Montage Gold Corp. (“Montage” or the “Company”)

(TSXV: MAU, OTCQX: MAUTF) is pleased to announce that it has

launched the construction of its Koné project in Côte d’Ivoire

(“Koné” or the “Project”) with first gold production scheduled for

Q2-2027. To mark this significant milestone, a groundbreaking

ceremony was held at Koné today with a strong presence from

government officials and local communities, demonstrating their

support for the project given its significant social and economic

benefits.

Significant progress is being made to rapidly

advance and derisk the project as early works are well underway and

major construction works are set to commence in the coming weeks,

once further construction equipment arrives to site. The

engineering, procurement and construction management (“EPCM”)

contract has been awarded to Lycopodium Minerals Pty Ltd

(“Lycopodium”), with a number of tasks to be self-performed by

Montage’s experienced in-house construction team which already

totals approximately 350 people. Montage, together with Lycopodium,

have completed a comprehensive engineering review of Montage’s

Updated Feasibility Study (“UFS”) published in January 2024 which

has resulted in the optimization of several key design parameters

to enhance the crushing and milling circuit and improve the

efficiency of the overall operation. The project is fully funded

with significant headroom with upfront capex expected to be US$835

million while Montage has in excess of US$900 million in liquidity

sources.

Martino De Ciccio, CEO of Montage, commented:

“We are very pleased to announce the commencement of construction

at the Koné project in Côte d'Ivoire, marking a significant

milestone in our journey to becoming a premier African gold

producer and the culmination of this year’s efforts.

Our ability to rapidly advance the project is

driven by the strong partnerships we have built, based on a win-win

approach, with local stakeholders, strategic investors, financiers,

suppliers, and contractors. We are also grateful for the dedication

of our experienced management team, and we thank everyone involved

for their commitment.

Looking ahead, we are excited to continue

unlocking value for all our stakeholders by advancing our

construction efforts, while also creating value through exploration

and by expanding our focus on social, health, education, and

economic programmes for our local communities.”

Peder Olsen, President and Chief Development

Officer of Montage, commented: "We are excited to launch the

construction of the Koné project, which marks the culmination of

our efforts to optimize key design parameters aimed at enhancing

the crushing and milling circuit and improving the efficiency of

the overall operation. Additionally, to mitigate construction

risks, we have strategically placed orders for long-lead items,

securing both price stability and timely delivery.

Given the high quality of our project and our

intention to create a leading African gold producer, we are proud

to have assembled a highly experienced and skilled construction

team. Many of these team members have worked with me to

successfully deliver four projects over the last decade in West

Africa, including two in Côte d’Ivoire.

I would like to take this opportunity to thank

everyone who has contributed to getting us to this point. As the

ideal time to begin construction is after the rainy season, we are

excited to have commenced early works at the optimal time. We now

look forward to delivering on our construction schedule and

unlocking significant value for all stakeholders."

GROUNDBREAKING CEREMONY

Earlier today, a groundbreaking ceremony was

held at Koné with over 2,000 people present including a strong

presence from government officials and local communities,

demonstrating their support for the project, as shown in Figure 1

below. At the ceremony, Mamadou Sangafowa-Coulibaly, Côte

d’Ivoire’s Mines, Petroleum and Energy Minister reiterated the

country’s support for the mining sector and the Koné project in

particular, outlining the significant social and economic benefits

to all stakeholders.

Figure 1: Groundbreaking

ceremony

PROJECT CONSTRUCTION UPDATE

EPCM awardThe Company has

awarded the engineering, procurement and construction management

(“EPCM”) contract to Lycopodium Minerals Pty Ltd (“Lycopodium”).

