Anfield Energy, Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or “the Company”) is pleased to

announce it has submitted its production reactivation plan for the

Shootaring Canyon mill to the State of Utah’s Department of

Environmental Quality (UDEQ). This major milestone is critical to

restarting uranium production at Shootaring. The plan addresses the

updating the mill’s radioactive materials license from its current

standby status to operational status and the increasing of both

throughput capacity and the tripling of licensed production

capacity. Following approval of the reactivation plan and mill

refurbishment, Anfield will be able to both recommence uranium

production and start vanadium production in 2026 -- joining a

select group of North American and U.S. uranium producers meeting

the resurgence in uranium demand.

The plan outlines an increase in mill throughput

capacity to 1,000 tons per day from 750 tons per day and an

increase in annual uranium production capacity to 3 million pounds

from 1 million pounds. The Shootaring mill – one of only 3

licensed, permitted and constructed conventional uranium mills in

the U.S. -- is a significant differentiator between Anfield and its

peers.

Corey Dias, Anfield’s CEO states, “We at Anfield

are very proud of achieving the important milestone of submitting

the production restart application for Shootaring. This is an

achievement which has taken close to 18 months of engineering and

design input to complete and caps a decade of methodical and

strategic progression in asset development. Since acquiring the

Shootaring Canyon mill in 2015, we have maintained the facility,

waiting for the right market conditions to return the mill to

production status. With uranium reaching highs of greater than

US$100 per pound earlier this year, and a global environment in

which demand is expected to continue outstripping supply, we

believe this is the ideal time to advance our uranium assets to

production.”

“We believe that it is important to highlight

the challenges related to starting this process from a greenfield

position to reaching Anfield’s current production position. For

example, a company with no existing radioactive materials license

or mill site would need: 1) to secure an appropriate site for mill

construction and tailings buildout; 2) to complete baseline

environmental studies regarding potential environmental impacts of

mill operations to satisfy NEPA requirements (typically a two to

three-year undertaking); 3) access to infrastructure – roads and

power; and 4) the radioactive materials license itself, which

requires the submittal of a comprehensive application that

incorporates not only the previous items, but also a mill facility

and tailings construction, operation and reclamation and

decommissioning plan, including confirmatory studies outlining

emissions related to mill operations, as well as other ancillary

permits.

“Finally, the installation of Doug Beahm as

Chief Operating Officer (COO), bringing with him a wealth of

experience in progressing assets to production, means Anfield will

have the right permitted assets in the right place, at the right

time, with the right production-focused leadership. The uprating of

Anfield's status to production-ready will also be a strong case for

an uprating in Anfield’s valuation and share price to be much more

in line with Anfield’s peers.”

Next Steps

Early-stage refurbishment of Shootaring will

take place during the review of the restart application, preparing

the Company to complete refurbishment as soon as the restart

application is approved. The Company is targeting the mill restart

in 2026.

With the application submitted to the UDEQ, the

Company can prepare for uranium mill and tailings refurbishment and

vanadium circuit construction. Steps include: the rough grading of

the tailings pond cell area in advance of cell design approval; the

moving of ore stockpiles and remediation of sections of the

restricted area to establish a new radiation control boundary; the

building of a new ore dump wall and transportation roads, along

with a truck wash station; the demolition of all infrastructure to

be replaced (e.g., electrical, controls, leach tanks); the

installation of new generators, acid tanks and fuel tanks; the

construction of the vanadium circuit building and counter-current

decantation (CCD) circuit footers; the building of new ore pads

where Velvet-Wood ore can be stockpiled in anticipation of mill

restart; and the ordering of tanks and vessels needed for

processing circuits, having equipment onsite and ready to install

once the license is approved.

Uranium Market Outlook

The nuclear renaissance remains robust, with no

shortage of positive news entering the market daily. The continued

buildout of new reactors in disparate regions such as Asia, Europe,

North America and Africa truly underscores the global nature of the

nuclear embrace. At the same time, the Japanese reactor restarts

and life extensions reflect the continued confidence of Japan’s

reengagement of nuclear power, post-Fukushima. The U.S.’s

commitment to nuclear is reflected in not only life extensions of

existing nuclear reactors and commissioning of new reactors, but

also the return of a recently-decommissioned nuclear plant.

