Melcor Developments Ltd. (TSX: MRD), an Alberta-based real estate

development and asset management company, today reported results

for the second quarter and six months ended June 30, 2020.

Revenue was down 5% to $39.05 million compared to Q2-2019. Year to

date revenue was down 4% to $72.82 million compared to the same

period last year. This decrease is due to zero land acre sales thus

far in 2020, while 2019 revenue included 24.99 acres of raw,

commercial and other land sales for revenue of $17.71 million. This

led to the 54% decrease in community development revenue over

Q2-2019 and 48% year to date. Revenue in our Investment Properties

and REIT divisions grew by 2% over Q2-2019 and 3% year to date as a

result of transfers from the Property Development division and

third party acquisitions over the past 18 months. Investment

properties owned gross leasable area (GLA) grew by 4%, while GLA in

the REIT grew by 12%.

Net income in the second quarter and year to date was

significantly impacted by non-cash fair value gains on REIT units

and fair value losses on investment properties. In Q2-2020, we had

our entire Canadian property portfolio revalued by our external

valuation professionals which resulted in a non-cash fair value

loss on investment properties of $61.89 million contributing to the

overall net loss of $62.59 million in the quarter compared to net

income of $3.14 million in Q2-2019. Year to date net income was

positively impacted by non-cash fair value gains of $58.02 million

on REIT units as the unit price went from $8.12 at the beginning

the year to $3.70 at June 30, 2020. Year to date net income was

$4.05 million or $0.12 per share (basic) compared with a net income

of $4.73 million or $0.14 per share (basic) in the same period of

2019.

These drastic swings in net income caused by non-cash gains and

losses are the reason that management relies on Funds from

Operations (FFO) as a better reflection of Melcor’s true operating

performance. FFO was up 16% to $9.28 million or $0.28 per share in

the quarter and up 11% to $15.20 million or $0.46 per share year to

date. The FFO increase over last year is primarily due to the 21%

decrease in general and administrative spending over Q2-2019 and

16% year to date.

Darin Rayburn, Melcor’s President and Chief Executive Officer,

commented on the quarter: "While we have been working hard to

adjust and react thoughtfully to an ever changing situation due to

COVID-19 and other macro factors throughout the second quarter of

2020, we have been pleasantly surprised by our results. We planned

for the worst while hoping for the best and ended up somewhere in

the middle.

We moved quickly in response to COVID-19, providing a safe and

clean work environment for our tenants and our team to stop the

spread. We moved to work from home protocols internally by

mid-March and have recently developed re-opening protocols to keep

both our tenants and our team safe. Throughout the past 6 months,

we have continually kept stakeholders updated on measures taken,

operational updates and providing information or instructions for

applying for relief programs.

We also implemented measures to conserve cash so that we would

be in a position to support our builders, suppliers and tenants

through these challenging times. These measures included reducing

Melcor’s dividends and the REIT’s distributions, deferring

non-essential discretionary capital spending, deferring sales tax,

property tax and utility payments where available, and working with

our lenders to defer mortgage payments. Further, we reduced board

remuneration, implemented wage roll-backs for executive officers,

temporary lay offs for approximately 25% of full-time staff and

reduced remuneration for all remaining staff from April 1st to July

31st. The majority of furloughed staff returned to work on July

1st, in some cases as part of a work share program. Eight employees

were permanently laid off and the board and senior management

remains on reduced remuneration.

The amount of behind the scenes work that went into our COVID-19

response cannot be overemphasized. We are so proud of our team for

stepping up to the challenge to protect our company.

The federal government, in partnership with the provinces and

territories, announced the creation of the Canada Emergency

Commercial Rent Assistance (CECRA) program for small businesses

that qualify for the months of April, May, June, July and August

2020. Over 97% of retail tenants surveyed in late April and early

May let us know that they intend to apply for the CECRA program,

provided they qualify. As the deadline to apply for the CECRA

program for small businesses who qualify and wish to access funding

for April, May and June is August 31, 2020; and those who wish to

access funding for July can apply to do so in September, we cannot

yet determine the overall impact this program will have on Melcor.

To date, we have received requests to apply for the CECRA program

from approximately 10% of tenants representing 8% of total Canadian

GLA. We cannot yet determine how many of these applications will be

successful. We believe, based on existing information, that our net

exposure to CECRA claims for the Q2 period is approximately $0.65

million.

