- M&P's working interest production for the first nine

months of 2023: 27,944 boepd

- M&P working interest production of 15,710 bopd in Gabon, an

increase of 10% compared to the first nine months of 2022

- M&P working interest production of 3,957 bopd in Angola, up

3% compared to the first nine months of 2022

- M&P working interest gas production of 49.7 mmcfd in

Tanzania, up 15% compared to the first nine months of 2022

- Sales of $495 million for the first nine months of 2023

- The average sale price of oil was $77.8/bbl for the period,

down 26% on the first nine months of 2022 ($105.5/bbl)

- Valued production of $449 million for the first nine months of

2023

- Drilling activities contributed $17 million over the period,

while third-party oil marketing contributed $26 million

- Update on completion of ongoing M&A transactions

- In Gabon, discussions are underway with the authorities to

obtain the necessary approvals for the acquisition of Assala;

completion of the transaction is still expected between the end of

Q4 2023 and Q1 2024

- In Tanzania, discussions are continuing with TPDC for the

acquisition of Wentworth Resources

- Further reduction in net debt and redistribution to

shareholders

- Net debt of $181 million at 30 September 2023, down $19 million

over the first nine months of 2023 ($200 million at 31 December

2022)

- Dividend of €0.23 per share ($49 million) paid in early

July

M&P notes the release last night of General License 44

issued by the United States' Office of Foreign Assets Control

(OFAC) on Venezuela's oil and gas sector as a result of the

agreement reached between the Venezuelan government and the

Venezuelan opposition. Due to the timing of this publication, it

has not been possible to include this piece of information in this

press release. M&P is reviewing implications for its activities

in Venezuela and will publish a specific announcement on this

matter shortly.

Regulatory News:

Maurel & Prom (Paris:MAU):

Key indicators for the first nine

months of 2023

Q1

2023

Q2

2023

Q3

2023

9 months

2023

9 months

2022

Change 2023 vs. 2022

M&P working interest

production

Gabon (oil)

bopd

15,839

15,719

15,574

15,710

14,308

+10%

Angola (oil)

bopd

3,424

4,097

4,341

3,957

3,832

+3%

Tanzania (gas)

mmcfd

46.7

47.6

54.5

49.7

43.3

+15%

Total

boepd

27,054

27,755

29,003

27,944

25,359

+10%

Average sale price

Oil

$/bbl

75.2

74.0

83.3

77.8

105.5

-26%

Gas

$/mmBtu

3.76

3.77

3.76

3.76

3.50

+8%

Sales

Gabon

$ million

105

106

121

332

403

-18%

Angola

$ million

19

22

27

68

83

-19%

Tanzania

$ million

18

18

13

49

50

-0%

Valued production

$ million

142

147

160

449

536

-16%

Drilling activities

$ million

5

6

6

17

5

Third-party oil marketing

$ million

–

–

26

26

–

Restatement for lifting imbalances and

inventory revaluation

$ million

42

-43

3

2

-34

Consolidated sales

$ million

190

109

196

495

506

-2%

M&P’s working interest production in the first nine months

of 2023 was 27,944 boepd. The average sale price of oil was

$77.8/bbl for the period, a decrease of 26% from 2022.

The Group’s valued production (income from production

activities, excluding lifting imbalances and inventory revaluation)

was $449 million in the first nine months of 2023. It should be

noted that the change in valued production in Tanzania has

decoupled from the change in production due to the desaturation of

recoverable costs.

After taking into account income from drilling activities ($17

million), third-party oil marketing ($26 million in sales,

corresponding to 300,000 barrels sold in Angola), and the

restatement of lifting imbalances, net of inventory revaluation ($2

million), consolidated sales for the first nine months of 2023

totaled $495 million.

Production activities

M&P working interest oil production (80%) on the Ezanga

permit amounted to 15,710 bopd for the first nine months of 2023,

up 10% on 2022.

A small discovery was made on the Ezal structure. It was

immediately connected and put into production. An injector well was

drilled in sequence to complete the development.

The political changes that have taken place in Gabon since the

end of August have not caused any disruption to the Group’s

operations in the country. Neither production at the Ezanga site

nor operations at the Port-Gentil head office have been

affected.

M&P’s working interest gas production (48.06%) on the Mnazi

Bay permit in Tanzania was 49.7 mmcfd for the first nine months of

2023, up 15% compared to 2022.

M&P working interest production rose to 54.5 mmcfd in the

third quarter (gross production of 113.5 mmcfd for the Mnazi Bay

asset) thanks to the significant increase in production potential

resulting in particular from well interventions carried out in

2023.

