Unisync Reports a 16% Revenue Increase in Q2 Financial Results

17 May 2022 - 10:30PM

Unisync Corp. (“Unisync") (TSX:"UNI")

(OTCQX:“USYNF”) announces improved financial results for its second

quarter ended March 31, 2022. Unisync operates through two business

units: Unisync Group Limited (“UGL”) with operations throughout

Canada and the USA and 90% owned Peerless Garments LP (“Peerless”),

a domestic manufacturing operation based in Winnipeg, Manitoba. UGL

is a leading customer-focused provider of corporate apparel,

serving many leading Canadian and American iconic brands. Peerless

specializes in the production and distribution of highly technical

protective garments, military operational clothing and accessories

for a broad spectrum of Federal, Provincial and Municipal

government departments and agencies.

Results for Q2 2022 versus Q2

2021

Revenue for the three months ended March 31,

2022 (“Q2 2022”) of $24.6 million, net of inter segment

eliminations, rose by $3.4 million or 16% from the three months

ended March 31, 2021(“Q2 2021”) mostly due to a $3.2 million

revenue improvement in the UGL segment. UGL Q2 2022 segment revenue

of $19.5 million increased by 20% over Q2 2021 on an improvement in

sales to the segment’s airline accounts and the addition of new

accounts. Peerless’ $0.4 million revenue decrease in Q2 2022 was

due to a $1.2 million reduction in PPE product sales of masks and

manufactured gowns from Q2 2021, offset in part by higher uniform

product sales to the Department of National Defence.

The Company’s Gross profit for Q2 2022 of $5.1

million improved by $1.6 million over Q2 2021 with a resulting

gross profit margin improvement to 20.7% from 16.7%. UGL recorded a

gross profit of $4.3 million, or 22% of segment revenue in Q2 2022

compared to $2.5 million or 16% of segment revenue in Q2 2021 as it

benefited from the leverage of the sales increase on fixed costs.

The Peerless segment recorded gross profit of $0.9 million or 18%

against $1.1 million or 20% of segment revenue in Q2 2021 caused

primarily by the lower volume of sales in the current period.

At $4.9 million, total general and

administrative expenses were up $0.9 million or 22% from the Q2

2021 as a result of severance payments of $0.4 million accrued in

the UGL and Corporate segments as well as the costs associated with

the expansion of the UGL segment’s customer service and information

technology teams.

Adjusted EBITDA (before the aforementioned

severance payments associated with the recently announced corporate

restructuring) was $1.7 million for Q2 2022 versus $0.6 million for

the same period last year. The Company’s net loss of $0.3 million

in Q2 2022 declined from a net loss of $0.8 million in Q2 2021.

Adjusted EBITDA does not have a standardized

meaning prescribed by IFRS and is therefore unlikely to be

comparable to similar measures presented by other issuers and

should not be considered in isolation nor as a substitute for

financial information reported under IFRS. Unisync uses non-IFRS

measures, including Adjusted EBITDA, to provide shareholders with

supplemental measures of its operating performance. Unisync

believes adjusted EBITDA is a widely accepted indicator of an

entity’s ability to incur and service debt and commonly used by the

investing community to value businesses.

Business Outlook

UGL continues to experience a build-up in orders

in the transportation and hospitality sectors to pre-pandemic

levels since the latter part of Q4 2021. In addition, a new uniform

rollout for one of the UGL segment’s airline customers will be

shipped during Q3 and Q4 2022. As a result, a continuing increase

in sales and operating profitability is expected over the balance

of fiscal 2022.

Across the global supply chain, delays in the

importation of goods to North America from offshore suppliers

remain a challenge. Accordingly, UGL has had to adjust its planning

and purchasing schedule lead times which, in combination with the

onboarding of new accounts, has contributed to an increase in

inventory levels.

Similar to many other service companies, we also

continue to experience delays in hiring sufficient warehouse staff

to accommodate the sudden increase in the delivery demands of our

clients. This has in turn caused an unprecedented backlog in orders

and a resulting delay in converting inventory on-hand to sales.

The Company expects that these supply chain and

distribution issues and the resulting need for increased inventory

levels are temporary and will be resolved in the coming months.

Peerless had $14 million in firm contracts and

options on hand as at March 31, 2022 and was subsequently awarded a

contract from the Department of National Defence estimated at $4.7

million involving the production of converged hot, wet weather,

static dissipative CADPATTM jackets, trousers and hoods. The firm

portion of the contract amounts to $1.6 million with the remaining

option portions exercisable over three years.

The corporate restructuring announced on

February 25, 2022 has resulted in a much leaner and cohesive

management team focused on maximizing shareholder value. The

elimination of significant executive overhead associated with this

restructuring will reduce fixed overhead and, at the same time,

support continued investment in advanced technology that will

ensure we maintain a pre-eminent managed services offering for our

clients.

We are extremely pleased with the level of

support received from management and staff regarding the

restructuring and believe that the current corporate structure is a

sustainable one that can efficiently support our future growth

initiatives.

More detailed information is contained in the

Company’s Condensed Interim Consolidated Financial Statements for

the quarter ended March 31, 2022 and Management Discussion and

Analysis dated May 13, 2022 which may be accessed at

www.sedar.com.

On Behalf of the Board of Directors

Douglas F. Good Executive Chairman

Investor relations

contact:Douglas F. Good, Executive Chairman at

778-370-1725 Email: dgood@unisyncgroup.com

Forward Looking StatementsThis

news release may contain forward-looking statements that involve

known and unknown risk and uncertainties that may cause the

Company’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied in these forward-looking

statements. Any forward-looking statements contained herein are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Except as

required by law, the Company undertakes no obligation to publicly

update or revise any such forward-looking statements to reflect any

change in its expectations or in events, conditions or

circumstances on which any such forward-looking statements may be

based, or that may affect the likelihood that actual results will

differ from those set forth in the forward-looking statements.

Neither the TSX nor its Regulation Services Provider (as that term

is defined in the policies of the TSX) accepts responsibility for

the adequacy or accuracy of this release.

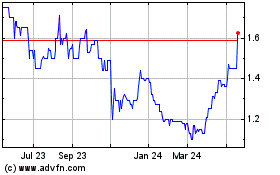

Unisync (TSX:UNI)

Historical Stock Chart

From Feb 2025 to Mar 2025

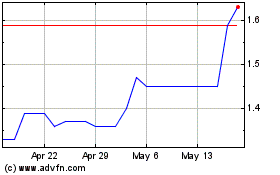

Unisync (TSX:UNI)

Historical Stock Chart

From Mar 2024 to Mar 2025