Due to the rapidly evolving and widespread impacts of the

pandemic, our total Canadian portfolio was revalued by our external

valuation professionals in Q2-2020, resulting in a fair value loss

of $68.68, or 6% of our portfolio value. Losses were due to

declining stabilized NOI and projected cash flows as well as a

25-50 bps increase in capitalization rates and discount rates.

The significant difference between our second quarter results in

2020 and 2019 was the commercial and raw land sales that closed in

2019 in our community development division and a delay to the

spring home buying season, particularly in Canada, as a result of

measures implemented to stop the spread of COVID-19."

The Board today declared a quarterly dividend of $0.08 per

share, payable on September 30, 2020 to shareholders of record

on September 15, 2020. The dividend is an eligible dividend

for Canadian tax purposes.

Second Quarter Results

Given the longer term nature of real estate development,

comparison of any three-month period may not be meaningful.

Revenue in Q2-2020 was down 5% over Q2-2019 and 4% year to date.

The significant contributor to this decrease in revenue was

commercial, industrial and raw land sales in 2019, where none have

been recorded to date in 2020. Land sales, which can have a

significant impact on quarterly results, are uneven by nature and

it is difficult to predict when they will close. Overall, Community

Development revenue was down 54% in the quarter and 48% year to

date.

COVID-19 delayed the typical spring selling season, resulting in

fewer single-family lot sales in Canada through the first half of

the year compared to 2019. In addition, the price per lot sold was

impacted by both the prevalence of sales in joint venture

communities along with the focus on smaller product type to meet

new home buyer market trends. This decrease in Canadian sales was

offset by 33 single-family lot sales in the US during Q2-2020 as we

sold most of the remaining lots in the first phase of Harmony,

contributing $4.94 million ($US3.62 million) in revenue.

Our income producing divisions (Investment Properties and REIT)

continue to grow, with an 8% increase in GLA under management

contributing to second quarter revenue growth of 2% over Q2-2019

and 3% year to date, which helped to partially offset the decline

in Community Development revenue. Third-party acquisitions and

transfers from our Property Development division over the past 18

months contributed to the growth in GLA. US Community Development

revenue will continue to be uneven as the development model differs

from our Canadian markets. Production builders bulk buy lots from

Melcor to then finish, build homes and sell to homeowners. Strong

sales to homeowners continued in the US through the second quarter,

resulting in continued demand for additional lots in the second

phase of our Harmony community in Denver, which is now under

development.

Our strategy of geographic and product mix diversification over

the past few years continues to positively impact our financial

results and serve as a partial offset to the impact of softer

residential markets in Alberta.

Our Community Development and Property Development divisions are

actively engaged in a small number of projects during the 2020

construction season, including two brand new communities that are

adjacent to successful communities that are close-to or fully built

out and the continued build out of neighbourhood shopping centres

adjacent to some of our most popular communities.

The community phases under development are comprised of

predominantly smaller, more affordable product types such as laned

homes, duplex, townhomes and multi-family sites as there has been

demand from builders for these products.

FINANCIAL HIGHLIGHTS

- Revenue was down 4% year to date and 5% in the quarter as a

result of the timing of raw, multi-family and commercial land

sales, which tend to fluctuate quarter to quarter. Land sales made

up over 50% of community development revenue in 2019 versus zero

land sales to date in 2020. Although the number of single-family

lots sold in the current period were comparable to 2019, year to

date revenues from these sales increased from $15.09 million in

2019 to $17.06 million in 2020 as a result of sales of

higher-priced products such as lake-view estate lots in Kelowna,

BC.

- Funds from operations (FFO) increased 11% year to date and 16%

in the quarter. FFO increased as a result of our continued focus on

reducing general and administrative expenses, which were down 21%

in the quarter and 16% year to date.

- Net income for the six-months ended June 30, 2020 was

positively impacted by the non-cash fair value gains on REIT units

of $58.02 million due to the drastic swing in the REIT unit price

from December 31, 2019 at $8.12 per unit down to $3.70 per unit on

June 30, 2020 as worldwide equity markets experienced significant

volatility due to COVID-19. This non-cash increase to net income

was offset by non-cash fair value losses on investment properties

of $68.68 million. Both these gains and losses are driven by market

forces outside of Melcor’s control and are a key reason we focus on

FFO as a better measure of our financial performance.

