|

| At 31 March 2021 |

26,964,836 |

38,700,439 |

(2,784,493 |

) |

(29,806,199 |

) |

33,074,0583 |

|

33,074,583 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| At 1 January 2022 |

29,326,143 |

42,528,627 |

(2,482,038 |

) |

31,198,756 |

|

38,173,976 |

|

38,173,976 |

|

| Comprehensive income: |

|

|

|

|

|

|

| Loss for the period |

- |

- |

- |

|

(667,879 |

) |

(667,879 |

) |

(667,879 |

) |

| Other comprehensive income: |

|

|

|

|

|

|

| Currency translation

differences |

- |

- |

664,824 |

|

- |

|

664,824 |

|

664,824 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Total comprehensive income |

- |

- |

664,824 |

|

(667,879 |

) |

(3,055 |

) |

(3,055 |

) |

| |

|

|

|

|

|

|

| New shares issued |

60,000 |

6,000 |

- |

|

- |

|

66,000 |

|

66,000 |

|

| Issue costs |

- |

- |

- |

|

- |

|

- |

|

- |

|

| Share based payment |

- |

- |

- |

|

162,159 |

|

|

|

| |

|

|

|

|

|

|

| At 31 March 2022 |

29,386,143 |

42,534,627 |

(1,817,214 |

) |

(31,704,476 |

) |

38,399,080 |

|

38,399,080 |

|

| |

| |

CONDOR GOLD PLC

CONDENSED CONSOLIDATED CASH FLOW

STATEMENTAS AT 31 MARCH 2022

| |

|

|

|

|

|

| |

|

|

Three monthsto 31.03.22unaudited£ |

|

Three monthsto 31.03.21unaudited£ |

|

Cash flows from operating activities |

|

|

|

|

|

|

|

| Gain/(loss) before tax |

|

|

(667,879 |

) |

|

(512,518 |

) |

| Share based payment |

|

|

162,159 |

|

|

88,271 |

|

| Depreciation charges |

|

|

- |

|

|

- |

|

| Exchange differences |

|

|

75,920 |

|

|

23,259 |

|

| Finance income |

|

|

(255 |

) |

|

- |

|

| |

|

|

(430,055 |

) |

|

(400,988 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| (Increase) in trade and other

receivables |

|

|

(99,697 |

) |

|

(167,793 |

) |

| Increase/(decrease) in trade and

other payables |

|

|

(148,986 |

) |

|

(73,887 |

) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Net cash absorbed in operating

activities |

|

|

(678,738 |

) |

|

(642,668 |

) |

| |

|

|

|

|

|

| Cash flows from investing

activities |

|

|

|

|

|

| Purchase of intangible fixed

assets |

|

|

(1,006,948 |

) |

|

(1,061,879 |

) |

| Purchase of tangible fixed

assets |

|

|

(61,787 |

) |

|

(933,020 |

) |

| Interest received |

|

|

255 |

|

|

- |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Net cash absorbed in investing

activities |

|

|

(1,068,480 |

) |

|

(1,944,899 |

) |

| |

|

|

|

|

|

| Cash flows from financing

activities |

|

|

|

|

|

| Net proceeds from share

issue |

|

|

66,000 |

|

|

4,757,123 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Net cash generated in financing

activities |

|

|

66,000 |

|

|

4,757,123 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Increase / (decrease) in cash and

cash equivalents |

|

|

(1,739,939 |

) |

|

2,119,556 |

|

| Cash and cash equivalents at

beginning of period |

|

|

2,072,046 |

|

|

4,159,391 |

|

| Exchange losses on cash and

bank |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

| Cash and cash equivalents at end

of period |

|

|

408,028 |

|

|

6,278,947 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

CONDOR GOLD PLC

NOTES TO THE CONDENSED FINANCIAL

STATEMENTSFOR THE THREE MONTHS TO 31 MARCH

2022

1. COMPLIANCE WITH

ACCOUNTING STANDARDSBasis of

preparation

This condensed set of financial statements has

been prepared in accordance with IAS 34 Interim Financial Reporting

as issued by the International Accounting Standards Board (IASB).

