Journey Energy Inc. (JOY – TSX) (“

Journey” or the

“

Company”) is pleased to report its year-end 2023

oil and gas reserves evaluation.

2023 Reserve Report

Highlights:

- Proved developed producing reserves

decreased 7% to 36.9 MMboe, with a corresponding decrease of 25% in

NPV@10% to $361.9 million ($368.4 million including the Countess

Power Project (“CPP”)). The PDP reserve life index increased to 8.4

years from 8.3 years.

- Proved reserves decreased 2% to

50.0 MMboe, with a corresponding decrease of 17% in NPV@10% to

$504.1 million ($581.5 million including the CPP, Gilby Power

Project “GPP”) and Mazeppa power project (“MPP”).

- Proved plus Probable Developed

Producing reserves decreased 5% to 48.6 MMboe, with a corresponding

decrease of 22% in NPV@10% to $450.5 million ($457.0 million

including the CPP). The Proved plus Probable Developed Producing

reserve life index increased to 10.8 years from 10.5 years.

- Proved plus Probable reserves

decreased 1% to 80.4 MMboe, with a corresponding decrease of 14% in

NPV@10% to $772.2 million ($849.6 million including the CPP, GPP

and MPP projects).

- Proved developed producing and

proved plus probable developed producing reserve life index of 8.4

and 10.8 years respectively, are testaments to Journey’s low

decline asset base, and the YoY increase in reserve life index

demonstrates Journey’s ability to grow our base production base

while simultaneously reducing our corporate decline rate.

- Realized attractive F&D and

FD&A recycle ratios of 2.4 and 2.5 respectively for proven

reserves; and 8.9 and 8.5 respectively for proven plus probable

reserves.

- The $247 million of total proved

plus probable undeveloped future development cost (“FDC”) in

Journey’s reserve report generates $299 million in future NPV @

10%. The development wedge generates development cost of

approximately $8.25/boe, a cost which is consistent with Journey’s

historical averages.

Unaudited Financial Information and 2023

Update Guidance

The preliminary financial information contained

in this press release is not a comprehensive statement of our

financial results for the fourth quarter and year ended December

31, 2023. Journey’s actual results may differ materially from these

estimates due to the currently ongoing finalization of our

financial statements. The Company’s audited financial results for

the year ended December 31, 2023, are expected to be released on

March 12, 2024. Journey will be providing an update on its 2024

guidance and capital program at that time.

COMPANY GROSS WORKING INTEREST OIL AND

GAS RESERVES AND NET PRESENT VALUES

The following table provides summary information

presented in the GLJ Petroleum Consultants Limited

(“GLJ”) independent reserves assessment and

evaluation effective December 31, 2023, (the “GLJ

Report”). GLJ evaluated 100% of Journey’s crude oil,

natural gas liquids and natural gas reserves. The evaluation of all

of its oil and gas properties was prepared in accordance with the

definitions, standards and procedures contained in the Canadian Oil

and Gas Evaluation Handbook (“COGE Handbook”) and National

Instrument 51-101, Standards of Disclosure for Oil and Gas

Activities (“NI 51-101”).

The 2023 GLJ reserve report includes the

abandonment and reclamation liability associated with all active

and inactive wells, facilities, pipelines and gathering

systems.

Detailed reserve information will be presented

in the Company’s upcoming Statement of Reserves Data and Other Oil

and Gas Information section of the Company’s Annual Information

Form scheduled to be filed on SEDAR on or before March 31,

2024.

Company Gross

ReservesBased on Three Consultants Average Price

and Costs as at December 31, 2023

|

|

Light/Medium Oil |

TightOil |

HeavyOil |

NaturalGas |

NGL’s |

Total(2) |

|

Reserves Category |

(Mbbl) |

(Mbbl) |

(Mbbl) |

(MMcf) |

(Mbbl) |

(Mboe) |

|

Proved |

|

|

|

|

|

|

|

Producing |

7,822 |

116 |

9,254 |

95,517 |

3,835 |

36,947 |

|

Developed non-producing |

263 |

- |

521 |

2,914 |

106 |

1,376 |

|

Undeveloped |

2,865 |

- |

3,098 |

26,590 |

1,257 |

11,652 |

|

Total proved |

10,951 |

116 |

12,873 |

125,021 |

5,198 |

49,975 |

|

Probable |

7,191 |

34 |

5,535 |

78,695 |

4,525 |

30,402 |

|

Total proved plus probable |

18,142 |

151 |

18,408 |

203,716 |

9,724 |

80,377 |

|

|

|

|

|

|

|

|

|

Included in Above |

|

|

|

|

|

|

|

Proved plus probable producing |

10,515 |

151 |

11,502 |

128,858 |

4,999 |

48,643 |

Notes:(1) Company Gross Reserves consists

of Journey’s working interest (operated and non-operated) share of

reserves before deduction of royalties payable and without

including royalties receivable by the Company.(2) In the case

of natural gas volumes, boes are derived by converting natural gas

to oil using the ratio of six thousand cubic feet of natural gas to

one barrel of oil (6 Mcf:1 bbl).(3) Total values may not add

due to rounding.Net Present Values of Future Net Revenue

(Based on Three Consultants Average Forecast Prices and

Costs)

