PrairieSky Royalty Ltd. ("

PrairieSky" or the

"

Company") (TSX: PSK) is pleased to announce its

fourth quarter ("

Q4 2023") and year-end operating

and financial results for the period ended December 31, 2023.

PrairieSky is also pleased to announce a 4% increase in its annual

dividend to $1.00 per common share ($0.25 per common share

quarterly).

Fourth Quarter Highlights

- Quarterly average royalty

production volumes of 25,608 BOE per day, which included record oil

royalty production volumes of 12,844 barrels per day.

- Quarterly revenues totaled $136.6

million, comprised of royalty production revenues of $122.0 million

and other revenues of $14.6 million, including bonus consideration

of $11.2 million, the highest quarterly bonus earned since

2017.

- Quarterly funds from operations of

$111.1 million ($0.46 per share basic and diluted) generated

primarily from robust organic oil royalty production growth and

strong bonus consideration earned on active third-party

leasing.

- Completed acquisitions of producing

and non-producing royalty interests, as well as incremental seismic

data, for aggregate cash consideration of $22.2 million.

- Declared a fourth quarter dividend

of $57.3 million ($0.24 per share), representing a 52% quarterly

payout ratio.

Annual Highlights

- Royalty production volumes averaged

24,857 BOE per day, flat with 2022 annual average royalty

production volumes and comprised of 59.5 MMcf per day of natural

gas, 2,502 barrels per day of natural gas liquids

("NGL") and a record 12,438 barrels per day of

oil.

- Annual revenues totaled $513.2

million comprised of:

- Royalty production revenue of

$474.6 million, a decrease of 23% from 2022 primarily due to lower

benchmark commodity prices; and

- Other revenue of $38.6 million,

including $26.0 million of bonus consideration earned on entering

into 202 new leasing arrangements with 110 separate

counterparties.

- Annual funds from operations

totaled $382.5 million ($1.60 per share basic and diluted), driven

by organic production growth in oil royalty volumes combined with

strong bonus consideration earned on active leasing to third-party

operators.

- Proved plus probable reserves

totaled 65,762 MBOE with a before-tax net present value, discounted

at 10%, of $1.84 billion, a decrease of 5% from December 31, 2022

primarily due to lower near-term natural gas and NGL commodity

price assumptions.

- Declared cumulative annual

dividends of $229.2 million ($0.96 per share), representing an

annual payout ratio of 60%.

- At December 31, 2023, net debt

totaled $222.1 million, a decrease of 30% from December 31, 2022

net debt of $315.1 million, as excess funds from operations after

payment of the dividend and royalty acquisitions were used to

retire bank debt.

Dividend Increase

- PrairieSky is pleased to announce a

4% increase in its annual dividend to $1.00 per common share, to be

paid on a quarterly basis ($0.25 per common share quarterly),

effective for the March 29, 2024 record date.

Sustainability Highlights

- Maintained "Negligible Risk" ESG

Risk Rating and received "2024 ESG Global 50 Top-Rated Badge"

awarded to the top 50 ranked companies in Sustainalytics ESG Risk

Ratings universe which covers more than 14,000 companies across 42

industries.

- Maintained AAA ESG Risk Rating from

MSCI, measuring resilience to long-term, industry material ESG

risks.

- Included in the S&P's Global

Sustainability Yearbook 2024 based on top 15% performance in the

S&P's Global 2023 Corporate Sustainability Assessment which

evaluated over 9,400 companies globally.

Leadership Update

- PrairieSky is pleased to announce

the appointment of Michael Murphy as Vice-President, Geosciences

and Capital Markets. Mr. Murphy is a professional geologist with 19

years of experience in the oil and gas industry and equity

research.

President's Message

An active fourth quarter of leasing activity

capped off another strong year in 2023. PrairieSky entered into 50

leasing arrangements in the quarter earning bonus consideration of

$11.2 million, primarily from leasing of Duvernay rights, the

highest quarterly bonus consideration earned since 2017. Annual

bonus consideration totaled $26.0 million, the highest annual bonus

consideration earned since 2017, with PrairieSky entering into 202

leasing arrangements with 110 different counterparties. In both

2022 and 2023, leasing activity was focused on oil targets which

has resulted in strong organic oil growth on PrairieSky's royalty

properties. PrairieSky averaged a record 12,844 barrels per day of

oil royalty production in the quarter which was 6% above Q4 2022.

Annually, average oil royalty volumes reached a record 12,438

barrels per day, 6% above 2022. With the incremental Duvernay

leasing, we anticipate long-term light oil royalty production

growth to complement the growth in heavy oil from PrairieSky's

Clearwater and Mannville Stack oil plays.

