Spectral Medical Inc. (“Spectral” or the “Company”) (TSX:

EDT), a late-stage theranostic company advancing

therapeutic options for sepsis and septic shock, today announced

its financial results for the third quarter ended September 30,

2024, and provided a corporate update.

Spectral has continued its significant progress

throughout the third quarter of 2024 both clinically and

operationally and year-to-date enrolled 54 patients for a total of

135 patients out of the 150 total patients target. The Company is

focused on the final push to fully enroll and finish the Tigris

trial, bringing the Company closer to FDA submission and potential

FDA approval. In parallel to its clinical trial, the Company

continues to work closely with its commercialization partner,

Baxter.

Dr. John Kellum, Chief Medical Officer of

Spectral Medical, stated, “We continue to witness robust enrollment

activity in 2024, with record enrollment rates over several months

of the year. Screening rates have been at approximately 50% higher

throughout the year compared to 2023. Tigris is approaching the

final phase of the trial, and we have very dedicated investigators

who believe in the project. In October, we experienced some

disruptions due to Hurricane Helene – mainly the national saline

shortage (required to prepare the device for treatment). Our

clinical team is focused on trial site support and is working to

help resolve this issue. We are committed alongside our trial sites

to advancing Tigris and believe PMX, if ultimately approved, will

play a major role in reducing the tragic rates of mortality caused

by sepsis.”

“I am pleased with the increased level of

activity across the Company and the resultant ramp up of patient

enrollment throughout 2024. With the recent medical supply chain

events negatively impacting enrollment, we anticipate a slight

shift in finalizing Tigris enrollment into the early 2025

timeframe,” said Chris Seto, Chief Executive Officer of Spectral.

“That being said, with the receipt of gross proceeds of

approximately $11 million since the beginning of April, we believe

we have secured funding to finalize Tigris enrollment.”

Corporate Highlights During & Subsequent to Third

Quarter 2024

Tigris Trial and Regulatory Program

- Patient

EnrollmentTotal of 135 patients randomized to date out of

the target 150 total patients to be enrolled in the Tigris trial.

- Year-to-date

enrollment experienced in 2024 has been robust with 54 patients

enrolled so far.

- Record monthly

enrollment to start Q3 2024, with nine patients enrolled in July;

followed by anticipated slowdown in August and September with

lighter enrollment activity due to site vacation schedules.

- Experienced

significantly lower patient enrollment in October due to the impact

of Hurricane Helene on the medical supply chain. The disruption in

production of critical intravenous fluids has led to a rationing of

saline, which is required to prepare PMX for treatment, negatively

impacted patient enrollment, despite record patient screening

levels. Our clinical team is working to help sites resolve this

issue.

- For more

information on Hurricane Helene’s impact on the supply of critical

intravenous fluids, see the following link: Letter to Health Care

Leaders and Stakeholders on Impacts of Hurricane Helene from

Secretary Becerra | HHS.gov

- Tigris

SitesCurrently 22 Tigris sites participating.

- Spectral clinical

team focused on trial site management activities to ensure that

Tigris sites have the support and resources to enroll patients as

efficiently as possible.

-

TimingThe Company continues to focus on finalizing

the Tigris trial within the reasonably shortest timelines. Based on

the current rate of enrollment, management believes Tigris should

be completed in first quarter of 2025.

PMX Commercialization

- Baxter

Partnership ActivitiesIn anticipation of a positive Tigris

trial outcome, the Company has been working closely with Baxter on

post-approval marketing plans for PMX commercialization. This

includes developing product branding, pricing and roll-out plans

with numerous Baxter departments, including marketing, regulatory,

clinical and reimbursement. Baxter has communicated its intention

to undertake a broad marketing campaign on day one of FDA approval

for PMX.

- Prismax

Sub-studyThe Company is also working with Baxter on a

sub-study to obtain FDA clearance for hemoperfusion for Baxter’s

Prismax device. The Prismax, with its leading installed base in

ICUs throughout the U.S., is anticipated to be the primary ICU

device utilized for PMX treatments on commercial launch.