Lycopodium’s involvement in the project commenced in 2018 and were

the engineers for Montage’s Definitive Feasibility Study (“DFS”)

and Updated Feasibility Study (“UFS”). In addition, Lycopodium has

a strong track record in West Africa and in particular in Côte

d’Ivoire, having recently completed construction of Fortuna Mining

Corp’s Séguéla project in 2023 and Endeavour Mining Plc’s Lafigue

mine in 2024, both on time and on budget. Other projects in Côte

d’Ivoire completed by Lycopodium include the Yaouré project for

Perseus Mining Ltd, and Endeavour Mining Plc’s Ity CIL and Agbaou

projects. Integrating fully into the owner’s team, Lycopodium is

responsible for providing Montage with support on the engineering,

design, procurement, construction management and commissioning of

the processing plant and process related infrastructure.

Order of long-lead itemsA

significant number of long lead item orders have been committed to

by Montage, securing pricing for equipment and services on initial

capital of over US$150 million, with key orders placed

including:

- Ball mill,

high-pressure grinding rolls (“HPGR”) and crushers (primary and

secondary)

- Thickeners and

CIL tanks

- Key earthworks

mobile equipment leases

- Early camp

facilities are complete while construction of the permanent camp is

underway which will also accommodate construction personnel

Early works Early works were

launched in Q4-2024 and are progressing well with the following key

highlights:

- No lost time

incidents (“LTIs”), with over 138,890 workhours completed since the

commencement of early works

- In line with its

commitment to local content, Montage has partnered with the

government-accredited Lycée Technique de Mankono to deliver

practical vocational training programs tailored to the needs of the

Koné project for an initial 80 individuals. The first group of

participants, drawn from impacted local communities, has

successfully completed its training and is now commencing

employment with Montage. This first group includes steel fixers,

building electricians, masons, carpenters and plumbers. The second

group of trainees began its practical training on October 21,

2024

- In addition,

Montage is pleased to be using local contractors for buildings,

earthworks and camp electricals

- Montage has

initiated a literacy and numeracy program for individuals in nearby

affected villages. Currently over 500 participants are attending

the programme which aims to empower local communities with

essential skills to pursue employment and improve access to

economic opportunities and enhance long-term socio-economic

resilience

- Land

compensation and resettlement activities have begun with access

secured to all major early works areas including the plant, camp,

water storage facility and the tailings storage facility

(“TSF”)

- The resettlement

site for the relocation of the Village of Dolourougokaha has been

agreed between affected and host communities with housing

construction set to commence in late Q1-2025

- With Koné

located in a low water stress area, project water will be sourced

from the nearby Marahoué river into a water storage facility

(“WSF”) and from pit dewatering with a supplementary borefield. The

Ministry of Water and Forests granted the required water

abstraction authorizations in Q3-2024 and compensation for access

clearing for the pipeline is commencing

- Earthworks are

underway for the access road construction, clearing of major work

areas, and stockpiling of topsoil is ongoing

- Permanent camp

construction has begun with the construction of the first 40-man

blocks well advanced

- Montage is also

focusing on developing an Ivorian supply chain utilising local

supply for project and camp consumables, and is advancing major

contracts to procure fuel, cement, aggregates and explosive

supplies, as well as sustainable food sources

- Power will be

drawn from the national grid operator, Compagnie Ivoirienne

d’Electricite (“CIE”), via a new 225kV transmission line connecting

to existing power lines located approximately 20km from the

processing plant area. Natural gas and hydro-electric generation

account for approximately 70% and 20% of Côte d’Ivoire’s

electricity generation1 with expansions projects underway to

install an additional 1,448MW of natural gas and 297MW of

hydro-electric generation capacity. The CIE has confirmed capacity

to meet the demand requirements for the Koné project and Montage

has conducted a power system study with CIE which supports the

delivery of high quality power, without additional support

measures.

Figure 2: Early works

underway

Engineering

optimizationsFurther to Montage’s Updated Feasibility

Study (“UFS”) published on January 16, 2024, Lycopodium and Montage

have undertaken a comprehensive Front-End Engineering and Design

process which has resulted in the optimization of several key

design parameters to enhance the crushing and milling circuit and

improve the efficiency of the overall operation.