Total royalty production averaged 25,608 BOE per

day in the fourth quarter generating royalty production revenue of

$122.0 million which combined with $11.2 million of bonus

consideration, $2.9 million of lease rentals and $0.5 million of

other revenues drove Q4 2023 funds from operations of $111.1

million. Annually, total royalty production averaged 24,857 BOE per

day generating $474.6 million in royalty production revenue. Funds

from operations totaled $382.5 million for 2023 generated primarily

on strong oil royalty production revenue which made up 79% of

royalty production revenue combined with $26.0 million in bonus

consideration. PrairieSky's annual 2023 dividend was $229.2 million

or $0.96 per common share, resulting in an annual payout ratio of

60%. PrairieSky executed on $58.4 million in acquisitions and

directed the remainder of funds from operations to retiring bank

debt. At December 31, 2023, PrairieSky's net debt totaled $222.1

million, a decrease of 30% from $315.1 million at December 31,

2022. Management believes PrairieSky's business model is uniquely

suited to provide sustainable returns to shareholders through all

commodity price cycles and we are pleased to announce a 4% dividend

increase effective for the March 29, 2024 record date.

During Q4 2023, PrairieSky added incremental

royalty acreage through $22.2 million in acquisitions which

included undeveloped lands in the Mannville Stack oil play. We have

focused our acquisition strategy since 2016 on entering early stage

plays such as the Clearwater and Mannville Stack. This strategy has

driven strong oil royalty production growth and we anticipate these

acquisitions will continue to provide strong returns on invested

capital. In addition to early-stage opportunities, PrairieSky

acquired approximately 67,000 acres of producing and non-producing

royalty acreage in Central Alberta for $14.0 million before

customary closing adjustments, which closed on December 6, 2023.

The acquisition included royalty production volumes of 90 BOE per

day (72% liquids) and seismic covering the acquired assets.

It was an active fourth quarter on our royalty

properties with 197 wells spud, comprised of 184 oil wells, 12

natural gas wells and 1 helium well. Drilling activity in the

quarter spanned from Northeast British Columbia to Southwest

Manitoba and was focused on oil plays including 44 Clearwater oil

wells across our 1.4 million acres of Clearwater acreage, 48

Mannville Stack oil wells and 33 Viking oil wells primarily on fee

leases in Saskatchewan. With the level of third-party drilling

activity and new leasing, management expects oil royalty production

volumes to maintain momentum into 2024. In 2023, there were 805

wells spud, down from 850 wells in 2022. PrairieSky estimates that

$2.0 billion (net - $112 million) in third-party capital was spent

in 2023 drilling and completing wells on PrairieSky's royalty

properties, up from $1.5 billion (net - $84 million) in 2022.

Capital spending by third-party operators targeted oil plays,

including those where PrairieSky has made strategic investments,

with the most active plays being the Clearwater oil play, Mannville

Stack heavy oil play and the Viking oil play.

We were very pleased with the level of organic

growth in oil royalty volumes we have achieved over the last two

years and the level of activity across our land base. We anticipate

2024 will continue to be active and we will remain disciplined,

focusing on our core strategies of leasing land, managing

controllable costs and conducting royalty and land compliance

activities. We are pleased to welcome Michael to our team and look

forward to working with him to meet our corporate objectives. We

would like to thank our shareholders for their support, and our

staff for their continued hard work.

Andrew Phillips, President & CEOQ4

2023 FINANCIAL HIGHLIGHTS

- PrairieSky generated funds from

operations of $111.1 million or $0.46 per share (basic and diluted)

in Q4 2023, an increase of 18% over Q3 2023 and 7% below Q4 2022.

The increase in funds from operations over Q3 2023 was driven by a

combination of organic growth in oil royalty production volumes and

increased bonus consideration earned on new leasing activity. These

positive impacts were more than offset by lower WTI and AECO

benchmark pricing as compared to Q4 2022.

- PrairieSky's royalty production

volumes totaled 25,608 BOE per day and generated royalty production

revenue of $122.0 million in Q4 2023. A further breakdown is as

follows:

- PrairieSky achieved record oil

royalty production volumes of 12,844 barrels per day, a 6% increase

over both Q3 2023 and Q4 2022 as royalty production from new wells

on stream more than offset natural declines. Oil royalty production

volumes included 24 barrels per day related to acquisitions in the

quarter.

- Oil royalty production revenue

totaled $98.4 million, a decrease of 4% from Q3 2023 as higher

royalty production volumes were offset by weaker WTI benchmark

pricing and wider light and heavy oil differentials. Oil royalty

production revenue was lower than Q4 2022 due to lower WTI

benchmark pricing and a wider light oil differential partially

offset by stronger royalty production volumes, a narrowed heavy oil

differential and a weaker Canadian dollar relative to the US

dollar.

- Natural gas royalty production

volumes averaged 60.4 MMcf per day in Q4 2023, a 6% decrease from

Q3 2023 and 9% from Q4 2022 as new wells on stream were offset by

natural declines.

