Discovery Silver Corp. (TSX: DSV, OTCQX: DSVSF)

(“Discovery” or the “Company”) today announced financial results

for the three months (“Q3 2024”) and nine months (“YTD 2024”) ended

September 30, 2024. All figures are stated in Canadian dollars

unless otherwise noted.

Tony Makuch, CEO, commented: “As a precious

metals company focused on creating value, it is a great time to be

advancing one of the world’s largest silver development projects,

with market fundamentals pointing to continued deficits and

diminishing inventories. Our Cordero project (“Cordero” or the

“Project”) is a large-scale project that can help meet the growing

demand for silver in key areas like solar, battery electric and

other forms of green energy, medicine and pharmaceuticals given its

anti-bacterial qualities, food preservation, water purification, as

well as its traditional role as a store of value in uncertain

times.

“The Cordero Feasibility Study (the “Feasibility

Study”) was issued in February and clearly established Cordero as a

future industry leader. The Project has a reserve of 302 million

ounces of silver, expected annual silver equivalent (“AgEq”)1

production of 37 million ounces (“Moz”) over the first 12 years,

low unit costs, attractive economics and tremendous leverage to

higher silver prices. The robust economics included in the

Feasibility Study included a net present value (“NPV5%”) of US$1.2

billion using a silver price of US$22 per ounce. At current metals

prices, Cordero’s NPV5% increases to $2.1 billion, and grows to

US$3.2 billion in Year 4, when we complete the Project to its full

capacity.

“In Mexico, we have been encouraged by the

efforts of President Claudia Sheinbaum’s government to emphasize

both the importance of foreign investment to Mexico’s economy and

the role that industry can play in supporting areas like advancing

energy transition and improving water treatment and availability.

In addition to creating thousands of jobs and committing billions

of dollars for investment, local procurement and tax payments in

Mexico, we are also evaluating investments that will support the

use of solar, battery electric, trolley assist, 5G wireless

networks and AI wherever practical. In terms of water, the

Feasibility Study includes investments to upgrade the local water

treatment plant, which will provide water for the mine and also

increase the amount of treated water in the community.

“A key highlight of the third quarter was the

release of our 2023 ESG Report, which documents an important year

of achievement in responsible mining. Our success last year was

recognized with a number of awards and distinctions, including

receiving the Quality Environmental Certification from the Mexican

Government’s Federal Attorney’s Office for Environmental Protection

(“PROFEPA”), the Socially Responsible Enterprise Distinction from

the Mexican Center for Philanthropy, and the Great Place to Work

Certification. As we continue to work through the permitting

process, we are proud of our many accomplishments and are looking

forward to advancing Cordero into development and operation for the

benefit of all our stakeholders.”

2023 ENVIRONMENTAL, SOCIAL AND GOVERNANCE REPORT (“ESG

REPORT”)

On August 22, 2024, Discovery released its 2023

ESG Report, highlighting the Company’s current practices and

priorities going forward.

Among the achievements highlighted in the ESG

Report were the receipt of awards and distinctions as described

below.

- Quality

Environmental Certification: Awarded by PROFEPA, which

recognizes companies that achieve full compliance with all

environmental regulations. Discovery was the only mining company to

receive this certification in 2023.

- Socially

Responsible Enterprise (“ESR”) Distinction: Received for

the second consecutive year from the Mexican Center for

Philanthropy. The ESR honours companies for outstanding performance

in five key areas, business ethics, community engagement,

protection and preservation of the environment, quality of life for

employees and corporate social responsibility.

- Great Place to Work

Certification: Received for the second consecutive year,

which is an internationally recognized distinction for companies

creating an outstanding employee experience.

Other key highlights of the 2023 ESG Report

include:

- $19.2

million of goods and services purchased from local Mexican

businesses;

- $5.0

million in salaries and benefits paid to local

employees;

-

Workforce of 85, including 69 employees and 16

contractors;

- 88% of workforce

located in Mexico with almost all employees from Chihuahua

State

-

$193,000 invested directly in the communities

around Cordero;

- 26

hours of health, safety and emergency response training

provided on average per employee;

- Zero

reportable environmental incidents; and,

- 21.09 GJ of

renewable energy generated using solar panels.

FEASIBILITY STUDY HIGHLIGHTS:

-

Feasibility Study: Results of the Feasibility

Study for Cordero were released on February 20, 2024.

-

Large-scale, long-life, low-cost

production: 19-year life-of-mine (“LOM”) with

average annual production of 37 Moz AgEq in Years 1 – 12, and

average all-in sustaining costs2 under US$12.50 per AgEq ounce in

Years 1 – 8.