The plant nominal throughput as per the UFS is

11.0 Mtpa, based on a primary crushing, secondary crushing and

HPGR, milling and carbon-in-leach (“CIL”) availability of 75%, 88%

and 91% respectively. The following engineering improvements have

subsequently been made:

- The primary

crusher has been upgraded with 33% extra power capacity (from 450kW

to 600kW) and the eccentric speed has been increased, which

generates the potential to increase the throughput.

- The secondary

crushers have been upsized by 50% from (from 600kW to 930kW) to

ensure that the secondary crushing circuit, which typically has an

availability of 75%, can match the full availability of the

HPGR.

- The two HPGR's

have been replaced with a single larger unit for ease of

maintenance, as well as the ability to accept a coarser feed

size.

- The HPGR circuit

includes a stockpile in lieu of a surge bin which is expected to

provide significantly greater operating flexibility.

- Ball mill

installed power has increased by 10% with a single ball mill of

22MW which compared to the two 10MW ball mills previously

considered. This single larger mill will be simpler to operate

given that the addition of low-speed synchronous motors has

eliminated the need for gearboxes in the drive train, reducing

components that need auxiliary cooling systems, maintenance and

spares.

- The twin seven

tank CIL trains provide a combined slurry residence time of 36

hours for the 10% oxide / 90% fresh ore blend. Should Montage

decide to further increase the mill throughput, provisions have

been made to add an extra tank to each train to either improve

residence time or maintain it with the potential to increase

throughput.

- Montage

continues to engineer the potential addition of an oxide circuit

consisting of a sizer and conveyor to directly feed the mill with

oxide and transitional material, bypassing the hard rock

comminution and HPGR. The current design limits oxide material to

10% of total feed, and requires 18.8Mt of pre-stripping,

stockpiling, and gradual reintroduction of oxide material into the

feed over the first eight years of production. An oxide circuit

would enable an earlier first gold pour while the hard rock

comminution is being commissioned, reduce rehandling costs for

oxide ore mined in pre-production, provide significant operational

flexibility to continue production during maintenance of the

crushing circuit and would improve blending optionality. While

oxide feed is limited within the Koné deposit, Montage’s ability to

discovery more oxide material across new and existing targets will

be a determining factor in forming an investment decision for the

oxide circuit.

Based on these optimization modifications, the

treatment plant design now incorporates crushing, screening, HPGR,

grinding and classification, pre-leach and tailings thickening, CIL

circuit, carbon recovery and acid wash, carbon elution,

electrowinning trains and smelting, as further detailed below:

- Primary crushing

using a gyratory crusher Metso 54/75 and 600kW drive

- Coarse ore

stockpile with 24 hours live capacity (34,200 tonnes) complete with

three 50% capacity reclaim apron feeders

- Closed-circuit

secondary crushing and screening with nominally duty stand-by

cone crushers, Metso MP1250 and 930kW drives, and double deck

multi-slope screens, Schenck 4397, to produce a crushed product

size P80 of approximately 32mm

- HPGR, Metso

HRC2400e with dual 3.0MW drives to produce a nominal P80 of

6mm

- Covered HPGR

product stockpile with a live capacity of 4 hours (4,800 tonnes)

