Unisync Corp. (“Unisync") (TSX:"UNI")

(OTC:“USYNF”) announces its audited financial results for

the fourth quarter and fiscal year ended September 30, 2024.

Unisync operates through two business units: Unisync Group Limited

(“UGL”) with operations throughout Canada and the USA and 90% owned

Peerless Garments LP (“Peerless”), a domestic manufacturing

operation based in Winnipeg, Manitoba. UGL is a leading

customer-focused provider of corporate apparel, serving many

leading Canadian and American iconic brands. Peerless specializes

in the production and distribution of highly technical protective

garments, military operational clothing, and accessories for a

broad spectrum of Federal, Provincial and Municipal government

departments and agencies.

Results for Fiscal 2024 versus Fiscal

2023

Consolidated revenue for the year ended

September 30, 2024 of $89.8 million was down $13.8 million or 13.3%

from the prior year due to a decrease in revenue in both the UGL

and Peerless segments. UGL segment revenue of $80.4 million was

lower by $12.0 million or 12.9% and the Peerless segment revenue

was lower by $1.4 million or 12.5%, compared to the prior year.

UGL revenues returned to more normal seasonal

levels in the current year following the post pandemic rebound in

airline industry revenues during 2023 when new hires and the

resulting staffing levels surged above pre-pandemic levels, which

resulted in a decrease of $3.9 million across all airline accounts

in the segment. Additionally, the sale of the New Jersey division

in the prior year contributed to $5.3 million of the decrease in

the current year. Despite this lower level of revenues, the UGL

segment experienced a $3.4 million increase in gross profit to $9.8

million or 12.2% of segment revenue compared to $6.4 million or

6.9% of segment revenue in the prior year. The improved margins

were related to customer pricing adjustments, the gradual movement

of offshore production to lower cost jurisdictions and relatively

lower offshore container delivery costs. In addition, the recently

completed consolidation of facilities and the discontinued use of

3PL services has further reduced fixed overhead costs and staffing

levels. While gross margins improved year-over-year, the segment

had a non-cash adjustment to inventory in the amount of $2.5

million that negatively impacted gross margins in the current

fiscal year. This adjustment was related to the increase in

container delivery costs originating from 2022 and 2023 that

resulted in a timing difference in the recognition of the expense

compared to when the product was shipped. Excluding this

adjustment, the gross margin was $12.3 million or 15.3% of segment

revenues. We continue to pursue a tenant to lease out the resulting

40,000+ square feet of unutilized space at its Saint-Laurent

facility or an outright sale of the 60,000 square foot facility

which, in either case, will further reduce UGL’s direct overhead

costs.

The revenue decrease in the Peerless segment was

due to lower uniform product shipments to the Department of

National Defence (“DND”) as a result of delays in receipt of key

fabric and the exercise of contract options by the DND experienced

during the latter part of fiscal 2024. The segment experienced $0.6

million increase in gross profit or 26.5% compared to 18.0% in

prior year due to a higher margin mix of product sales, while

decreasing the use of subcontractors to perform a portion of

manufacturing output.

Depreciation and amortization increased to $5.4

million in the current fiscal year from $4.9 million largely due to

the increase in right of use assets related to a UGL lease

extension in the current fiscal year.

At $14.0 million, consolidated general and

administrative expenses were down $2.4 million or 14.6% from the

prior year due to overhead reductions associated with the

consolidation of UGL operations. Excluding $0.6 million in

separation and other employee related UGL costs which pertained to

a prior year, consolidated general & administrative costs were

down $3.0 million from the prior year.

Interest expense of $3.8 million in the current

fiscal year was higher than the prior year due to higher short term

bank lending rates and an increase in average debt outstanding at

UGL, which was partially offset by lower borrowing costs as a

result of the August 2023 BDC mortgage loan financing replacing

previously availed high interest rate shareholder loans.

The Company reported a net loss before tax of

$6.6 million in the year ended September 30, 2024 compared to a

loss of $12.4 million in the prior year. Adjusted EBITDA in the

current year was $6.5 million versus $2.3 million for the prior

year. More detailed information, including a breakdown of non-cash

and non-recurring operating expenses deducted from Net Income

Before Tax in arriving at Adjusted EBITDA, is contained in the

Company’s Management Discussion and Analysis dated December 12,

2024 which may be accessed at www.sedarplus.com.

Adjusted EBITDA does not have a standardized

meaning prescribed by IFRS and is therefore unlikely to be

comparable to similar measures presented by other issuers and

should not be considered in isolation nor as a substitute for

financial information reported under IFRS. Unisync uses non-IFRS

measures, including Adjusted EBITDA, to provide shareholders with

supplemental measures of its operating performance. Unisync

believes adjusted EBITDA is a widely accepted indicator of an

entity’s ability to incur and service debt and commonly used by the

investing community to value businesses.

Results for Q4 2024 versus Q4

2023

Consolidated revenue for the three months ended

September 30, 2024 of $20.0 million was down $0.7 million or 3.5%

from the same period last year.