Finally, China’s accelerated buildout of nuclear reactors continues

unabated.

While the demand side of the uranium market is

rapidly growing, the supply side continues to face challenges to

meet demand. Recent concerns regarding Kazatomprom’s ability to

meet its production targets, coupled with recent floods in

Kazakhstan, has created unexpected challenges for the world’s

largest uranium producer. Supply chain logistics for access to

Western consumers have also weakened due to war in Ukraine,

exacerbated by China’s aggressive pursuit of Kazakh uranium

supplies. Moreover, the U.S. government’s push to ban the sale of

Russian enriched uranium is likely to lead to a division between

western-derived nuclear fuel supply – including uranium – and

eastern-derived material.

While these challenges are likely to remain in

the near term, the US government’s recognition of these issues has

led to the creation of a 200GW energy roadmap to expand domestic

milling and mining operations by 500,000MT per year – 110 million

pounds of uranium per year – is a significant catalyst for US-based

producers. This is taking place while U.S. uranium production fell

to essentially zero in the fourth quarter of 2023. Anfield’s

milestone takes it one step closer to full participation in

domestic uranium production.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a publicly

traded corporation listed on the TSX Venture Exchange (AEC-V), the

OTCQB Marketplace (ANLDF) and the Frankfurt Stock Exchange (0AD).

Anfield is focused on its conventional asset centre, as summarized

below:

Arizona/Utah/Colorado – Shootaring Canyon Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado, and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Slick Rock Project, the West Slope

Project, the Frank M Uranium Project, the Findlay Tank breccia pipe

as well as an additional 12 U.S. Department of Energy (DoE) leases

in Colorado. A combined NI 43-101 PEA has been completed for the

Velvet-Wood Project and the Slick Rock Project. The PEA is

preliminary in nature, and includes inferred mineral resources that

are considered too speculative geologically to have economic

considerations applied to them that would enable them to be

categorized as mineral reserves, and there is no certainty that the

preliminary economic assessment would be realized. All conventional

uranium assets are situated within a 200-mile radius of the

Shootaring Mill.

See table and footnote below for additions.

Technical Disclosure

Table 1. Anfield’s existing conventional

uranium-vanadium project portfolio resources.

|

Project |

Location |

Classification |

Tons (kt) |

UraniumGrade(%

U3O8) |

Contained Uranium(Mlbs

U3O8) |

VanadiumGrade(%

V2O5) |

Contained Vanadium(Mlbs

V2O5) |

|

Velvet-Wood |

Utah |

M & I |

811 |

0.29% |

4.6 |

- |

- |

|

|

|

Inferred |

87 |

0.32% |

0.6 |

0.404% |

7.3 |

|

West Slope |

Colorado |

Indicated |

1,367 |

0.197% |

5.4 |

- |

- |

|

|

|

Inferred |

1,367 |

- |

- |

0.984% |

26.9 |

|

|

|

Historic* |

630 |

0.31% |

3.9 |

1.59% |

20.0 |

|

Slick Rock |

Colorado |

Inferred |

1,760 |

0.224% |

7.9 |

1.35% |

47.1 |

|

Frank M |

Utah |

Historic* |

1,137 |

0.101% |

2.3 |

- |

- |

|

Findlay Tank |

Arizona |

Historic* |

211 |

0.226% |

1.0 |

- |

- |

|

Date Creek/Artillery Peak |

Arizona |

Historic* |

2,602 |

0.054% |

2.8 |

|

|

|

Marquez-Juan Tafoya |

New Mexico |

Historic* |

7,100 |

0.127% |

18.1 |

|

* The Company’s Qualified Person has not done

sufficient work to classify these historic estimates as current

mineral resources and Anfield is not treating such historical

resources as current mineral resources.