- Natural gas royalty revenue totaled

$12.2 million, a 5% increase over Q3 2023 due to certain royalty

volumes being sold at higher Sumas pricing. Natural gas royalty

revenue decreased 62% from Q4 2022 when daily AECO pricing averaged

$5.11 per mcf and monthly AECO pricing averaged $5.58 per mcf which

was more than 50% above Q4 2023 AECO pricing.

- NGL royalty production volumes

averaged 2,697 barrels per day, flat with both Q3 2023 and Q4 2022

as new wells on stream offset natural declines.

- NGL royalty revenue totaled $11.4

million, down 12% from Q3 2023 and 16% from Q4 2022 due to lower

benchmark pricing.

- PrairieSky generated $11.2 million

in bonus consideration in Q4 2023, the highest quarterly bonus

consideration earned since 2017, which was earned on entering into

50 new leasing arrangements with 43 different counterparties.

PrairieSky earned an incremental $2.9 million in lease rentals and

$0.5 million in other revenue in the quarter. Compliance recoveries

totaled $2.0 million in Q4 2023.

- Cash administrative expenses

totaled $5.6 million or $2.38 per BOE, in line with Q4 2022.

- PrairieSky declared a dividend of

$57.3 million ($0.24 per share) during Q4 2023, representing a 52%

payout ratio. Remaining funds from operations were allocated to

acquisitions and to retiring bank debt.

- During Q4 2023, PrairieSky acquired

undeveloped lands in the Mannville Stack as well as incremental

producing and non-producing royalty interests and seismic for cash

consideration of $22.2 million.

ANNUAL FINANCIAL HIGHLIGHTS

- PrairieSky generated annual funds

from operations of $382.5 million ($1.60 per share basic and

diluted), 25% below 2022, as record oil royalty production volumes

and strong bonus consideration were more than offset by the

negative impacts of lower benchmark commodity pricing.

- Royalty production volumes averaged

24,857 BOE per day, flat year over year, as increased oil royalty

production volumes were offset by lower natural gas royalty volumes

which were negatively impacted during the year due to facility

maintenance downtime and forest fire related shut-ins. Average oil

royalty production volumes reached a record 12,438 barrels per day,

6% higher than 2022.

- PrairieSky achieved total revenues

of $513.2 million, comprised of $474.6 million of royalty

production revenue and $38.6 million of other revenue. Other

revenue included $26.0 million of bonus consideration, the highest

annual amount since 2017, earned on entering into 202 new leasing

arrangements with 110 counterparties. Compliance recoveries

totalled $6.6 million for the year.

- Administrative expenses totaled

$45.0 million or $4.96 per BOE, below 2022 administrative expenses

of $48.8 million or $5.30 per BOE. Cash administrative expenses

totaled $47.9 million or $5.28 per BOE higher than 2022 cash

administrative expense primarily due to share-based compensation

payments, including a termination payment related to a leadership

change and a director retirement.

- During 2023, PrairieSky completed

acquisitions of fee mineral title and GORR interests primarily

targeting Mannville Stack heavy oil for $58.4 million. Annually,

acquisitions added 35 BOE per day to royalty production

volumes.

- PrairieSky declared cumulative

annual dividends of $229.2 million or $0.96 per share with a

resulting annual payout ratio of 60%.

- At December 31, 2023, PrairieSky's

net debt totaled $222.1 million, a decrease of $93.0 million or 30%

from December 31, 2022 net debt of $315.1 million.

ACTIVITY ON PRAIRIESKY’S ROYALTY

PROPERTIES

Third-party drilling activity remained strong in

Q4 2023 with 197 wells spud on PrairieSky's royalty properties

consisting of 95 wells spud on Fee Lands, 93 wells spud on GORR

acreage and 9 unit wells spud. Activity was focused on oil targets

with 184 wells spud which included 48 Mannville Stack oil wells, 44

Clearwater oil wells, 33 Viking oil wells, 17 Mannville oil wells,

13 Cardium oil wells, 11 Mississippian oil wells, 6 Duvernay oil

wells, and 12 additional oil wells spud in the Bakken, Belly River,

Charlie Lake, Jurassic and Nisku formations. There were 12 natural

gas wells spud in Q4 2023, including 5 Montney natural gas wells, 7

Mannville and Spirit River wells, and 1 helium well. PrairieSky's

average royalty rate for wells spud in Q4 2023 was 7.2% (Q4 2022 -

6.4%). Spuds on PrairieSky's royalty properties in 2023 totaled 805

wells, as compared to 850 wells in 2022. The average royalty rate

for wells spud in 2023 was 7.2% (2022 - 7.3%).