|

|

Before Tax Net Present

Value(1)($000’s) |

|

Reserves category |

0% |

5% |

10% |

15% |

20% |

|

Proved |

|

|

|

|

|

|

Producing |

295,958 |

403,659 |

361,865 |

313,670 |

274,349 |

|

Developed non-producing |

29,316 |

22,091 |

17,405 |

14,190 |

11,881 |

|

Undeveloped |

279,788 |

182,574 |

124,838 |

88,668 |

64,765 |

|

Total proved |

605,061 |

608,325 |

504,108 |

416,528 |

350,995 |

|

Probable |

698,808 |

409,299 |

268,051 |

189,444 |

141,187 |

|

Total proved plus probable |

1,303,869 |

1,017,623 |

772,160 |

605,973 |

492,182 |

|

|

|

|

|

|

|

|

Included in Above |

|

|

|

|

|

|

Proved plus probable producing |

562,812 |

546,891 |

450,543 |

374,276 |

318,755 |

Notes:(1) The net present values presented

in the above table do not include any value associated with the

Power Projects.(2) Forecast pricing used is the average of the

published price forecasts for GLJ Petroleum Consultants Ltd.,

Sproule Associates Ltd. and McDaniel & Associates Ltd. as at

December 31, 2023.(3) It should not be assumed that the net

present values of future net revenues estimated by GLJ represent

fair market value of the reserves. There is no assurance that the

forecast price and cost assumptions will be attained and variances

could be material.(4) Total values may not add due to

rounding.

The forecast prices and foreign exchange rates

used in the GLJ Report are as follows:

|

|

WTI

CushingOklahoma($US/bbl) |

Edmonton40

API($CDN/bbl) |

WCS CrudeOil

Stream($CDN/bbl) |

AlbertaAECO-spot($CDN/Mmbtu) |

NYMEXHenry Hub($US/Mmbtu) |

ForeignExchange($US/$CDN) |

|

2024 |

73.67 |

92.91 |

76.74 |

2.20 |

2.75 |

0.752 |

|

2025 |

74.98 |

95.04 |

79.77 |

3.37 |

3.64 |

0.752 |

|

2026 |

76.14 |

96.07 |

81.12 |

4.05 |

4.02 |

0.755 |

|

2027 |

77.66 |

97.99 |

82.88 |

4.13 |

4.10 |

0.755 |

|

2028 |

79.22 |

99.95 |

85.04 |

4.21 |

4.18 |

0.755 |

|

2029 |

80.80 |

101.95 |

86.74 |

4.30 |

4.27 |

0.755 |

|

2030 |

82.42 |

103.98 |

88.48 |

4.38 |

4.35 |

0.755 |

|

2031 |

84.06 |

106.07 |

90.24 |

4.47 |

4.44 |

0.755 |

|

2032 |

85.75 |

108.18 |

92.04 |

4.56 |

4.53 |

0.755 |

|

2033 |

87.46 |

110.35 |

93.89 |

4.65 |

4.62 |

0.755 |

|

2034 |

89.21 |

112.56 |

95.77 |

4.74 |

4.71 |

0.755 |

|

2035 |

90.99 |

114.81 |

97.68 |

4.84 |

4.80 |

0.755 |

|

2036 |

92.82 |

117.10 |

99.63 |

4.94 |

4.90 |

0.755 |

|

2037 |

94.67 |

119.44 |

101.63 |

5.03 |

5.00 |

0.755 |

|

2038 |

96.56 |

121.83 |

103.66 |

5.13 |

5.10 |

0.755 |

|

Thereafter |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

+2.0%/yr |

|

Reserves Reconciliation

The following table sets out the reconciliation of

Journey’s total gross reserves based on forecast prices and costs

by principal product type as at December 31, 2023 relative to

December 31, 2022.

