Source Energy Services Ltd.

(TSX: SHLE) (“Source”

or the “Company”) is pleased to announce its financial results for

the three months ended March 31, 2024.

Q1 2024 PERFORMANCE

HIGHLIGHTS

Key achievements for the quarter ended March 31,

2024 include the following:

- realized sand sales

volumes of 874,849 metric tonnes (“MT”) and sand revenue of $133.0

million, an increase of $1.2 million from the first quarter of

2023;

- generated total

revenue of $169.6 million, a $5.8 million increase from the same

period last year;

- realized gross

margin of $35.6 million and Adjusted Gross Margin(1) of $43.2

million, increases of 12% and 14%, respectively, when compared to

the first quarter of 2023;

- reported net income

of $1.9 million;

- realized Adjusted

EBITDA(1) of $32.0 million, a $4.4 million improvement from the

same period of 2023;

- repurchased $6.8

million aggregate principal value of senior secured notes during

the quarter;

- completed the

acquisition of a fleet of sand trucking assets, further

strengthening Source’s well site solutions platform;

- achieved record

sand throughput across the Sahara fleet, driving utilization of 98%

across the nine-unit Sahara fleet, compared to 89% utilization for

the first quarter of 2023; and

- began the expansion

of the Chetwynd terminal facility to a full unit train facility, in

support of growing activity in northeastern British Columbia.

Note:(1)

Adjusted Gross Margin (including on a per MT basis) and Adjusted

EBITDA are not defined under IFRS and might not be comparable to

similar financial measures disclosed by other issuers, refer to

‘Non-IFRS Measures’ below for reconciliations to measures

recognized by IFRS. For additional information, please refer to

Source’s Management’s Discussion and Analysis (“MD&A”), dated

May 9, 2024, available online at www.sedarplus.ca.

RESULTS OVERVIEW

| |

Three months ended March 31, |

|

($000’s, except MT and per unit amounts) |

2024 |

|

|

2023 |

|

|

Sand volumes (MT)(1) |

874,849 |

|

|

907,483 |

|

| |

|

|

|

| Sand revenue |

132,994 |

|

|

131,755 |

|

| Well site solutions |

35,720 |

|

|

30,627 |

|

|

Terminal services |

854 |

|

|

1,342 |

|

|

Sales |

169,568 |

|

|

163,724 |

|

| Cost of sales |

126,382 |

|

|

125,927 |

|

| Cost of

sales – depreciation |

7,549 |

|

|

6,045 |

|

|

Cost of sales |

133,931 |

|

|

131,972 |

|

|

Gross margin |

35,637 |

|

|

31,752 |

|

|

Operating expense |

6,042 |

|

|

5,884 |

|

| General & administrative

expense |

5,350 |

|

|

4,229 |

|

|

Depreciation |

4,210 |

|

|

3,091 |

|

|

Income from operations |

20,035 |

|

|

18,548 |

|

|

Total other expense (income) |

16,384 |

|

|

10,669 |

|

|

Income before income taxes |

3,651 |

|

|

7,879 |

|

| Current tax expense |

1,909 |

|

|

— |

|

|

Deferred tax recovery |

(151 |

) |

|

— |

|

|

Net income (loss)(2) |

1,893 |

|

|

7,879 |

|

|

Net earnings (loss) per share ($/share) |

0.14 |

|

|

0.58 |

|

|

Diluted net earnings (loss) per share ($/share) |

0.14 |

|

|

0.58 |

|

|

Adjusted EBITDA(3) |

32,021 |

|

|

27,618 |

|

|

Sand revenue sales/MT |

152.02 |

|

|

145.19 |

|

|

Gross margin/MT |

40.74 |

|

|

34.99 |

|

|

Adjusted Gross Margin(3) |

43,186 |

|

|

37,797 |

|

|

Adjusted Gross Margin/MT(3) |

49.36 |

|

|

41.65 |

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

| Total assets |

520,600 |

|

|

482,830 |

|

|

Current portion of long-term debt and non-current financial

liabilities |

245,345 |

|

|

213,715 |

|

Notes:(1) One

MT is approximately equal to 1.102 short tons. (2) The average

Canadian to United States (“US”) dollar exchange rate for the three

months ended March 31, 2024, was $0.7414 (2023 - $0.7394).(3)

