Unisync Reports a 19% Revenue Increase in Q3 2022 Over Q3 2021

16 August 2022 - 9:30PM

Unisync Corp. (“Unisync") (TSX:"UNI")

(OTCQX:“USYNF”) announces its financial results for its third

quarter ended June 30, 2022. Unisync operates through two business

units: Unisync Group Limited (“UGL”) with operations throughout

Canada and the USA and 90% owned Peerless Garments LP (“Peerless”),

a domestic manufacturing operation based in Winnipeg, Manitoba. UGL

is a leading customer-focused provider of corporate apparel,

serving many leading Canadian and American iconic brands. Peerless

specializes in the production and distribution of highly technical

protective garments, military operational clothing and accessories

for a broad spectrum of Federal, Provincial and Municipal

government departments and agencies.

Results for Q3 2022 versus Q3

2021

Revenue for the three months ended June 30, 2022

of $24.6 million rose by $4.0 million or 19% from the three months

ended June 30, 2021 due to a $5.5 million revenue improvement in

the UGL segment less a $1.2 million revenue decrease in the

Peerless segment and less a $0.3 million increase in intersegment

sales eliminations. UGL segment revenue of $21.8 million increased

by 33% over the same period in the prior year on an improvement in

sales to the segment’s airline accounts. The revenue decrease in

the Peerless segment in the current quarter was due to a reduction

in uniform product deliveries to the Department of National Defence

(“DND”).

Gross profit for Q3 2022 of $4.5 million was up

$1.0 million from the same quarter of fiscal 2021 and the gross

profit margin improved to 18.1% of revenue from 16.7%. As a result

of the higher margin mix of sales realized in the UGL segment,

gross profit of $3.9 million or 18% of segment revenue was recorded

in Q3 2022 compared to $2.6 million or 16% of segment revenue in Q3

of the prior fiscal year. Peerless recorded gross profit revenue in

Q3 2022 of $0.6 million or 20% against $0.9 million or 23% of

revenue in Q3 of the prior fiscal year on account of the lower

volume of deliveries in the current period.

At $4.4 million, total general and

administrative expenses for Q3 2022 were up a modest $0.1 million

or 3% from Q3 2021 on account of employee cost of living pay

increases and management restructuring costs incurred in the UGL

segment.

The Company’s net loss of $0.5 million before

tax in Q3 2022 declined from a net loss before tax of $1.4 million

in the same quarter last year. Although a significant improvement

over the $0.3 million recorded for Q3 2021, Adjusted EBITDA of $1.2

million for Q3 2022 was adversely affected by $0.5 million in

inventory write-downs and one-time employee severance costs

associated with the previously announced management

restructuring.

Adjusted EBITDA does not have a standardized

meaning prescribed by IFRS and is therefore unlikely to be

comparable to similar measures presented by other issuers and

should not be considered in isolation nor as a substitute for

financial information reported under IFRS. Unisync uses non-IFRS

measures, including Adjusted EBITDA, to provide shareholders with

supplemental measures of its operating performance. Unisync

believes adjusted EBITDA is a widely accepted indicator of an

entity’s ability to incur and service debt and commonly used by the

investing community to value businesses.

Business Trends

The Company continues to experience an

improvement in demand from its customer base as COVID restrictions

are lifted, confidence returns, and life begins to return to

normal. In particular, the Company’s North American airline

accounts are experiencing increased demand and have returned to

pre-pandemic passenger volumes. The Company expects that this will

continue to cause a strong increase in uniform sales to these

accounts as well as other accounts in the transportation and

hospitality sectors and when complimented by recent new account

additions, is expected to result in an improving revenue and

profitability picture.

Delays in the importation of goods to North

America from offshore suppliers in combination with delays in

hiring sufficient warehouse staff to accommodate the sudden

increase in the delivery demands of our clients, continues to

contribute to an unprecedented backlog in orders and a resulting

delay in converting inventory on-hand to sales. The Company expects

that these supply chain and distribution issues and the resulting

need for increased inventory levels are temporary and will be

resolved in the coming months.

Unisync is a well-known and respected managed

service provider of custom corporate image apparel. Unisync’s

recent decision to focus more on strategic growth in the US,

combined with the addition of a US based Vice President with

extensive experience and relationships in the industry is already

making significant contributions to UGL’s expansion into the

market. In the last few months, Unisync has been successful

in being added as an approved supplier to a number of upcoming

requests for formal proposals (“RFPs”) with major US corporations

totaling over Cdn$54 million in potential additional annual

revenue. Furthermore, Unisync is in active discussions for

upcoming RFP opportunities expected to be released over the next

two years representing an additional Cdn$150 million in annual

revenue. The Company’s management team continues to develop

its product and services offering to maximize its success in being

awarded a major portion of these opportunities.

More detailed information is contained in the

Company’s Condensed Interim Consolidated Financial Statements for

the quarter ended June 30, 2022 and Management Discussion and

Analysis dated August 12, 2022 which may be accessed at

www.sedar.com.

On Behalf of the Board of Directors

Douglas F. Good Executive Chairman

|

Investor relations contact: |

|

| Douglas F. Good, Executive Chairman |

Email: dgood@unisyncgroup.com |

Forward Looking StatementsThis

news release may contain forward-looking statements that involve

known and unknown risk and uncertainties that may cause the

Company’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied in these forward-looking

statements. Any forward-looking statements contained herein are

made as of the date of this news release and are expressly

qualified in their entirety by this cautionary statement. Except as

required by law, the Company undertakes no obligation to publicly

update or revise any such forward-looking statements to reflect any

change in its expectations or in events, conditions or

circumstances on which any such forward-looking statements may be

based, or that may affect the likelihood that actual results will

differ from those set forth in the forward-looking statements.

Neither the TSX nor its Regulation Services Provider (as that term

is defined in the policies of the TSX) accepts responsibility for

the adequacy or accuracy of this release.

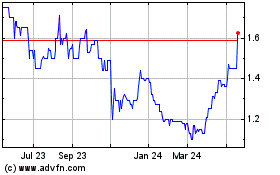

Unisync (TSX:UNI)

Historical Stock Chart

From Feb 2025 to Mar 2025

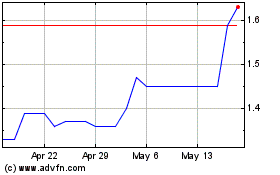

Unisync (TSX:UNI)

Historical Stock Chart

From Mar 2024 to Mar 2025