08/10/27 - TSX Venture Exchange Daily Bulletins

TSX VENTURE COMPANIES

AMADOR GOLD CORP. ("AGX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the second tranche of a Non-Brokered Private Placement announced September

9, 2008 and October 7, 2008:

Number of Shares: 3,800,000 flow-through shares

Purchase Price: $0.10 per share

Warrants: 3,800,000 share purchase warrants to

purchase 3,800,000 shares

Warrant Exercise Price: $0.15 for a two year period

Number of Placees: 5 placees

Finders' Fees: Research Capital Corp. - $3,600.00

Barrington Capital Corp. - $16,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

AVION RESOURCES CORP. ("AVR")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to a

Share Purchase Agreement (the "Agreement") dated October 8, 2008, between

Avion Resources Corp. (the "Company"), and Dynamite Resources Ltd. (the

"Purchaser"), whereby the Company has agreed to sell 50% of its 80%

interest in the Segala Gold Project (the "Property"), located in Mali,

West Africa. The Company will retain a 40% interest in the Property, with

the remaining 20% interest held by the Government of Mali.

Under the terms of the Agreement, the Purchaser has agreed a cash payment

of US$5,000,000. This amount is to be provided to Company as a short-term

loan. Upon satisfaction of certain conditions precedent, the principal

amount of the loan shall be applied as the purchase price for the

Transaction.

For further details, please refer to the Company's new release dated

October 9, 2008.

TSX-X

--------------------------------------------------------------------------

BACTECH MINING CORPORATION ("BM")

BULLETIN TYPE: Private Placement-Non-Brokered, Convertible Debenture/s

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced July 23, 2008:

Convertible Debenture $530,000

Conversion Price: The Company may redeem the Debentures at

any time during the first four months at

its option in which case the

debentureholder has the option to

convert 20% of the Debentures into

common shares at $0.10 per share. After

the four month period, the Debentures

are convertible into common shares at

the option of the holder at $0.10 per

share until August 7, 2010.

Maturity date: August 7, 2010

Warrants 2,650,000 warrants. Each warrant will

have a term of two years from the date

of issuance of the notes and entitle the

holder to purchase one common share. The

warrants are exercisable at the price of

$0.15 within two years from closing. The

Exchange notes that 1,060,000 warrants

will only become exercisable commencing

February 7, 2009 in the event that the

Company has not redeemed or repaid the

Debenture in full by that date. If the

Debenture is redeemed by the Company

(within four months) or they are repaid

within six months, these warrants will

expire and be void.

Interest rate: 18% per annum

Number of Placees: 9 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / Principal Amount

McGreen Partners P $30,000

Marie C. McFarlane P $30,000

Donald McFarlane P $30,000

Finder's Fee: $16,500 payable to Tim Gould

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

BLUE PARROT ENERGY INC. ("BPA")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: October 27, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 9,000,000 shares to settle outstanding debt for $450,000. This

settlement was announced in the Company's press release dated October 22,

2008.

Number of Creditors: 1 Creditor

TSX-X

--------------------------------------------------------------------------

CANADIAN PHOENIX RESOURCES CORP. ("CPH")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

Property-Asset or Share Purchase Agreement:

TSX Venture Exchange (the Exchange) has accepted for filing documentation

in respect of the Company's arm's length acquisition (the Acquisition) of

certain oil and natural gas assets (the Assets) from Blue Parrot Energy,

Inc. (Blue Parrot), an Exchange listed issuer, as reflected in a purchase

and sale agreement dated June 11, 2008, as entered into between the

Company and Blue Parrot. Pursuant to the Acquisition, the Company acquired

the Assets for a total consideration of $14,250,000, subject to

adjustments, which consideration was payable through the issuance of

95,000,000 units of the Company (the Units) at a deemed price of $0.15 per

Unit.

Each Unit consists of one common share of the Company (the Common Share)

and one-half of one share purchase warrant. Each whole warrant (the

Warrant) entitles the holder to acquire one Common Share at a price of

$0.20 per share until September 25, 2010. However, if the closing price of

Common Shares on the Exchange is at least $0.30 per share for a minimum of

at least 30 trading days, the Company may reduce the exercise period to a

date which is 30 days following the date on which the holder of the

Warrants receives written notice of the shortened exercise period.

For further information, please refer to the Management Proxy and

Information Circular of the Company dated as of June 30, 2008, news

releases of the Company dated June 12 and October 1, 2008, all as filed on

SEDAR, as well as Exchange Bulletins dated October 8 and October 15, 2008,

in respect of Blue Parrot's disposition.