Funding

- Exercise of

Anti-Dilution Pre-emptive Rights On July 19, 2024 the

Company completed an additional non-brokered offering of US$1

million of 9% convertible notes of the Company (the “Notes”) at a

price of US$1,000 per convertible note due on May 1, 2028 (the

“Offering”). The Notes were sold to one of the Company’s largest

shareholders pursuant to the exercise of their anti-dilution

pre-emptive rights relating to the closing of the offering of the

approximately CAD$8.5 million offering of Notes that was completed

on May 30, 2024.

- Share

Warrant Exercise / Expired WarrantsIn the third quarter

232,500 share warrants were exercised for gross proceeds of

approximately $114,250. These warrants were issued in conjunction

with the Company’s July 27, 2021 and November 2, 2022 unit

offerings.On July 29, 2024, 10,982,500 share warrants expired.

These expired share warrants were issued in conjunction with the

Company’s approximately $10 million unit offering which closed on

July 27, 2021. As at the time of this MD&A, the Company has

7,730,464 share warrants outstanding.

- Early conversion of

Convertible notes issued on September 7, 2023On August 19,

2024, 150 Notes having a face value of USD $1,000 were converted

into 509,850 Common Shares at a conversion rate of 3,399 Common

Shares per USD$1,000 principal amount of the Notes.On September 25,

2024, 225 Notes having a face value of USD $1,000 were converted

into 764,755 Common Shares at a conversion rate of 3,399 Common

Shares per USD $ 1,000 principal amount of the Notes.

Change of Auditors

- On July 11, 2024, the Company

announced that MNP had been appointed as the auditors of the

Company following the decision by PricewaterhouseCoopers LLP

(“PWC”) to resign as the auditor of Spectral. The PWC resignation

was not the result of any disagreement between the Company and PWC

on any matter of accounting principles or practices, financial

statement disclosure, or auditing scope or procedure.

Financial Review

Revenue for the three-months ended September 30,

2024 was $502,000 compared to $397,000 for the same three-month

period last year, representing an increase of $105,000 or 26%.

Revenue for nine months ended September 30, 2024, was $1,641,000

and $1,233,000 for the same period last year, representing an

increase of $408,000 or 33%. Royalty revenue for the three-months

ended September 30, 2024 was $NIL and $NIL for the same period

prior year. Royalty revenue for the nine months ended September 30,

2024 was $135,000 compared to $126,000 for the same nine-month

period last year. This is due to an increase in usage of the

Company’s IP from one customer. Product Revenue for the

three-months ended September 30, 2024 was $274,000 compared to

$186,000 for the same three-month period last year, representing an

increase of $88,000 or 47% Product revenue for nine months ended

September 30, 2024 was $841,000 and $562,000, representing an

increase of $279,000 or 50%.

Operating expenses for the three-months ended

September 30, 2024, were $10,497,000, compared to $4,072,000 for

the same period in the preceding year, an increase of $6,425,000 or

158%. The increase is majorly due to the change in Fair value

adjustment for derivative liabilities which increased by $6,075,000

and also the Interest expense increased by $628,000 due to

convertible notes payable issued on September 7, 2023, May 30, 2024

and July 19, 2024.

Operating expenses for the nine months ended

September 30, 2024 were $20,194,000 compared to $10,292,000 for the

same period in the preceding year, an increase of $9,902,000 or

96%. The change is primarily due to an increase in interest expense

by $1,339,000 and Fair value adjustment in derivative liability

increased by $6,530,000. All these increases are due to the funding

received during September 2023, May 2024 and July 19, 2024. In

addition, share-based compensation expense increased by $197,000.

Lastly, consulting and professional fees increased by $352,000 due

to increased site and patient fees related to the Tigris trial.

