Trisura Group Ltd. (“Trisura” or “Trisura Group”) (TSX: TSU), a

leading specialty insurance provider, today announced financial

results for the fourth quarter and year ended December 31, 2023.

David Clare, President and CEO of Trisura,

stated, “Trisura ended the year with strong operational

performance. Operating net income of $25.9 million in the quarter,

or $0.54 per share, was achieved through measured growth,

profitable underwriting and enhanced investment income – supporting

annual operating net income of over $110 million. Quarterly Net

income of $11.3 million, or $0.23 per share, was impacted by the

run-off of a US program, partially offset by unrealized gains in

the investment portfolio.

Maturation of our business and continued

expansion with distribution partners drove insurance revenue growth

of 26.7% in the quarter and 38.4% for the full year. In Canada, Q4

combined ratio of 85.8% was strong and contributed to an 81.1% full

year combined ratio. Our US fronting platform has substantially

navigated the run-off associated with the Q4 2022 write down. We

have further rationalized our US program portfolio, which impacted

fourth quarter results, though sets a firm foundation for

profitability ahead.

Net investment income grew 71.0% in the quarter,

reaching $16.2 million through higher yields and an increased size

of the investment portfolio.

Growth, strong earnings, and gains on the

investment portfolio lifted book value to over $619 million. Our

business remains well-capitalized, supported by surplus capital, a

$50 million revolving credit facility, a 10.8% debt-to-capital

ratio and a conservatively positioned investment portfolio.”

Financial Highlights

- Insurance

revenue growth of 26.7% in Q4 2023 reflected sustained momentum

across North America.

- Net income of

$11.3 million in the quarter was higher than Q4 2022 as a result of

a write down on reinsurance recoverables in Q4 2022. Operating net

income(1) of $25.9 million in the quarter grew 10.0% compared to Q4

2022, driven by growth in core operations(2), strong underwriting

performance in Canada and increased investment income.

- EPS of $0.23 in

Q4 2023 compared to ($0.87) in Q4 2022. Operating EPS(3) of $0.54

for the quarter compared to $0.50 in the prior year.

- Book value per

share(4) of $13.02 increased 21.0% from December 31, 2022,

primarily the result of earnings in the Canadian operations, higher

investment income and the equity raise in Q3 2023.

- ROE(4) of 12.2%

compared to 6.5% in Q4 2022, re-approaching our mid-teens target

despite the costs of run-off this year. Operating ROE(5) of 20.0%

demonstrates the strength and potential of the platform.

