Unisync Announces Its Decision to Withdraw From OCFC2 Bid

20 May 2022 - 10:30PM

The global disruptions that are currently occurring and the

concurrent meteoric rise in a number of key inflationary factors

has resulted in the need to re-assess the economic feasibility of

the large managed service opportunity that we have been pursuing

with the Department of National Defence since it was first

announced to the industry over a decade ago. Solicitation

W8486-206245/A issued by Public Works and Government Services

Canada is referred to as OCFC2, the acronym for the Operational

Clothing and Footwear Contract for the Canadian armed forces. The

contract, which is anticipated to be awarded in the next few

months, involves an initial term of five years with multiple

renewal provisions resulting in a potential term of twenty years

and estimated gross revenues exceeding $1 billion.

After much deliberation and analysis of the

risks, we have concluded that OCFC2 as currently constructed does

not provide an appropriate return on our invested capital and

therefore have decided to withdraw our proposal that was formally

submitted in August of 2021. We were hesitant to make this critical

decision as we incurred significant management time and costs in

positioning Unisync to respond to this opportunity. However, we

were unanimous in our conclusion that the risks associated with

this contract as constructed far outweighed the benefits to be

derived.

The concept of a long-term fixed fee contract

that commences about two years following bid submission is, in

itself, a formidable obstacle to deal with in any environment. As

prime contractor, we would be locked into a fixed rate management

fee for the full duration of the contract, a rate which was

established two years prior to the contract launch and which has

already been significantly eroded as a result of soaring interest

rates, the surging cost of wages combined with the reduced

availability of workers, major increases in transportation costs

and in property values and the resulting cost of warehousing. This

challenge was further exacerbated due to the inclusion of value

proposition commitments under the Industrial and Technological

Benefits (ITB) Policy for the life of the contract, and the lack of

a foreign exchange adjustment provision.

The contractual and financial risks also extend

to our suppliers, most of whom are small cut-and-sew businesses,

who would be locked into firm unit prices subject to adjustment for

inflation tied to increases in the Consumer Price Index, an index

not representative of the actual inflationary factors the industry

is experiencing. We, as the prime contractor, would be required to

have subcontractors provide supporting contractual long-term

pricing commitments based on their assumptions of future fabric

pricing, wage increases and other inflationary factors or, where

preferred subcontractors refused to commit to pricing beyond some

short-term period, we would have to absorb these key inflation

risks ourselves. As a prime contractor, we felt we have a

responsibility for the future viability of our suppliers and would

find it counter-productive to hold small subcontractors to their

pricing and supply commitments when doing so could put them out of

business.

Providing advanced managed clothing solutions

remains a core competency and strategic direction for Unisync and,

as a Canadian owned public company, we remain committed to pursuing

future managed clothing opportunities with the various departments

and agencies of the Government of Canada. Similarly, Peerless

Garments, our in-house Winnipeg based manufacturing subsidiary and

major supplier to the Canadian Armed Forces for over 70 years, also

looks forward to being of continued service to the Canadian

Government.

We are confident that management,

infrastructure, and capital resources previously required for the

OCFC2 bid can be readily deployed to other attractive, lower risk

managed workwear opportunities throughout North America.

On Behalf of the Board of Directors

Douglas F. Good Executive Chairman

|

Investor relations contact: |

Tel.

778-370-1725 Email: dgood@unisyncgroup.com |

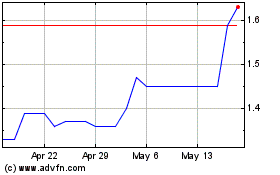

Unisync (TSX:UNI)

Historical Stock Chart

From Feb 2025 to Mar 2025

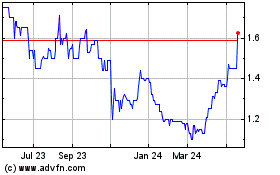

Unisync (TSX:UNI)

Historical Stock Chart

From Mar 2024 to Mar 2025