complete with two reclaim belt feeders

- HPGR product wet

sizing/re-pulping screens, Schenck 4397, with undersize slurry

reporting to the milling circuit via the cyclone feed hopper

- HPGR screen

oversize stockpile complete with three 50% capacity vibrating

reclaim feeders

- Primary ball

mill, Metso Φ8.53 metre diameter 14 metre long 22MW dual

pinion, in closed circuit with 2 clusters of 14 each 500mm

diameter hydrocyclones to produce a grind size with a P80

of 75µm

- Pre-leach

thickening (44 metre diameter high rate) to increase the slurry

density feeding the carbon in leach, CIL, circuit to minimise

tankage and reduce overall reagent consumption

- Leach circuit

incorporating 14 leach tanks, arranged in two parallel trains of

seven each in series, to provide 36 hours leach residence time, and

equipped with external oxygen contactors, while provisions have

been made to add an extra tank in the future if required

- Twin 17 tonne

split AARL elution circuits, electrowinning and gold smelting to

recover gold from the loaded carbon to produce a gold/silver

doré

- Tailings

thickening (44 metre diameter high rate) to recover cyanide and

recycle process water from the CIL tailings

- Tailings pumping

to the TSF complete with a supernatant reclaim and return

system

- River water

abstraction system from the Marahoué river and 32km pipeline

Based on the above-described optimization

modifications, the total process plant capital cost has increased

by US$33 million, or approximately 10%. Based upon a comprehensive

review of total project costs accounting for scope changes,

realized tender prices, more conservative working capital

assumptions (to account for greater volumes of spares and

reagents), inclusion of a livelihood restoration programme, and a

higher contingency. Consequently, the total capital cost estimate

has increased by approximately 12%, from US$742 million to US$835

million, compared to the UFS, as shown in Table 1 below. The UFS

assumed US$30 million of vendor financing, mainly related to the

mining contractor mobilization, which reduced the upfront capital

to US$712 million, whereas given the strong liquidity sources

secured by Montage, vendor financing is currently no longer being

contemplated for contract mining.

Table 1 – Koné project capital

expenditure, in US$m

|

Main Area |

Previous UFS CAPEX |

Updated CAPEX |

Variance |

|

($M) |

($M) |

($M) |

% |

|

Process Plant |

338 |

371 |

+33 |

+10% |

| Mining and contractor

mobilization1 |

87 |

78 |

(9) |

(10%) |

| EPCM & Owners Costs |

69 |

67 |

(2) |

(3%) |

| Camp & Other

Infrastructure |

64 |

60 |

(4) |

(6%) |

| Tailings and Water

Storage |

55 |

60 |

+5 |

+8% |

| Grid Connection |

26 |

31 |

+5 |

+18% |

| Compensation, Resettlement &

Livelihood Restoration |

9 |

22 |

+13 |

+135% |

| Pre-Production, Start-up &

Commissioning |

13 |

19 |

+6 |

+49% |

| Taxes |

5 |

8 |

+3 |

+63% |

| Working Capital |

11 |

35 |

+24 |

+231% |

| Contingency |

65 |

83 |

+18 |

+27% |

|

Total CAPEX |

742 |

835 |

+93 |

+12% |

| Vendor Finance (Mining

Mobilisation and Camp) |

(30) |

- |

+30 |

+100% |

|

Total upfront capital |

712 |

835 |

+123 |

+17% |

1UFS assumed vendor financing for the mining contractor

mobilization while the updated estimate does not consider vendor

financing given Montage’s available liquidity sources

Foreign exchange rates of 1.08 for USD:EUR,

0.053 for USD:ZAR, 1.56 for USD:AUD and 1.26 for USD:GBP have been

used to determine capital cost estimates.

Timetable to First Gold PourAs

shown in Figure 3 below, first gold pour is targeted for Q2-2027,

based on a 27-month construction period for the process plant. As

noted, early works are well underway and major construction works,

as well as water storage and dam construction, are due to commence

in early Q1-2025.