UGL revenues experienced a $1 million increase

to $18.3 million due in most part to price increases that took

effect during the year, while the Peerless segment experienced a

$1.7 million decrease due to delays in receipt of key fabric and

the exercise of contract options by DND. While revenues increased

marginally quarter over quarter, the UGL segment experienced a

gross profit increase of $3.7 million to $0.1M or 0.4% of segment

revenues. The increase was attributed to price increases, lower

product costs from offshore vendors, and a decrease in inventory

write downs from the same quarter last year. In addition, the

previously announced consolidation of facilities along with the

discontinued use of 3PL services, reduced fixed overhead costs and

staffing levels. This was partially offset by a non-cash adjustment

to inventory in the amount of $2.5 million that negatively impacted

gross margins in the current quarter but was related to the

increased container delivery costs originating from 2022 and 2023.

Excluding this noncash inventory adjustment, gross margins were

$2.5 million or 13.9% of segment revenues.

The $1.7 million revenue decrease in the

Peerless segment during the fourth quarter was due to lower uniform

product deliveries to the Department of National Defence (“DND”) on

account of delays in receipt of key fabric and the exercise of

contract options by the DND. This segment experienced $0.1 million

decrease in gross profit, while gross margin increased to 17.5%

compared to 11.0% in same period last year due to a higher margin

mix of product sales and a decrease in the use of subcontractors to

perform a portion of manufacturing output.

Depreciation and amortization increased to $1.3

million in the quarter from $1.2 million due to a lease extension

in the current year involving UGL right of use assets.

At $3.3 million, consolidated general and

administrative expenses were lower by $0.4 million from the same

quarter last year due to overhead reductions associated with the

previously announced consolidation of UGL operations. Included in

general and administrative expenses was $0.6 million related to

separation and other related costs for UGL employee matters

pertaining to a prior year. Excluding these costs, consolidated

general & administrative costs were down $1.0 million from the

same quarter last year.

Interest expense of $1.0 million was lower by

$0.1 million from the same quarter last year due to lower borrowing

costs resulting from the August 2023 BDC mortgage loan financing at

UGL that replaced previously availed high interest rate shareholder

loans.

The Company reported a consolidated net loss

before tax of $4.9 million in the three months ended September 30,

2024 compared to a loss of $9.1 million in the same quarter last

year. Adjusted EBITDA in the quarter was $1.4 million versus a loss

of $1.8 million for the same quarter last year.

Business Outlook

There continues to be a buildup in large managed

image wear opportunities coming to the market RFP stage at UGL.

Some competitors have had performance issues during the economic

turmoil experienced in recent years and/or have signalled

withdrawing from this marketplace, leaving UGL well positioned for

accelerated organic growth in both Canada and the USA. Our

demonstrated capability to manage large complicated operational

uniform programs, combined with a base of credible referenceable

clients provides the opportunity for near-term accelerated

growth.

The UGL segment continues to place strong focus

on the US market. UGL is in advanced discussions with several major

corporations with respect to their image wear programs totaling

close to US$100 million annually in potential new business.

The Peerless business segment is also well

positioned to maintain its current level of revenues and

profitability through fiscal 2025 with $34 million in firm

government contracts and options on hand covering deliveries in

future years. The Company continues to pursue opportunities that

will expand the potential for increased participation in DND

contracts and in other domestic manufacturing verticals.

Due to the size and imminent nature of the

opportunities in front of us, it is important that we restore our

UGL capital base that has eroded from a multitude of global

disruptions ranging from COVID to major wars and now the weakness

in the Canadian dollar due to the threatened implementation of

material tariffs on exports by the US President Elect. To this end,

the Company’s Board is pursuing various capital raising

opportunities to improve working capital and capitalize on the

growth opportunities in front of us.

We wish to thank our shareholders for their

continued support and understanding. Please be assured that

management and your Board are committed to achieving continued

future growth and the development of an improved level of

profitability to enhance shareholder value.

On Behalf of the Board of

Directors

Douglas F GoodDirector & CEO

Investor relations

contact:Douglas F Good, Director & CEO at Email:

dgood@unisyncgroup.com

Forward Looking Statements

This news release may contain forward-looking

statements that involve known and unknown risk and uncertainties

that may cause the Company’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied in these

forward-looking statements. Any forward-looking statements

contained herein are made as of the date of this news release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect any change in its expectations or in events,

conditions or circumstances on which any such forward-looking

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

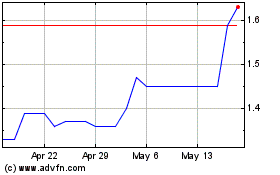

Unisync (TSX:UNI)

Historical Stock Chart

From Dec 2024 to Dec 2024

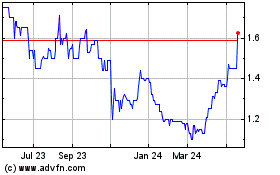

Unisync (TSX:UNI)

Historical Stock Chart

From Dec 2023 to Dec 2024