DIVISIONAL OPERATING HIGHLIGHTS

- All Community Development regions continue to focus on moving

existing inventory and are deploying strategies and marketing

programs to this effect. These efforts, combined with very cautious

new development, have resulted in a 23% reduction to single-family

lot inventory since June 30, 2019.

- We began marketing the initial phase of North Clifton Estates

in Kelowna, BC in Q1-2020. This highly anticipated development is a

high-end Okanagan lake view community just 20 minutes from downtown

Kelowna. Interest in the project has been strong through Q2-2020,

with 11 of the 44 lots in Phase 1 sold.

- Showhomes in our new community of Lanark Landing, adjacent to

King’s Heights in Airdrie, AB, opened during the quarter with laned

single-family, duplex and townhome product available in Phase 1A.

Interest in the project has been strong and we are beginning Phase

1B of the community.

- Showhomes in our new community of Rosewood, adjacent to

Rosenthal in Edmonton, AB, are nearing completion and will be

opening in Q3-2020.

- Interest in Harmony in Aurora, CO remained strong throughout

the quarter with a total of 33 lots sold as of June 30, 2020. The

STEM-focused neighbourhood school, Harmony Ridge, is set to open

for the 2020-21 school year and the community centre with pool was

completed in June 2020; however, it remains closed due to COVID-19.

Phase 2 of the community is under development.

- Our Property Development team has a total of 115,244 sf

currently under construction in five projects. A further 52,548 sf

is complete and awaiting lease-up and/or transfer in two projects.

Our Property Development division currently only operates in

Alberta.

- As a result of the uncertainty surrounding the fair value of

many of our investment properties, management engaged our

independent external valuation professionals to perform assessments

of Canadian properties in our income generating divisions. This

resulted in a net fair value loss of $61.89 million in the quarter

and $68.68 million year to date.

- Total GLA under management has increased 8% via acquisitions

and transfers from Property Development since June 30, 2019.

Revenue in our income-producing divisions (Investment Properties

and REIT) was up 2% over Q2-2019 and 3% over the same period last

year. These divisions continue to yield stable results and have

achieved consistent occupancy and base rents despite challenging

market conditions. See the COVID-19 section for rent collection

information.

- Our golf courses (Recreational Properties) opened May 1 in BC

and May 7 in Alberta. These openings are later than the weather

would have otherwise allowed as a result of COVID-19. In response

to regulations put in place by health officials, services provided

at the golf courses were limited in scope in early May. Clubhouses

are now open and following all guidelines for safe physical

distancing of patrons.

RETURNING VALUE

- We continue to return value to our shareholders and unit

holders:

- We paid a quarterly dividend of $0.08 per share on June 30,

2020. This is a reduction from the $0.10 per share dividend paid

during the first quarter in order to conserve cash as a response to

COVID-19.

- On August 11, 2020 we declared a quarterly dividend of

$0.08 per share, payable on September 30, 2020 to shareholders

of record on September 15, 2020. The dividend is an eligible

dividend for Canadian tax purposes.

- The REIT paid distributions of $0.03 per unit in April, May and

June for a quarterly payout ratio of 55%. Distributions made

subsequent to June 2020 remained at $0.03 per unit to conserve cash

in response to COVID-19.

