Bear Creek Mining Corporation (TSXV: BCM) (OTCQX:BCEKF) (BVL: BCM)

(“Bear Creek” or the “Company”) announces that its Board of

Directors (the “Board”) has initiated a comprehensive and thorough

strategic review process (the “Strategic Review”) to explore and

evaluate, on an expeditious basis, the strategic and financial

options available to the Company with the ultimate view of

enhancing value. The Board has also established a special committee

of independent directors (the “Special Committee”) to manage the

process, with a goal to complete the Strategic Review on an

expeditious basis. Mr. Milau will advise the Special Committee and

Board as the Company carries out the Strategic Review.

Strategic Review

The strategic and financial options that may be

considered under the Strategic Review include, but are not limited

to, recapitalization, a sale of all or some of the Company’s

assets, a merger, joint-venture, business combination or any

combination thereof. There is no deadline or definitive timetable

for completion of the Strategic Review. It is the Company’s current

intention not to disclose developments with respect to the

Strategic Review until the Board has approved a specific

transaction or otherwise determines that disclosure is necessary or

appropriate. The Company cautions that there are no assurances or

guarantees that the Strategic Review will result in a transaction

or, if a transaction is undertaken, the terms or timing of such a

transaction.

The Special Committee is expected to consist of

Catherine McLeod-Seltzer, Peter Mitchell and Kevin Morano, as

advised by Christian Milau. The Company has engaged BMO Capital

Markets to act as financial advisor to the Company with respect to

the Strategic Review and Sandstorm Gold Ltd. (“Sandstorm”) and

Equinox Gold Corp. (“Equinox”), both significant shareholders of

the Company, are supportive of the Strategic Review.

Eric Caba, President and CEO of the Company,

states: “We are grateful to our major stakeholder partners,

Sandstorm and Equinox, who share our opinion of the inherent

potential within both Mercedes and Corani. With their support, our

focus on unlocking the value of a fully permitted, world class

silver deposit at Corani and an incredibly prospective land package

at Mercedes continues with dedication and determination."

Nolan Watson, President and CEO of Sandstorm,

comments: “We see deep value in Bear Creek’s assets, which include

one of the world’s largest, fully-permitted silver deposits,

together with an operating gold-silver mine hosted within a large,

highly-prospective land package. We look forward to the Strategic

Review daylighting this value.”

Greg Smith, President and CEO of Equinox, adds,

“We believe the value of Bear Creek’s assets is underappreciated by

the markets and fully support the Strategic Review. Corani is a

world-class silver deposit and Mercedes is a cash flow generator

with substantial exploration potential. As shareholders of Bear

Creek, we look forward to seeing this value unlocked.”

The Board is also pleased to announce that Mr.

Christian Milau has been engaged as a strategic advisor to the

Board and Special Committee to assist with oversight of the

Strategic Review. Mr. Milau is a mining executive with over 25

years of expertise in finance, capital markets and mining including

extensive experience leading growth-oriented exploration,

development, and operating mining companies. Mr. Milau was the

Chief Executive Officer of Equinox Gold Corp. from 2016 to 2022,

leading the company through five mergers and acquisitions and

growing from a single-asset developer to a multi-mine producer with

eight operating mines. He originally commenced the

Chief Executive Officer role at Luna Gold Corp. (the predecessor

company to Equinox) after its only mine was put on care and

maintenance and subsequently led the team in recapitalizing and

reconstructing the original operating mine in Northern Brazil

(Aurizona), which provided the foundation for what is now Equinox,

a major gold producer in the Americas with a multi-billion dollar

market value. Prior to Equinox, he was Chief Executive Officer of

True Gold Mining Inc, which was sold to Endeavour Mining PLC for

approximately C$225 million after a recapitalization, mine

construction and turnaround process from 2015 to 2016. And Mr.