Adjusted EBITDA and Adjusted Gross Margin (including on a per MT

basis) are not defined under IFRS, refer to ‘Non-IFRS Measures’

below for reconciliations to measures recognized by IFRS. For

additional information, please refer to Source’s MD&A available

online at www.sedarplus.ca.

FIRST QUARTER 2024 RESULTS

Source recorded a $5.8 million increase in total

revenue for the three months ended March 31, 2024, compared to the

first quarter last year. Total sand sales volumes was impacted by

an extreme cold weather snap realized in the Western Canadian

Sedimentary Basin (“WCSB”) in mid-January, resulting in a 4%

reduction in sand sales volumes compared to the first quarter of

2023. Notwithstanding the slower start to the quarter, margin

performance remained strong. Customer activity levels led to record

volumes for “last mile” logistics volumes during the period, and

the Sahara fleet set a new Source record for the highest quarterly

throughput to date.

Cost of sales, excluding depreciation, was

$126.4 million compared to $125.9 million for the first quarter of

2023. The quarter-over-quarter increase of $0.5 million is

primarily attributed to higher transportation costs, resulting from

the record volumes hauled by “last mile” logistics. This increase

was partly offset by a $1.23 per MT reduction in northern white

sand cost, reflecting lower transportation fuel surcharges, and a

shift in terminal mix, despite a weakened Canadian dollar relative

to the same period last year.

For the three months ended March 31, 2024, gross

margin increased by $3.9 million, or 12% compared to the same

period in 2023. Excluding gross margin from mine gate volumes,

Adjusted Gross Margin was $50.93 per MT compared to $44.81 per MT

for the first quarter of last year. Adjusted Gross Margin benefited

from continued strength in sand pricing, increased sand volumes

trucked and cost savings generated by the new trucking assets

acquired during the quarter, compared to the first quarter of 2023.

The weakening of the Canadian dollar relative to the first quarter

of 2023, which negatively impacted cost of sales for US dollar

denominated expenses, was fully offset by an increase in revenue

denominated in US dollars for the quarter.

Operating expenses increased by $0.2 million for

the first quarter of 2024, compared to the same period last year.

Higher people costs, reflecting increased compensation costs

attributed to increased activity levels, and higher selling costs

related to higher royalty costs were offset by a reduction in

repairs and maintenance expenses compared to the first quarter of

2023. General and administrative expense increased by $1.1 million

for the first quarter of the year, largely the result of higher

salaries and variable incentive compensation expense, and increased

professional fees compared to the same period last year.

Adjusted EBITDA increased by 16%, or $4.4

million, to $32.0 million for the three months ended March 31,

2024, attributed to strong sand sales volumes and prices, record

well site solutions performance and incremental benefit from the

acquisition completed in the period, as outlined below. The

weakening of the Canadian dollar unfavorably impacted Adjusted

EBITDA by $0.2 million for the first quarter, attributed to the

movement in exchange rates on the settlement of working

capital.

Acquisition of Sand Trucking

Assets

On March 13, 2024, Source completed the

acquisition of the sand trucking assets of RWR Trucking Inc. (the

“Acquisition”), for an aggregate purchase price of $8.1 million,

comprised of cash, a promissory note and the assumption of lease

obligations related to certain of the sand trucking assets

purchased. The asset acquisition enables Source to enhance its

logistics service offerings and strengthen its mine to well site

offering in the WCSB.