For 2023, PrairieSky estimates that $2.0 billion

(net - $112 million) in third-party capital was spent drilling and

completing wells on PrairieSky royalty properties, up from $1.5

billion (net capital - $84 million) in 2022, representing a 33%

increase in net capital spent on PrairieSky's land base year over

year. The increase was primarily a result of inflation in the

service sector.

ANNUAL DIVIDEND INCREASED 4% TO $1.00

PER SHARE

PrairieSky is pleased to announce a 4% increase

in its annual dividend to $1.00 per common share in 2024, to be

paid on a quarterly basis effective for the March 29, 2024 record

date. In determining changes to the dividend level, the Board of

Directors considers a number of factors including current and

projected activity levels on PrairieSky's royalty lands, the

current commodity price environment, the working capital and bank

debt balance and net earnings of the Company.

2023 RESERVES INFORMATION

PrairieSky's proved plus probable reserves

totaled 65,762 MBOE at December 31, 2023 (December 31, 2022 -

66,719 MBOE) and include only developed assets (developed producing

and developed non-producing properties) and do not include any

future development capital on undeveloped lands. Proved plus

probable reserves remained relatively flat with 2022, with year

over year changes comprised of additions related to third-party

drilling and improved recovery (7,111 MBOE), technical additions

(971 MBOE), acquisitions (14 MBOE) and economic factors (19 MBOE)

less 2023 royalty production volumes of 9,072 MBOE. At December 31,

2023, the before-tax net present value of total proved plus

probable reserves, discounted at 10%, decreased 5% to $1.84

billion (2022 - $1.94 billion) primarily as a result of lower

near-term natural gas and NGL commodity price assumptions.

PrairieSky's year end 2023 reserves were

evaluated by independent reserves evaluators GLJ Ltd. The

evaluation of PrairieSky's royalty properties was done in

accordance with the definitions, standards and procedures contained

in the Canadian Oil and Gas Evaluation Handbook and National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities. PrairieSky's reserves information is included in the

Company’s Annual Information Form which is available on SEDAR+

at www.sedarplus.ca and PrairieSky's website

at www.prairiesky.com.

GLOBAL SUSTAINABILITY

RANKINGS

Once again PrairieSky has received industry

leading scores from several globally recognized environmental,

social and governance ("ESG") rating agencies for 2023. These

results demonstrate our carbon neutral status(1) and ongoing

commitment to environmental stewardship, social responsibility, and

strong corporate governance practices and are set forth below.

2023 ESG Rankings

|

Rating Agency |

PrairieSky Score/Ranking |

Description of Score/Ranking |

|

Sustainalytics ESG Risk (All Industries) |

7.4Negligible Risk |

Ranked in the top 0.5% of all companies in Sustainalytics global

coverage universe(2)and maintained "Negligible Risk" ESG Risk

Rating.Received "2024 ESG Global 50 Top-Rated Badge" awarded to the

top 50 ranked companies in Sustainalytics ESG Risk Ratings universe

which covers more than 14,000 companies across 42 industries. |

|

Sustainalytics ESG Risk (Oil and Gas Producers) |

1 out of 315 |

Maintained top overall global(2)ranking and awarded Sustainalytics

"Industry Top-Rated Badge". |

|

MSCI ESG Risk Rating |

AAA |

Maintained AAA "Leader" status, denoting companies leading the

industry in managing the most significant ESG risks and

opportunities.Measurement of resilience to long-term, industry

material ESG risks on a relative ranking from AAA to CCC. |

|

CDP Climate Change 2023 |

B |

Received a score of B, as compared to the North American and global

average of C, indicating the Company has addressed the

environmental impacts of their business and ensures good

environmental management. |

|

S&P’s Global Corporate Sustainability Assessment (CSA) |

62 |

Scored 62 out of 100, achieving a top 15% ranking and included as a

member of S&P’s Global Sustainability Yearbook 2024 for

corporate sustainability excellence. |

|

Globe and Mail Governance Overall Survey Score |

84/100 |

Ranked 57 out of 219 companies in the S&P/TSX Composite Index

with an overall score of 84 out of 100. Survey assesses quality of

governance practices. |

(1) Carbon neutral refers to PrairieSky’s

Scope 1 and Scope 2 emissions which are net zero. (2)

PrairieSky’s ranking as of January 24, 2024.

FINANCIAL AND OPERATIONAL

INFORMATION

The following table summarizes select

operational and financial information of the Company for the

periods noted. All dollar amounts are stated in Canadian dollars

unless otherwise noted.