|

|

Proved (Mboe) |

Probable (Mboe) |

TPP (Mboe) |

|

December 31, 2022 |

50,813 |

30,159 |

80,972 |

|

Discoveries |

- |

- |

- |

|

Extensions |

1,608 |

99 |

1,707 |

|

Infill drilling |

- |

- |

- |

|

Improved recovery |

1,634 |

959 |

2,594 |

|

Technical revisions |

254 |

(882) |

(628) |

|

Acquisitions |

197 |

79 |

276 |

|

Dispositions |

(22) |

(5) |

(27) |

|

Economic factors |

(46) |

(9) |

(55) |

|

Production |

(4,463) |

- |

(4,463) |

|

December 31, 2023 |

49,975 |

30,402 |

80,377 |

FINDING, DEVELOPMENT AND ACQUISITION

COSTS

Journey’s finding and development

(“F&D”) and finding, development and

acquisition (“FD&A”) costs for 2023, 2022 and

the three-year average are presented in the tables below. The

capital costs used in the calculations are those costs related to:

land acquisition and retention, seismic, drilling, completions,

tangible well site, tie-ins, and facilities, plus the change in

estimated future development costs (“FDC”) as per

the independent evaluator’s reserve report. Net acquisition costs

are the cash outlays in respect of acquisitions; minus the proceeds

from the disposition of properties during the year. Due to the

timing of capital costs and the subjectivity in the estimation of

future costs, the aggregate of the exploration and development

costs incurred in the most recent financial year and the change

during that year in estimated FDC’s generally will not necessarily

reflect total FDC’s related to reserve additions for that year. The

reserves used in this calculation are working interest reserve

additions, including technical revisions and changes due to

economic factors. The 2023 and the three-year average capital

expenditures are currently unaudited as the 2023 financial results

are in the process of being finalized. For the unaudited

information see the reconciliation of the capital expenditures

below which are as of the date of this press release.

|

Proved Finding, Development & Acquisition

Costs |

2023 |

2022 |

3 Year |

|

Capital expenditures (including A&D) ($000’s) |

26,400 |

178,030 |

215,142 |

|

Change in future capital ($000’s) |

15 |

44,714 |

52,194 |

|

Total capital for FD&A (000’s) |

26,415 |

222,744 |

267,336 |

|

Reserve additions, including A&D (Mboe) |

3,625 |

21,178 |

31,726 |

|

Proved FD&A costs – including changes in future capital

($/boe) |

7.29 |

10.52 |

8.43 |

|

Proved FD&A costs – excluding changes in future capital

($/boe) |

7.28 |

8.41 |

6.78 |

|

Recycle ratio(1) |

|

|

|

|

Including changes in future capital |

2.5 |

3.0 |

2.7 |

|

Proved plus Probable Finding, Development & Acquisition

Costs |

2023 |

2022 |

3 Year |

|

Capital expenditures (including A&D) ($000’s) |

26,400 |

178,030 |

215,142 |

|

Change in future capital ($000’s) |

(18,203) |

90,257 |

86,860 |

|

Total capital for FD&A ($000’s) |

8,197 |

268,287 |

302,002 |

|

Reserve additions, including A&D (Mboe) |

3,867 |

29,753 |

41,318 |

|

Proved FD&A costs – including changes in future capital

($/boe) |

2.12 |

9.02 |

7.31 |

|

Proved FD&A costs – excluding changes in future capital

($/boe) |

6.83 |

5.98 |

5.21 |

|

Recycle ratio(1) |

|

|

|

|

Including changes in future capital |

8.5 |

3.5 |

3.1 |

|

Proved Finding & Development Costs |

2023 |

2022 |

3 Year |

|

Capital expenditures (excluding A&D) ($000’s) |

25,469 |

41,577 |

70,036 |

|

Change in future capital ($000’s) |

(23) |

11,433 |

18,379 |

|

Total capital for F&D (000’s) |

25,446 |

53,010 |

88,415 |

|

Reserve additions, excluding A&D (Mboe) |

3,428 |

3,636 |

11,800 |

|

Proved F&D costs – including changes in future capital

($/boe) |

7.42 |

14.58 |

7.49 |

|

Proved F&D costs – excluding changes in future capital

($/boe) |

7.43 |

11.43 |

5.94 |

|

Recycle ratio(1) |

|

|

|

|

Including changes in future capital |

2.4 |

2.2 |

3.0 |

|

Proved plus Probable Finding & Development

Costs |

2023 |

2022 |

3 Year |

|

Capital expenditures (excluding A&D) ($000’s) |

25,469 |

41,577 |

70,036 |

|

Change in future capital ($000’s) |

(18,241) |

31,654 |

27,623 |

|

Total capital for F&D (000’s) |

7,228 |

73,231 |

97,659 |

|

Reserve additions, excluding A&D (Mboe) |

3,591 |

5,951 |

14,596 |

|

Proved F&D costs – including changes in future capital

($/boe) |

2.01 |

12.31 |

6.69 |

|

Proved F&D costs – excluding changes in future capital

($/boe) |

7.09 |

6.99 |

4.80 |

|

Recycle ratio(1) |

|

|

|

|

Including changes in future capital |

8.9 |

2.6 |

3.4 |

Notes:(1) Recycle ratio is calculated as

the operating netback per boe divided by F&D or FD&A costs

per boe as applicable. The operating netbacks used in the

respective years are as follows: 2023 (unaudited) - $17.98/boe;

2022 - $31.88/boe and the three-year average is $22.72/boe (see

full reconciliation in the “Advisories” section).(2) Future

Development Costs have been adjusted for the effects of reserves

categorized as acquisitions and dispositions.

