Discovery Silver Corp. (TSX: DSV, OTCQX: DSVSF)

(“

Discovery” or the “

Company”)

today reported that the Company has closed the bought deal public

offering (the “

Offering”) of subscription receipts

(the “

Subscription Receipts”) previously announced

on January 27, 2025. Pursuant to the Offering, the Company has

issued an aggregate of 275,000,000 Subscription Receipts at an

issue price of C$0.90 per Subscription Receipt, for gross proceeds

of C$247,500,000, which includes 25,000,000 Subscription Receipts

issued pursuant to the exercise, in full, of the over-allotment

option granted to the Underwriters (as defined below) in connection

with the Offering.

Tony Makuch, Discovery’s CEO commented: “We are

extremely pleased with the favourable reaction of the investment

community to the Offering, which included the full exercise of the

Underwriters' over-allotment option. We regard the strong investor

interest as a clear endorsement of our recently announced

acquisition (the “Acquisition”) of Newmont

Corporation’s Porcupine Complex, located in and near Timmins,

Ontario. Through the Acquisition, we will establish Discovery as a

new Canadian gold producer with a large Mineral Resource base in a

Tier 1 jurisdiction and with significant operational and

exploration upside potential. The Acquisition will bring to the

Porcupine Complex a management team that has a solid track record

for value creation and is highly experienced working in the Timmins

Camp. Following the closing of the Acquisition, we will have a

diversified portfolio combining high-quality gold production with

tremendous upside in Canada and our Cordero project in Mexico, one

of the industry’s leading silver development projects based on

reserves and expected production. We will also emerge with a strong

balance sheet providing the necessary financial capacity to invest

in our assets for future growth and success.”

BMO Capital Markets acted as sole bookrunner for

the Offering, which was co-led by SCP Resource Finance LP and

included a syndicate of underwriters consisting of CIBC World

Markets Inc., Cormark Securities Inc., National Bank Financial

Inc., Raymond James Ltd. and Ventum Financial Corp. (collectively

the “Underwriters”).

Each Subscription Receipt entitles the holder to

receive, without payment of additional consideration and without

further action, one common share of Discovery upon the satisfaction

or waiver of certain release conditions (the “Release

Conditions”). For additional details related to the

Acquisition and the Offering, please see Discovery’s press release

entitled, “Discovery Announces Transformational Acquisition

of Newmont’s Porcupine Complex,” issued on January 27,

2025. Closing of the Acquisition is expected during the first half

of 2025.

The Subscription Receipts were offered by way of

a prospectus supplement dated January 29, 2025 (the

“Prospectus Supplement”) to the short form base

shelf prospectus dated March 23, 2023 (the “Base

Shelf”). The Prospectus Supplement, which provides the

full terms related to the Subscription Receipts, was filed with the

securities commissions or other similar regulatory authorities in

each of the provinces and territories of Canada other than Québec

and Nunavut, on January 29, 2025.

The gross proceeds from the sale of the

Subscription Receipts, less 50% of the Underwriters’ fee that was

payable on closing of the Offering, have been deposited and will be

held in escrow by TSX Trust Company, as subscription receipt agent,

pending the satisfaction or waiver of the Release Conditions. If

the Release Conditions do not occur on or before 5:00 p.m. (Eastern

time) on June 30, 2025, the share purchase agreement with respect

to the Acquisition is terminated, or Discovery has announced to the

public that it does not intend to proceed with the Acquisition,

then an amount per Subscription Receipt equal to the full issue

price therefor plus a pro rata share of any earned interest on such

amount, net of any applicable withholding, will be returned to the

holders of the Subscription Receipts.

The Subscription Receipts will commence trading

on the Toronto Stock Exchange today under the trading symbol

"DSV.R".

This press release does not constitute an offer

to sell or the solicitation of an offer to buy Subscription

Receipts or common shares issuable upon the exchange of

Subscription Receipts in the United States or in any Jurisdiction

in which such an offer, solicitation or sale would be unlawful. The

Subscription Receipts and common shares issuable upon the exchange

of Subscription Receipts have not been approved or disapproved by

any regulatory authority. The Subscription Receipts and common

shares issuable upon the exchange of Subscription Receipts have not

been, and will not be, registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities

Act"), or any state securities laws and may not be

offered, sold or delivered in the United States except in

transactions exempt from the registration requirements of the U.S.

Securities Act and applicable state securities laws.

ABOUT DISCOVERY

Discovery is a growing North American precious

metals company. The Company has exposure to silver through its

first asset, the 100%-owned Cordero project, one of the world’s

largest undeveloped silver deposits, which is located close to

infrastructure in a prolific mining belt in Chihuahua State,

Mexico. On January 27, 2025, Discovery announced an agreement to

acquire a 100% interest in the Porcupine Complex from a subsidiary

of Newmont Corporation. The addition of the Porcupine Complex will

transform the Company into a new Canadian gold producer with

multiple operations in one of the world’s most renowned gold camps

in and near Timmins, Ontario, with a large base of Mineral

Resources remaining and substantial growth and exploration upside.