Velvet-Wood: The PEA for Velvet-Wood/Slick Rock

was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, of

BRS Inc., Harold H. Hutson, P.E., P.G., Carl D. Warren, P.E., P.G.,

and Terence P. (Terry) McNulty, P.E., D. Sc., of T.P. McNulty and

Associates Inc. (May 6, 2023). Mineral resources are not mineral

reserves and do not have demonstrated economic viability in

accordance with CIM standards. GT cut-off varies by locality from

0.25%-0.50%.

West Slope: NI 43-101 resource estimate for the

JD-6, JD-7, JD-8 and JD-9 properties, completed by BRS Inc.

(effective March 2022); Historic resource estimate for the SR-11,

SR-13A, SM-18 N, SM-18 S, LP-21 and CM-25 properties, completed by

Behre Dolbear for Cotter Corporation (August 2007). Indicated and

Inferred resources using GT cut-off of 0.1 ft% eU3O8; historic

resources using cut-off of 0.05% U3O8.

Slick Rock: The PEA for Velvet-Wood/Slick Rock

was authored by Douglas L. Beahm, P.E., P.G. Principal Engineer, of

BRS Inc., Harold H. Hutson, P.E., P.G., Carl D. Warren, P.E., P.G.,

and Terence P. (Terry) McNulty, P.E., D. Sc., of T.P. McNulty and

Associates Inc. (May 6, 2023). Mineral resources are not mineral

reserves and do not have demonstrated economic viability in

accordance with CIM standards. GT cut-off varies by locality from

0.25%-0.50%.

Frank M: Historic Technical Report for Frank M,

prepared for Uranium One Americas, was authored by Douglas L.

Beahm, P.E., P.G. Principal Engineer of BRS Inc., and Andrew C.

Anderson, P.E., P.G. Senior Engineer/Geologist of BRS Inc., dated

June 10, 2008. Frank M historic resource used a GT cut-off of

0.25%.

Findlay Tank: Historic Technical Report for

Findlay Tank, prepared for Uranium One Americas, was authored by

Douglas L. Beahm, P.E., P.G. Principal Engineer of BRS Inc., dated

October 2, 2008. Findlay Tank historic resource used a grade

cut-off of 0.05% eU3O8.

Artillery Peak: Artillery Peak Exploration

Project, Mohave County, Arizona, 43-101 Technical Report, authored

by Dr. Karen Wenrich, October 12, 2010. GT cut-off varies by

locality from 0.01%-0.05%.

Marquez-Juan Tafoya: The Historical Technical

Report, Preliminary Economic Assessment, for Marquez-Juan Tafoya,

prepared for Uranium Energy Corporation, was authored by Douglas L.

Beahm, P.E., P.G., Principal Engineer of BRS Inc., and Terence P.

McNulty, P.E., PhD, McNulty & Associates, dated June 9, 2021.

The mineral resources are reported at a 0.60 GT cut-off.

On behalf of the Board of

DirectorsANFIELD ENERGY INC.Corey Dias, Chief

Executive Officer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.Contact:Anfield Energy, Inc.Clive

MostertCorporate

Communications780-920-5044contact@anfieldenergy.comwww.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING

STATEMENTS”. STATEMENTS IN THIS NEWS RELEASE THAT ARE NOT PURELY

HISTORICAL ARE FORWARD-LOOKING STATEMENTS AND INCLUDE ANY

STATEMENTS REGARDING BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS

REGARDING THE FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION

AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S MOST RECENT

ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER

PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS

INCLUDE RISKS ASSOCIATED FUTURE CAPITAL REQUIREMENTS AND THE

COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND

DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE

COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL

ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY

MANAGEMENT OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS

CONTENTS.

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Dec 2024 to Jan 2025

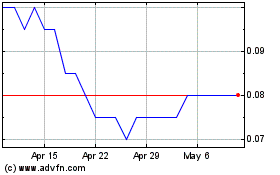

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Jan 2024 to Jan 2025