Milau served as Chief Financial Officer of Endeavour Mining PLC

from 2011 to 2015, during a period of significant growth through

multiple mergers and acquisitions, financings and mine construction

projects to create the foundation for what is now one of the

largest global gold producers. Mr. Milau currently serves as Chief

Executive Officer of Saudi Discovery Company, a private exploration

company, and is on the boards of New Gold Inc., Copper Standard

Resources, Arras Minerals Corporation, and Northern Dynasty

Minerals.

On behalf of the Board of Directors,Eric CabaPresident and Chief

Executive Officer

For further information contact:Barbara Henderson - VP Corporate

CommunicationsDirect:

604-628-1111E-mail: barb@bearcreekmining.comwww.bearcreekmining.com

Subscribe to Bear Creek Mining news

Cautionary Statement Regarding Forward-Looking

Statements

Information and statements contained in this

news release that are not historical facts are “forward-looking

information” within the meaning of applicable securities

legislation. Forward-looking information can often be identified by

forward-looking words such as “believe”, “goal”, “intention”, “may”

and “will” or the negative of these terms or similar words

suggesting future outcomes, or other expectations, beliefs, plans,

objectives, assumptions, intentions or statements about future

events or performance. Examples of forward-looking information in

this news release include, without limitation: the Strategic

Review; potential strategic and financial options available to the

Company; whether the Strategic Review will result in a transaction;

the terms or timing of any transaction resulting from the Strategic

Review; Equinox and Sandstorm’s continuing support of the Strategic

Review; and the ability of the Strategic Review to unlock value.

These forward-looking statements are provided as of the date of

this news release, and reflect predictions, expectations or beliefs

regarding future events based on the Company's beliefs at the time

the statements were made, as well as various assumptions made by

and information currently available to them.

In making the forward-looking statements

included in this news release, the Company has applied several

material assumptions, including, but not limited to assumptions

related to the Company’s operating results, business objectives,

goals and capabilities. There is no guarantee that the Strategic

Review will result in a transaction that will enhance the value of

the company. Although management considers the assumptions

underlying its forward-looking statement to be reasonable based on

information available to it, they may prove to be incorrect.

By their very nature, forward-looking statements

involve inherent risks and uncertainties, both general and

specific, and the risk exists that estimates, forecasts,

projections, and other forward-looking statements will not be

achieved or that assumptions on which they are based do not reflect

future experience. We caution readers not to place undue reliance

on these forward-looking statements as a number of important

factors could cause the actual outcomes to differ materially from

the expectations expressed in them. These risk factors may be

generally stated as the risk that the assumptions expressed above

do not occur, but may include additional risks as described in the

Company’s latest Annual Information Form, and other disclosure

documents filed by the Company on SEDAR+. The foregoing list of

factors that may affect future results is not exhaustive. Investors

and others should carefully consider the foregoing factors and

other uncertainties and potential events. The Company does not

undertake to update any forward-looking statement, whether written

or oral, that may be made from time to time by the Company or on

behalf of the Company, except as required by law.

In its last reported financial results as of

September 30, 2024, the Company had a working capital (current

assets minus current liabilities) deficiency of $93.2 million. The

Company’s interim condensed consolidated financial statements for

the three months ended September 30, 2024 were prepared following

accounting principles applicable to a going concern, which assumes

the Company will be able to continue operations for at least twelve

months from September 30, 2024 and will be able to realize its

assets and discharge its liabilities in the ordinary course of

operations. As of September 30, 2024, the Company does not have

sufficient funds to cover its working capital deficiency and fund

ongoing obligations and therefore its ability to continue as a

“going concern” is at risk.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

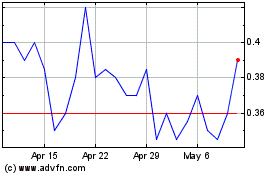

Bear Creek Mining (TSXV:BCM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Bear Creek Mining (TSXV:BCM)

Historical Stock Chart

From Mar 2024 to Mar 2025