TSX-X

--------------------------------------------------------------------------

CAPELLA RESOURCES LTD. ("CPS")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange Inc. (the "Exchange") has accepted for filing

documentation in connection with a Royalty Purchase Agreement among

Capella Resources Ltd. (the "Company"), Compania Minera Cerro El Diablo

("CMCED"), a wholly-owned subsidiary of the Company, International Mineral

Resources Ltd. ("IMR"), and Roberto Alarcon Bittner ("Bittner") (IMR and

Bittner together the "Royalty Holders") dated August 29, 2008 (the

"Agreement"). Under the Agreement, CMCED will have the right to reduce the

net smelter return royalty on the Company's 100 interest in the Dorado

(Lajitas) Gold Property located in Northern Chile from 5% to 2% (the

"Royalty Reduction Option"). Pursuant to the Agreement the Company, on

behalf of CMCED, is required to pay, within 30 days of this Bulletin,

CDN$100,000, or at the election of the Company the equivalent value in

common shares of the Company at a deemed value of $0.08 per common share

(being 1,250,000 common shares) to the Royalty Holders (half to each of

IMR and Bittner). CMCED may exercise the Royalty Reduction Option, on or

before August 29, 2011, by making a further cash payment of US$3,000,000

(the "Option Payment") to the Royalty Holders (half to each of IMR and

Bittner). The Option Payment is subject to the approval of the

shareholders of the Company and the Company advises that it will seek the

same at its next Annual General Meeting and, in any event, prior to the

exercise of the Royalty Reduction Option.

Insider / Pro Group Participation: IMR is legally and beneficially owned

by Richard L. Bachman. Mr. Bachman is currently a director and an officer

of the Company.

TSX-X

--------------------------------------------------------------------------

DYNAMITE RESOURCES LTD. ("DNR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to a

Share Purchase Agreement (the "Agreement") dated October 8, 2008, between

Dynamite Resources Ltd. (the "Company"), and Avion Resources Corp (the

"Vendor"), whereby the Company has agreed to acquire a 40% interest in the

Segala Gold Project (the "Property"), located in Mali, West Africa. The

Vendor will retain a 40% interest in the Property, with the remaining 20%

interest held by the Government of Mali.

Under the terms of the Agreement, the Company has agreed to a cash payment

of US$5,000,000. This amount is to be provided to Vendor as a short-term

loan. Upon satisfaction of certain conditions precedent, the principal

amount of the loan shall be applied as the purchase price for the

Transaction.

For further details, please refer to the Company's new release dated

October 9, 2008.

TSX-X

--------------------------------------------------------------------------

IRONHORSE OIL & GAS INC. ("IOG")

BULLETIN TYPE: Private Placement-Brokered

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Brokered Private Placement announced October 2, 2008:

Number of Shares: 1,683,000 flow-through shares

Purchase Price: $2.08 per share

Number of Placees: 6 placees

No Insider / Pro Group Participation

Agents: Dundee Securities Corporation

Blackmont Capital Inc.

Agent's Fees: Dundee Securities Corporation -

$136,524.96 cash

Blackmont Capital Inc. - $73,513.44 cash

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

--------------------------------------------------------------------------

MACMILLAN GOLD CORP. ("MMG")

BULLETIN TYPE: Halt

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

Effective at the open, October 27, 2008, trading in the shares of the

Company was halted pending an announcement; this regulatory halt is

imposed by Investment Industry Regulatory Organization of Canada, the

Market Regulator of the Exchange pursuant to the provisions of Section

10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

MAYA GOLD & SILVER INC. ("MYA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced on July 11, 2008:

Number of Shares: 540,000 shares

Purchase Price: $0.25 per share

Warrants: 270,000 share purchase warrants to

purchase 270,000 shares

Warrant Exercise Price: $0.35 for a one year period

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider equals Y /

Name Pro Group equals P / Number of Shares

172169 Canada Inc.

(Martin Wong) Y 350,000

The Company issued a press release on October 16, 2008 to announce this

private placement.

MAYA OR & ARGENT INC. (" MYA ")

TYPE DE BULLETIN : Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN : Le 27 octobre 2008

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 11

juillet 2008 :

Nombre d'actions : 540 000 actions ordinaires

Prix : 0,25 $ par action ordinaire

Bons de souscription : 270 000 bons de souscription permettant

de souscrire a 270 000 d'actions

Prix d'exercice des bons : 0,35 $ par action pour une periode de 12

mois.