Liquidity and Capital Resources

| Free Cash

Flow |

Three months ended March 31, |

|

($000’s) |

2024 |

|

|

2023 |

|

|

Adjusted EBITDA(1) |

32,021 |

|

|

27,618 |

|

| Financing expense paid |

(6,812 |

) |

|

(7,539 |

) |

| Capital expenditures, net of

proceeds on disposal of property, plant and equipment and

reimbursement of capital costs |

(4,595 |

) |

|

(2,146 |

) |

| Payment

of lease obligations |

(5,119 |

) |

|

(5,047 |

) |

|

Free Cash Flow(1) |

15,495 |

|

|

12,886 |

|

Note:(1)

Adjusted EBITDA and Free Cash Flow are not defined under IFRS and

might not be comparable to similar financial measures disclosed by

other issuers, refer to ‘Non-IFRS Measures’ below. The

reconciliation to the comparable IFRS measure can be found in the

table below.

Source realized an increase in Free Cash Flow of

$2.6 million for the first three months of 2024, compared to the

first quarter of 2023. The improvement is due to the increase in

Adjusted EBITDA and lower financing expense paid, including a $0.4

million reduction in interest for the ABL facility due to lower

draws outstanding. Higher payments for lease obligations,

attributed to additional equipment and leases for the newly

acquired trucking operations, as well as an increase in net

expenditures for capital assets, as outlined below, partially

offset the increase in Free Cash Flow for the first quarter.

For the first quarter of 2024 total capital

expenditures, net of proceeds on disposals and reimbursements, were

$4.6 million, an increase of $2.4 million compared to the first

quarter last year. The increase was largely attributed to the

acquisition of the sand trucking assets, as discussed above, and an

increase in costs associated with overburden removal for mining

operations. Costs to rebuild the piece of equipment which

malfunctioned last year, as well as construction costs associated

with building Source’s tenth and eleventh Sahara units, continued

through the first quarter; however, all of these expenditures were

recovered during the quarter. During the three months ended March

31, 2024, Source commenced a rail expansion project at the Chetwynd

terminal facility. The expansion project will enable the terminal

to be unit-train capable and is expected to be completed by the end

of the second quarter.

ESG

Source’s annual ESG report was released with

first quarter results and details the Company’s 2023 ESG

performance. For more information, refer to Source’s ESG report

which is available at www.sourceenergyservices.com.

BUSINESS OUTLOOK

WCSB activity levels are expected to remain

strong through the balance of the year, with modest growth in

completion activities throughout the Montney, but particularly in

northeastern British Columbia as preparation for LNG Canada coming

online continues. The rail expansion project at Source’s Chetwynd

terminal facility, which commenced during the first quarter, will

support increased demand by Source’s exploration and production

(“E&P”) customers in this area.

Increased demand for mine to well site services

in the Attachie area, combined with the Chetwynd rail expansion and

the recent acquisition of sand trucking assets, in combination with

its existing terminal network footprint, will create additional

opportunities for Source to continue to grow its business through

the balance of the year.

In the longer-term, Source believes the

increased demand for natural gas, driven by power generation

facilities, increased natural gas pipeline export capabilities and

liquefied natural gas exports will drive incremental demand for

Source’s services in the WCSB. Source continues to see increased

demand from customers that are primarily focused on the development

of natural gas properties in the Montney, Duvernay and Deep Basin.

This trend is consistent with Source’s view that natural gas will

be an important transitional fuel that is critical for the

successful movement to a less carbon-intensive world.

Source continues to focus on increasing its

involvement in the provision of logistics services for other items

needed at the well site in response to customer requests to expand

its service offerings and to further utilize its existing Western

Canadian terminals to provide additional services.

FIRST QUARTER CONFERENCE CALL

A conference call to discuss Source’s first

quarter financial results has been scheduled for 7:30 am MST (9:30

am ET) on Friday, May 10, 2024.

Interested analysts, investors and media

representatives are invited to register to participate in the call.