-

Attractive returns: NPV5% of US$1.2 billion at

US$22 per ounce silver, which increases to US$2.2 billion in Year 4

when the Project reaches final completion to 51,000 tonnes per

day.

-

Tremendous leverage to silver prices: NPV5%

increases 81%, to US$2.1 billion, using current metal prices as of

November 11, 20243 and grows to US$3.2 billion in Year 4 (5.2x

initial capital expenditures).

-

Substantial benefits for Mexico: Total investment

of US$1.4 billion (including a US$606 million initial investment),

2,500 direct jobs created during construction, peak employment of

over 1,000 direct jobs during operation, an estimated US$4.0

billion of goods and services purchased and expected tax payments

of approximately US$2.3 billion within Mexico (at current metal

prices as of November 11, 2024).

-

Industry-leading environmental standards:

Third-party reviews of proposed environmental practices completed

to ensure compliance with industry-leading standards; US$130

million budgeted for site restoration and rehabilitation; and

significant investment to promote green energy sources and to bring

infrastructure and technology to improve water treatment with

treated water to be the primary source of water for the

Project.

- Please see the Technical Disclosure section of this news

release for more information related to AgEq production.

- Non-GAAP Measure. Please see the Technical Disclosure and

Non-GAAP Measures sections of this news release.

- Current spot metal prices as at November 11, 2024 include

silver: US$30.64 per ounce; gold: US$2,619 per ounce, zinc: US$1.35

per pound and lead: US$0.92 per pound versus Feasibility Study

prices of silver: US$22.00 per ounce; gold: US$1,600 per ounce;

zinc: US$1.20 per pound; lead: US$1.00 per pound.

SELECTED FINANCIAL DATA:The following selected

financial data is taken from the Company’s unaudited condensed

interim consolidated financial statements (the “Financial

Statements”) and the Management’s Discussion and Analysis

(“MD&A”) for the three and nine months ended September 30,

2024.

The Company’s Financial Statements and MD&A are available at

www.discoverysilver.com and on SEDAR+

at www.sedarplus.ca.

|

|

Q3 2024 |

|

Q3 2023 |

|

|

YTD 2024 |

|

|

YTD 2023 |

|

|

Net Loss |

$ |

(5,265,159 |

) |

$ |

(2,207,479 |

) |

$ |

(12,977,155 |

) |

$ |

(10,086,917 |

) |

|

Basic and diluted loss per share |

$ |

(0.01 |

) |

$ |

(0.01 |

) |

$ |

(0.03 |

) |

$ |

(0.03 |

) |

|

Total comprehensive loss |

$ |

(8,647,141 |

) |

$ |

(3,059,766 |

) |

$ |

(16,170,588 |

) |

$ |

(9,863,458 |

) |

|

Total weighted average shares outstanding |

|

397,696,018 |

|

|

395,720,230 |

|

|

399,537,915 |

|

|

391,708,180 |

|

|

|

September 30, 2024 |

December 31, 2023 |

|

Cash and cash equivalents |

$ |

33,442,223 |

$ |

58,944,459 |

|

Total assets |

$ |

125,095,052 |

$ |

146,065,998 |

|

Total current liabilities |

$ |

6,224,929 |

$ |

12,168,225 |

|

Working capital(1) |

$ |

30,899,454 |

$ |

49,691,371 |

|

Total shareholders’ equity |

$ |

117,607,412 |

$ |

129,421,106 |

(1) Defined as current assets less current

liabilities from the Company’s consolidated financial

statements.

ABOUT DISCOVERY Discovery is a precious metals

company engaged in the acquisition, development and operation of

high-quality assets. The Company’s flagship asset is its 100%-owned

Cordero project, one of the world’s largest undeveloped silver

deposits, which is located close to infrastructure in a prolific

mining belt in Chihuahua State, Mexico. The Feasibility Study

completed in February 2024 demonstrates that Cordero has the

potential to be developed into a large-scale, long-life project

that generates attractive economic returns and delivers substantial

socio-economic benefits for local stakeholders. In developing and

operating Cordero, important priorities will be maximizing the use

of green energy sources, such as electric vehicles and solar power,

as well as contributing to improved water treatment infrastructure

in the area surrounding the Project.

On Behalf of the Board of Directors,

Tony Makuch, P.EngPresident, CEO &

Director

For further information contact:

Mark

Utting, CFAVP Investor RelationsPhone: 416-806-6298Email:

mark.utting@discoverysilver.comWebsite: www.discoverysilver.com

Qualified Person Gernot Wober,

P.Geo, VP Exploration, Discovery Silver Corp. and Pierre Rocque,

P.Eng., an independent consultant to the Company, both “Qualified

Persons” as such term is defined in National Instrument 43-101

Standards of Disclosure for Mineral Projects (“NI 43-101”), are the

Company's designated Qualified Persons for this news release within

the meaning of NI 43-101. Mr. Wober and Mr. Rocque have reviewed

and validated that the information contained in this news release

is accurate.