Clinical development and regulatory program

costs (as disclosed in Note 13 of the condensed interim

consolidated financial statements) were $638,000 for the

three-months ended September 30, 2024 compared to $1,263,000 for

the same period in the prior year. For the nine months ended

September 30, 2024, clinical development costs are $3,015,000

compared to $3,258,000 for the corresponding period in the prior

year. A significant portion of clinical trial and regulatory costs

consists of consulting and professional fees paid to contract

research organizations, clinical sites, and other clinical and

regulatory consultants. The decrease in costs reflects decreased

start up activity with respect to the initialization of new

clinical sites and the absence of upfront CRO switching costs which

were experienced in 2023.

Loss for the three-months ended September 30,

2024 was $9,995,000, $(0.04) per share compared to a loss of

$3,804,000, $(0.01) per share for the same period in the prior

year. The increased loss of $6,191,000 was due to increased

operating expenses, partially offset by a reduction in loss from

discontinued operations of $130,000 related to the reduction in

Dialco operating expenses.

Loss for the nine months ended September 30,

2024 was $18,556,000, $(0.07) per share, compared to a loss of

$9,184,000 $(0.03) per share, for the same period in the prior

year. The increased loss of $9,372,000 was due to operating

expenses, partially offset by a reduction in loss from discontinued

operations of $122,000 related to the reduction in Dialco operating

expenses.

The Company concluded the third quarter of 2024

with cash of $5,759,000 compared to $2,952,000 of cash on hand as

of December 31, 2023.

The total number of common shares outstanding

for the Company was 282,815,223 at September 30, 2024.

About Spectral

Spectral is a Phase 3 company seeking U.S. FDA

approval for its unique product for the treatment of patients with

septic shock, Toraymyxin™ (“PMX”). PMX is a therapeutic

hemoperfusion device that removes endotoxin, which can cause

sepsis, from the bloodstream and is guided by the Company’s

Endotoxin Activity Assay (EAA™), the only FDA cleared diagnostic

for the risk of developing sepsis.

PMX is approved for therapeutic use in Japan and

Europe and has been used safely and effectively on more than

340,000 patients to date. In March 2009, Spectral obtained the

exclusive development and commercial rights in the U.S. for PMX,

and in November 2010, signed an exclusive distribution agreement

for this product in Canada. In July 2022, the U.S. FDA granted

Breakthrough Device Designation for PMX for the treatment of

endotoxic septic shock. Approximately 330,000 patients are

diagnosed with septic shock in North America each year.

The Tigris Trial is a confirmatory study of PMX

in addition to standard care vs standard care alone and is designed

as a 2:1 randomized trial of 150 patients using Bayesian

statistics. Endotoxic septic shock is a malignant form of sepsis

https://www.youtube.com/watch?v=6RANrHHi9L8.

The trial methods are detailed in

“Bayesian methods: a potential path forward for sepsis

trials”.

Spectral is listed on the Toronto Stock Exchange under the

symbol EDT. For more information, please visit

www.spectraldx.com.

Forward-looking statement

Information in this news release that is not

current or historical factual information may constitute

forward-looking information within the meaning of securities laws.

Implicit in this information, particularly in respect of the future

outlook of Spectral and anticipated events or results, are

assumptions based on beliefs of Spectral's senior management as

well as information currently available to it. While these

assumptions were considered reasonable by Spectral at the time of

preparation, they may prove to be incorrect. Readers are cautioned

that actual results are subject to a number of risks and

uncertainties, including the availability of funds and resources to

pursue R&D projects, the successful and timely completion of

clinical studies, the ability of Spectral to take advantage of

business opportunities in the biomedical industry, the granting of

necessary approvals by regulatory authorities as well as general

economic, market and business conditions, and could differ

materially from what is currently expected.

The TSX has not reviewed and does not accept responsibility for

the adequacy or accuracy of this statement.