|

Amounts in C$ millions |

Q4 2023 |

Q4 2022 |

Variance |

2023 |

|

2022 |

|

Variance |

|

Insurance revenue |

755.0 |

|

595.7 |

|

26.7% |

2,789.2 |

|

2,014.9 |

|

38.4% |

|

Net income |

11.3 |

|

(40.7 |

) |

(127.8%) |

66.9 |

|

27.8 |

|

140.8% |

|

Operating net income(1) |

25.9 |

|

23.5 |

|

10.0% |

110.2 |

|

83.3 |

|

32.4% |

|

EPS – diluted, $ |

0.23 |

|

(0.87 |

) |

(126.4%) |

1.42 |

|

0.63 |

|

125.4% |

|

Operating EPS – diluted, $(3) |

0.54 |

|

0.50 |

|

8.0% |

2.34 |

|

1.88 |

|

24.5% |

|

Book value per share, $(4) |

13.02 |

|

10.76 |

|

21.0% |

13.02 |

|

10.76 |

|

21.0% |

|

Debt-to-Capital ratio(4)(11) |

10.8 |

% |

13.2 |

% |

(2.4pts) |

10.8 |

% |

13.2 |

% |

(2.4pts) |

|

ROE(4) |

12.2 |

% |

6.5 |

% |

5.7pts |

12.2 |

% |

6.5 |

% |

5.7pts |

|

Operating ROE(5) |

20.0 |

% |

19.6 |

% |

0.4pts |

20.0 |

% |

19.6 |

% |

0.4pts |

|

Combined ratio – Canada |

85.8 |

% |

83.4 |

% |

2.4pts |

81.1 |

% |

80.7 |

% |

0.4pts |

|

Fronting operational ratio – US(4) |

143.0 |

% |

242.8 |

% |

(99.8pts) |

109.6 |

% |

128.3 |

% |

(18.7pts) |

|

Fronting operational ratio excluding certain non-recurring items –

US(6) |

106.0 |

% |

83.2 |

% |

22.8pts |

90.3 |

% |

80.5 |

% |

9.8pts |

Insurance Operations

- Insurance

revenue in Canada of $227.4 million in the quarter increased by

31.9% compared to Q4 2022, reflecting increased market share,

expansion of distribution relationships, expanding fronting and

growth of US Surety. Strong underwriting contributed to a Combined

ratio of 85.8%, a ROE of 29.1% and Operating ROE of 29.2% in Q4

2023.

- Insurance

revenue in the US of $527.5 million in the quarter increased by

24.6%, compared to Q4 2022, reflecting favourable market conditions

and maturation of existing programs. Fee income(7) of $22.2 million

in the quarter increased by 14.5% compared to Q4 2022. Net loss of

$8.9 million was the result of costs related to the run-off.

Operating net income of $5.8 million supported a 13.6% Operating

ROE.

Capital

- The Minimum

Capital Test ratio(8) of our regulated Canadian subsidiary was 251%

as at December 31, 2023 (233% as at December 31, 2022), which

comfortably exceeded regulatory requirements(9) of 150%.

- As at December

31, 2023, the Risk-Based Capital of the regulated insurance

companies of Trisura US are expected to be in excess of the various

company action levels of the states in which they are

licensed.

- Consolidated

debt-to-capital ratio of 10.8% as at December 31, 2023 is below our

long-term target of 20.0%.

Investments

- Net investment

income rose 71.0% in the quarter compared to Q4 2022. The portfolio

benefited from higher risk-adjusted yields, increased capital

generated from strong operational performance and recent equity

raises.

Corporate Development

- On February 7,

2024, Trisura received regulatory approval for its previously

announced acquisition of a Treasury-listed US surety company.

Earnings Conference Call

Trisura will host its Fourth Quarter Earnings

Conference Call to review financial results at 9:00a.m. ET on

Friday, February 9th, 2024.

To listen to the call via live audio webcast,

please follow the link below:

https://edge.media-server.com/mmc/p/z27khy8h

A replay of the call will be available through the link

above.

About Trisura Group

Trisura Group Ltd. is a specialty insurance

provider operating in the Surety, Risk Solutions, Corporate

Insurance, and Fronting business lines of the market. Trisura has

investments in wholly owned subsidiaries through which it conducts

insurance and reinsurance operations. Those operations are

primarily in Canada (“Trisura Canada”) and the United States

(“Trisura US”). Trisura Group Ltd. is listed on the Toronto Stock

Exchange under the symbol “TSU”.

Further information is available at

http://www.trisura.com. Important information may be disseminated

exclusively via the website; investors should consult the site to

access this information. Details regarding the operations of

Trisura Group Ltd. Are also set forth in regulatory filings. A copy

of the filings may be obtained on Trisura Group’s SEDAR+ profile at

www.sedarplus.ca.

