DMG Blockchain Solutions Inc. (

TSXV:

DMGI) (“

DMG” or the

“

Company”) is pleased to announce that it has

filed its prospectus supplement dated November 14, 2024 (the

“

Prospectus Supplement”) to the Company’s short

form base shelf prospectus dated October 1, 2024 (the "

Base

Shelf Prospectus") in each of the provinces of Canada,

except Quebec, in respect of its previously announced overnight

marketed offering (the “

Offering”) of 28,310,000

units of the Company (the “

Units”) at a price of

$0.53 per Unit for aggregate gross proceeds of $15,004,300 through

a syndicate of underwriters led by Canaccord Genuity Corp. (the

“

Lead Underwriter”), including Roth Canada Inc.

and Ventum Financial Corp. (collectively, the

“

Underwriters”). The Offering will be conducted

pursuant to the terms of an underwriting agreement entered into by

the Company and the Underwriters on November 14, 2024 (the

“

Underwriting Agreement”).

Each Unit shall be comprised of one common share

of the Company (a “Unit Share”) and one common

share purchase warrant (a “Warrant”). Each Warrant

shall be exercisable into one common share of the Company (a

“Warrant Share”) for a period of 60 months from

the closing date of the Offering (the “Closing

Date”) at an exercise price of C$0.65 per Warrant Share,

subject to adjustment in certain events.

Pursuant to the Underwriting Agreement, the

Company has granted the Underwriters an over-allotment option (the

“Over-Allotment Option”) exercisable, in whole or

in part, in the sole discretion of the Lead Underwriter, to

purchase up to an additional 15% of the number of Units sold in the

Offering for up to 30 days from the Closing Date. The

Over-Allotment Option is exercisable to acquire Units, Unit Shares

and/or Warrants (or any combination thereof) at the discretion of

the Lead Underwriter, as more particularly described in the

Prospectus Supplement.

The Offering will be conducted in each of the

provinces of Canada, except Quebec, and may be conducted in the

United States on a private placement basis pursuant to an exemption

from the registration requirements of the United States Securities

Act of 1933, as amended (the “1933 Act”), and

applicable state securities laws, and in certain other

jurisdictions outside of Canada and the United States that are

mutually agreed to by the Company and the Underwriters, in each

case in accordance with all applicable laws of any such

jurisdiction and on a basis which does not give rise to any

requirement under the laws of any such jurisdiction to prepare

and/or file a prospectus, registration statement, offering

memorandum, or document having similar effect, or create any

ongoing compliance or continuous disclosure obligations for the

Company pursuant to the laws of such jurisdiction.

Closing of the Offering is expected to occur on

or about November 19, 2024. The TSX Venture Exchange has

conditionally approved the listing of the Unit Shares, the Warrants

and the Warrant Shares to be issued pursuant to the Offering,

including any Unit Shares, Warrants and/or Warrant Shares issued

upon exercise of the Over-Allotment Option, subject to customary

conditions.

Access to the Prospectus Supplement, the Base

Shelf Prospectus and any amendment thereto is provided in

accordance with securities legislation relating to procedures for

providing access to a shelf prospectus supplement, a base shelf

prospectus and any amendment. The Prospectus Supplement and the

Base Shelf Prospectus are each accessible under the Company’s

profile on SEDAR+ at www.sedarplus.ca. An electronic or paper copy

of the Prospectus Supplement, the Base Shelf Prospectus and any

amendment thereto, may be obtained, without charge, from the

Company at investors@dmgblockchain.com by providing the contact

with an email address or address, as applicable.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities being offered have not been, nor will they

be, registered under the 1933 Act or under any U.S. state

securities laws, and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the 1933 Act, and applicable U.S.

state securities laws.

Correction to Press Release dated

November 12, 2024

The Company’s press release issued on November

12, 2024 announcing the Offering included a minor error in the

statement of expected use of proceeds. As disclosed in the

Prospectus Supplement, the net proceeds of the Offering are

expected to be used in conjunction with the Company’s purchase of

six one-megawatt hydro mining containers, scheduled for delivery

and installation in the current quarter as well as for working

capital and other general corporate purposes.