FUTURE DEVELOPMENT COSTS

The following table provides the breakdown of

future development costs deducted in the estimation of the future

net revenue attributable to the proved and proved plus probable

reserve categories noted below:

|

($000’s) |

Proved |

Proved plusProbable |

|

2024 |

13,920 |

16,058 |

|

2025 |

48,068 |

75,879 |

|

2026 |

36,399 |

88,272 |

|

2027 |

20,727 |

41,551 |

|

2028 |

14,143 |

29,987 |

|

Remaining |

9,089 |

23,065 |

|

Total (Undiscounted) |

142,346 |

274,812 |

RESERVE LIFE INDEX

The Company’s reserve life index

(“RLI”) is calculated by taking the Company Gross

Reserves from the GLJ Report and dividing them by the projected

2024 production as estimated in the GLJ Report.

|

|

Company GrossReserves |

2024 CompanyGross Production |

RLI |

|

Reserves Category |

(Mboe) |

(Mboe) |

(Years) |

|

Proved, developed, producing |

36,947 |

4,395 |

8.4 |

|

Total proved |

49,975 |

4,544 |

11.0 |

|

Proved plus probable producing |

48,643 |

4,514 |

10.8 |

|

Proved plus probable |

80,377 |

4,707 |

17.1 |

NET ASSET VALUEThe following

table provides a calculation of Journey’s estimated net asset value

(“NAV”) and net asset value per share

(“NAVPS”) as at December 31, 2023 based on the

estimated future net revenues associated with Journey’s reserves as

presented in the GLJ Report. NAV does not include any provision for

Journey’s undeveloped land or seismic database. However, NAV in the

table below includes the future discounted cash flows of Journey’s

Countess Power Project, Gilby Power Project, and Mazeppa Power

Projects based upon an economic run completed by GLJ and using

their pricing assumptions.

|

|

Net Asset Value ($000’s) |

Net Asset Value ($/share) |

|

Category |

2023 |

2022 |

% |

2023 |

2022 |

% |

|

PDP plus CPP (developed) |

306,698 |

392,085 |

(22) |

|

5.00 |

6.77 |

(26 |

) |

|

TP plus CPP, GPP & MPP (developed + undeveloped) |

519,819 |

540,829 |

(4) |

|

8.47 |

9.34 |

(9 |

) |

|

P+P DP plus CPP (developed) |

395,298 |

488,596 |

(19) |

|

6.44 |

8.44 |

(24 |

) |

|

TPP plus CPP, GPP & MPP (developed + undeveloped) |

787,919 |

830,867 |

(5) |

|

12.84 |

14.35 |

(11 |

) |

Notes: (1) Aggregate NAV is calculated by taking

the future net revenues per the GLJ report, on a before tax basis,

discounted at 10% and subtracting net debt at December 31, 2023 of

approximately $61,676 thousand (unaudited); (December 31, 2022 -

$98,767 thousand). The 2023 NAV has been adjusted to include the

value of power generation at Countess, Gilby and Mazeppa. Countess

was commissioned on September 29, 2020 (10% NPV: $6,474 thousand).

Gilby power generation is expected to start power generation in

late 2024 (10% NPV: $30,555 thousand), Mazeppa power generation is

expected to start power generation in late 2024 (10% NPV: $40,366

thousands), as evaluated by GLJ effective January 1, 2024. (2)

Year-end NAVPS is calculated by taking the NAV and dividing it by

the basic shares outstanding as at December 31, 2023 of 61,350

thousand shares (December 31, 2022 – 57,882 thousand). All share

counts have been rounded to the nearest 1,000 shares.

OPERATIONS UPDATEJourney is

happy to report that it has now completed expenditures and

obligations in association with the March 2023 flow through share

issuance. Journey’s exploration and development program costs were

well under the originally forecast amount, thereby allowing the

Company to expand its drilling program. During the fourth quarter

of 2023 and to date in 2024, Journey has drilled 16.0 wells (13.1

net) in 4 of its core areas. 12.0 wells (10.3 net) are now

on-production. 4.0 wells (2.9 net) were drilled in 2024 to date in

Medicine Hat and are currently forecast to be producing by

mid-March. The net capital expenditures for this drilling program

were approximately $25 million. Current sales volumes (net to

Journey) from the new wells that are currently producing is

approximately 1,100 boe/d (79% crude oil and NGL’s).

