Andean American Reports Financial Results for the Quarter Ended September 30, 2011 and Provides a Corporate Update

16 November 2011 - 11:30PM

Marketwired Canada

Andean American Gold Corp. ("Andean" or the "Company") (TSX

VENTURE:AAG)(FRANKFURT:AQN) reports that for the three and six months ended

September 30, 2011, it incurred a net loss of US$3,152,566 or US$0.02 per share

and US$4,768,107 or US$0.03 per share compared to US$890,347 or US$0.01 per

share and US$1,661,325 or US$0.02 per share for the same period in 2010. Andean

ended the quarter with cash on hand of US$19,454,725 and a working capital

surplus of US$17,172,485.

Andean is an international mining and Exploration Company focused on gold and

copper projects in Peru and currently has two key assets: the 31,600 hectare

Invicta gold-silver-copper advanced exploration stage project located in the

Huaura Province in Peru, and 64.95% of Sinchao Metals Corp., a company listed on

the TSX-V trading under the symbol 'SMZ'. Sinchao is the owner of a

gold-silver-copper-zinc-lead exploration project.

Results of Operations

----------------------------------------------------------------------------

Six months ended Six months ended

September 30, 2011 September 30, 2010

----------------------------------------------------------------------------

Income/(loss) before

income tax ($4,768,107) ($1,661,325)

----------------------------------------------------------------------------

Income/(loss) per share ($0.03) ($0.02)

----------------------------------------------------------------------------

Total assets $61,907,971 $46,143,937

----------------------------------------------------------------------------

Working capital

surplus/(deficit) $17,172,485 ($2,501,078)

----------------------------------------------------------------------------

Mineral properties $40,398,760 $42,826,794

----------------------------------------------------------------------------

Share Capital:

----------------------------------------------------------------------------

Outstanding 144,543,476 102,797,287

----------------------------------------------------------------------------

Warrants 3,908,450(1) 5,005,918

----------------------------------------------------------------------------

Options 7,670,088 9,240,588

----------------------------------------------------------------------------

1. On November 12, 2011, 908,450 warrants expire and on November 25, 2011,

500,000 warrants expire.

Cash Flow and Liquidity

As at September 30, 2011, Andean had working capital of US$17,172,485, compared

to a working capital surplus of US$22,894,392 at March 31, 2011. For the six

months ended September 30, 2011, Andean used cash of US$6,746,216, which

included cash used in operations of US$4,134,861, expenditures on plant and

equipment and mineral properties and deferred costs of US$3,396,779. This was

offset by financing activities of $785,424.

International Financial Reporting Standards ("IFRS")

The Company adopted IFRS on April 1, 2011, with a transition date of April 1,

2010. Under IFRS 1 First-time Adoption of IFRS, the IFRS are applied

retrospectively at the transition date of April 1, 2010. The effect of the

transition from Canadian Generally Accepted Accounting Principles ("Canadian

GAAP") to IFRS is not material and the explanation of how the transition from

Canadian GAAP to IFRS has affected Andean's financial position, financial

performance and cash flows are set out in the financial statements.

The information above should be reviewed in conjunction with the Company's

unaudited consolidated financial statements, management discussion and analysis,

for the three and six months ended September 30, 2011 that will be available

shortly on www.sedar.com. For further information visit our website at

www.AAGgold.com.

Acquisition of Sundust Resources Inc.'s interest in Invicta

Andean wishes to report that it has entered into a letter of intent with Sundust

Resources Inc. to resolve its previously disclosed disagreement regarding

Sundust's ownership interest in the Company's Invicta Project. Under the terms

of the letter of intent, Sundust would transfer any interest it has in the

Invicta Project and provide Andean with a release with respect to any future

claims in exchange for a payment of $400,000 and the issuance of 5,600,000

common shares. The completion of this transaction is subject to, among other

things, the negotiation and execution of definitive documentation, receipt of

shareholder approval from the shareholders of Sundust, expected to take place

mid-January 2012, and receipt of all necessary regulatory approvals, which will

include a minimum four month hold. Following the approval of the transaction by

the Sundust shareholders, Sundust will cause the Andean shares to be distributed

to its shareholders by way of dividend or in the most tax efficient manner. The

Company cannot be certain that these conditions will be satisfied and that the

transaction will be completed.

Award of Stock Options

The Company has granted 100,000 options to a director of the Board, effective

November 15, 2011. The options will have a term of five years, will vest

immediately and have an exercise price of $0.415 per share.

On behalf of Andean American Gold Corp.,

Bruce Ramsden, Vice President, Finance and CFO

This news release may contain forward-looking information within the meaning of

the Securities Act (Ontario) ("forward-looking statements"). Such

forward-looking statements may include the Company's plans for its mineral

projects, the overall economic potential of its properties, the availability of

adequate financing and involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or achievements

expressed or implied by such forward-looking statements to be materially

different. Such factors include, among others, risks and uncertainties relating

to potential political risks involving the Company's operations in a foreign

jurisdiction, uncertainty of production and costs estimates and the potential

for unexpected costs and expenses, physical risks inherent in mining operations,

currency fluctuations, fluctuations in the price of gold and other metals,

completion of economic evaluations, changes in project parameters as plans

continue to be refined, the inability or failure to obtain adequate financing on

a timely basis, and other risks and uncertainties, including those described in

the Company's Financial Statements, Management Discussion and Analysis and

Material Change Reports filed with the Canadian Securities Administrators and

available at www.sedar.com.

This press release is not an offer to sell or the solicitation of an offer to

buy the securities, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior

to qualification or registration under the securities laws of such jurisdiction.

The securities being offered have not been, nor will they be, registered under

the United States Securities Act of 1933, as amended and such securities may not

be offered or sold within the United States absent an applicable exemption from

U.S. registration requirements.

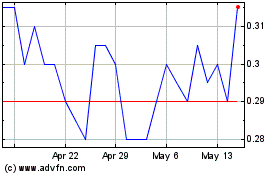

Aftermath Silver (TSXV:AAG)

Historical Stock Chart

From Apr 2024 to May 2024

Aftermath Silver (TSXV:AAG)

Historical Stock Chart

From May 2023 to May 2024