Figure 3 – Koné project timeline to first

gold pour

|

Work Stream |

Q4-2024 |

Q1-2025 |

Q2-2025 |

Q3-2025 |

Q4-2025 |

Q1-2026 |

Q2-2026 |

Q3-2026 |

Q4-2026 |

Q1-2027 |

Q2-2027 |

|

Early Works |

|

|

|

|

|

|

|

|

|

|

|

|

FID & EPCM Award |

* |

|

|

|

|

|

|

|

|

|

|

|

Detailed Design & Engineering |

* |

* |

* |

|

|

|

|

|

|

|

|

|

Order & Procure Long Lead Items |

* |

* |

|

|

|

|

|

|

|

|

|

| Tailings Dam &

Water Dams |

|

|

|

|

|

|

|

|

|

|

|

|

Tailings Dam |

|

|

|

|

* |

* |

* |

|

|

|

|

|

Water Storage & Dam |

|

* |

* |

|

|

|

|

|

|

|

|

|

Construction |

|

|

|

|

|

|

|

|

|

|

|

|

Power Supply |

|

|

* |

* |

* |

* |

* |

|

|

|

|

|

Site Infrastructure |

|

* |

* |

* |

* |

* |

* |

* |

|

|

|

|

Earth works & Concrete Works |

|

* |

* |

* |

* |

* |

* |

|

|

|

|

|

Structural, Mechanical, Piping |

|

|

|

* |

* |

* |

* |

* |

* |

|

|

|

Electrical |

|

|

|

|

|

* |

* |

* |

* |

|

|

|

Process Plant Commissioning |

|

|

|

|

|

|

|

|

* |

* |

|

|

First Gold |

|

|

|

|

|

|

|

|

|

|

* |

Exploration UpdateMontage

remains on track to achieve its previously published target of

discovering more than 1 million ounces of Measured and Indicated

resources, at a grade 50% higher than the Koné deposit, to be

achieved before the commencement of production.

2024’s first drill campaign was completed at the

end of July, totalling 30,170 metres, with the goal of prioritizing

key targets for the next drill programme. This first programme

successfully confirmed mineralisation at all 14 targets tested. A

second 2024 drilling campaign, totalling 60,000 metres, commenced

in mid-September and to date has achieved 45,000 meters. Montage

remains on track to incorporate the 2024 drilling data into its

year-end resource statement, with a maiden mineral resource

expected to be published in Q1-2025.

In line with Montage’s goal of unlocking

exploration value, the Company expects to conduct similar

exploration efforts in 2025, while construction activities are

ongoing.

Grant of stock incentivesGiven

the recent hires, the Company has granted a total of 347,124

Restricted Share Units (“RSUs”) to non-executive team members. The

RSUs are granted in accordance with the Company’s 2024 Omnibus

Equity Incentive Plan. The RSUs are subject to vesting

provisions.

Neither TSX Venture Exchange nor its

Regulation Services Provider accepts responsibility for the

adequacy or accuracy of this release.

ABOUT MONTAGE GOLD Montage Gold

Corp. (TSXV: MAU) is a Canadian-listed company focused on becoming

a premier multi-asset African gold producer, with its flagship Koné

project, located in Côte d’Ivoire, at the forefront. Based on the

Updated Feasibility Study published in 2024, the Koné project has

an estimated 16-year mine life and sizeable annual production of

+300koz of gold over the first 8 years and is expected to enter

production in Q2-2027.

TECHNICAL

DISCLOSUREMineral Resource and Reserve

EstimatesThe Koné and Gbongogo Main Mineral Resource

Estimates were carried out by Mr. Jonathon Abbott of Matrix

Resource Consultants of Perth, Western Australia, who is considered

to be independent of Montage Gold. Mr. Abbott is a member in good

standing of the Australian Institute of Geoscientists and has

sufficient experience which is relevant to the commodity, style of

mineralisation under consideration and activity which he is

undertaking to qualify as a Qualified Person under NI 43–101.

The Mineral Reserve Estimate was carried out by

Ms. Joeline McGrath of Carci Mining Consultants Ltd., who is

considered to be independent of Montage Gold. Ms. McGrath is a

member in good standing of the Australian Institute of Mining and

Metallurgy and has sufficient experience which is relevant to the

work which she is undertaking to qualify as a Qualified Person

under NI 43–101.

2024 ExplorationAll exploration

work on Kone project is designed and carried out under the

supervision of Montage Gold Corp, Executive Vice President,

Exploration, Silvia Bottero, a registered Professional Natural

Scientist with the South African Council for Natural Scientific

Professions (SACNASP) and Qualified Person as defined in National

Instrument 43-101 developed by the Canadian Securities

Administrators.