A full version of PrairieSky's management's

discussion and analysis ("MD&A") and annual

audited consolidated financial statements and notes thereto for the

fiscal period ended December 31, 2023 are available on SEDAR+ at

www.sedarplus.ca and PrairieSky’s website at

www.prairiesky.com.

|

|

Three months ended |

Year ended |

|

(millions, except per share or as otherwise noted) |

December 31 2023 |

September 302023 |

December 31 2022 |

December 31 2023 |

December 31 2022 |

|

FINANCIAL |

|

|

|

|

|

|

Revenues |

$ |

136.6 |

|

$ |

133.1 |

|

$ |

150.6 |

|

$ |

513.2 |

|

$ |

643.3 |

|

|

|

|

|

|

|

|

|

Funds from Operations |

|

111.1 |

|

|

93.8 |

|

|

119.5 |

|

|

382.5 |

|

|

507.6 |

|

|

Per Share - basic(1) |

|

0.46 |

|

|

0.39 |

|

|

0.50 |

|

|

1.60 |

|

|

2.13 |

|

|

Per Share - diluted(1) |

|

0.46 |

|

|

0.39 |

|

|

0.50 |

|

|

1.60 |

|

|

2.12 |

|

|

Net Earnings |

|

67.4 |

|

|

55.4 |

|

|

67.3 |

|

|

227.6 |

|

|

317.5 |

|

|

Per Share - basic and diluted(1) |

|

0.28 |

|

|

0.23 |

|

|

0.28 |

|

|

0.95 |

|

|

1.33 |

|

|

Dividends declared(2) |

|

57.3 |

|

|

57.3 |

|

|

57.3 |

|

|

229.2 |

|

|

143.3 |

|

|

Per Share |

|

0.24 |

|

|

0.24 |

|

|

0.24 |

|

|

0.96 |

|

|

0.60 |

|

|

Dividend payout ratio(3) |

|

52 |

% |

|

61 |

% |

|

48 |

% |

|

60 |

% |

|

28 |

% |

|

|

|

|

|

|

|

|

Acquisitions |

|

22.2 |

|

|

15.6 |

|

|

6.2 |

|

|

58.4 |

|

|

30.6 |

|

|

Net debt at period end(4) |

|

222.1 |

|

|

253.7 |

|

|

315.1 |

|

|

222.1 |

|

|

315.1 |

|

|

|

|

|

|

|

|

|

Shares Outstanding |

|

|

|

|

|

|

Shares outstanding at period end |

|

239.0 |

|

|

239.0 |

|

|

238.9 |

|

|

239.0 |

|

|

238.9 |

|

|

Weighted average - basic |

|

239.0 |

|

|

238.9 |

|

|

238.8 |

|

|

239.0 |

|

|

238.8 |

|

|

Weighted average - diluted |

|

239.0 |

|

|

238.9 |

|

|

239.2 |

|

|

239.0 |

|

|

239.1 |

|

|

|

|

|

|

|

|

|

OPERATIONALRoyalty Production

Volumes |

|

|

|

|

|

|

Crude Oil (bbls/d) |

|

12,844 |

|

|

12,084 |

|

|

12,166 |

|

|

12,438 |

|

|

11,739 |

|

|

NGL (bbls/d) |

|

2,697 |

|

|

2,702 |

|

|

2,681 |

|

|

2,502 |

|

|

2,684 |

|

|

Natural Gas (MMcf/d) |

|

60.4 |

|

|

64.1 |

|

|

66.4 |

|

|

59.5 |

|

|

64.7 |

|

|

Royalty Production (BOE/d)(5) |

|

25,608 |

|

|

25,469 |

|

|

25,914 |

|

|

24,857 |

|

|

25,206 |

|

|

|

|

|

|

|

|

|

Realized Pricing |

|

|

|

|

|

|

Crude Oil ($/bbl) |

|

83.27 |

|

|

92.53 |

|

|

88.36 |

|

|

82.52 |

|

|

102.88 |

|

|

NGL ($/bbl) |

|

46.07 |

|

|

52.01 |

|

|

54.56 |

|

|

47.60 |

|

|

59.73 |

|

|

Natural Gas ($/Mcf) |

|

2.19 |

|

|

1.97 |

|

|

5.30 |

|

|

2.60 |

|

|

4.93 |

|

|

Total ($/BOE)(5) |

|

51.78 |

|

|

54.37 |

|

|

60.74 |

|

|

52.31 |

|

|

66.92 |

|

|

|

|

|

|

|

|

|

Operating Netback per BOE(6) |

|

48.68 |

|

|

46.09 |

|

|

57.89 |

|

|

46.32 |

|

|

63.43 |

|

|

Funds from Operations per BOE |

|

47.16 |

|

|

40.03 |

|

|

50.12 |

|

|

42.16 |

|

|

55.17 |

|

|

|

|

|

|

|

|

|

Oil Price Benchmarks |

|

|

|

|

|

|

Western Texas Intermediate (WTI) (US$/bbl) |

|

78.32 |

|

|

82.32 |

|

|

82.64 |

|

|

77.62 |

|

|

94.23 |

|

|

Edmonton Light Sweet ($/bbl) |

|

99.72 |

|

|

107.87 |

|

|

110.04 |

|

|

100.46 |

|

|

120.07 |

|

|

Western Canadian Select (WCS) crude oildifferential to WTI

(US$/bbl) |

|

(21.89 |

) |

|

(12.89 |

) |

|

(25.66 |

) |

|

(18.65 |

) |

|

(18.22 |

) |

|

|

|

|

|

|

|

|

Natural Gas Price Benchmarks |

|

|

|

|

|

|

AECO monthly index ($/Mcf) |

|

2.66 |

|

|

2.39 |

|

|

5.58 |

|

|

2.93 |

|

|

5.56 |

|

|

AECO daily index ($/Mcf) |

|

2.30 |

|

|

2.60 |

|

|

5.11 |

|

|

2.64 |

|

|

5.31 |

|

|

|

|

|

|

|

|

|

Foreign Exchange Rate (US$/CAD$) |

|

0.7343 |

|

|

0.7466 |

|

|

0.7365 |

|

|

0.7410 |

|

|

0.7683 |

|

(1) Net Earnings and Funds from Operations per

Share are calculated using the weighted average number of basic and

diluted common shares outstanding.(2) A dividend of $0.24 per share

was declared on December 5, 2023. The dividend was paid on January

15, 2024 to shareholders of record as at December 29, 2023.(3)

Dividend payout ratio is defined in "Non-GAAP Measures and Ratios"