For more information, please contact:

Name: Bryan SinclairTel: 416 607 2135Email:

bryan.sinclair@trisura.com

Trisura Group

Ltd.Consolidated Statements of Financial

PositionAs at December 31, 2023 and December 31,

2022(in thousands of Canadian dollars, except as

otherwise noted)

|

As at |

December 31, 2023 |

December 31, 2022 |

|

Cash and cash equivalents |

604,016 |

406,368 |

|

Investments |

890,157 |

765,375 |

|

Other assets |

53,712 |

61,852 |

|

Reinsurance contract assets |

2,003,589 |

1,527,799 |

|

Capital assets and intangible assets |

16,657 |

19,529 |

|

Deferred tax assets |

16,314 |

17,942 |

|

Total assets |

3,584,445 |

2,798,865 |

|

Insurance contract liabilities |

2,769,951 |

2,165,103 |

|

Other liabilities |

120,065 |

65,111 |

|

Loan payable |

75,000 |

75,000 |

|

Total liabilities |

2,965,016 |

2,305,214 |

|

Shareholders' equity |

619,429 |

493,651 |

|

Total liabilities and shareholders' equity |

3,584,445 |

2,798,865 |

| |

Trisura Group

Ltd.Consolidated Statements of Comprehensive

IncomeFor the three and twelve months ended

December 31(in thousands of Canadian dollars,

except as otherwise noted)

|

|

Q4 2023 |

Q4 2022 |

2023 |

2022 |

|

Insurance revenue |

754,953 |

|

595,742 |

|

2,789,187 |

|

2,014,915 |

|

|

Insurance service expenses |

(615,167 |

) |

(474,120 |

) |

(2,245,246 |

) |

(1,742,601 |

) |

|

Net expense from reinsurance contracts assets |

(135,627 |

) |

(175,384 |

) |

(458,606 |

) |

(243,128 |

) |

|

Insurance service result |

4,159 |

|

(53,762 |

) |

85,335 |

|

29,186 |

|

|

Net investment income |

16,206 |

|

9,479 |

|

51,669 |

|

25,162 |

|

|

Net gains (losses) |

8,132 |

|

4,112 |

|

(9,658 |

) |

8,802 |

|

|

Net credit impairment reversals |

926 |

|

- |

|

895 |

|

- |

|

|

Total investment income |

25,264 |

|

13,591 |

|

42,906 |

|

33,964 |

|

|

Finance (expenses) income from insurance contracts |

(27,716 |

) |

(7,400 |

) |

(75,875 |

) |

4,582 |

|

|

Finance income (expenses) from reinsurance contracts |

23,511 |

|

7,000 |

|

65,759 |

|

(2,765 |

) |

|

Net insurance finance (expenses) income |

(4,205 |

) |

(400 |

) |

(10,116 |

) |

1,817 |

|

|

Net financial result |

21,059 |

|

13,191 |

|

32,790 |

|

35,781 |

|

|

Net insurance and financial result |

25,218 |

|

(40,571 |

) |

118,125 |

|

64,967 |

|

|

Other income |

727 |

|

733 |

|

7,654 |

|

6,593 |

|

|

Other operating expenses |

(10,346 |

) |

(9,742 |

) |

(32,947 |

) |

(29,171 |

) |

|

Other finance costs |

(565 |

) |

(588 |

) |

(2,409 |

) |

(2,644 |

) |

|

Income (loss) before income taxes |

15,034 |

|

(50,168 |

) |

90,423 |

|

39,745 |

|

|

Income tax expense |

(3,714 |

) |

9,458 |

|

(23,482 |

) |

(11,950 |

) |

|

Net income (loss) |

11,320 |

|

(40,710 |

) |

66,941 |

|

27,795 |

|

|

Operating net income |

25,875 |

|

23,519 |

|

110,201 |

|

83,250 |

|

|

Other comprehensive income (loss) |

8,452 |

|

(3,953 |

) |

6,328 |

|

(47,707 |

) |

|

Comprehensive income (loss) |

19,772 |

|

(44,663 |

) |

73,269 |

|

(19,912 |

) |

| |

Trisura Group

Ltd.Consolidated Statements of Cash

FlowsFor the three and twelve months ended

December 31(in thousands of Canadian dollars,

except as otherwise noted)