Selected Highlights

| ($000s except as noted) |

Three-months |

Six-months |

| |

30-June-20 |

30-June-19 |

Change |

30-June-20 |

30-June-19 |

Change |

|

Revenue |

39,053 |

|

41,085 |

|

(4.9 |

)% |

72,820 |

|

75,969 |

|

(4.1 |

)% |

|

Gross margin (%) * |

49.5 |

% |

53.6 |

% |

(7.6 |

)% |

50.2 |

% |

53.8 |

% |

(6.7 |

)% |

|

Net income (loss) |

(62,590 |

) |

3,137 |

|

(2,095.2 |

)% |

4,050 |

|

4,727 |

|

(14.3 |

)% |

|

Net margin (%) * |

(160.3 |

)% |

7.6 |

% |

(2,209.2 |

)% |

5.6 |

% |

6.2 |

% |

(9.7 |

)% |

|

Funds from operations * |

9,276 |

|

7,975 |

|

16.3 |

% |

15,201 |

|

13,652 |

|

11.3 |

% |

| Per Share Data ($) |

|

|

|

|

|

|

|

Basic earnings (loss) |

(1.88 |

) |

0.09 |

|

(2,188.9 |

)% |

0.12 |

|

0.14 |

|

(14.3 |

)% |

|

Diluted earnings (loss) |

(1.88 |

) |

0.09 |

|

(2,188.9 |

)% |

0.12 |

|

0.14 |

|

(14.3 |

)% |

|

Funds from operations * |

0.28 |

|

0.24 |

|

16.7 |

% |

0.46 |

|

0.41 |

|

12.2 |

% |

|

|

|

|

|

|

|

|

| As at ($000s except as

noted) |

|

|

|

30-June-20 |

31-Dec-19 |

Change |

| Shareholders' equity |

|

|

|

1,086,281 |

|

1,080,257 |

|

0.6 |

% |

| Total assets |

|

|

|

2,034,787 |

|

2,096,047 |

|

(2.9 |

)% |

| |

|

|

|

|

|

|

| Per Share Data ($) |

|

|

|

|

|

|

| Book

value * |

|

|

|

32.76 |

|

32.51 |

|

0.8 |

% |

MD&A and Financial Statements

Information included in this press release is a summary of

results. This press release should be read in conjunction with

Melcor’s consolidated financial statements and management’s

discussion and analysis for the three and six months ended

June 30, 2020, which can be found on the company’s website at

www.Melcor.ca or on SEDAR (www.sedar.com).

About Melcor Developments Ltd.

Melcor is a diversified real estate development and asset

management company that transforms real estate from raw land

through to high-quality finished product in both residential and

commercial built form. Melcor develops and manages mixed-use

residential communities, business and industrial parks, office

buildings, retail commercial centres and golf courses. Melcor owns

a well diversified portfolio of assets in Alberta, Saskatchewan,

British Columbia, Arizona and Colorado.

Melcor has been focused on real estate since 1923. The company

has built over 140 communities and commercial projects across

Western Canada and today manages 4.52 million sf in commercial real

estate assets and 607 residential rental units. Melcor is committed

to building communities that enrich quality of life - communities

where people live, work, shop and play.

Melcor’s headquarters are located in Edmonton, Alberta, with

regional offices throughout Alberta and in Kelowna, British

Columbia and Phoenix, Arizona. Melcor has been a public company

since 1968 and trades on the Toronto Stock Exchange (TSX:MRD).

Forward Looking Statements

In order to provide our investors with an understanding of our

current results and future prospects, our public communications

often include written or verbal forward-looking statements.

Forward-looking statements are disclosures regarding possible

events, conditions, or results of operations that are based on

assumptions about future economic conditions, courses of action and

include future-oriented financial information.

This news release and other materials filed with the Canadian

securities regulators contain statements that are forward-looking.

These statements represent Melcor’s intentions, plans,

expectations, and beliefs and are based on our experience and our

assessment of historical and future trends, and the application of

key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to,

comments with respect to our strategic initiatives for 2020 and

beyond, future development plans and objectives, targets,

expectations of the real estate, financing and economic

environments, our financial condition or the results of or outlook

of our operations.

By their nature, forward-looking statements require assumptions

and involve risks and uncertainties related to the business and

general economic environment, many beyond our control. There is

significant risk that the predictions, forecasts, valuations,

conclusions or projections we make will not prove to be accurate

and that our actual results will be materially different from

targets, expectations, estimates or intentions expressed in

forward-looking statements. We caution readers of this document not

to place undue reliance on forward-looking statements. Assumptions

about the performance of the Canadian and US economies and how this

performance will affect Melcor’s business are material factors we

consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions,

please see the discussion under Business Environment and Risk in

our annual MD&A and the additional disclosure under Business

Environment and Risk in this MD&A.

Readers should carefully consider these factors, as well as

other uncertainties and potential events, and the inherent

uncertainty of forward-looking statements. Except as may be

required by law, we do not undertake to update any forward-looking

statement, whether written or oral, made by the company or on its

behalf.

Contact Information:

Nicole Forsythe

Director, Corporate Communications

Tel: 1.855.673.6931 x4707

ir@melcor.ca

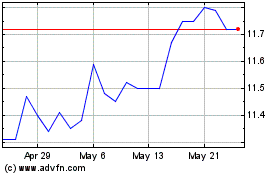

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

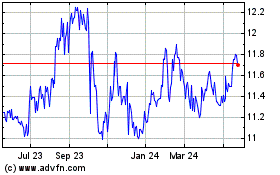

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Nov 2023 to Nov 2024