section in this press release.(4) See Note 15 "Capital Management"

in the annual audited consolidated financial statements for the

years ended December 31, 2023 and 2022 and the section "Capital

Management" contained in the Company’s MD&A for the years ended

December 31, 2023 and 2022.(5) See "Conversions of Natural Gas to

BOE" in this press release.(6) Operating Netback per BOE is defined

in "Non-GAAP Measures and Ratios" section of this press

release.

CONFERENCE CALL DETAILS

A conference call to discuss the results will be

held for the investment community on Tuesday, February 13, 2024,

beginning at 6:30 a.m. MDT (8:30 a.m. EDT). To participate in the

conference call, you are asked to register at the link provided

below. Details regarding the call will be provided to you upon

registration.

Live call participants registration

URL:

https://register.vevent.com/register/BIc8d6ed709556478090dacabbb21e8b02

FORWARD-LOOKING STATEMENTS

This press release includes certain statements

regarding PrairieSky's future plans and operations and contains

forward-looking statements that we believe allow readers to better

understand our business and prospects. The use of any of the words

"expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans",

"intends", "strategy" and similar expressions are intended to

identify forward-looking information or statements. Forward-looking

statements contained in this press release include estimates

regarding our expectations with respect to PrairieSky's business

and growth strategy; future growth from PrairieSky's existing

royalty asset portfolio, including but not limited to the

expectation that Duvernay leasing will result in long-term light

oil royalty production growth which will complement the growth in

heavy oil from PrairieSky's Clearwater and Mannville Stack oil

plays; expectation that PrairieSky's acquisitions will provide

strong returns on invested capital; expectation that PrairieSky's

business model is uniquely suited to provide sustainable returns to

shareholders through all commodity price cycles; the quality of

PrairieSky's existing royalty asset portfolio; the expectation that

oil royalty production volumes will maintain momentum into 2024 and

that 2024 will continue to be active and expected dividends.

With respect to forward-looking statements

contained in this press release, we have made several assumptions

including those described in detail in our MD&A and the Annual

Information Form for the year ended December 31, 2023. Readers and

investors are cautioned that the assumptions used in the

preparation of such forward-looking information and statements,

although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be

placed on forward-looking statements. Our actual results,

performance, or achievements could differ materially from those

expressed in, or implied by, these forward-looking statements. We

can give no assurance that any of the events anticipated will

transpire or occur, or if any of them do, what benefits we will

derive from them.

By their nature, forward-looking statements are

subject to numerous risks and uncertainties, some of which are

beyond our control, including the impact of general economic

conditions including inflation, industry conditions, volatility of

commodity prices, lack of pipeline capacity, currency fluctuations,

imprecision of reserve estimates, competitive factors impacting

royalty rates, environmental risks, the effects of inclement and

severe weather events and natural disasters, including fire,

drought and flooding, taxation, regulation, changes in tax or other

legislation, competition from other industry participants, the lack

of availability of qualified personnel or management, stock market

volatility, political and geopolitical instability and our ability

to access sufficient capital from internal and external sources. In

addition, PrairieSky is subject to numerous risks and uncertainties

in relation to acquisitions. These risks and uncertainties include

risks relating to the potential for disputes to arise with

counterparties and limited ability to recover indemnification under

certain agreements. The foregoing and other risks are described in

more detail in PrairieSky's MD&A, and the Annual Information

Form for the year ended December 31, 2023 under the headings "Risk

Management" and "Risk Factors", respectively, each of which is

available at www.sedarplus.ca and PrairieSky's website

at www.prairiesky.com.