Technical Disclosure

- The Feasibility

Study project team was led by Ausenco Engineering Canada ULC

(“Ausenco”), with support from AGP Mining Consultants Inc. (“AGP”),

WSP USA Inc. (“WSP”) and RedDot3D Inc.

- Mineral

resources that are not mineral reserves do not have demonstrated

economic viability.

- A full technical

report has been prepared in accordance with NI 43-101 and was filed

on SEDAR on March 28, 2024.

- AgEq produced is

metal recovered in concentrate. AgEq payable is metal payable from

concentrate. AgEq produced and AgEq payable are calculated as Ag +

(Au x 72.7) + (Pb x 45.5) + (Zn x 54.6); these factors are based on

metal prices of Ag - $22/oz, Au - $1,600/oz, Pb - $1.00/lb and Zn -

$1.20/lb.

- AISC is

calculated as: [Operating costs (mining, processing and G&A) +

Royalties + Concentrate Transportation + Treatment & Refining

Charges + Concentrate Penalties + Sustaining Capital (excluding

$37M of capex for the initial purchase of mining fleet in Year 1)]

/ Payable AgEq ounces.

NON-GAAP MEASURES:The Company has included

certain non-GAAP performance measures and ratios as detailed below.

In the mining industry, these are common performance measures and

ratios but may not be comparable to similar measures or ratios

presented by other issuers and the non-GAAP measures and ratios do

not have any standardized meaning. Accordingly, these measures and

ratios are included to provide additional information and should

not be considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS Accounting Standards.

Total cash costs per ounce, all-in sustaining costs, and free cash

flow, are all forward-looking non-GAAP financial measures or

ratios. As the Cordero Project is not in production, these

prospective non-GAAP financial measures or ratios may not be

reconciled to the nearest comparable measure under IFRS and there

is no equivalent historical non-GAAP financial measure or ratio for

these prospective non-GAAP financial measures or ratios. Each

non-GAAP financial measure and ratio used herein is described in

more detail below.

TOTAL CASH COSTSThe Company calculated total

cash costs per ounce by dividing the sum of operating costs,

royalty costs, production taxes, refining and shipping costs, net

of by-product silver credits, by payable ounces. While there is no

standardized meaning of the measure across the industry, the

Company believes that this measure is useful to external users in

assessing operating performance.

ALL-IN SUSTAINING COSTSThe Company has provided

an all-in sustaining costs performance measure that reflects all

the expenditures that are required to produce an ounce of silver

from operations. While there is no standardized meaning of the

measure across the industry, the Company’s definition conforms to

the all-in sustaining cost definition as set out by the World Gold

Council in its updated Guidance Note issued in 2018. The Company

believes that this measure is useful to external users in assessing

operating performance and the Company’s ability to generate free

cash flow from current operations. Subsequent amendments to the

guidance have not materially affected the figures presented.

FREE CASH FLOWFree Cash Flow is a non-GAAP

performance measure that is calculated as cash flows from

operations net of cash flows invested in mineral property, plant,

and equipment and exploration and evaluation assets. The Company

believes that this measure is useful to the external users in

assessing the Company’s ability to generate cash flows from its

mineral projects.

FORWARD-LOOKING STATEMENTS:Neither TSX Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Exchange) accepts responsibility for the

adequacy or accuracy of this release. This news release is not for

distribution to United States newswire services or for

dissemination in the United States. This news release does not

constitute an offer to sell or a solicitation of an offer to buy

nor shall there be any sale of any of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful, including any of the securities in the United States of

America. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

“1933 Act”) or any state securities laws and may not be offered or

sold within the United States or to, or for account or benefit of,

U.S. Persons (as defined in Regulation S under the 1933 Act) unless

registered under the 1933 Act and applicable state securities laws,

or an exemption from such registration requirements is available.

Cautionary Note Regarding Forward-Looking Statements This news

release may include forward-looking statements that are subject to

inherent risks and uncertainties. All statements within this news

release, other than statements of historical fact, are to be

considered forward looking. Although Discovery believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those described in forward-looking statements.