For further information, please contact:

| Ali Mahdavi |

Chris

Seto |

| Capital Markets & Investor

Relations |

CEO |

| Spinnaker Capital Markets

Inc. |

Spectral

Medical Inc. |

| 416-962-3300 |

|

|

am@spinnakercmi.com |

cseto@spectraldx.com |

|

Spectral Medical Inc. |

|

Condensed Interim Consolidated Statements of Financial

Position |

|

In CAD (000s), except for share and per share

data |

|

(Unaudited) |

|

|

|

|

|

|

|

| |

Notes |

September 30,2024 |

December 31,2023(Refer

Note 3) |

January 1,2023(Refer Note

3) |

|

|

|

$ |

$ |

$ |

|

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash |

|

5,759 |

2,952 |

8,414 |

|

|

Trade and other receivables |

|

337 |

186 |

1,056 |

|

|

Inventories |

|

318 |

366 |

340 |

|

|

Prepayments and other assets |

|

882 |

621 |

276 |

|

|

|

|

7,296 |

4,125 |

10,086 |

|

|

Non-current assets |

|

|

|

|

|

|

Right-of-use-asset |

|

475 |

567 |

464 |

|

|

Property and equipment |

|

268 |

326 |

237 |

|

|

Intangible asset |

|

180 |

193 |

211 |

|

|

Investment in Dialco |

|

- |

- |

998 |

|

|

Total assets |

|

8,219 |

5,211 |

11,996 |

|

|

Liabilities |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Trade and other payables |

|

3,004 |

2,820 |

3,087 |

|

|

Current portion of contract liabilities |

7 |

502 |

727 |

696 |

|

|

Current portion of lease liability |

|

126 |

121 |

96 |

|

|

Notes Payable |

8&3 |

12,890 |

7,940 |

3,566 |

|

|

Derivative Liability |

8&4 |

17,405 |

6,310 |

2,674 |

|

|

|

|

33,927 |

17,918 |

10,119 |

|

|

Non-current liability |

|

|

|

|

|

|

Lease liability |

|

404 |

500 |

420 |

|

|

Non-current portion of contract liabilities |

7 |

5,170 |

3,342 |

4,011 |

|

|

Total liabilities |

|

39,501 |

21,760 |

14,550 |

|

|

Shareholders' (deficiency) equity |

10 |

|

|

|

|

|

Share capital |

|

89,871 |

87,061 |

87,050 |

|

|

Contributed surplus |

|

10,148 |

8,916 |

8,773 |

|

|

Share-based compensation |

|

11,308 |

10,385 |

8,908 |

|

|

Warrants |

|

1,384 |

2,526 |

2,490 |

|

|

Deficit |

|

(143,993) |

(125,437) |

(109,775) |

|

|

Total shareholders' (deficiency) equity |

|

(31,282) |

(16,549) |

(2,554) |

|

|

Total liabilities and shareholders' (deficiency)