About the Company Journey is a

Canadian exploration and production company focused on oil-weighted

operations in western Canada. Journey’s strategy is to grow its

production base by drilling on its existing core lands,

implementing waterflood projects, and by executing on accretive

acquisitions. Journey seeks to optimize its legacy oil pools on

existing lands through the application of best practices in

horizontal drilling and, where feasible, with water floods.

For further information contact:

| Alex G. Verge |

or |

Gerry Gilewicz |

| President and Chief Executive Officer |

|

Chief Financial Officer |

| 403.303.3232 |

|

403.303.3238 |

| alex.verge@journeyenergy.ca |

|

gerry.gilewicz@journeyenergy.ca |

| |

|

|

| Journey Energy Inc. |

|

|

| 700, 517 – 10thAvenue SW |

|

|

| Calgary, AB T2R 0A8 |

|

|

| 403.294.1635 |

|

|

| www.journeyenergy.ca |

|

|

ADVISORIES

This press release contains forward-looking

statements and forward-looking information (collectively "forward

looking information") within the meaning of applicable securities

laws relating to the Company’s plans and other aspects of our

anticipated future operations, management focus, strategies,

financial, operating and production results, industry conditions,

commodity prices and business opportunities. In addition, and

without limiting the generality of the foregoing, this press

release contains forward-looking information regarding decline

rates, anticipated netbacks, drilling inventory, estimated average

drill, complete and equip and tie-in costs, anticipated potential

of the Assets including, but not limited to, EOR performance and

opportunities, capacity of infrastructure, potential reduction in

operating costs, production guidance, total payout ratio, capital

program and allocation thereof, future production, decline rates,

funds flow, net debt, net debt to funds flow, exchange rates,

reserve life, development and drilling plans, well economics,

future cost reductions, potential growth, and the source of funding

our capital spending. Forward-looking information typically uses

words such as "anticipate", "believe", "project", "expect", "goal",

"plan", "intend" or similar words suggesting future outcomes,

statements that actions, events or conditions "may", "would",

"could" or "will" be taken or occur in the future.

The forward-looking information is based on

certain key expectations and assumptions made by our management,

including expectations and assumptions concerning prevailing

commodity prices and differentials, exchange rates, interest rates,

applicable royalty rates and tax laws; future production rates and

estimates of operating costs; performance of existing and future

wells; reserve and resource volumes; anticipated timing and results

of capital expenditures; the success obtained in drilling new

wells; the sufficiency of budgeted capital expenditures in carrying

out planned activities; the timing, location and extent of future

drilling operations; the state of the economy and the exploration

and production business; results of operations; performance;

business prospects and opportunities; the availability and cost of

financing, labour and services; the impact of increasing

competition; the ability to efficiently integrate assets and

employees acquired through acquisitions, including the Acquisition,

the ability to market oil and natural gas successfully and our

ability to access capital. Although we believe that the

expectations and assumptions on which such forward-looking

information is based are reasonable, undue reliance should not be

placed on the forward-looking information because Journey can give

no assurance that they will prove to be correct. Since

forward-looking information addresses future events and conditions,

by its very nature they involve inherent risks and uncertainties.

Our actual results, performance or achievement could differ

materially from those expressed in, or implied by, the

forward-looking information and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

information will transpire or occur, or if any of them do so, what

benefits that we will derive therefrom. Management has included the

above summary of assumptions and risks related to forward-looking

information provided in this press release in order to provide

security holders with a more complete perspective on our future

operations and such information may not be appropriate for other

purposes.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other factors that could affect our operations or financial results

are included in reports on file with applicable securities

regulatory authorities and may be accessed through the SEDAR

website (www.sedar.com).These forward looking statements are made

as of the date of this press release and we disclaim any intent or

obligation to update publicly any forward-looking information,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about Journeys prospective results of

operations, funds flow, netbacks, debt, payout ratio well economics

and components thereof, all of which are subject to the same

assumptions, risk factors, limitations and qualifications as set

forth in the above paragraphs. FOFI contained in this press release

was made as of the date of this press release and was provided for

providing further information about Journey’s anticipated future

business operations. Journey disclaims any intention or obligation

to update or revise any FOFI contained in this press release,

whether as a result of new information, future events or otherwise,

unless required pursuant to applicable law. Readers are cautioned

that the FOFI contained in this press release should not be used

for purposes other than for which it is disclosed herein.