Statements include but are not limited to the feasibility of the

Project and its attractive economics and significant exploration

upside; construction decision and development of the Project,

timing and results of the feasibility study and the anticipated

capital and operating costs, sustaining costs, net present value,

internal rate of return, the method of mining the Project, payback

period, process capacity, average annual metal production, average

process recoveries, concession renewal, permitting of the Project,

anticipated mining and processing methods, feasibility study

production schedule and metal production profile, anticipated

construction period, anticipated mine life, expected recoveries and

grades, anticipated production rates, infrastructure, social and

environmental impact studies, the completion of key de-risking

items, including the timing of receipt permits, availability of

water and power, availability of labour, job creation and other

local economic benefits, tax rates and commodity prices that would

support development of the Project, and other statements that

express management's expectations or estimates of future

performance, operational, geological or financial results

Information concerning mineral resource/reserve estimates and the

economic analysis thereof contained in the results of the

feasibility study are also forward-looking statements in that they

reflect a prediction of the mineralization that would be

encountered, and the results of mining, if a mineral deposit were

developed and mined. Forward-looking statements are statements that

are not historical facts which address events, results, outcomes or

developments that the Company expects to occur. Forward-looking

statements are based on the beliefs, estimates and opinions of the

Company’s management on the date the statements are made and they

involve a number of risks and uncertainties.

Factors that could cause actual results to differ materially

from those described in forward-looking statements include

fluctuations in market prices, including metal prices, continued

availability of capital and financing, and general economic, market

or business conditions, the actual results of current and future

exploration activities; changes to current estimates of mineral

reserves and mineral resources; conclusions of economic and

geological evaluations; changes in project parameters as plans

continue to be refined; the speculative nature of mineral

exploration and development; risks in obtaining and maintaining

necessary licenses, permits and authorizations for the Company’s

development stage and operating assets; operations may be exposed

to new diseases, epidemics and pandemics, including any ongoing or

future effects of COVID-19 (and any related ongoing or future

regulatory or government responses) and its impact on the broader

market and the trading price of the Company’s shares; provincial

and federal orders or mandates (including with respect to mining

operations generally or auxiliary businesses or services required

for operations) in Mexico, all of which may affect many aspects of

the Company's operations including the ability to transport

personnel to and from site, contractor and supply availability and

the ability to sell or deliver mined silver; changes in national

and local government legislation, controls or regulations; failure

to comply with environmental and health and safety laws and

regulations; labour and contractor availability (and being able to

secure the same on favourable terms); disruptions in the

maintenance or provision of required infrastructure and information

technology systems; fluctuations in the price of gold or certain

other commodities such as, diesel fuel, natural gas, and

electricity; operating or technical difficulties in connection with

mining or development activities, including geotechnical challenges

and changes to production estimates (which assume accuracy of

projected ore grade, mining rates, recovery timing and recovery

rate estimates and may be impacted by unscheduled maintenance);

changes in foreign exchange rates (particularly the Canadian

dollar, U.S. dollar and Mexican peso); the impact of inflation;

geopolitical conflicts; employee and community relations; the

impact of litigation and administrative proceedings (including but

not limited to mining reform laws in Mexico) and any interim or

final court, arbitral and/or administrative decisions; disruptions

affecting operations; availability of and increased costs

associated with mining inputs and labour; delays in construction

decisions and any development of the Project; changes with respect

to the intended method of mining and processing ore from the

Project; inherent risks and hazards associated with mining and

mineral processing including environmental hazards, industrial

accidents, unusual or unexpected formations, pressures and

cave-ins; the risk that the Company’s mines may not perform as

planned; uncertainty with the Company's ability to secure

additional capital to execute its business plans; contests over

title to properties; expropriation +or nationalization of property;

political or economic developments in Canada and Mexico and other

jurisdictions in which the Company may carry on business in the

future; increased costs and risks related to the potential impact

of climate change; the costs and timing of exploration,

construction and development of new deposits; risk of loss due to

sabotage, protests and other civil disturbances; the impact of

global liquidity and credit availability and the values of assets

and liabilities based on projected future cash flows; risks arising

from holding derivative instruments; and business opportunities

that may be pursued by the Company. There can be no assurances that

such statements will prove accurate and, therefore, readers are

advised to rely on their own evaluation of such uncertainties.

Discovery does not assume any obligation to update any

forward-looking statements except as required under applicable

laws. The risks and uncertainties that may affect forward-looking

statements, or the material factors or assumptions used to develop

such forward-looking information, are described under the heading

"Risks Factors" in the Company’s Annual Information Form dated

March 28, 2024, which is available under the Company’s issuer

profile on SEDAR+ at www.sedarplus.ca.

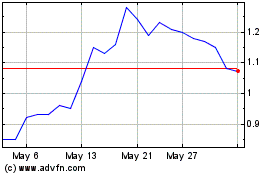

Discovery Silver (TSX:DSV)

Historical Stock Chart

From Feb 2025 to Mar 2025

Discovery Silver (TSX:DSV)

Historical Stock Chart

From Mar 2024 to Mar 2025