equity |

|

8,219 |

5,211 |

11,996 |

|

|

Spectral Medical Inc. |

|

Condensed Interim Consolidated Statements of Loss and Comprehensive

Loss |

|

In CAD (000s), except for share and per share

data |

|

(Unaudited) |

|

|

|

|

|

|

|

|

| |

|

|

Revised |

|

Revised |

|

|

|

|

(Refer Note 16) |

|

(Refer Note 16) |

|

|

Notes |

Three monthsended Sep 30,2024 |

Three monthsended Sep 30,2023 |

Nine monthsended Sep 30,2024 |

Nine monthsended Sep 30,2023 |

|

|

|

|

$ |

$ |

$ |

$ |

|

|

Revenue |

7&12 |

502 |

397 |

1,641 |

1,233 |

|

|

Expenses |

|

|

|

|

|

|

|

Raw materials and consumables used |

|

327 |

305 |

994 |

722 |

|

|

Salaries and benefits |

14 |

1,078 |

986 |

3,101 |

2,918 |

|

|

Consulting and professional fees |

|

1,282 |

1,198 |

3,652 |

3,300 |

|

|

Regulatory and investor relations |

|

284 |

110 |

585 |

414 |

|

|

Travel and entertainment |

|

136 |

63 |

407 |

245 |

|

|

Facilities and communication |

|

90 |

81 |

353 |

245 |

|

|

Insurance |

|

105 |

102 |

315 |

290 |

|

|

Depreciation and amortization |

|

64 |

57 |

191 |

172 |

|

|

Interest expense |

8 |

970 |

342 |

2,178 |

839 |

|

|

Foreign exchange loss |

|

(399) |

46 |

129 |

(205) |

|

|

Share-based compensation |

|

241 |

340 |

1,497 |

1,300 |

|

|

Other expense |

|

163 |

320 |

704 |

289 |

|

|

Net loss on joint arrangement |

6 |

- |

41 |

- |

205 |

|

|

Fair value adjustment derivative liabilities |

8 |

6,156 |

81 |

6,088 |

(442) |

|

|

|

|

10,497 |

4,072 |

20,194 |

10,292 |

|

|

Loss and comprehensive loss for the period from continuing

operations |

|

(9,995) |

(3,675) |

(18,553) |

(9,059) |

|

|

Gain (loss) from discontinued operations |

5 |

- |

(130) |

(3) |

(125) |

|

|

Loss and comprehensive loss for the period |

|

(9,995) |

(3,805) |

(18,556) |

(9,184) |

|

|

Basic and diluted loss from continuing operations per

common share |

11 |

(0.04) |

(0.01) |

(0.07) |

(0.03) |

|

|

Basic and diluted loss from discontinued operations per

common share |

11 |

(0.00) |

(0.00) |

(0.00) |

(0.00) |

|

|

Basic and diluted loss per common share |

11 |

(0.04) |

(0.01) |

(0.07) |

(0.03) |

|

|

Weighted average number of common shares outstanding -

basic and diluted |

11 |

281,705,359 |

278,604,718 |

280,269,516 |

278,569,902 |

|

|

Spectral Medical Inc. |

|

Condensed Interim Consolidated Statements of Changes in

Shareholders’ Deficiency |

|

In CAD (000s) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Notes |

Number ofShares |

ShareCapital |

Contributedsurplus |

|

Share-based compensation |

Warrants |

Deficit |

|

Total Shareholders’ (deficiency) equity |

|

|

|

|

$ |

$ |

|

$ |

$ |

$ |

|

$ |

|

|

Balance January 1, 2023 |

|

278,547,804 |

87,050 |

8,773 |

|

8,908 |

2,490 |

(109,775) |

|

(2,554) |

|

|

RSU released |

10 |

28,457 |

11 |

- |

|

(11) |

- |

- |

|

- |

|

|

Warrants issued |

10 |

- |

- |

- |

|

- |

179 |

- |

|

179 |

|

|

Warrants expired |

10 |

- |

- |

143 |

|

- |

(143) |

- |

|

- |

|

|

Loss and comprehensive loss for the period |

|

- |

- |

- |

|

- |

- |

(9,184) |

|

(9,184) |

|

|

Share-based compensation |

10 |

- |

- |

- |

|

1,300 |

- |

- |

|

1,300 |

|

|

Revised (Refer note 16) Balance, September 30,

2023 |

|

278,576,261 |

87,061 |

8,916 |

|

10,197 |

2,526 |

(118,959) |

|

(10,259) |

|

|

Loss and comprehensive loss for the period |

|

- |

- |

- |

|