Information in this press release that is not current or historical

factual information may constitute forward-looking information

within the meaning of securities laws, which involves substantial

known and unknown risks and uncertainties, most of which are beyond

the control of Journey, including, without limitation, those listed

under “Risk Factors” and “Forward Looking Statements” in the Annual

Information Form filed on www.SEDAR.com on March 31, 2023.

Forward-looking information may relate to our future outlook and

anticipated events or results and may include statements regarding

the business strategy and plans and objectives. Particularly,

forward-looking information in this press release includes, but is

not limited to, information concerning Journey’s drilling and other

operational plans, production rates, and long-term objectives.

Journey cautions investors in Journey’s securities about important

factors that could cause Journey’s actual results to differ

materially from those projected in any forward-looking statements

included in this press release. Information in this press release

about Journey’s prospective funds flows and financial position is

based on assumptions about future events, including economic

conditions and courses of action, based on management’s assessment

of the relevant information currently available. Readers are

cautioned that information regarding Journey’s financial outlook

should not be used for purposes other than those disclosed herein.

Forward-looking information contained in this press release is

based on our current estimates, expectations and projections, which

we believe are reasonable as of the current date. No assurance can

be given that the expectations set out in the Prospectus or herein

will prove to be correct and accordingly, you should not place

undue importance on forward-looking information and should not rely

upon this information as of any other date. While we may elect to,

we are under no obligation and do not undertake to update this

information at any particular time except as required by applicable

securities law.

Non-IFRS Measures

The Company uses the following non-IFRS measures

in evaluating corporate performance. These terms do not have a

standardized meaning prescribed by International Financial

Reporting Standards and therefore may not be comparable with the

calculation of similar measures by other companies.

1) “Netback(s)”. The

Company uses netbacks to help evaluate its performance, leverage,

and liquidity; comparisons with peers; as well as to assess

potential acquisitions. Management considers netbacks as a key

performance measure as it demonstrates the Company’s profitability

relative to current commodity prices. Management also uses them in

operational and capital allocation decisions. Journey uses netbacks

to assess its own performance and performance in relation to its

peers. These netbacks are operating, Funds Flow and net income

(loss). “Operating netback” is calculated as the

average sales price of the commodities sold (excluding financial

hedging gains and losses), less royalties, transportation costs and

operating expenses. There is no GAAP measure that is reasonably

comparable to netbacks. Below is the reconciliation of the

Operating Netback for Journey for 2023, 2022 and the three year

average:

|

|

$000’s |

$/boe |

|

|

2023 |

|

2022 |

|

3 Year |

2023 |

|

2022 |

|

3 Year |

|

Revenues |

224,353 |

|

235,583 |

|

583,779 |

|

49.50 |

|

66.01 |

|

52.96 |

|

|

Royalties |

(46,980) |

|

(46,976) |

|

(113,166) |

|

(10.37) |

|

(13.16) |

|

(10.27) |

|

|

Operating expenses |

(91,577) |

|

(72,356) |

|

(211,977) |

|

(20.20) |

|

(20.27) |

|

(19.23) |

|

|

Transportation |

(4,325) |

|

(2,485) |

|

(8,195) |

|

(0.95) |

|

(0.70) |

|

(0.74) |

|

|

Operating netback |

81,491 |

|

113,766 |

|

250,451 |

|

17.98 |

|

31.88 |

|

22.72 |

|

2) “Net debt” is

calculated by taking current assets and then subtracting accounts

payable and accrued liabilities; the principal amount of term debt;

and the carrying value of the other liability. Net debt is used to

assess the capital efficiency, liquidity and general financial

strength of the Company. In addition, it is used as a comparison

tool to assess financial strength in relation to Journey’s

peers.

|

Net Debt Reconciliation ($000’s) |

2023 |

|

2022 |

|

|

Principal amount of term debt |

43,763 |

|

67,580 |

|

|

Principal amount of vendor-take-back debt |

17,000 |

|

43,000 |

|

|

Accounts payable and accrued liabilities |

47,214 |

|

45,495 |

|

|

Principal amount of contingent bank debt |

- |

|

5,000 |

|

|

Other loans |

419 |

|

419 |

|

|

Deduct: |

|

|

|

Cash in bank |

(17,715) |

|

(31,400) |

|

|

Accounts receivable |

(24,734) |

|

(29,677) |

|

|

Prepaid expenses |

(4,271) |

|

(1,650) |

|

|

Net debt |

61,676 |

|

98,767 |

|

3) Journey uses “Capital

Expenditures (excluding A&D)” and “Capital

Expenditures (including A&D)” to measure its capital

investment level compared to the Company’s annual budgeted capital

expenditures for its organic capital program, excluding

acquisitions or dispositions. The directly comparable GAAP measure

to capital expenditures is cash used in investing activities.