The Acquisition is expected to close in the first half of 2025.

On Behalf of the Board of Directors,

Tony Makuch, P.EngPresident, CEO &

Director

For further information contact:

Mark

Utting, CFAVP Investor RelationsPhone: 416-806-6298Email:

mark.utting@discoverysilver.comWebsite: www.discoverysilver.com

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. All information, other than statements of historical

facts, included in this press release that address activities,

events or developments that the Company expects or anticipates will

or may occur in the future, including such things as future

business strategy, competitive strengths, goals, expansion and

growth of the Company's businesses, operations, plans and other

such matters are forward-looking information.

When used in this press release, the words

"estimate", "plan", "continue", "anticipate", "might", "expect",

"project", "intend", "may", "will", "shall", "should", "could",

"would", "predict", "predict", "forecast", "pursue", "potential",

"believe" and similar expressions are intended to identify

forward-looking information. This information involves known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

information.

Examples of such forward-looking information

include information pertaining to, without limitation, statements

with respect to: the anticipated timing and closing of the

Acquisition; the anticipated benefits of the Acquisition, including

the impact of the Acquisition on the Company's operations,

financial condition, cash flows and overall strategy; the expected

use of net proceeds from the Offering, which ultimately remains

subject to the Company's discretion, as well as the impact of

general business, economic and political conditions; satisfaction

of the Release Conditions; other statements relating to the

financial and business prospects of the Company; information as to

the Company's strategy, plans or future financial or operating

performance; and other events or conditions that may occur in the

future.

Factors that could cause actual results to vary

materially from results anticipated by such forward-looking

statements include, among others: the satisfaction of all

conditions to closing the Acquisition on the timeframe

contemplated; the Company's ability to obtain the anticipated

benefits from the Acquisition; the Company's ability to integrate

the Porcupine Complex into the Company's operations; the accuracy

of financial and operational projections of the Company following

completion of the Acquisition; satisfaction of the Release

Conditions; the ability to repay the debt financing that may be

drawn upon in the future; the future financial or operating

performance of the Company and its business, operations, properties

and condition, resource potential, including the potential quantity

and/or grade of minerals, or the potential size of a mineralized

zone; potential expansion of mineralization; the timing and results

of future resource and/or reserve estimates; the timing of other

exploration and development plans at the Company's mineral project

interests and at the Porcupine Complex; the proposed timing and

amount of estimated future production and the costs thereof;

requirements for additional capital; environmental risks; general

business and economic conditions; delays in obtaining, or the

inability to obtain, third-party contracts, equipment, supplies and

governmental or other approvals; changes in law, including the

enactment of mining law reforms in Mexico; accidents; labour

disputes; unavailability of appropriate land use permits; changes

to land usage agreements and other risks of the mining industry

generally; the inability to obtain financing required for the

completion of exploration and development activities; changes in

business and economic conditions; international conflicts; other

factors beyond the Company's control; and those factors included

herein and elsewhere in the Company's public disclosure.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially, there may be other factors that cause results not to be

as anticipated, estimated, or intended. See the section entitled

"Risk Factors" in the Prospectus Supplement and the accompanying

Base Shelf, and in the section entitled "Risk Factors" in the

Company's annual information form dated as of March 28, 2024 for

the financial year ended December 31, 2023, for additional risk

factors that could cause results to differ materially from

forward-looking statements.

There can be no assurance that such information

will prove to be accurate as actual developments or events could

cause results to differ materially from those anticipated. These

include, among others, the factors described or referred to

elsewhere herein and include unanticipated and/or unusual events.

Many of such factors are beyond the Company's ability to predict or

control.

The forward-looking information included in this

press release is expressly qualified by the foregoing cautionary

statements. Readers of this press release are cautioned not to put

undue reliance on forward-looking information due to its inherent

uncertainty. The Company disclaims any intent or obligation to

update any forward-looking information, whether as a result of new

information, future events or results or otherwise, unless required

under applicable laws. This forward-looking information should not

be relied upon as representing management's views as of any date

subsequent to the date of this press release.

Statements concerning mineral resource estimates

may also be deemed to constitute forward-looking statements to the

extent they involve estimates of the mineralization that will be

encountered if the property is developed and are based on the

results of a preliminary economic assessment which is preliminary

in nature.

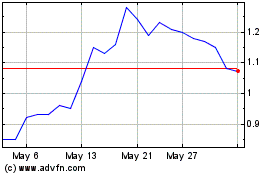

Discovery Silver (TSX:DSV)

Historical Stock Chart

From Feb 2025 to Mar 2025

Discovery Silver (TSX:DSV)

Historical Stock Chart

From Mar 2024 to Mar 2025