Firm Capital Mortgage Investment Corporation Announces Election of Directors

14 June 2023 - 6:03AM

Firm Capital Mortgage Investment Corporation (the

“

Corporation”) (TSX: FC) today announced that at

the annual and special meeting (the “

Meeting”) of

shareholders of the Corporation held earlier today, all director

nominees were elected as directors of the Corporation, as follows:

|

Nominee |

Votes “For” |

% Votes “For” |

Votes “Against” |

% of Votes “Against” |

|

Geoffrey Bledin |

8,001,305 |

98.32% |

136,698 |

1.68% |

|

Eli Dadouch |

8,031,760 |

98.69% |

106,243 |

1.31% |

|

Morris Fischtein |

7,499,507 |

92.15% |

638,496 |

7.85% |

|

Stanley Goldfarb |

7,518,732 |

92.39% |

619,271 |

7.61% |

|

Victoria Granovski |

7,959,706 |

97.81% |

178,297 |

2.19% |

|

Anthony Heller |

7,504,125 |

92.21% |

633,878 |

7.79% |

|

Jonathan Mair |

7,986,271 |

98.14% |

151,732 |

1.86% |

|

Hon. Francis Newbould |

8,003,476 |

98.35% |

134,527 |

1.65% |

|

Hon. Joe Oliver, P.C. |

7,991,738 |

98.20% |

146,265 |

1.80% |

|

Keith Ray |

8,001,096 |

98.32% |

136,907 |

1.68% |

|

Lawrence Shulman |

7,529,860 |

92.53% |

608,143 |

7.47% |

|

Michael Warner |

7,971,188 |

97.95% |

166,815 |

2.05% |

* The number of votes disclosed reflects proxies

received by management of the Corporation in advance of the

Meeting.

All other matters considered by shareholders at

the Meeting were also approved, the details of which are contained

in the Report on Voting Results regarding the Meeting filed by the

Corporation on SEDAR at www.sedar.com.

ABOUT THE CORPORATION

Where Mortgage Deals Get

Done®

The Corporation, through its mortgage banker,

Firm Capital Corporation, is a non-bank lender providing

residential and commercial short-term bridge and conventional real

estate financing, including construction, mezzanine and equity

investments. The Corporation's investment objective is the

preservation of shareholders' equity, while providing shareholders

with a stable stream of monthly dividends from investments. The

Corporation achieves its investment objectives through investments

in selected niche markets that are under-serviced by large lending

institutions. The Corporation is a Mortgage Investment Corporation

(MIC) as defined in the Income Tax Act (Canada). Accordingly, The

Corporation is not taxed on income provided that its taxable income

is paid to its shareholders in the form of dividends within 90 days

after December 31 each year. Such dividends are generally treated

by shareholders as interest income, so that each shareholder is in

the same position as if the mortgage investments made by the

company had been made directly by the shareholder. Full reports of

the financial results of the Corporation for the year are outlined

in the audited financial statements and the related management

discussion and analysis of Corporation, available on the SEDAR

website at www.sedar.com. In addition, supplemental information is

available on Corporation’s website at www.firmcapital.com.

For further information, please contact:

Firm Capital Mortgage Investment CorporationEli

DadouchPresident & Chief Executive Officer(416) 635-0221

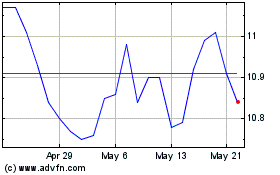

Firm Capital Mortgage In... (TSX:FC)

Historical Stock Chart

From Oct 2024 to Nov 2024

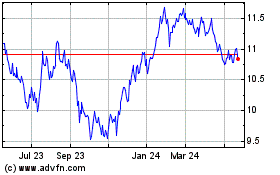

Firm Capital Mortgage In... (TSX:FC)

Historical Stock Chart

From Nov 2023 to Nov 2024