Nombre de souscripteurs : 5 souscripteurs

Participation des inities / Groupe Pro :

Initie egale Y /

Nom Groupe Pro egale P / Nombre d'actions

172169 Canada Inc.

(Martin Wong) Y 350,000

La societe a emis un communique de presse le 16 octobre 2008 annoncant la

cloture du placement prive precite.

TSX-X

--------------------------------------------------------------------------

MINERAL HILL INDUSTRIES LTD. ("MHI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: October 27, 2008

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 2, 2008:

Number of Shares: 2,001,363 shares

Purchase Price: $0.11 per share

Warrants: 1,000,680 share purchase warrants to

purchase 1,000,680 shares

Warrant Exercise Price: $0.15 for a one year period

$0.18 in the second year

Number of Placees: 9 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

Dean Duke P 272,727

Patrick H. Pettman Y 50,000

Merfin Management Limited

(Dieter Peter & Vera Kaiser) Y 795,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

MINT TECHNOLOGY CORP. ("MIT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced June 24, 2008:

Number of Shares: 2,600,000 shares

Purchase Price: $0.20 per share

Warrants: 1,300,000 share purchase warrants to

purchase 1,300,000 shares

Warrant Exercise Price: $0.35 for a one year period

Number of Placees: 11 placees

Insider / Pro Group Participation:

Insider equals Y /

Name ProGroup equals P / # of Shares

169199 Canada Inc. (J. Alexander) P 250,000

Finder's Fee: 160,000 finder's warrants, each

exercisable into 1 common share at a

price of $0.20 for a two year period,

payable to Revol Holdings Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

PRIMELINE ENERGY HOLDINGS INC. ("PEH")

BULLETIN TYPE: Halt

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

Effective at 6:17 a.m. PST, October 27, 2008, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

PRIMELINE ENERGY HOLDINGS INC. ("PEH")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

Effective at 8:30 a.m. PST, October 27, 2008, shares of the Company

resumed trading, an announcement having been made over Marketwire.

TSX-X

--------------------------------------------------------------------------

SEAMILES LIMITED ("SEE")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue up to 300,000 shares at a deemed value of US$1.17 to settle

outstanding debt for US$350,000.

Number of Creditors: 1 Creditor

For further information, please refer to the Company's press releases

dated October 21, 2008 and October 27, 2008.

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

SILVERBIRCH INC. ("SVB")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 562,500 shares at a deemed value of $0.08 per share and 281,250

share purchase warrants to settle outstanding debt for $45,000.

Number of Creditors: 1 Creditor

Warrants: 281,250 share purchase warrants to

purchase 281,250 shares

Warrant Exercise Price: $0.18 for a two year period

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

TERRA FIRMA CAPITAL CORPORATION ("TII.P")

BULLETIN TYPE: CPC-Filing Statement, Resume Trading

BULLETIN DATE: October 27, 2008

TSX Venture Tier 2 Company

1. Filing Statement

TSX Venture Exchange has accepted for filing the Company's CPC Filing

Statement dated October 23, 2008, for the purpose of filing on SEDAR.

2. Resume Trading

Further to TSX Venture Exchange Bulletins dated May 23, 2008 and June 2,

2008, and the Company press release dated June 3, 2008, effective at the

opening Tuesday, October 28, 2008, the common shares of the Company will

resume trading.

TSX-X

--------------------------------------------------------------------------

NEX COMPANIES

META HEALTH SERVICES INC. ("MHS.H")

BULLETIN TYPE: Reinstated for Trading

BULLETIN DATE: October 27, 2008

NEX Company

Further to TSX Venture Exchange Bulletin dated December 1, 2006, the

Exchange has been advised that the Cease Trade Order issued by the Ontario

Securities Commission on December 1, 2006 has been revoked. Please refer

to the Company's press release dated October 24, 2008 for further

information.

Effective at the opening Tuesday, October 28, 2008, trading will be

reinstated in the securities of the Company.

TSX-X

--------------------------------------------------------------------------

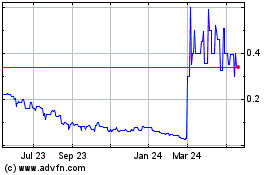

iMetal Resources (TSXV:IMR)

Historical Stock Chart

From Dec 2024 to Jan 2025

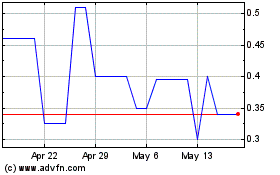

iMetal Resources (TSXV:IMR)

Historical Stock Chart

From Jan 2024 to Jan 2025