- |

- |

(6,478) |

|

(6,478) |

|

|

Share-based compensation |

10 |

- |

- |

- |

|

188 |

- |

- |

|

188 |

|

|

Balance December 31, 2023 |

|

278,576,261 |

87,061 |

8,916 |

|

10,385 |

2,526 |

(125,437) |

|

(16,549) |

|

|

Balance January 1, 2024 |

|

278,576,261 |

87,061 |

8,916 |

|

10,385 |

2,526 |

(125,437) |

|

(16,549) |

|

|

Warrants exercised |

10 |

982,500 |

618 |

- |

|

- |

(121) |

- |

|

497 |

|

|

Warrants issued |

10 |

- |

- |

- |

|

- |

211 |

- |

|

211 |

|

|

Warrants expired |

10 |

- |

- |

1,232 |

|

- |

(1,232) |

- |

|

- |

|

|

Share Options Exercised |

10 |

1,867,627 |

1,163 |

- |

|

(524) |

- |

- |

|

639 |

|

|

RSU released |

10 |

114,210 |

50 |

- |

|

(50) |

- |

- |

|

- |

|

|

Notes Conversion |

10 |

1,274,625 |

979 |

- |

|

- |

- |

- |

|

979 |

|

|

Loss and comprehensive loss for the period |

|

- |

- |

- |

|

- |

- |

(18,556) |

|

(18,556) |

|

|

Share-based compensation |

10 |

- |

- |

- |

|

1,497 |

- |

- |

|

1,497 |

|

|

Balance September 30, 2024 |

|

282,815,223 |

89,871 |

10,148 |

|

11,308 |

1,384 |

(143,993) |

|

(31,282) |

|

|

Spectral Medical Inc. |

|

Condensed Interim Consolidated Statements of Cash Flows |

|

In CAD (000s) |

|

(Unaudited) |

| |

|

|

|

|

|

Revised |

|

|

|

|

(Refer note 16) |

|

|

|

Nine monthsendedSeptember 30,2024 |

Nine monthsendedSeptember 30,2023 |

|

|

Cash flow provided by (used in) |

|

|

|

Operating activities |

|

|

|

Loss and comprehensive loss for the period |

(18,556) |

(9,184) |

|

|

Adjustments for: |

|

|

|

Depreciation on right-of-use asset |

92 |

73 |

|

|

Depreciation on property and equipment |

85 |

87 |

|

|

Amortization of intangible asset |

13 |

19 |

|

|

Amortization of deferred financing fee |

788 |

373 |

|

|

Unrealized foreign exchange gain/loss |

76 |

(155) |

|

|

Interest expense on lease liability |

25 |

30 |

|

|

Accreted interest on notes payable |

2,154 |

809 |

|

|

Share-based compensation expense |

1,497 |

1,300 |

|

|

Net loss on joint venture arrangement |

- |

205 |

|

|

Fair value adjustment derivative liabilities |

6,088 |

(442) |

|

|

Changes in items of working capital: |

|

|

|

Trade and other receivables |

(151) |

337 |

|

|

Inventories |

48 |

36 |

|

|

Prepayments and other assets |

(261) |

(636) |

|

|

Trade and other payables |

(24) |

(781) |

|

|

Contract liabilities |

1,603 |

(647) |

|

|

Net cash used in operating activities |

(6,523) |

(8,576) |

|

|

Investing activities |

|

|

|

Purchase of property and equipment |

(28) |

(15) |

|

|

Net cash used in investing activities |

(28) |

(15) |

|

|

Financing activities |

|

|

|

Financing charges paid |

(766) |

(641) |

|

|

Interest expense paid |

(794) |

(472) |

|

|

Lease liability payments |

(115) |

110 |

|

|

Proceeds from share options exercised |

639 |

- |

|

|

Proceeds from share warrants exercised |

497 |

- |

|

|

Proceeds from 9% convertible notes issued |

9,897 |

6,212 |

|

|

Net cash provided by financing activities |

9,358 |

5,209 |

|

|

Change in cash |

2,807 |

(3,383) |

|

|

Cash, beginning of period |

2,952 |

8,414 |

|

|

Cash, end of period |

5,759 |

5,031 |

|

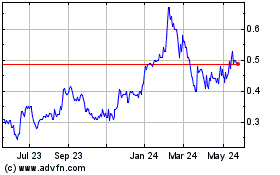

Spectral Medical (TSX:EDT)

Historical Stock Chart

From Nov 2024 to Dec 2024

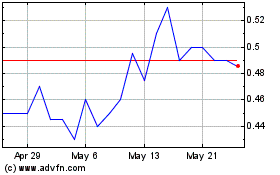

Spectral Medical (TSX:EDT)

Historical Stock Chart

From Dec 2023 to Dec 2024