About DMG Blockchain Solutions

Inc.

DMG is a sustainable, vertically integrated

blockchain and data center technology company that develops,

manages, and operates comprehensive platform solutions to monetize

the blockchain ecosystem. The company’s operations are driven by

two strategic pillars: Core and Core+, both unified by DMG’s

commitment to vertical integration and environmentally responsible

practices. DMG is the parent company of Systemic Trust Corporation,

which is focused on the custody of digital assets.

For more information on DMG Blockchain Solutions

visit: www.dmgblockchain.com Follow @dmgblockchain on X,

LinkedIn, Facebook and subscribe to DMG's YouTube channel.

For further information, please

contact:On behalf of the Board of

Directors,Sheldon Bennett, CEO &

DirectorTel: +1 778 300 5406Email:

investors@dmgblockchain.comWeb: www.dmgblockchain.com

For Investor

Relations:investors@dmgblockchain.com

For Media Inquiries:Chantelle

BorrelliHead of Communicationschantelle@dmgblockchain.com

Neither the TSX Venture Exchange nor its

Regulation Service Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Cautionary Note Regarding

Forward-Looking Statements

This press release may contain statements that

may be deemed to be "forward-looking statements" within the meaning

of applicable Canadian securities legislation. All statements,

other than statements of historical fact, included herein are

forward-looking information, including, but not limited to,

statements regarding: the anticipated terms of the Offering, the

anticipated terms of the Units and the Warrants, the anticipated

offering jurisdictions in respect of the Offering, the anticipated

timing of the closing of the Offering and the anticipated use of

the net proceeds of the Offering. Generally, forward-looking

information may be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect",

"proposed", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases, or by the use

of words or phrases which state that certain actions, events or

results may, could, would, or might occur or be achieved. This

forward-looking information reflects DMG’s current beliefs and is

based on information currently available to DMG and on assumptions

DMG believes are reasonable. These assumptions include, but are not

limited to assumptions regarding: the completion of the Offering,

on the anticipated terms thereof or at all; the ability of

blockchain technology to disrupt multiple industries; growth and

expectations of the Company’s Terra Pool, Core+ business strategy

and Bitcoin self-mining operations; the expansion of the Company’s

mining operations to additional sites; the purchase, delivery and

installation of additional Bitcoin mining rigs at the Christina

Lake Facility or any additional sites to be developed or acquired

by the Company; changes to market conditions; changes to the

regulatory climate; and such other factors and risks as disclosed

in the Company’s most recent annual information form, management’s

discussion and analysis and other documents filed from time to time

under the Company’s profile on SEDAR+ at www.sedarplus.ca.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance, or achievements of the Company or

its subsidiaries to be materially different from those expressed or

implied by such forward-looking information. Such risks and

uncertainties may include, but are not limited to: the risk that

the Company does not complete the Offering, on the anticipated

terms thereof or at all, prevailing capital markets conditions, the

risks and uncertainties associated with the digital currency and

blockchain industry, equipment failures, lack of supply of

equipment, power and infrastructure, general business, economic,

competitive, political and social uncertainties, changes in

legislation, including regulatory legislation, affecting digital

assets, and lack of qualified, skilled labor or loss of key

individuals. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated, or intended. Accordingly, readers should

not place undue reliance on forward-looking information. The

Company does not undertake to update any forward-looking

information, except in accordance with applicable securities

laws.

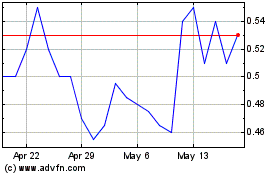

DMG Blockchain Solutions (TSXV:DMGI)

Historical Stock Chart

From Nov 2024 to Dec 2024

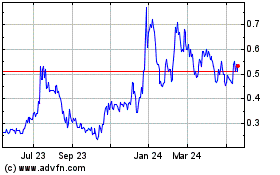

DMG Blockchain Solutions (TSXV:DMGI)

Historical Stock Chart

From Dec 2023 to Dec 2024