Montage Gold Corp. (“Montage” or the “Company”)

(TSXV: MAU, OTCQX: MAUTF) is pleased to announce the implementation

of a revenue protection programme with the goal of securing

significant margins to enhance its financial flexibility and

achieve its strategic objectives at the onset of production from

its Koné project.

Martino De Ciccio, CEO of Montage, commented:

“We are pleased to complement our recently secured financing

package with the successful execution of our revenue protection

programme which takes advantage of unprecedented put option

pricing. By entering into put options we have secured a minimum

gold price of US$2,500/oz on 400,000 ounces over the 2027-2028

period, while retaining full upside to the gold price. As prudent

allocators of capital, this programme positions us well to generate

significant margins and deliver on our strategic objectives for the

benefit of all stakeholders.”

The voluntary revenue protection programme

consists of the purchase of 400,000 ounces of put options at a

strike price of US$2,500/oz, for a total cash consideration of

US$52.7 million, equally spread every month across the January 2027

to September 2028 period, which can be cash or physically

settled.

The programme has been designed to protect

Montage’s margins during its peak reimbursement phase as it has

committed to deliver 19.5% of its payable gold to Wheaton Precious

Metal, at a transfer price of circa 20% of the spot price, until

400,000 ounces of gold have been delivered (the “First Dropdown

Threshold”), thereafter dropping to 10.8% until an additional

130,000 ounces of gold have been delivered (the “Second Dropdown

Threshold”).

Securing strong margins during the First

Dropdown Threshold is expected to provide the Company optionality

to accelerate its deleveraging by delivering more than its minimum

required commitments under the Wheaton Stream and by exercising its

buyback options under the Zijin Fully Redeemable Stream1.

Furthermore, as the programme consists solely of put options,

Montage retains the financial flexibility to later offset its

initial cash outlay by converting the programme into a zero-cost

collar or through the early monetization of the put options,

based on its assessment of market conditions and its capital

allocation priorities.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

CONTACT INFORMATION

|

For Investor Relations Inquiries:Jake CainStrategy

& Investor Relations Managerjcain@montagegold.com+44 7788 687

567 |

For Media Inquiries:John VincicOakstrom

Advisorsjohn@oakstrom.com+1-647-402-6375 |

For Regulatory Inquiries:Kathy LoveCorporate

Secretaryklove@montagegold.com+1-604-512-2959 |

ABOUT MONTAGE GOLD CORP.

Montage Gold Corp. (TSXV: MAU) is a Canadian-listed company focused

on becoming a premier multi-asset African gold producer, with its

flagship Koné project, located in Côte d’Ivoire, at the forefront.

Based on the Feasibility Study published in 2024, the Koné project

has an estimated 16-year mine life and sizeable annual production

of +300koz of gold over the first 8 years. Over the course of 2024,

the Montage management team will be leveraging their extensive

track record in developing projects in Africa to progress the Koné

project towards a construction launch.

TECHNICAL DISCLOSUREThe Koné

and Gbongogo Main Mineral Resource Estimates were carried out by

Mr. Jonathon Abbott of Matrix Resource Consultants of Perth,

Western Australia, who is considered to be independent of Montage

Gold. Mr. Abbott is a member in good standing of the Australian

Institute of Geoscientists and has sufficient experience which is

relevant to the commodity, style of mineralization under

consideration and activity which he is undertaking to qualify as a

Qualified Person under NI 43–101.

The Mineral Reserve Estimate was carried out by

Ms. Joeline McGrath of Carci Mining Consultants Ltd., who is

considered to be independent of Montage Gold. Ms. McGrath is a

member in good standing of the Australian Institute of Mining and

Metallurgy and has sufficient experience which is relevant to the

work which she is undertaking to qualify as a Qualified Person

under NI 43–101.

For further details of the data verification

undertaken, exploration undertaken and associated QA/QC programs,

and the interpretation thereof, and the assumptions, parameters and

methods used to develop the Mineral Reserve Estimate for the Koné

Gold Project, please see the UFS, entitled "Koné Gold Project, Côte

d'Ivoire Updated Feasibility Study National Instrument 43-101

Technical Report" and filed on SEDAR+ at www.sedarplus.ca. Readers

are encouraged to read the UFS in its entirety, including all

qualifications, assumptions and exclusions that relate to the

details summarized in this news release. The UFS is intended to be

read as a whole, and sections should not be read or relied upon out

of context.

QUALIFIED PERSONS STATEMENTThe

scientific and technical contents of this press release have been

verified and approved by Silvia Bottero, BSc, MSc, a Qualified

Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of

Montage, is a registered Professional Natural Scientist with the

South African Council for Natural Scientific Professions (SACNASP),

a member of the Geological Society of South Africa and a Member of

AusIMM.