Journey then adjusts its capital expenditures for A&D activity

to give a more complete analysis for its capital spending used for

FD&A purposes. The capital spending for A&D proposes has

been adjusted to reflect the non-cash component of the

consideration paid (i.e. shares issued). The following table

details the composition of capital expenditures and its

reconciliation to cash flow used in investing activities:

|

(000’s) |

Year endedDecember 31 |

|

|

2023 |

2022 |

|

Land and lease rentals |

1,740 |

919 |

|

Geological and geophysical |

351 |

63 |

|

Drilling and completions |

15,620 |

31,260 |

|

Well equipment and facilities |

7,758 |

9,335 |

|

Capital Expenditures (excluding A&D) |

25,469 |

41,577 |

|

Corporate acquisition (cash less working capital assumed) |

- |

8,226 |

|

Corporate acquisition - shares |

- |

10,920 |

|

Asset acquisitions – cash |

6,467 |

120,307 |

|

Asset dispositions - cash |

(5,536) |

(3,000) |

|

Capital Expenditures (including A&D ) |

26,400 |

178,030 |

|

Other capital – power generation |

14,456 |

2,996 |

Measurements

All dollar figures included herein are presented

in Canadian dollars, unless otherwise noted.

Where amounts are expressed in a barrel of oil

equivalent (“boe”), or barrel of oil equivalent per day (“boe/d”),

natural gas volumes have been converted to barrels of oil

equivalent at nine (6) thousand cubic feet (“Mcf”) to one (1)

barrel. Use of the term boe may be misleading particularly if used

in isolation. The boe conversion ratio of 6 Mcf to 1 barrel (“Bbl”)

of oil or natural gas liquids is based on an energy equivalency

conversion methodology primarily applicable at the burner tip, and

does not represent a value equivalency at the wellhead. This

conversion conforms to the Canadian Securities Regulators’ National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities.

Reserves Disclosure

Journey’s Statement of Reserves Data and Other

Oil and Gas Information on Form 51-101F1 dated effective as at

December 31, 2023, which will include further disclosure of

Journey’s oil and gas reserves and other oil and gas information in

accordance with NI 51-101 and COGEH forming the basis of this press

release, will be included in the AIF, which will be available on

SEDAR at www.sedar.com on or near March 31, 2024.

All reserves values, future net revenue and

ancillary information contained in this press release are derived

from the GLJ Report unless otherwise noted. All reserve references

in this press release are “Company gross reserves”. Company gross

reserves are the Company’s total working interest reserves before

the deduction of any royalties payable by the Company. Estimates of

reserves and future net revenue for individual properties may not

reflect the same level of confidence as estimates of reserves and

future net revenue for all properties, due to the effect of

aggregation. There is no assurance that the forecast price and cost

assumptions applied by GLJ in evaluating Journey’s reserves will be

attained and variances could be material. All reserves assigned in

the GLJ Report are located in the Province of Alberta and presented

on a consolidated basis.

All evaluations and summaries of future net

revenue are stated prior to the provision for interest, debt

service charges or general and administrative expenses and after

deduction of royalties, operating costs, estimated well abandonment

and reclamation costs and estimated future capital expenditures. It

should not be assumed that the estimates of future net revenues

presented in the tables below represent the fair market value of

the reserves. The recovery and reserve estimates of Journey’s oil,

NGLs and natural gas reserves provided herein are estimates only

and there is no guarantee that the estimated reserves will be

recovered. Actual oil, natural gas and NGL reserves may be greater

than or less than the estimates provided herein. There are numerous

uncertainties inherent in estimating quantities of crude oil,

reserves and the future cash flows attributed to such reserves. The

reserve and associated cash flow information set forth herein are

estimates only.

Proved reserves are those reserves that can be

estimated with a high degree of certainty to be recoverable. It is

likely that the actual remaining quantities recovered will exceed

the estimated proved reserves. Probable reserves are those

additional reserves that are less certain to be recovered than

proved reserves. It is equally likely that the actual remaining

quantities recovered will be greater or less than the sum of the

estimated proved plus probable reserves. Proved developed producing

reserves are those reserves that are expected to be recovered from

completion intervals open at the time of the estimate. These

reserves may be currently producing or, if shut-in, they must have

previously been on production, and the date of resumption of

production must be known with reasonable certainty. Undeveloped

reserves are those reserves expected to be recovered from known

accumulations where a significant expenditure (e.g., when compared

to the cost of drilling a well) is required to render them capable

of production. They must fully meet the requirements of the

reserves category (proved or probable) to which they are assigned.