It has been prepared in accordance with International Financial

Reporting Standards (IFRS and IFRIC interpretations) (“IFRS”) in

force at the reporting date, and their interpretations issued by

the IASB as adopted for use within the European Union, and with

IFRS and their interpretations as issued by the IASB.

The interim results for the three months to 31

March 2022 are neither audited nor reviewed by our auditors and the

accounts in this interim report do not therefore constitute

statutory accounts in accordance with Section 434 of the Companies

Act 2006.

Statutory accounts for the year ended 31

December 2021 have been prepared and for which the auditor's report

was unqualified, did not contain any statement under Section 498(2)

or 498(3) of the Companies Act 2006 and did not contain any matters

to which the auditors drew attention without qualifying their

report.

The interim financial information for the three

months ended 31 March 2022 were approved by the Board on 12 May

2022.

The directors do not propose an interim

dividend.

The Directors consider the going concern basis

to be appropriate based on cash flow forecasts and projections and

current levels of commitments, cash and cash equivalents. The

comparative period presented is that of the three months ended 31

March 2021.

The Directors are of the opinion that due to the

nature of the Group’s activities and the events during that period

these are the most appropriate comparatives for the current period.

Copies of these financial statements are available on the Company’s

website and on www.Sedar.com.

2. ACCOUNTING

POLICIES

The accounting policies used in preparing the

interim results are the same as those applied to the latest audited

annual financial statements, which are available on www.Sedar.com

and on the Company’s website www.condorgold.com. These accounting

policies are those expected to be applied in the financial

statements for the year ended 31 December 2022.

3. REVENUE

AND SEGMENTAL REPORTING

The Group has not generated any revenue during

the period. The Group’s operations are located in England and

Nicaragua.The following is an analysis of the carrying amount of

segment assets, and additions to plant and equipment, analysed by

geographical area in which the assets are located.

CONDOR GOLD PLC

NOTES TO THE CONDENSED FINANCIAL

STATEMENTSFOR THE THREE MONTHS TO 31 MARCH

2022

The Group’s results by reportable segment for

the three month period ended 31 March 2021 are as follows:

| |

UKThree months to 31 March

2021£ |

|

|

NicaraguaThree months to 31 March

2021£ |

|

ConsolidationThree months to 31 March

2021£ |

| RESULTS |

|

|

|

|

|

|

|

Operating (loss) |

(446,674 |

) |

|

|

(65,844 |

) |

|

(512,518 |

) |

| Interest income |

- |

|

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

Assets and liabilitiesAll

transactions between each reportable segment are accounted for

using the same accounting policies as the Group uses.

| |

UKAs at 31 March

2021£ |

|

|

NicaraguaAs at 31 March

2021£ |

|

ConsolidationAs at 31 March

2021£ |

| ASSETS |

|

|

|

|

|

|

|

Total assets |

7,885,554 |

|

|

|

25,588,654 |

|

|

33,474,208 |

|

| |

|

|

|

|

|

|

| |

UKAs at 31March

2021£ |

|

|

NicaraguaAs at 31 March

2021£ |

|

ConsolidationAs at 31 March

2021£ |

| LIABILITIES |

|

|

|

|

|

|

| Total liabilities |

(132,077 |

) |

|

|

(60,448 |

) |

|

(192,525 |

) |

| |

|

|

|

|

|

|

The Group’s results by reportable segment for

the three month period ended 31 March 2021 are as follows:

| |

UKThree months to 31 March

2022£ |

|

|

NicaraguaThree months to 31 March

2022£ |

|

ConsolidationThree months to 31 March

2022£ |

| RESULTS |

|

|

|

|

|

|

|

Operating gain/(loss) |

(642,496 |

) |

|

|

(25,638 |

) |

|

(668,134 |

) |

| Interest |

255 |

|

|

|

- |

|

|

255 |

|

| |

|

|

|

|

|

|

Assets and liabilities

All transactions between each reportable segment

are accounted for using the same accounting policies as the Group

uses.