Once you are registered, a dial-in number and passcode will be

provided to you via email. The link to register for the call is on

the Upcoming Events page of our website and as

follows:

Source Energy Services Q1 2024 Results

Call

The call will be recorded and available for

playback approximately 2 hours after the meeting end time, until

June 10, 2024, using the following dial-in:

Toll-Free Playback Number: 1-855-669-9656

Playback Passcode: 0814

ABOUT SOURCE ENERGY

SERVICES

Source is a company that focuses on the

integrated production and distribution of frac sand, as well as the

distribution of other bulk completion materials not produced by

Source. Source provides its customers with an end-to-end solution

for frac sand supported by its Wisconsin and Peace River mines and

processing facilities, its Western Canadian terminal network and

its “last mile” logistics capabilities, including its trucking

operations, and Sahara, a proprietary well site mobile sand storage

and handling system.

Source’s full-service approach allows customers

to rely on its logistics platform to increase reliability of supply

and to ensure the timely delivery of frac sand and other bulk

completion materials at the well site.

IMPORTANT INFORMATION

These results should be read in conjunction with

Source’s unaudited interim condensed consolidated financial

statements for the three months ended March 31, 2024 and 2023 and

the audited consolidated financial statements for the years ended

December 31, 2023 and 2022, together with the accompanying notes

(the “Financial Statements”) and its corresponding MD&A for

such periods. The Financial Statements and MD&A and other

information relating to Source, including the Annual Information

Form, are available under the Company’s SEDAR+ profile at

www.sedarplus.ca. The Financial Statements and comparative

statements have been prepared in accordance with International

Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board. Unless otherwise stated,

all amounts are expressed in Canadian dollars.

NON-IFRS MEASURES

In this press release Source has used the terms

Free Cash Flow, Adjusted Gross Margin and Adjusted EBITDA,

including per MT, which do not have standardized meanings

prescribed by IFRS and Source’s method of calculating these

measures may differ from the method used by other entities and,

accordingly, they may not be comparable to similar measures

presented by other companies. These financial measures should not

be considered as an alternative to, or more meaningful than, net

income (loss) and gross margin, respectively, which represent the

most directly comparable measures of financial performance as

determined in accordance with IFRS.

Reconciliation of Adjusted EBITDA and

Free Cash Flow to Net Income (Loss)

| |

Three months ended March 31, |

|

($000’s) |

2024 |

|

|

2023 |

|

|

Net income |

1,893 |

|

|

7,879 |

|

| Add: |

|

|

| Income taxes |

1,758 |

|

|

— |

|

| Interest expense |

6,283 |

|

|

7,129 |

|

| Cost of sales –

depreciation |

7,549 |

|

|

6,045 |

|

| Depreciation |

4,210 |

|

|

3,091 |

|

| Loss on debt

extinguishment |

115 |

|

|

— |

|

| Finance expense (excluding

interest expense) |

2,433 |

|

|

2,159 |

|

| Share-based compensation

expense |

9,341 |

|

|

1,537 |

|

| Gain on asset disposal |

(1,931 |

) |

|

(451 |

) |

| Loss on sublease |

— |

|

|

3 |

|

| Other

expense(1) |

370 |

|

|

226 |

|

|

Adjusted EBITDA |

32,021 |

|

|

27,618 |

|

|

Financing expense paid |

(6,812 |

) |

|

(7,539 |

) |

| Capital expenditures, net of

proceeds on disposal of property, plant and equipment and

reimbursement of capital costs |

(4,595 |

) |

|

(2,146 |

) |

| Payment

of lease obligations |

(5,119 |

) |

|

(5,047 |

) |

|

Free Cash Flow |

15,495 |

|

|

12,886 |

|

Note:

(1) Includes expenses related to the incident at

the Fox Creek terminal facility, costs and reimbursements under

insurance claims and other one-time expenses.

