Claim Post Resources Inc. Announces Non-Brokered Private Placement

04 July 2013 - 12:00AM

Marketwired Canada

Claim Post Resources Inc. (TSX VENTURE:CPS) (the "Company") is pleased to

announce that it intends to complete a new non-brokered private placement

offering (the "Offering") of up 24,000,000 common shares (the "Common Shares")

at a price of $0.05 per Common Share for a gross proceeds of up to $1,200,000.

The proceeds received from the Offering will be used (1) to carry out a minimum

1,000 meter drilling program towards completing a resource estimation of the

"Seymourville Frac Sand Project" in accordance with NI 43-101 rules; (2) to

complete a scoping study on the project (Preliminary Economic Assessment); which

will give Claim Post the ability to test market forward selling frac sand and

(3) for general working capital purposes.

All Shares issued will be subject to a four (4) month hold period from the date

of closing. The Offering is subject to the approval of the TSX Venture Exchange.

At closing of the Offering finder fees of 7% of the proceeds may be payable in

cash, and 7% finder warrants which are exercisable at the price of $0.10 per

share and expiring 36 months from the date of closing of the Offering.

The main driver for the very rapid, steadily increasing demand of frac sand is

the United States focus on becoming self-sufficient in energy (6 million barrels

new oil per day) by the year 2020 plus the reduction of green house gases. The

demand has been generated by the technology breakthrough of horizontal drilling

combined with multiple fracking. President Obama's climate plan will accelerate

natural gas (NG) usage as well. NG is targeted to replace coal (50% less CO2 and

no mercury) in electrical power generating plants plus there is now the drive to

covert trains and highway trucks from diesel to NG.

Natural sand is the least expensive proppant used in fracking. The demand for

natural frac sand continues to grow and is now 90% of the market. The US mined

and processed 31 million tons of frac sand in 2012 to produce about 2 million

barrels of new shale oil. (USGS and 2nd annual Frac Sand Conference Houston and

Hart Energy Graph DUG Conference Calgary 2013) The 2020 target of energy self

sufficiency requires about 6 million barrels of new oil per day (DUG Conference

Calgary 2013) thus requiring 3 times the amount of frac sand or approx. 90

million tons. The demand for NG continues to grow thus frac sand demand could

even be higher by 2020.

The Canadian frac sand market is growing at the same rate. Saskatchewan and

Alberta added 200,000 barrels of new light and medium crude oil per day in 2012

requiring about 2.8 million tonnes of frac sand. The political will to build NG

pipelines and major LNG export plants in British Columbia is increasing; NG

drilling will substantially increase the demand for frac sand. Canada's 4 frac

sand mines produced less than 2 million tonnes of sand in 2012; the remainder is

imported by rail from the US.

The largest cost component for frac sand is transportation. Talisman Energy at

the 2013 DUG Conference in Calgary presented a logistics slide for the Winn Bay

Mine at Hanson Lake, Saskatchewan. The frac sand is hauled 98 km by truck to

Flin Flon, Manitoba, railed 2,025 km by CN to Chetwynd, British Columbia and

trucked 120 km to the well. The premium white sand from Winn Bay is 1350 km

closer than the next closest supply; Talisman saving per well approx. $150,000.

Seymourville will have similar logistics and savings for any oil company

serviced by CN, CPR or the Warren Buffet owned BNSF railroad.

Charles Gryba, CEO of Claim Post Resources, stated: "We recognized 18 months ago

that there was a growing market for frac sand and that Claim Post could

transition to becoming an 'Oil Service Company' rather than just being an

exploration company. Timmins mines have used 100 million tons of natural sand

for mine backfill thus it was an easy transition to evaluate mining and

processing frac sand. Similarly, the First Nation people that live near the

proposed "Seymourville Frac Sand Project" have extensive experience as they

worked at mining and processing Black Island silica sand; started in 1928 and

closed in 2004. Others in the local communities have current permitting

experience as well as active mining careers. This financing is the first step in

funding the Seymourville Frac Sand Project."

Claim Post Resources Inc. is a Canadian based mineral exploration company that

is transitioning from gold and base metal exploration into now becoming a frac

sand supplier to Canadian oil and gas industry. Claim Post is a reporting issuer

in Ontario, Alberta and British Columbia. The Company now has a 100% ownership

right in 428 hectares of quarry sand leases and an option to purchase 100% in

the adjoining 306 hectares near Seymourville, Manitoba. The Company intends to

develop the "Seymourville Frac Sand Project" as a source of fracking sand for

the oil and gas industry in Western Canada. Claim Post also has mineral claims

in the Timmins area for gold and base metal exploration. There are 48,288,831

common shares of the Company issued and outstanding.

Statements in this release that are forward-looking reflect the Company's

current views and expectations with respect to its performance, business, and

future events. Such statements are subject to various risks and assumptions,

some, but not necessarily all, are disclosed elsewhere in the Company's periodic

filings with Canadian securities regulators. Such statements and information

contained herein represent management's best judgment as of the date hereof

based on the information currently available; however actual results and events

may vary significantly. The Company does not assume the obligation to update any

forward-looking statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Claim Post Resources Inc.

Charles Gryba

President and Director

416-801-6366

Claim Post Resources Inc.

Peter Gryba

Corporate Affairs

416-203-3776

www.claimpostresources.com

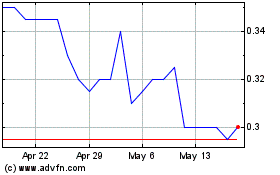

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Jan 2025 to Feb 2025

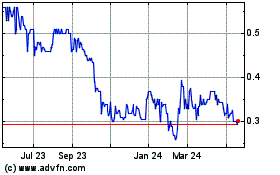

Canadian Premium Sands (TSXV:CPS)

Historical Stock Chart

From Feb 2024 to Feb 2025