Gibson Energy Announces Renewal of Normal Course Issuer Bid

16 September 2024 - 10:00PM

Gibson Energy Inc. (“Gibson” or the “Company”), (TSX: GEI),

announced today the renewal of its Normal Course Issuer Bid

(“NCIB”).

Gibson’s Board of Directors has approved a

renewal of the Company’s NCIB, and the Toronto Stock Exchange (the

“TSX”) has accepted Gibson’s notice of intention to commence its

NCIB for an additional one-year period. This enables the Company to

purchase and cancel up to 7.5% or 9,958,026 of the public float for

the issued and outstanding common shares as of September 11, 2024

over the next 12 months commencing September 18, 2024 in accordance

with the applicable rules and policies of the TSX and applicable

securities laws. As of September 11, 2024, the Company had

162,758,103 common shares issued and outstanding.

Under the NCIB, common shares may be repurchased

in open market transactions on the TSX, and/or other Canadian

alternative trading platforms. In accordance with the rules of the

TSX governing a NCIB, the total number of common shares the Company

is permitted to purchase is subject to a daily purchase limit of

132,241 common shares, representing 25% of the average daily

trading volume of common shares on the TSX calculated for the

six-month period ended August 31, 2024. The NCIB will terminate at

the earlier of September 17, 2025 and the date on which the maximum

number of common shares that can be acquired pursuant to the NCIB

have been purchased.

The price that Gibson will pay for common shares

in open market transactions will be the market price at the time of

purchase. Gibson continues to believe that the availability of a

NCIB will enable the Company to maximize return to shareholders.

The actual number of common shares that may be purchased, if any,

and the timing of any such purchases, will be determined by Gibson

based on several factors, including the continued adherence to its

Financial Governing Principles. Gibson did not purchase any common

shares under its normal course issuer bid that commenced on

September 15, 2023 and ended on September 14, 2024 (the “Prior

NCIB”). 9,812,193 common shares were approved for purchase under

the Prior NCIB.

The Company has renewed its automatic purchase

plan with its broker, BMO Nesbitt Burns Inc., to facilitate

purchases of its common shares. The automatic purchase plan allows

for purchases by the Company of its common shares at any time,

including, without limitation, when the Company would ordinarily

not be permitted to make purchases due to regulatory restriction or

self-imposed blackout periods. Purchases will be made by Gibson’s

broker based upon the parameters prescribed by the TSX and the

terms of the parties’ written agreement.

About Gibson Gibson is a

leading liquids infrastructure company with its principal

businesses consisting of the storage, optimization, processing, and

gathering of liquids and refined products. Headquartered in

Calgary, Alberta, the Company’s operations are located across North

America, with core terminal assets in Hardisty and Edmonton,

Alberta, Ingleside, Texas, and a facility in Moose Jaw,

Saskatchewan.

Gibson shares trade under the symbol GEI and are

listed on the Toronto Stock Exchange. For more information,

visit www.gibsonenergy.com.

Forward-Looking Statements Certain

statements contained in this news release constitute

forward-looking information and statements (collectively,

“forward-looking statements”) including, but not limited to,

statements concerning the NCIB, common shares which may be

purchased under the NCIB and related matters. All statements other

than statements of historical fact are forward-looking statements.

The use of any of the words “anticipate”, “plan”, “contemplate”,

“continue”, “estimate”, “expect”, “intend”, “propose”, “might”,

“may”, “will”, “shall”, “project”, “should”, “could”, “would”,

“believe”, “predict”, “forecast”, “pursue”, “potential” and

“capable” and similar expressions are intended to identify forward

looking statements. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. No assurance can be given that

these expectations will prove to be correct and such

forward-looking statements included in this news release should not

be unduly relied upon. These statements speak only as of the date

of this news release. The Company does not undertake any

obligations to publicly update or revise any forward-looking

statements except as required by securities law. Actual results

could differ materially from those anticipated in these

forward-looking statements as a result of numerous risks and

uncertainties including, but not limited to, the risks and

uncertainties described in “Forward-Looking Statements“ and “Risk

Factors” included in the Company’s Annual Information Form and

Management’s Discussion and Analysis, each dated February 20, 2024,

as filed on SEDAR+ and available on the Gibson website at

www.gibsonenergy.com.

For further information, please

contact:

Investor Relations:(403)

776-3077investor.relations@gibsonenergy.com

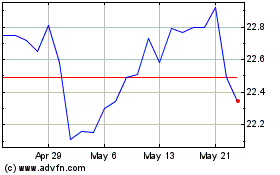

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Gibson Energy (TSX:GEI)

Historical Stock Chart

From Nov 2023 to Nov 2024