Reconciliation of Gross Margin to Adjusted Gross

Margin

| |

Three months ended March 31, |

|

($000’s) |

2024 |

|

|

2023 |

|

|

Gross margin |

35,637 |

|

|

31,752 |

|

| Cost of

sales – depreciation |

7,549 |

|

|

6,045 |

|

|

Adjusted Gross Margin |

43,186 |

|

|

37,797 |

|

For additional information regarding non-IFRS

measures, including their use to management and investors, their

composition and discussion of changes to either their composition

or label, if any, please refer to the ‘Non-IFRS Measures’ section

of the MD&A, which is incorporated herein by reference.

Source’s MD&A is available online at www.sedarplus.ca and

through Source’s website at www.sourceenergyservices.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release constitute forward-looking statements relating to, without

limitation, expectations, intentions, plans and beliefs, including

information as to the future events, results of operations and

Source’s future performance (both operational and financial) and

business prospects. In certain cases, forward-looking statements

can be identified by the use of words such as “expects”,

“believes”, “continues”, “focus”, “trend”, or variations of such

words and phrases, or state that certain actions, events or results

“may” or “will” be taken, occur or be achieved. Such

forward-looking statements reflect Source’s beliefs, estimates and

opinions regarding its future growth, results of operations, future

performance (both operational and financial), and business

prospects and opportunities at the time such statements are made,

and Source undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions or

circumstances should change unless required by applicable law.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions made by Source that are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Forward-looking

statements are not guarantees of future performance. In particular,

this press release contains forward-looking statements pertaining,

but not limited to: expectations that WCSB activity levels will

remain strong through the balance of the year, particularly in

northeastern British Columbia with the expectation that LNG Canada

will come online; expectations that the Chetwynd terminal facility

rail expansion project will enable its terminal to be unit-train

capable, be completed by the end of the second quarter and support

increased demand by Source’s E&P customers; management’s

continued assessment respecting Source’s equipment and other assets

required to service Source’s operations; additional growth

opportunities in 2024 in connection with mine to wellsite services

in the Attachie area; improvement of Source’s production

efficiencies; strong operational performance for 2024 through the

strengthening of Source’s leading service offerings and logistic

capabilities; expectations that increased demand for natural gas,

increased natural gas pipeline export capabilities and liquefied

natural gas exports will drive incremental demand for Source’s

services in the WCSB; continued increase in demand from customers

primarily focused on the development of natural gas properties in

Montney, Duvernay and Deep Basin; views that natural gas is an

important transitional fuel for the successful movement to a less

carbon-intensive world; Source’s focus on and expectations

regarding increasing its involvement in the provision of logistics

services for other wellsite items; expectations respecting future

conditions; and profitability.

By their nature, forward-looking statements

involve numerous current assumptions, known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of Source to differ materially from

those anticipated by Source and described in the forward-looking

statements.

With respect to the forward-looking statements

contained in this press release assumptions have been made

regarding, among other things: proppant market prices; future oil,

natural gas and liquefied natural gas prices; future global

economic and financial conditions; future commodity prices, demand

for oil and gas and the product mix of such demand; levels of

activity in the oil and gas industry in the areas in which Source

operates; the continued availability of timely and safe

transportation for Source’s products, including without limitation,

Source’s rail car fleet and the accessibility of additional

transportation by rail and truck; the maintenance of Source’s key

customers and the financial strength of its key customers; the

maintenance of Source’s significant contracts or their replacement

with new contracts on substantially similar terms and that

contractual counterparties will comply with current contractual

terms; operating costs; that the regulatory environment in which

Source operates will be maintained in the manner currently

anticipated by Source; future exchange and interest rates;

geological and engineering estimates in respect of Source’s

resources; the recoverability of Source’s resources; the accuracy

and veracity of information and projections sourced from third

parties respecting, among other things, future industry conditions

and product demand; demand for horizontal drilling and hydraulic

fracturing and the maintenance of current techniques and

procedures, particularly with respect to the use of proppants;

Source’s ability to obtain qualified staff and equipment in a

timely and cost-efficient manner; the regulatory framework

governing royalties, taxes and environmental matters in the

jurisdictions in which Source conducts its business and any other

jurisdictions in which Source may conduct its business in the

future; future capital expenditures to be made by Source; future

sources of funding for Source’s capital program; Source’s future

debt levels; the impact of competition on Source; and Source’s

ability to obtain financing on acceptable terms.