|

|

Q4 2023 |

Q4 2022 |

2023 |

2022 |

|

Net income |

11,320 |

|

(40,710 |

) |

66,941 |

|

27,795 |

|

|

Non-cash items |

(11,727 |

) |

1,640 |

|

5,264 |

|

2,872 |

|

|

Write down on reinsurance recoverables |

- |

|

81,473 |

|

- |

|

81,473 |

|

|

Change in working capital |

100,302 |

|

13,050 |

|

194,038 |

|

82,619 |

|

|

Realized losses (gains) |

1,769 |

|

(3,087 |

) |

3,950 |

|

(10,066 |

) |

|

Income taxes paid |

(1,736 |

) |

(2,272 |

) |

(9,841 |

) |

(31,101 |

) |

|

Interest paid |

(1,115 |

) |

(1,056 |

) |

(2,439 |

) |

(2,662 |

) |

|

Net cash from operating activities |

98,813 |

|

49,038 |

|

257,913 |

|

150,930 |

|

|

Proceeds on disposal of investments |

12,894 |

|

24,085 |

|

102,492 |

|

144,168 |

|

|

Purchases of investments |

(41,001 |

) |

(50,712 |

) |

(219,121 |

) |

(384,030 |

) |

|

Net purchases of capital and intangible assets |

32 |

|

(397 |

) |

(714 |

) |

(2,131 |

) |

|

Net cash used in investing activities |

(28,075 |

) |

(27,024 |

) |

(117,343 |

) |

(241,993 |

) |

|

Shares issued |

(63 |

) |

282 |

|

51,507 |

|

145,442 |

|

|

Shares purchased under Restricted Share Units plan |

436 |

|

221 |

|

(1,409 |

) |

(1,946 |

) |

|

Loans received |

- |

|

- |

|

- |

|

30,000 |

|

|

Loans repaid |

- |

|

- |

|

- |

|

(30,000 |

) |

|

Lease payments |

(510 |

) |

(481 |

) |

(2,034 |

) |

(1,905 |

) |

|

Net cash (used in) from financing activities |

(137 |

) |

22 |

|

48,064 |

|

141,591 |

|

|

Net increase in cash and cash equivalents, during the

year |

70,601 |

|

22,036 |

|

188,634 |

|

50,528 |

|

|

Cash and cash equivalents, beginning of year |

531,484 |

|

384,553 |

|

406,368 |

|

341,319 |

|

|

Currency translation |

1,931 |

|

(221 |

) |

9,014 |

|

14,521 |

|

|

Cash and cash equivalents, end of year |

604,016 |

|

406,368 |

|

604,016 |

|

406,368 |

|

| |

Non-IFRS Financial Measures

Table 1 – Reconciliation of reported Net

income to Operating net

income(4):

reflect Net income, adjusted for certain items to normalize

earnings to core operations in order to reflect our North American

specialty operations.

|

|

Q4 2023 |

Q4 2022 |

2023 |

2022 |

|

Net income |

11,320 |

|

(40,710 |

) |

66,941 |

|

27,795 |

|

|

Adjustments: |

|

|

|

|

|

Non-recurring items |

23,744 |

|

81,473 |

|

47,181 |

|

81,473 |

|

|

Impact of share based compensation |

1,589 |

|

3,991 |

|

(1,914 |

) |

1,484 |

|

|

Impact of movement in yield curve within Finance income from

insurance and reinsurance contracts |

2,071 |

|

255 |

|

723 |

|

(3,731 |

) |

|

Net (gains) losses |

(8,132 |

) |

(4,112 |

) |

9,658 |

|

(8,802 |

) |

|

Net credit impairment reversals |

(926 |

) |

- |

|

(895 |

) |

- |

|

|

Tax impact of above items |

(3,791 |

) |

(17,378 |

) |

(11,493 |

) |

(14,969 |

) |

|

Operating net income |

25,875 |

|

23,519 |

|

110,201 |

|

83,250 |

|

Table 2 –

ROE(4) and

Operating ROE(5): a measure of the

Company’s use of equity.