Samples used for the results described above

come from Diamond Drilling Holes and are based on 1 metre composite

sample. Core samples have been cut in two by core blade at the camp

facilities then shipped by road to Bureau Veritas facility in

Abidjan, Côte d’Ivoire.

For RC drilling, samples were collected over 1

metre downhole intervals from the base of the cyclone and split

with a three-tier riffle split. Three kilograms samples were

collected then shipped by road to Bureau Veritas facility in

Abidjan, Côte d’Ivoire. All samples have been crushed to 2mm (80%

passing) with 1 kilogram split out for pulverization to 75μm (85%

passing) then analysed by fire assay using a 50-gram charge.

Field duplicate samples are taken, and blanks

and standards are inserted by Montage geologists into the sample

sequence at a rate of one of each sample type per 25 samples. This

ensures that there is a minimum 4% QA/QC sample insertion rate

applied to each fire assay batch. The sampling and assaying are

monitored and audited through analysis of these QA/QC samples by a

consultant independent of Montage. QA/QC has been designed to be in

line with industry best standards and to follow NI 43-101 standards

and the interpretation reviewed by the Qualified Person. Individual

batches are monitored for Standard and Blank failure during import

to the database, whilst longer term QAQC trends are monitored on a

periodic basis by Jonathan Hunt, independent consultant of Montage

and Chartered Geologist of the Geological Society of London.

Results for exploration drillholes used the

following parameters: 0.3 g/t Au cut off for samples, 0.5 g/t Au

minimum value composite and 2.0 metre maximum interval dilution

length. Composite intervals represent (apparent) downhole

thickness. “Including” represents >10 g/t Au.

For further details of the assumptions,

parameters and methods used to develop the Mineral Resource

Estimates and the Mineral Reserve Estimate for the Koné Gold

Project, please see the UFS, entitled "Koné Gold Project, Côte

d'Ivoire Updated Feasibility Study National Instrument 43-101

Technical Report" and filed on SEDAR+ at www.sedarplus.ca. Readers

are encouraged to read the UFS in its entirety, including all

qualifications, assumptions and exclusions that relate to the

details summarized in this news release. The UFS is intended to be

read as a whole, and sections should not be read or relied upon out

of context.

Processing plant reviewStephan

Buys, who is an Extractive Metallurgist with Lycopodium,

independent to Montage, and fellow of AusIMM, is a Qualified Person

under NI 43-101 and has reviewed and approved the scientific and

technical information contained in this news release concerning the

process plant. Mr. Buys has 30 years of experience in plant design,

operations, and research in Africa, Australia, Southeast Asia and

South America's metals and minerals processing industry.

QUALIFIED PERSONS STATEMENTThe

scientific and technical contents of this press release have been

verified and approved by Silvia Bottero, BSc, MSc, a Qualified

Person pursuant to NI 43-101. Mrs. Bottero, EVP Exploration of

Montage, is a registered Professional Natural Scientist with the

South African Council for Natural Scientific Professions (SACNASP),

a member of the Geological Society of South Africa and a Member of

AusIMM.