The desaturation of recoverable costs took place as expected in

June 2023, with a notable impact on production sharing. As the

Group has now recovered its past costs, the majority of production

is now recognised as “profit gas”, with the State taking around 70%

of this portion.

M&P working interest production from Blocks 3/05 (20%) and

3/05A (26.7%) amounted to 3,957 bopd for the first nine months of

2023, up 15% compared to 2022.

The new, improved tax terms obtained as part of the extension of

the Block 3/05 license until 2040 came into force on 1 October

2023.

Information on the ongoing acquisition

of Assala

Discussions with the Gabonese authorities are currently underway

to obtain the necessary approvals to finalise the acquisition of

Assala announced on 15 August. Several constructive meetings have

been held with the relevant ministries and administrations since

the appointment of the transition government in early

September.

The administrative procedures required to obtain the approval of

CEMAC (the Economic and Monetary Community of Central Africa) are

being carried out in parallel.

Completion of the transaction is expected between the end of Q4

2023 and Q1 2024.

Information on the current offer for

Wentworth Resources

Discussions are ongoing with the Tanzanian authorities, notably

with TPDC, to reach an agreement in order to complete the

acquisition of Wentworth Resources by M&P.

The completion of the transaction is now expected during Q4

2023. It is worth noting that the current offer for Wentworth

Resources has a longstop date as at 31 December 2023.

Financial position

Available liquidity at 30 September 2023 stood at $112 million,

covering only the cash position, as the $67 million RCF tranche was

fully drawn down. This excludes the amount placed in escrow under

the offer for Wentworth Resources announced on 5 December 2022,

which amounted to $79 million at 30 September 2023.

Gross debt stood at $292 million at 30 September 2023 (versus

$337 million at 31 December 2022), including $217 million in bank

loans and $75 million in shareholder loans. In total, the Group

repaid $45 million in gross debt in the first nine months of

2023.

The $183 million increase in M&P’s existing bank loan,

announced in connection with the acquisition of Assala and

originally scheduled to be drawn down at the end of August 2023,

has been postponed. Finalisation of this increase is underway, and

should take place by the end of 2023.

Net debt therefore stood at $181 million at 30 September 2023,

down $19 million on 31 December 2022 ($200 million), after the

payment of $49 million in dividends in July (€0.23 per share) and

the payment of a $20 million deposit in August in connection with

the pending acquisition of Assala.

Français

English

pieds cubes

pc

cf

cubic feet

millions de pieds cubes par

jour

Mpc/j

mmcfd

million cubic feet per day

milliards de pieds cubes

Gpc

bcf

billion cubic feet

baril

B

bbl

barrel

barils d’huile par jour

b/j

bopd

barrels of oil per day

millions de barils

Mb

mmbbls

million barrels

barils équivalent pétrole

bep

boe

barrels of oil equivalent

barils équivalent pétrole par

jour

bep/j

boepd

barrels of oil equivalent per day

millions de barils équivalent

pétrole

Mbep

mmboe

million barrels of oil equivalent

For more information, please visit www.maureletprom.fr/en/

This document may contain forecasts regarding

the financial position, results, business and industrial strategy

of Maurel & Prom. By nature, forecasts contain risks and

uncertainties to the extent that they are based on events or

circumstances that may or may not happen in the future. These

forecasts are based on assumptions we believe to be reasonable, but

which may prove to be incorrect and which depend on a number of

risk factors, such as fluctuations in crude oil prices, changes in

exchange rates, uncertainties related to the valuation of our oil

reserves, actual rates of oil production and the related costs,

operational problems, political stability, legislative or

regulatory reforms, or even wars, terrorism and sabotage.

Maurel & Prom is listed for trading on

Euronext Paris CAC All-Tradable – CAC Small – CAC Mid & Small –

Eligible PEA-PME and SRD Isin FR0000051070/Bloomberg MAU.FP/Reuters

MAUP.PA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231019435765/en/

Maurel & Prom Press, shareholder and investor

relations Tel: +33 (0)1 53 83 16 45 ir@maureletprom.fr

NewCap Financial communications and investor

relations/Media relations Louis-Victor Delouvrier/Nicolas Merigeau

Tel: +33 (0)1 44 71 98 53/+33 (0)1 44 71 94 98

maureletprom@newcap.eu

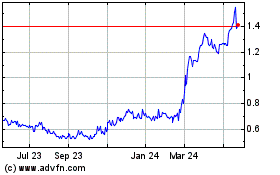

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

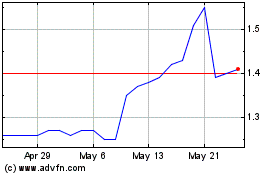

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2024 to Jan 2025