|

|

Q4 2023 |

Q4 2022 |

|

LTM net income |

66,941 |

|

27,795 |

|

|

LTM average equity |

549,672 |

|

425,593 |

|

|

ROE |

12.2 |

% |

6.5 |

% |

|

Operating LTM net income(5) |

110,201 |

|

83,250 |

|

|

LTM average equity |

549,672 |

|

425,593 |

|

|

Operating LTM ROE |

20.0 |

% |

19.6 |

% |

Table 3 – Reconciliation of Average

equity(10)

to LTM average equity: LTM average equity is used

in calculating Operating ROE.

|

|

|

Q4 2023 |

Q4 2022 |

|

Average equity |

556,538 |

|

429,869 |

|

|

Adjustments: days in quarter proration |

(6,866 |

) |

(4,276 |

) |

|

LTM average equity |

549,672 |

|

425,593 |

|

Footnotes

(1) See section on Non-IFRS financial measures

table 10.2.1 in Q4 2023 MD&A for details on composition.

Operating net income is a non-IFRS financial measure. Non-IFRS

financial measures are not standardized financial measures under

the financial reporting framework used to prepare the financial

statements of the Company to which the measure relates and might

not be comparable to similar financial measures disclosed by other

companies. Details and an explanation of how it provides useful

information to an investor can be found in table 1.

(2) See Section 10, Operating Metrics in Q4 2023

MD&A for the definition of Operating Net Income, and for

further explanation of “core operations”.

(3) This is a non-IFRS ratio, see table 10.2 in

Q4 2023 MD&A for details on composition, as well as each

non-IFRS financial measure used as a component of the ratio, and an

explanation of how it provides useful information to an investor.

Non-IFRS ratios are not standardized under the financial reporting

framework used to prepare the financial statements of the Company

to which the ratio relates and might not be comparable to similar

ratios disclosed by other companies. To access MD&A, see

Trisura’s website or SEDAR+ at www.sedarplus.ca.

(4) This is a supplementary financial measure.

Refer to Q4 2023 MD&A, Section 10, Operating Metrics table for

its composition.

(5) This is a non-IFRS ratio. See table 10.4 in

Q4 2023 MD&A for details on composition, as well as each

non-IFRS financial measure used as a component of ratio, and an

explanation of how it provides useful information to an

investor.

(6) This is a non-IFRS financial measure.

Adjusted figures exclude the impacts from write down of reinsurance

recoverables, and the run-off program.

(7) This is a non-IFRS financial measure. See

table 10.5.5 in Q4 2023 MDA for details on composition.

(8) This measure is calculated in accordance

with the Office of the Superintendent of Financial Institutions

Canada’s (OSFI’s) Guideline A, Minimum Capital Test.

(9) This target is in accordance with OSFI’s

Guideline A-4, Regulatory Capital and Internal Capital Targets.

(10) Average equity is calculated as the sum of

opening equity and closing equity over the last twelve months,

divided by two.

(11) The Q4 2022 and Q4 2022 YTD metric has not

been restated to reflect the adoption of IFRS 9.

Cautionary Statement Regarding Forward-Looking

Statements and Information

Note: This news release contains

“forward-looking information” within the meaning of Canadian

provincial securities laws and “forward-looking statements” within

the meaning of applicable Canadian securities legislation.

Forward-looking statements include statements that are predictive

in nature, depend upon or refer to future events or conditions,

include statements regarding operations, business, financial

condition, expected financial results, performance, prospects,

opportunities, priorities, targets, goals, ongoing objectives,

strategies and outlook of our Company and its subsidiaries, as well

as the outlook for North American and international economies for

the current fiscal year and subsequent periods, and include words

such as “expects,” “likely,” “anticipates,” “plans,” “believes,”

“estimates,” “seeks,” “intends,” “targets,” “projects,”

“forecasts”, “potential” or negative versions thereof and other

similar expressions, or future or conditional verbs such as “may,”

“will,” “should,” “would” and “could”.