| |

UKAs at 31 March

2022£ |

|

|

NicaraguaAs at 31 March

2022£ |

|

ConsolidationAs at 31 March

2022£ |

| ASSETS |

|

|

|

|

|

|

|

Total assets |

5,523,889 |

|

|

|

33,598,210 |

|

39,122,099 |

|

| |

|

|

|

|

|

|

| |

UKAs at 31March

2022£ |

|

|

NicaraguaAs at 31 March

2022£ |

|

ConsolidationAs at 31 March

2022£ |

| LIABILITIES |

|

|

|

|

|

|

| Total liabilities |

(138,495 |

) |

|

|

39,305 |

|

(99,190 |

) |

| |

|

|

|

|

|

|

|

|

4. TAXATION

There is no current tax charge for the period.

The accounts do not include a deferred tax asset in respect of

carry forward unused tax losses as the Directors are unable to

assess that there will be probable future taxable profits available

against which the unused tax losses can be utilised.

5. INTANGIBLE FIXED

ASSETS

During the three months ended 31 March 2022, the

Group acquired intangible assets with a cost of £1,006,948 (three

months ended 31 March 2021: £ 1,061,879).

6. EQUITY-SETTLED SHARE OPTION

SCHEME AND WARRANTS

The estimated fair value of the options and

warrants granted was;

|

|

|

|

|

|

|

|

|

|

|

Three months to31 March

2022unaudited£ |

|

Three months to31 March

2021unaudited£ |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Warrants and options charge |

|

|

(162,159 |

) |

|

(88,271 |

) |

During the period, no share options were

crystallised into cash.

The fair value has been fully recognised within

administration expenses, on a pro-rata basis over the vesting

period. This fair value has been calculated using the Black-Scholes

option pricing model. The latest inputs into the model were as

follows:

| |

2022 |

|

2021 |

|

Expected volatility |

-- |

% |

|

29 |

% |

|

Expected life options (yrs.) |

5 |

|

|

5 |

|

|

Expected dividend yield |

- |

|

|

- |

|

|

|

|

|

|

|

|

7. EARNINGS

PER SHAREBasic earnings per share is calculated by

dividing the earnings attributable to ordinary shareholders by the

weighted average number of ordinary shares outstanding during the

period. A reconciliation is set out below:

| |

| |

|

|

|

Three months to31 March 2022 |

|

Three months to31 March 2021 |

| Basic EPS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Gain/(loss) for the period |

|

|

|

(667,879 |

) |

|

(512,518 |

) |

| Weighted average number of

shares |

|

|

|

146,752,359 |

|

|

124,488,017 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Gain/(loss) per share (in

pence) |

|

|

|

(0,46 |

) |

|

(0.41 |

) |

| |

|

|

|

|

|

|

|

In accordance with IAS 33, as the Group has reported a loss for the

period, diluted earnings per share are not included. |

|

| |

|

|

|

|

|

|

|

8. CALLED-UP SHARE

CAPITAL |

|

|

|

|

|

|

| |

|

|

|

As at 31 March 2022£ |

|

As at 31 March 2021£ |

| Allotted and fully

paid |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Ordinary shares:

146,930,715 of 20p each (as at 31 March 2021:

134,824,179 of 20p each) |

|

|

29,386,143 |

|

|

26,964,836 |

|

|

|

|

|

|

|

|

|

Share issuances in the three months ended 31

March 2022 were as follows:

|

Nature of issuance |

Issue price perOrdinary share |

Date of shareissuance |

Number of sharesissued |

Total Cumulativenumber ofordinary sharesissued |

|

Opening |

|

1 January 2022 |

|

118,662,629 |

|

Warrant exercise |

22 pence |

13 January 2022 |

300,000 |

146,930,715 |

|

9. RELATED PARTY

TRANSACTIONS |

| During the reporting

period the Company received consultancy advice from the following

related parties: |

| |

|

|

|

|

| |

|

|

|

Company |

Related party |

Three months to31 March

2022£ |

Three months to31 March

2021£ |

|

|

| Axial Associates Limited |

Mark Child |

- |

- |

|

|

| Burnbrae Limited |

Jim Mellon |

6,250 |

6,250 |

|

|

| Promaco Limited |

Ian Stalker |

11,700 |

7,575 |

|

|

| AMC Geological Advisory Group

Inc. |

Andrew Cheatle |

- |

- |

|

|

| |

| |

|

10. SEASONALITY OF THE GROUP’S

BUSINESS OPERATIONSThere are no seasonal factors which

affect the trade of any company in the Group. |

| |

| |

For further information please visit www.condorgold.com or

contact:

|

Condor Gold plc |

Mark Child, Chairman and CEO+44 (0) 20 7493 2784 |

|

| Beaumont Cornish Limited |

Roland Cornish and James

Biddle+44 (0) 20 7628 3396 |

|

| SP Angel Corporate Finance

LLPH&P Advisory Limited |

Ewan Leggat+44 (0) 20 3470

0470Andrew Chubb and Nelish Patel+44 (0) 20 7907 8500 |

|

| Blytheweigh |

Tim Blythe and Megan Ray+44 (0)

20 7138 3204 |

|

About Condor Gold plc:

Condor Gold plc was admitted to AIM in May 2006

and dual listed on the TSX in January 2018. The Company is a gold

exploration and development company with a focus on Nicaragua.

On 25 October 2021 Condor announced the filing

of a Preliminary Economic Assessment Technical Report (“PEA”) for

its La India Project, Nicaragua on SEDAR https://www.sedar.com. The

highlight of the technical study is a post-tax, post upfront

capital expenditure NPV of US$418 million, with an IRR of 54% and

12 month pay-back period, assuming a US$1,700 per oz gold price,

with average annual production of 150,000 oz gold per annum for the

initial 9 years of gold production. The open pit mine schedules

have been optimised from designed pits, bringing higher grade gold

forward resulting in average annual production of 157,000 oz gold

in the first 2 years from open pit material and underground mining

funded out of cashflow.

In August 2018, the Company announced that the

Ministry of the Environment in Nicaragua had granted the

Environmental Permit (“EP”) for the development, construction and

operation of a processing plant with capacity to process up to

2,800 tonnes per day at its wholly-owned La India gold Project (“La

India Project”). The EP is considered the master permit for mining

operations in Nicaragua. Condor has purchased a new SAG Mill, which

has mainly arrived in Nicaragua. Site clearance and preparation is

at an advanced stage.

Environmental Permits were granted in April and

May 2020 for the Mestiza and America open pits respectively, both

located close to La India. The Mestiza open pit hosts 92 Kt at a

grade of 12.1 g/t gold (36,000 oz contained gold) in the Indicated

Mineral Resource category and 341 Kt at a grade of 7.7 g/t gold

(85,000 oz contained gold) in the Inferred Mineral Resource

category. The America open pit hosts 114 Kt at a grade of 8.1 g/t

gold (30,000 oz) in the Indicated Mineral Resource category and 677

Kt at a grade of 3.1 g/t gold (67,000 oz) in the Inferred Mineral

Resource category. Following the permitting of the Mestiza and

America open pits, together with the La India Open Pit Condor has

1.12 M oz gold open pit Mineral Resources permitted for

extraction.

Disclaimer

Neither the contents of the Company's website

nor the contents of any website accessible from hyperlinks on the

Company's website (or any other website) is incorporated into, or

forms part of, this announcement.