A number of factors, risks and uncertainties

could cause results to differ materially from those anticipated and

described herein including, among others: the effects of

competition and pricing pressures; risks inherent in key customer

dependence; effects of fluctuations in the price of proppants;

risks related to indebtedness and liquidity, including Source’s

leverage, restrictive covenants in Source’s debt instruments and

Source’s capital requirements; risks related to interest rate

fluctuations and foreign exchange rate fluctuations; changes in

general economic, financial, market and business conditions in the

markets in which Source operates; changes in the technologies used

to drill for and produce oil and natural gas; Source’s ability to

obtain, maintain and renew required permits, licenses and approvals

from regulatory authorities; the stringent requirements of and

potential changes to applicable legislation, regulations and

standards; the ability of Source to comply with unexpected costs of

government regulations; liabilities resulting from Source’s

operations; the results of litigation or regulatory proceedings

that may be brought by or against Source; the ability of Source to

successfully bid on new contracts and the loss of significant

contracts; uninsured and underinsured losses; risks related to the

transportation of Source’s products, including potential rail line

interruptions or a reduction in rail car availability; the

geographic and customer concentration of Source; the impact of

extreme weather patterns and natural disasters; the impact of

climate change risk; the ability of Source to retain and attract

qualified management and staff in the markets in which Source

operates; labour disputes and work stoppages and risks related to

employee health and safety; general risks associated with the oil

and natural gas industry, loss of markets, consumer and business

spending and borrowing trends; limited, unfavorable, or a lack of

access to capital markets; uncertainties inherent in estimating

quantities of mineral resources; sand processing problems;

implementation of recently issued accounting standards; the use and

suitability of Source’s accounting estimates and judgments; the

impact of information systems and cyber security breaches; the

impact of inflation on capital expenditures; and risks and

uncertainties related to pandemics such as COVID-19, including

changes in energy demand.

Although Source has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in the

forward-looking statements, there may be other factors that cause

actions, events or results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will materialize or prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. The forward-looking statements contained in this

press release are expressly qualified by this cautionary statement.

Readers should not place undue reliance on forward-looking

statements. These statements speak only as of the date of this

press release. Except as may be required by law, Source expressly

disclaims any intention or obligation to revise or update any

forward-looking statements or information whether as a result of

new information, future events or otherwise.

Any financial outlook and future-oriented

financial information contained in this press release regarding

prospective financial performance, financial position or cash flows

is based on assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information contains forward-looking

information and is based on a number of material assumptions and

factors, as are set out above. These projections may also be

considered to contain future oriented financial information or a

financial outlook. The actual results of Source’s operations for

any period will likely vary from the amounts set forth in these

projections and such variations may be material. Actual results

will vary from projected results. Readers are cautioned that any

such financial outlook and future-oriented financial information

contained herein should not be used for purposes other than those

for which it is disclosed herein. The forward-looking information

and statements contained in this document speak only as of the date

hereof and have been approved by the Company’s management as at the

date hereof. The Company does not assume any obligation to publicly

update or revise them to reflect new events or circumstances,

except as may be required pursuant to applicable laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Scott MelbournChief Executive Officer(403) 262-1312

investorrelations@sourceenergyservices.com

Derren NewellChief Financial Officer(403) 262-1312

investorrelations@sourceenergyservices.com

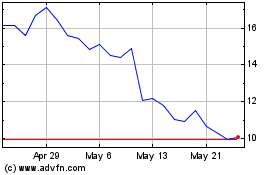

Source Energy Services (TSX:SHLE)

Historical Stock Chart

From Jan 2025 to Mar 2025

Source Energy Services (TSX:SHLE)

Historical Stock Chart

From Feb 2024 to Mar 2025