Although we believe that our anticipated future

results, performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, which may

cause the actual results, performance or achievements of our

Company to differ materially from anticipated future results,

performance or achievement expressed or implied by such

forward-looking statements and information.

Factors that could cause actual results to

differ materially from those contemplated or implied by

forward-looking statements include, but are not limited to: the

impact or unanticipated impact of general economic, political and

market factors in the countries in which we do business; the

behaviour of financial markets, including fluctuations in interest

and foreign exchange rates; global equity and capital markets and

the availability of equity and debt financing and refinancing

within these markets; insurance risks including pricing risk,

concentration risk and exposure to large losses, and risks

associated with estimates of loss reserves; strategic actions

including dispositions; the ability to complete and effectively

integrate acquisitions into existing operations and the ability to

attain expected benefits; changes in accounting policies and

methods used to report financial condition (including uncertainties

associated with critical accounting assumptions and estimates); the

ability to appropriately manage human capital; the effect of

applying future accounting changes; business competition;

operational and reputational risks; technological change; changes

in government regulation and legislation within the countries in

which we operate; governmental investigations; litigation; changes

in tax laws; changes in capital requirements; changes in

reinsurance arrangements and availability and cost of reinsurance;

ability to collect amounts owed; catastrophic events, such as

earthquakes, hurricanes or pandemics; the possible impact of

international conflicts and other developments including terrorist

acts and cyberterrorism; risks associated with reliance on

distribution partners, capacity providers and program

administrators; third party risks; risk that models used to manage

the business do not function as expected; climate change risk; risk

of economic downturn; risk of inflation; risks relating to

cyber-security; risks relating to credit ratings; and other risks

and factors detailed from time to time in our documents filed with

securities regulators in Canada.

We caution that the foregoing list of important

factors that may affect future results is not exhaustive. When

relying on our forward-looking statements and information,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Except as

required by law, our Company undertakes no obligation to publicly

update or revise any forward-looking statements or information,

whether written or oral, that may be as a result of new

information, future events or otherwise.

Cautionary Non-IFRS and Other Financial

Measures

Reported results conform to generally accepted

accounting principles (GAAP), in accordance with IFRS. In addition

to reported results, our Company also presents certain financial

measures, including non-IFRS financial measures that are

historical, non-IFRS ratios, and supplementary financial measures,

to assess results. Non-IFRS financial measures, such as operating

net income, are utilized to assess the Company’s overall

performance. To arrive at operating results, our Company adjusts

for certain items to normalize earnings to core operations, in

order to reflect our North American specialty operations. Non-IFRS

ratios include a non-IFRS financial measure as one or more of its

components. Examples of non-IFRS ratios include operating diluted

earnings per share and operating ROE. The Company believes that

non-IFRS financial measures and non-IFRS ratios provide the reader

with an enhanced understanding of our results and related trends

and increase transparency and clarity into the core results of the

business. Non-IFRS financial measures and non-IFRS ratios are not

standardized terms under IFRS and, therefore, may not be comparable

to similar terms used by other companies. Supplementary financial

measures depict the Company’s financial performance and position,

and are explained in this document where they first appear, and

incorporates information by reference to our Company’s current

MD&A, for the three and twelve months ended December 31, 2023.

To access MD&A, see Trisura’s website or SEDAR+ at

www.sedarplus.ca. These measures are pursuant to National

Instrument 52-112 Non-GAAP and Other Financial Measures

Disclosure.

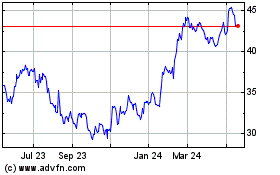

Trisura (TSX:TSU)

Historical Stock Chart

From Dec 2024 to Jan 2025

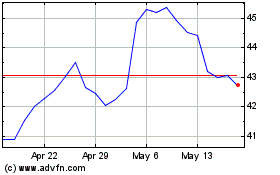

Trisura (TSX:TSU)

Historical Stock Chart

From Jan 2024 to Jan 2025