CONTACT INFORMATION

|

For Investor Relations Inquiries:Jake CainStrategy

& Investor Relations Managerjcain@montagegold.com+44 7788 687

567 |

For Media Inquiries:John VincicOakstrom

Advisorsjohn@oakstrom.com +1-647-402-6375 |

For Regulatory Inquiries:Kathy LoveCorporate

Secretary klove@montagegold.com+1-604-512-2959 |

|

|

|

|

FORWARD-LOOKING STATEMENTSThis

press release contains certain forward-looking information and

forward-looking statements within the meaning of Canadian

securities legislation (collectively, “Forward-looking

Statements”). All statements, other than statements of historical

fact, constitute Forward-looking Statements. Words such as “will”,

“intends”, “proposed” and “expects” or similar expressions are

intended to identify Forward-looking Statements. Forward-looking

Statements in this press release include statements related to the

Company’s objectives of achieving first gold pour in the second

quarter of 2027; expected enhancements of key design changes to the

process plant; being fully funded with significant headroom with

respect to the updated capital expenditure estimates; discovering

more than 1 million ounces of higher-grade measured and indicated

resources at a grade 50% higher than the Koné deposit and the

timing thereof; targeted publication of a maiden mineral resource

estimate in the first quarter of 2025; the Company’s mineral

reserve and resource estimates; the Company being on track to

deliver stellar results; the timing and amount of future production

from the Koné Gold Project; anticipated mining and processing

methods of the Koné Gold Project; anticipated mine life of the Koné

Gold Project; targeted improvements in the production profile;

expected timing of completion of our stated drill programs in 2024;

results of the drill programs including targeted additions to the

estimated mineral resources at the Koné Gold Project, and the

timing thereof; expected recoveries and grades of the Koné Gold

Project; timing in respect of future stages of major construction

works, and the length of construction, of the mining operations at

the Koné Gold Project; and timing for permits and concessions.

Forward-looking Statements involve various risks

and uncertainties and are based on certain factors and assumptions.

There is no assurance that any economic satellite deposits will be

discovered, and if discovered ever developed or mined. There can be

no assurance that any Forward-looking Statements will prove to be

accurate, and actual results and future events could differ

materially from those anticipated in such statements. Important

factors that could cause actual results to differ materially from

the Company's expectations include uncertainties inherent in the

preparation of mineral reserve and resource estimates and

definitive feasibility studies such as the Mineral Reserve Estimate

and the UFS, and in delineating new mineral reserve and resource

estimates, including but not limited to, assumptions underlying the

production estimates not being realized, incorrect cost

assumptions, unexpected variations in quantity of mineralized

material, grade or recovery rates being lower than expected,

unexpected adverse changes to geotechnical or hydrogeological

considerations, or expectations in that regard not being met,

unexpected failures of plant, equipment or processes (including

construction equipment), delays in or increased costs for the

delivery of construction equipment and services, unexpected changes

to availability of power or the power rates, failure to maintain

permits and licenses, higher than expected interest or tax rates,

adverse changes in project parameters, unanticipated delays and

costs of consulting and accommodating rights of local communities,

environmental risks inherent in the Côte d’Ivoire, title risks,

including failure to renew concessions, unanticipated commodity

price and exchange rate fluctuations, delays in or failure to

receive access agreements or amended permits, and other risk

factors set forth in the Company’s 2023 Annual Information form

available at www.sedarplus.ca, under the heading “Risk Factors”.

The Company undertakes no obligation to update or revise any

Forward-looking Statements, whether as a result of new information,

future events or otherwise, except as may be required by law. New

factors emerge from time to time, and it is not possible for

Montage to predict all of them, or assess the impact of each such

factor or the extent to which any factor, or combination of

factors, may cause results to differ materially from those

contained in any Forward-looking Statement. Any Forward-looking

Statements contained in this press release are expressly qualified

in their entirety by this cautionary statement.

1Source: International Energy Agency at

www.iea.org/countries/cote-divoire/electricity

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e7c33816-58bc-4d30-ba54-21cdfe372ecc

https://www.globenewswire.com/NewsRoom/AttachmentNg/96680ae7-eb05-41d5-a8ff-c3f8ea151950

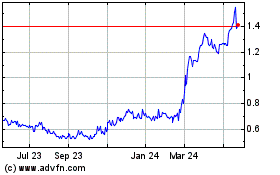

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

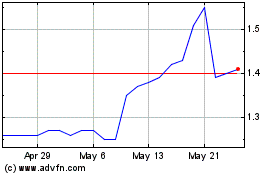

Montage Gold (TSXV:MAU)

Historical Stock Chart

From Jan 2024 to Jan 2025