Further, any forward-looking statement

is made only as of the date of this press release, and PrairieSky

undertakes no obligation to update or revise any forward-looking

statement or statements to reflect events or circumstances after

the date on which such statement is made or to reflect the

occurrence of unanticipated events, except as required by

applicable securities laws. New factors emerge from time to time,

and it is not possible for PrairieSky to predict all of these

factors or to assess in advance the impact of each such factor on

PrairieSky’s business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

The forward-looking statements contained in this document are

expressly qualified by this cautionary statement.

CONVERSIONS OF NATURAL GAS TO

BOE

To provide a single unit of production for

analytical purposes, natural gas production and reserves volumes

are converted mathematically to equivalent barrels of oil (BOE).

PrairieSky uses the industry-accepted standard conversion of six

thousand cubic feet of natural gas to one barrel of oil (6 Mcf = 1

bbl). The 6:1 BOE ratio is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead and is not based

on either energy content or current prices. While the BOE ratio is

useful for comparative measures and observing trends, it does not

accurately reflect individual product values and might be

misleading, particularly if used in isolation. As well, given that

the value ratio, based on the current price of crude oil to natural

gas, is significantly different from the 6:1 energy equivalency

ratio, using a 6:1 conversion ratio may be misleading as an

indication of value.

NON-GAAP MEASURES AND

RATIOS

Certain measures and ratios in this document do

not have any standardized meaning as prescribed by IFRS and,

therefore, are considered non-GAAP measures and ratios. These

measures and ratios may not be comparable to similar measures and

ratios presented by other issuers. These measures and ratios are

commonly used in the crude oil and natural gas industry and by

PrairieSky to provide potential investors with additional

information regarding the Company’s liquidity and its ability to

generate funds to conduct its business. Non-GAAP measures and

ratios include operating netback per BOE, operating margin, payout

ratio, cash administrative expenses and cash administrative

expenses per BOE. Non-GAAP measures should not be considered an

alternative to or more meaningful than the most directly comparable

financial measure of each such non-GAAP measure described below.

Management's use of these measures and ratios is discussed further

below. Further information can be found in the "Non-GAAP Measures

and Ratios" section of PrairieSky's MD&A.

"Operating Netback per BOE" represents the cash

margin for products sold on a BOE basis. Operating netback per BOE

is calculated by dividing the operating netback by the average

daily production volumes for the period. Operating netback per BOE

is used to assess the cash generating and operating performance per

unit of product sold and the comparability of the underlying

performance between years. Operating netback per BOE measures are

commonly used in the crude oil and natural gas industry to assess

performance comparability.

|

|

Three Months Ended |

Year Ended |

| ($

millions) |

December 312023 |

September 302023 |

December 312022 |

December 312023 |

December 312022 |

|

Cash from Operating Activities |

$ |

128.0 |

|

$ |

78.1 |

|

$ |

140.7 |

|

$ |

318.9 |

|

$ |

565.5 |

|

| Other Revenue |

|

(14.6 |

) |

|

(5.7 |

) |

|

(5.8 |

) |

|

(38.6 |

) |

|

(27.6 |

) |

| Non-cash Revenue |

|

- |

|

|

0.5 |

|

|

- |

|

|

0.5 |

|

|

0.2 |

|

| Amortization of Debt Issuance

Costs |

|

(0.1 |

) |

|

- |

|

|

(0.2 |

) |

|

(0.4 |

) |

|

(0.7 |

) |

| Finance Expense |

|

3.9 |

|

|

4.5 |

|

|

4.4 |

|

|

17.5 |

|

|

18.6 |

|

| Current Tax Expense |

|

14.4 |

|

|

14.9 |

|

|

20.2 |

|

|

58.8 |

|

|

85.6 |

|

| Interest on lease obligation |

|

- |

|

|

- |

|

|

(0.1 |

) |

|

- |

|

|

(0.1 |

) |

| Net Change in Non-cash Working

Capital |

|

(16.9 |

) |

|

15.7 |

|

|

(21.2 |

) |

|

63.6 |

|

|

(57.9 |

) |

|

Operating Netback |

$ |

114.7 |

|

$ |

108.0 |

|

$ |

138.0 |

|

$ |

420.3 |

|

$ |

583.6 |

|

"Operating Margin" represents operating netback

as a percentage of royalty production revenues. Management uses

this measure to demonstrate the comparability between the Company

and production and exploration companies in the crude oil and

natural gas industry as it shows net revenue generation from

operations.