Qualified Persons

The technical and scientific information in this

press release has been reviewed, verified and approved by Andrew

Cheatle, P.Geo., who is a “qualified person” as defined by NI

43-101 and Gerald D. Crawford, P.E., who is a “qualified person” as

defined by NI 43-101 and is the Chief Technical Officer of Condor

Gold plc.

Technical Information

Certain disclosure contained in this news

release of a scientific or technical nature has been summarised or

extracted from the technical report entitled “Technical Report on

the La India Gold Project, Nicaragua, October 2021”, dated October

22, 2021 with an effective date of September 9, 2021 (the

“Technical Report”), prepared in accordance with NI 43-101. The

Qualified Persons responsible for the Technical Report are Dr Tim

Lucks of SRK Consulting (UK) Limited, and Mr Fernando Rodrigues, Mr

Stephen Taylor and Mr Ben Parsons of SRK Consulting (U.S.) Inc. Mr

Parsons assumes responsibility for the MRE, Mr Rodrigues the open

pit mining aspects, Mr Taylor the underground mining aspects and Dr

Lucks for the oversight of the remaining technical disciplines and

compilation of the report.

Forward Looking Statements

All statements in this press release, other than

statements of historical fact, are ‘forward-looking information’

with respect to the Company within the meaning of applicable

securities laws, including statements with respect to: Development

Plans for the La India Project, Mineral Reserves and Resources at

La India Project. Forward-looking information is often, but not

always, identified by the use of words such as: "seek",

"anticipate", "plan", "continue", “strategies”, “estimate”,

"expect", "project", "predict", "potential", "targeting",

"intends", "believe", "potential", “could”, “might”, “will” and

similar expressions. Forward-looking information is not a guarantee

of future performance and is based upon a number of estimates and

assumptions of management at the date the statements are made

including, among others, assumptions regarding: future commodity

prices and royalty regimes; availability of skilled labour; timing

and amount of capital expenditures; future currency exchange and

interest rates; the impact of increasing competition; general

conditions in economic and financial markets; availability of

drilling and related equipment; effects of regulation by

governmental agencies; the receipt of required permits; royalty

rates; future tax rates; future operating costs; availability of

future sources of funding; ability to obtain financing and

assumptions underlying estimates related to adjusted funds from

operations. Many assumptions are based on factors and events that

are not within the control of the Company and there is no assurance

they will prove to be correct.

Such forward-looking information involves known

and unknown risks, which may cause the actual results to be

materially different from any future results expressed or implied

by such forward-looking information, including, risks related to:

mineral exploration, development and operating risks; estimation of

mineralisation, resources and reserves; environmental, health and

safety regulations of the resource industry; competitive

conditions; operational risks; liquidity and financing risks;

funding risk; exploration costs; uninsurable risks; conflicts of

interest; risks of operating in Nicaragua; government policy

changes; ownership risks; permitting and licencing risks; artisanal

miners and community relations; difficulty in enforcement of

judgments; market conditions; stress in the global economy; current

global financial condition; exchange rate and currency risks;

commodity prices; reliance on key personnel; dilution risk; payment

of dividends; as well as those factors discussed under the heading

“Risk Factors” in the Company’s annual information form for the

fiscal year ended December 31, 2020 dated March 31, 2021, available

under the Company’s SEDAR profile at www.sedar.com.

Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking information, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate as actual results and future events could

differ materially from those anticipated in such statements. The

Company disclaims any intention or obligation to update or revise

any forward-looking information, whether as a result of new

information, future events or otherwise unless required by law.

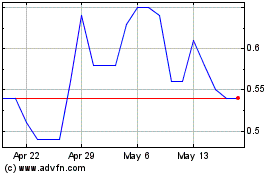

Condor Gold (TSX:COG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Condor Gold (TSX:COG)

Historical Stock Chart

From Feb 2024 to Feb 2025