FORWARD LOOKING STATEMENTSThis

press release contains certain forward-looking information and

forward-looking statements within the meaning of Canadian

securities legislation (collectively, “Forward-looking

Statements”). All statements, other than statements of historical

fact, constitute Forward-looking Statements. Words such as “will”,

“intends”, “proposed” and “expects” or similar expressions are

intended to identify Forward-looking Statements. Forward-looking

Statements in this press release include statements related to

redemption of the Zijin Stream; ability to deleverage more quickly;

securing significant margins; ability to later offset its initial

cash outlay by converting the programme into a zero-cost collar or

early monetization of the put options; the Company’s compliance

with certain ESG matters; the Company’s mineral reserve and

resource estimates; the timing and amount of future production and

the anticipated production costs from the Koné Gold Project;

anticipated mining and processing methods of the Koné Gold Project;

anticipated mine life of the Koné Gold Project; targeted

improvements in the production profile; expected timing of

commencement and completion of our stated drill programs in 2024;

results of the drill programs including targeted additions to the

estimated mineral resources at the Koné Gold Project, and the

timing thereof; the establishment of satellite deposits and the

development of these deposits; expected recoveries and grades of

the Koné Gold Project; timing in respect of the commencement of

construction, and the length of construction, of the mining

operations at the Koné Gold Project; timing and amount of necessary

financing related to the mining operations at the Koné Gold

Project; and timing for permits and concessions, including that the

Company will receive all approvals necessary to build the project

and exploration plans for 2024.

Forward-looking Statements involve various risks

and uncertainties and are based on certain factors and assumptions.

There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ

materially from those anticipated in such statements. Important

factors that could cause actual results to differ materially from

the Company's expectations include uncertainties inherent in the

preparation of mineral reserve and resource estimates and

definitive feasibility studies such as the Mineral Reserve Estimate

and the UFS, and in delineating new mineral reserve and resource

estimates, including but not limited to, assumptions underlying the

production estimates not being realized, incorrect cost

assumptions, unexpected variations in quantity of mineralized

material, grade or recovery rates being lower than expected,

unexpected adverse changes to geotechnical or hydrogeological

considerations, or expectations in that regard not being met,

unexpected failures of plant, equipment or processes, unexpected

changes to availability of power or the power rates, failure to

maintain permits and licenses, higher than expected interest or tax

rates, adverse changes in project parameters, unanticipated delays

and costs of consulting and accommodating rights of local

communities, environmental risks inherent in the Côte d’Ivoire,

title risks, including failure to renew concessions, unanticipated

commodity price and exchange rate fluctuations, delays in or

failure to receive access agreements or amended permits, and other

risk factors set forth in the Company’s 2023 Annual Information

Form available at www.sedarplus.ca, under the heading “Risk

Factors”. The Company undertakes no obligation to update or revise

any Forward-looking Statements, whether as a result of new

information, future events or otherwise, except as may be required

by law. New factors emerge from time to time, and it is not

possible for Montage to predict all of them, or assess the impact

of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any Forward-looking Statement. Any

Forward-looking Statements contained in this press release are

expressly qualified in their entirety by this cautionary

statement.

NON-GAAP MEASURES This

press release includes certain terms or performance measures

commonly used in the mining industry that are not defined under

International Financial Reporting Standards (“IFRS”), including

AISC or “all-in sustaining costs” per payable ounce of gold sold

and per tonne processed and mining, processing and operating costs

reported on a unit basis. Non-GAAP measures do not have any

standardized meaning prescribed under IFRS and, therefore, they may

not be comparable to similar measures employed by other companies.

The Company discloses “all-in sustaining costs” and other unit

costs because it understands that certain investors use this

information to determine the Company’s ability to generate earnings

and cash flows for use in investing and other activities. The

Company believes that conventional measures of performance prepared

in accordance with IFRS, do not fully illustrate the ability of

mines to generate cash flows. The measures, as determined under

IFRS, are not necessarily indicative of operating profit or cash

flows from operating activities. The measures cash costs and all-in

sustaining costs and unit costs are considered to be key indicators

of a project’s ability to generate operating earnings and cash

flows. Non-GAAP financial measures should not be considered in

isolation as a substitute for measures of performance prepared in

accordance with IFRS and are not necessarily indicative of

operating costs, operating profit or cash flows presented under

IFRS. Readers should also refer to our management’s discussion and

analysis, available under our corporate profile at www.sedarplus.ca

for a more detailed discussion of how we calculate such

measures.

__________________________

1 For more information on the Wheaton and Zijin streams, please

consult the comprehensive $825 million financing package announced

on October 23, 2024.

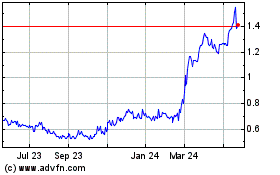

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

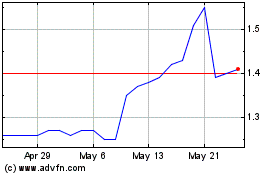

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2024 to Jan 2025