|

|

Three Months Ended |

Year Ended |

| ($

millions) |

December 312023 |

September 302023 |

December 312022 |

December 312023 |

December 312022 |

|

Royalty Production Revenue |

$ |

122.0 |

|

$ |

127.4 |

|

$ |

144.8 |

|

$ |

474.6 |

|

$ |

615.7 |

|

| Operating Netback |

$ |

114.7 |

|

$ |

108.0 |

|

$ |

138.0 |

|

$ |

420.3 |

|

$ |

583.6 |

|

|

Operating Margin |

|

94 |

% |

|

85 |

% |

|

95 |

% |

|

89 |

% |

|

95 |

% |

"Payout Ratio" is calculated as dividends

declared as a percentage of funds from operations. Payout ratio is

used by dividend paying companies to assess dividend levels in

relation to the funds generated and used in operating

activities.

|

|

Three Months Ended |

Year Ended |

| ($

millions) |

December 312023 |

September 302023 |

December 312022 |

December 312023 |

December 312022 |

|

Funds from Operations |

$ |

111.1 |

|

$ |

93.8 |

|

$ |

119.5 |

|

$ |

382.5 |

|

$ |

507.6 |

|

| Dividends Declared |

$ |

57.3 |

|

$ |

57.3 |

|

$ |

57.3 |

|

$ |

229.2 |

|

$ |

143.3 |

|

|

Payout Ratio |

|

52 |

% |

|

61 |

% |

|

48 |

% |

|

60 |

% |

|

28 |

% |

"Cash Administrative Expenses" represent

administrative expenses excluding the volatility and fluctuations

in share-based compensation expense for RSUs, PSUs, ODSUs and DSUs

and stock options that were not settled in cash in the current

period. Cash administrative expenses are calculated as total

administrative expenses, adjusting for share-based compensation

expense in the period, plus any actual cash payments made under the

RSU, PSU, ODSU or DSU plans. Management believes cash

administrative expenses are a common benchmark used by investors

when comparing companies to evaluate operating

performance.

Cash Administrative Expenses

The following table presents the computation of

cash administrative expenses:

|

|

Three Months Ended |

Year Ended |

| ($

millions) |

December 312023 |

September 302023 |

December 312022 |

December 312023 |

December 312022 |

|

Total Administrative Expenses |

$ |

6.1 |

|

$ |

15.0 |

|

$ |

16.4 |

|

$ |

45.0 |

|

$ |

48.8 |

|

| Share-Based Compensation

Expense |

|

(0.5 |

) |

|

(8.6 |

) |

|

(11.3 |

) |

|

(20.9 |

) |

|

(28.3 |

) |

| Cash Payments Made - Share Unit

Plans |

|

- |

|

|

11.5 |

|

|

- |

|

|

23.8 |

|

|

5.0 |

|

|

Cash Administrative Expenses |

$ |

5.6 |

|

$ |

17.9 |

|

$ |

5.1 |

|

$ |

47.9 |

|

$ |

25.5 |

|

"Cash Administrative Expenses per BOE"

represents cash administrative expenses on a BOE basis and is

calculated by dividing cash administrative expenses by the average

daily production volumes for the period. Cash administrative

expenses per BOE assists management and investors in evaluating

operating performance on a comparable basis.

ABOUT PRAIRIESKY ROYALTY

LTD.

PrairieSky is a royalty company, generating

royalty production revenues as petroleum and natural gas are

produced from its properties. PrairieSky has a diverse portfolio of

properties that have a long history of generating funds from

operations and that represent the largest and most consolidated

independently-owned fee simple mineral title position in Canada.

PrairieSky's common shares trade on the Toronto Stock Exchange

under the symbol PSK.

FOR FURTHER INFORMATION PLEASE

CONTACT:

|

Andrew Phillips |

Pamela Kazeil |

|

President & Chief Executive Officer |

Vice-President, Finance & Chief Financial Officer |

|

PrairieSky Royalty Ltd. |

PrairieSky Royalty Ltd. |

|

(587) 293-4005 |

(587) 293-4089 |

|

|

|

|

Investor Relations |

|

|

(587) 293-4000 |

|

|

www.prairiesky.com |

|

PDF

available: http://ml.globenewswire.com/Resource/Download/60ef50a5-1b76-450d-849a-23c5d028dd40

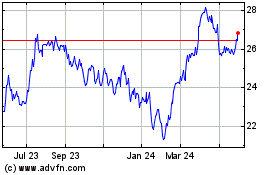

PrairieSky Royalty (TSX:PSK)

Historical Stock Chart

From Mar 2025 to Apr 2025

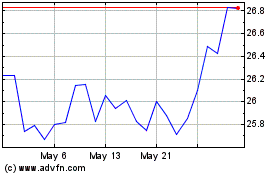

PrairieSky Royalty (TSX:PSK)

Historical Stock Chart

From Apr 2024 to Apr 2025