Certain terms used in this press release but not defined are

defined in NI 51-101, CSA Staff Notice 51-324 – Revised Glossary to

NI 51-101, Revised Glossary to NI 51-101, Standards of Disclosure

for Oil and Gas Activities (“CSA Staff Notice 51-324”) and/or the

COGEH and, unless the context otherwise requires, shall have the

same meanings herein as in NI 51-101, CSA Staff Notice 51-324 and

the COGEH, as the case may be.

Drilling LocationsThis press release discloses

drilling inventory in two categories: (a) proved locations; and (b)

probable locations. Proved locations and probable locations are

derived from the GLJ Report and account for drilling locations that

have associated proved and/or probable reserves, as applicable.

Of the 99 net total booked drilling locations

identified herein, 47 are net proved locations and 52 are net

probable locations.

“Development capital” means the

aggregate exploration and development costs incurred in the

financial year on reserves that are categorized as development.

Development capital excludes capitalized administration costs.

“FDC” Future development costs

are the future capital cost estimated for each respective category

in year- end reserves attributed with realizing those reserves and

associated future net revenue.

“Finding and development costs”

Journey calculates F&D costs, including FDC, as the sum of

“Capital Expenditures, before A&D” (as defined under “Non-GAAP

Measures”) and the change in FDC required to bring the reserves on

production, divided by the change in reserves within the applicable

reserves category. Management uses F&D costs as a measure of

capital efficiency for organic reserves development.

“F&D Cost per BOE” are the

F&D costs divided by the change in gross company interest

reserves volumes that are characterized as exploration or

development, excluding volumes associated with acquisitions, for

the period.

“Finding, development and acquisition

costs” Journey calculates FD&A costs, including FDC,

as the sum of “Capital Expenditures, excluding A&D” and

“Capital Expenditures, including A&D” (as defined under

“Non-IFRS Measures”), and the change in FDC required to bring the

reserves on production, divided by the change in reserves within

the applicable reserves category, inclusive of changes due to

acquisitions and dispositions. Management uses FD&A costs as a

measure of capital efficiency for organic and acquired reserves

development.

“FD&A Cost per BOE” is the

FD&A cost divided by the change in gross company interest

reserves volumes, including changes in volumes characterized as

acquisitions or divestitures, in the current period.

Readers are cautioned that the aggregate of

capital expenditures incurred in the year, comprised of exploration

and development costs and acquisition costs, and the change in

estimated FDC generally will not reflect total F&D or FD&A

costs related to reserves additions in the year.

Abbreviations

The following abbreviations are used throughout

these MD&A and have the ascribed meanings:

|

A&D |

acquisition and divestiture of petroleum and natural gas

assets |

|

API |

American Petroleum Institute |

|

bbl |

Barrel |

|

bbls |

Barrels |

|

boe |

barrels of oil equivalent (see conversion statement below) |

|

boe/d |

barrels of oil equivalent per day |

|

gj |

Gigajoules |

|

GAAP |

Generally Accepted Accounting Principles |

|

IFRS |

International Financial Reporting Standards |

|

Mbbls |

thousand barrels |

|

Mboe |

thousand boe |

|

Mcf |

thousand cubic feet |

|

Mmcf |

million cubic feet |

|

Mmcf/d |

million cubic feet per day |

|

MSW |

Mixed sweet Alberta benchmark oil price at Edmonton Alberta |

|

MW |

One million watts of power |

|

NGL’s |

natural gas liquids (ethane, propane, butane and condensate) |

|

WCS |

Western Canada Select benchmark oil price. This crude oil is

heavy/sour with API gravity of 19-22 degrees and sulphur content of

1.8-3.2%. |

|

WTI |

West Texas Intermediate benchmark Oil price. This crude oil is

light/sweet with API gravity of 39.6 degrees and sulfur content of

0.24%. |

All volumes in this press release refer to the

sales volumes of crude oil, natural gas and associated by-products

measured at the point of sale to third-party purchasers. For

natural gas, this occurs after the removal of natural gas

liquids.

No securities regulatory authority has either

approved or disapproved of the contents of this press release.

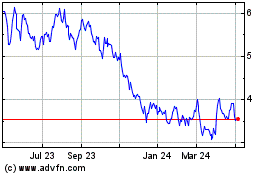

Journey Energy (TSX:JOY)

Historical Stock Chart

From Jan 2025 to Feb 2025

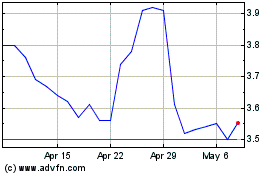

Journey Energy (TSX:JOY)

Historical Stock Chart

From Feb 2024 to Feb 2025